On Monday, the Hong Kong Securities and Futures Commission (SFC) gave conditional approval for spot Bitcoin and spot Ethereum Exchange Traded Funds (ETFs). These will be available to trade in the coming weeks.

- Hong Kong Securities and Futures Commission gives initial approval.

- US Bitcoin inflows were strong across Q1.

- Hong Kong BTC & ETH ETFs demand picture is unclear.

- Approval by more countries boosts crypto’s credibility.

Initial approvals were announced by Harvest Global Investments and a partnership between Bosera Asset Management and HashKet Capital.

The crypto market got a boost from the developments with Bitcoin briefly rising as much as 4.3% and Ethereum 6.5% before ending lower amid a broader financial market selloff.

Can these ETFs drive similar inflows to US BTC ETFs?

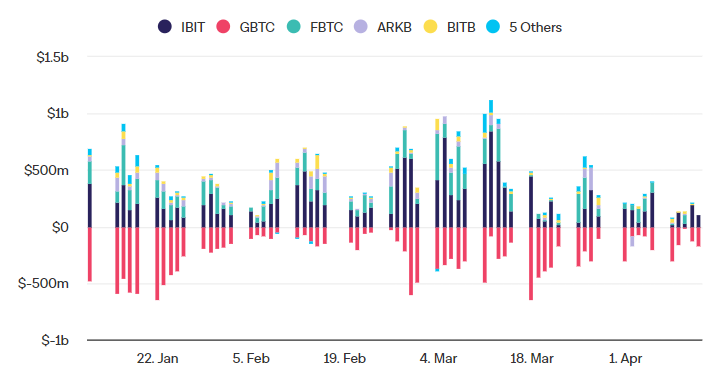

US Bitcoin EFT inflows

In the first quarter of this year, which marks the first quarter of Bitcoin ETF trading, eleven SEC-approved ETF offerings enjoyed $12.1 billion in total inflows. BlackRock’s IBIT was and continues to be the standout performer. Blackrock’s Bitcoin ETF has accumulated $13.9 billion in inflows since early January. Meanwhile, GBTC is another key outlier, seeing $14.7 billion of outflows due to this product’s high fees.

Charts showing BTC flows

Source: IntheBlock

Spot bitcoin ETF inflows also boosted Bitcoin’s price in Q1, which rose over 60% across the quarter. So, can we expect Hong Kong-approved Bitcoin ETFs to see similar demand?

Hong Kong BTC ETF demand outlook is unclear

Hong Kong is one of the world’s leading financial centres. It is also looking to position itself as a crypto hub and is a potential gateway for outbound Chinese investments.

The approval of BTC and ETH ETFs could result in Chinese mainland investors taking advantage of the Southbound Stock Connect programme. This programme enables qualified mainland Chinese investors to access some shares listed in Hong Kong up to a limit of $70 billion per year. Given the spare capacity in the programme, this could potentially be an open door to strong BTC and ETH ETF inflows. As we have seen, increased ETF inflows are favourable for the Bitcoin price.

However, it is still unclear whether the ETFs will be open to mainland Chinese investors. If they are, demand may not be that strong. Hong Kong already allows future-based crypto ETFs, with three listed to date: CSOP Futures, CSOP Futures, and Samsung Bitcoin Futures. These have combined assets of around $170 million, which is just a fraction of the US equivalent offerings.

There are other points to consider as well. Firstly, the Hong Kong ETF market is smaller than the US ETF market. Also, the approved issuers are small compared to the likes of BlackRock. As a result, the markets could lack liquidity, leading to potentially wider spreads and higher fees.

Conclusion

What is clear is that Bitcoin and Ethereum ETF approval by more countries and its adoption by more institutional investors adds to crypto’s credibility and creates new investment avenues. This has positive implications for Bitcoin, helping to bolster demand and the price.

Sources