As Bitcoin rose to $70,000 and a new record high, Ethereum is starting to catch up.

Ethereum has risen to $4000 taking the market capitalization to $2.7 trillion amid broadly bullish sentiment towards cryptocurrencies and ahead of the Ethereum Dencun upgrade on Mach 13.

What is the Dencun upgrade?

The Dencurn upgrade is the next upgrade on the Ethereum roadmap and marks a significant milestone in its ongoing evolution. It addresses some of the network’s longstanding challenges.

The upgrade will introduce a series of improvements aimed at enhancing Ethereum’s scalability, security, and overall network efficiency.

According to a report by Fidelity Digital Assets, the Dencun upgrade is the first step towards enabling the network’s roll-up roadmap. It allows the network to function as a database for layer-2 blockchains, storing data more efficiently and cheaply, which could result in users of layer-2 enjoying near-zero transaction fees.

At the moment, data can only be stored permanently on Ethereum, which is expensive. The proto-danksharding process enables a temporary method for data storage, which is just as secure and cheaper. The cost reduction for layer 2 blockchain will likely be passed on to users through lower fees, which could boost activity and lift mainstream interest.

The upgrade will bring the necessary capability and scaling to accommodate millions of users on the layer 2 blockchain, making it a more fitting distributed database for other blockchains. It is expected to add significantly more users to the Ethereum ecosystem and grow the network’s total addressable market.

It is worth noting that the event has stirred interest and excitement among the network’s dedicated tech enthusiasts. However, it has generated relatively little mainstream buzz compared to the 2022 merge, which transformed Ethereum into a more energy-efficient proof-of-stake.

Yet despite the lack of mainstream buzz, some industry experts have called the event seismic, shifting Ethereum into a new gear.

Ethereum price forecast

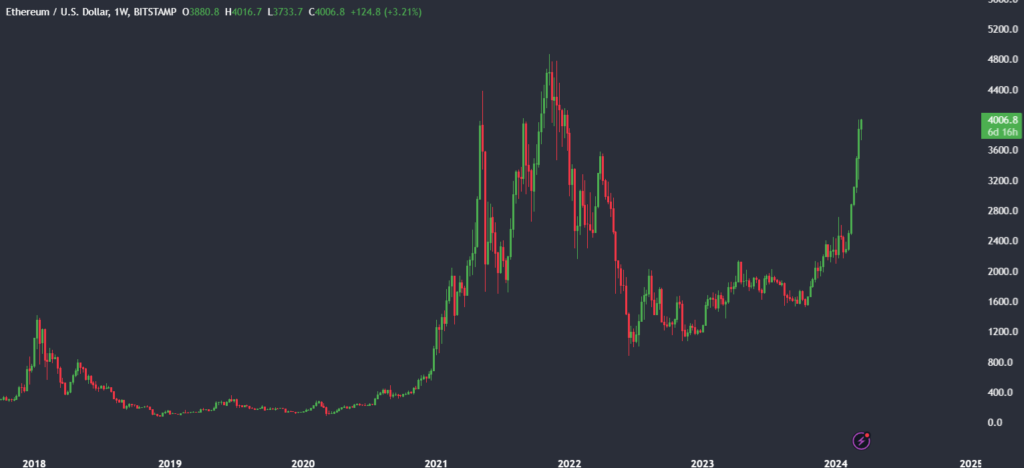

ETH/USD has rallied over 80% since the low on January 23 at $2165 and 60% in the past month, rising above $3000 to a peak of $4000, its highest level in almost two years. While the price pulled back from the $4000 level, it is again marching in that direction as the new week begins.

Upbeat investor sentiment towards Ethereum reflects optimism surrounding the upcoming Dencun upgrade and the potential upcoming approval by the US Securities and Exchange Commission of Ethereum Exchange-Traded Funds (ETFs).

ETH ETF approval

Since the Bitcoin ETF approval at the start of the year, the market has been waiting for developments surrounding a possible approval. While Grayscale submitted paperwork in October to transform its ETH trust into a spot market ETF, the SEC has not been so forthcoming. A potential approval would boost Ethereum#/’s appeal to institutional investors in a similar way that the BTC ETF approval did for Bitcoin.

Meanwhile, on-chain data showed that almost $200 million worth of ETH was burned over the past week, lowering the number of coins in circulation and bolstering the price.

Sources

https://cryptopotato.com/ethereums-dencun-upgrade-set-to-drive-near-zero-transaction-fees/

https://crypto.news/ethereum-4000-bullish-surge-dencun/

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.