Index trading is a strategic approach that allows traders to speculate on the overall performance of stock market indices rather than individual stocks. This method provides built-in diversification and reduces exposure to company-specific risks, making it a preferred choice for many investors.

By trading indices, traders can take positions based on broader economic trends instead of analyzing individual corporate earnings reports and balance sheets. The ability to go long or short with ease makes index trading a versatile tool for hedging and speculation.

What are Indices?

Stock indices track the collective performance of a selected group of stocks, offering a benchmark for market movements. These indices provide insights into the economic outlook of specific industries, regions, or entire economies.

There are different types of indices, such as:

- Broad Market Indices (e.g., S&P 500, Dow Jones Industrial Average) – Represent the overall market performance.

- Sector-Specific Indices (e.g., NASDAQ 100) – Focus on industries like technology or healthcare.

- Regional Indices (e.g., Hang Seng, FTSE 100) – Measure economic performance in specific geographic areas.

How Are Indices Calculated?

The calculation methods for stock indices vary. The two primary methods include:

- Price-Weighted Indices: Each stock contributes based on its price, meaning higher-priced stocks have more influence (e.g., Dow Jones Industrial Average).

- Market Capitalization-Weighted Indices: Companies with higher market caps hold more weight (e.g., S&P 500, NASDAQ 100).

Some indices adjust for trading volume to reflect actual market movements more accurately. Understanding these calculation methods is crucial for traders looking to analyze market trends effectively.

Why Trade Indices?

Why Trade Indices?

There are several advantages to trading indices:

1. Diversification Without Complexity

Instead of selecting individual stocks, traders can gain exposure to a diversified group, reducing risks associated with company-specific volatility.

2. Flexibility to Go Long or Short

Indices provide opportunities to profit from both rising and falling markets. Traders can go long when expecting a market uptrend or short when anticipating a downturn.

3. Leverage Opportunities

Many brokers offer leverage on index trading, allowing traders to control larger positions with a smaller initial investment. However, leverage should be used cautiously, as it magnifies both profits and losses.

4. Hedging Strategies

Indices can serve as a hedge against existing stock positions. If an investor holds multiple stocks and anticipates a market decline, shorting an index can help offset potential losses.

Key Stock Indices to Watch in 2025

NASDAQ 100 (US100)

A technology-focused index that includes major players like Apple, Microsoft, and Amazon. It represents high-growth, innovative companies and is heavily influenced by the tech sector’s performance.

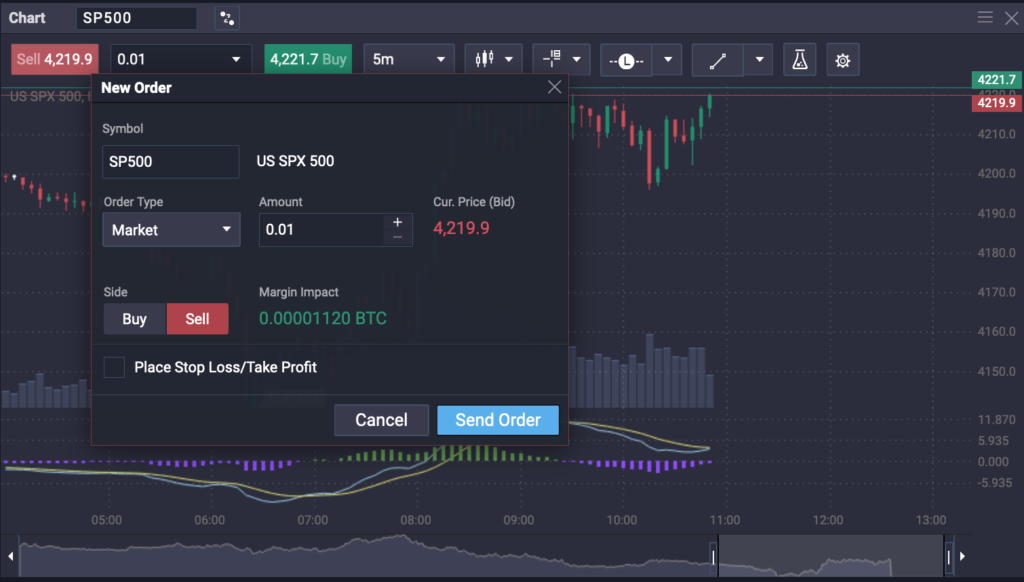

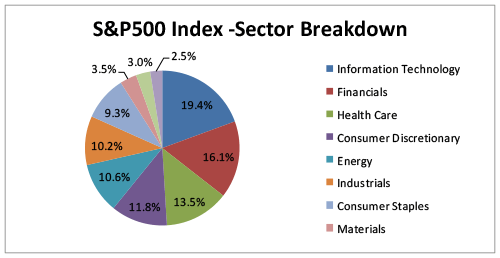

S&P 500 (SP500)

Comprising 500 of the largest publicly traded companies in the U.S., the S&P 500 is often considered the best indicator of overall market health.

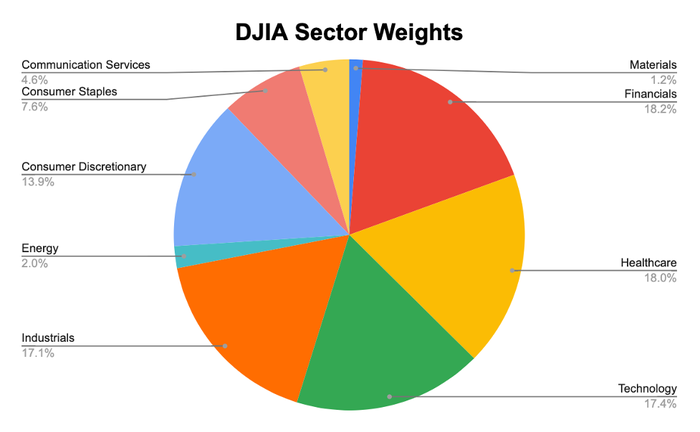

Dow Jones Industrial Average (US30)

One of the oldest stock indices, tracking 30 blue-chip companies. Unlike other indices, it is price-weighted, meaning stocks with higher prices have a greater impact.

Data source: Yahoo! Finance. Chart by author.

Hang Seng Index (HK50)

This index includes the largest companies listed in Hong Kong and provides insights into China’s economic trends.

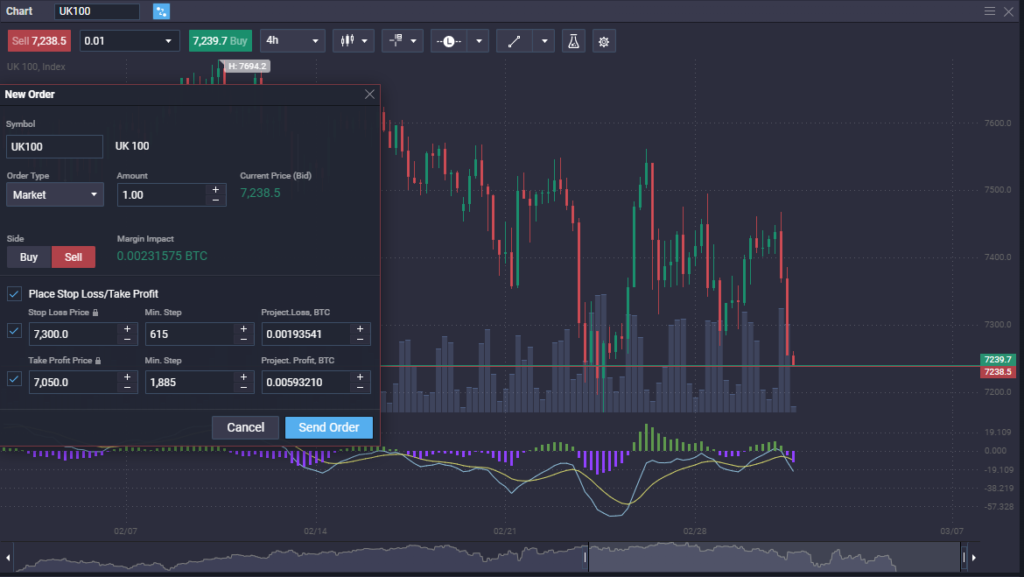

FTSE 100 (UK100)

The UK’s primary stock index, representing the 100 largest companies listed on the London Stock Exchange.

What Affects Index Prices?

Indices are influenced by various factors, including:

- Corporate Earnings Reports: Strong earnings drive indices higher, while weak earnings lead to declines.

- Economic Indicators: GDP growth, employment reports, and inflation impact overall market sentiment.

- Central Bank Policies: Interest rate decisions by the Federal Reserve, European Central Bank, and other monetary authorities affect investor confidence.

- Geopolitical Events: Global uncertainties, trade wars, and political changes can cause market volatility.

How to Trade Indices Effectively

1. Choose Your Trading Strategy

- Trend Trading: Identifying and following market trends.

- Breakout Trading: Entering trades when prices move beyond key support or resistance levels.

- Mean Reversion: Trading based on historical price levels.

2. Select the Right Index

Choose an index based on its volatility, liquidity, and correlation with your existing portfolio.

3. Decide Between Cash Indices or Futures

- Cash Indices: Track real-time prices and are preferred by day traders.

- Futures: Speculate on the future value of an index, commonly used for hedging.

4. Implement Risk Management

- Set Stop-Loss Orders: Limit potential losses by automatically closing trades at predetermined levels.

- Use Proper Position Sizing: Avoid excessive leverage to manage risk effectively.

- Monitor Market Conditions: Stay updated on economic reports and news that may impact indices.

How much money do you need to trade indices?

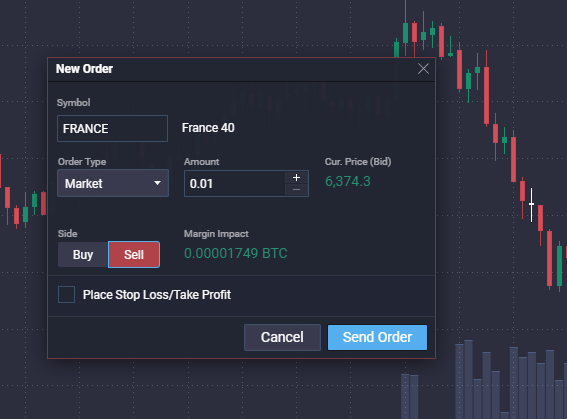

To trade indices, you need to put up margin. If you are trading with 1:100 leverage, you will need to put up $1000 to control $100,000 worth of an index. However, using all of your available margin makes little sense, because if the market moves against you, you will be liquidated rather quickly.

One of the greatest advantages of trading CFDs is that you can buy less than the full contract. When you trade a CFD, you can often trade as little as 0.01 lots, instead of the standardized futures contract for an index. This allows accounts of all sizes to get involved.

Stock Indices Trading Hours

Please be aware that stock indices do not necessarily trade 24 hours. Below is a chart that explains the hours available to trade each of the indices.

Tips for indices trading

Trading indices is a convenient way to take advantage of a group of stocks or underlying assets at one time. That being said, it is crucial to understand that not all indices are equal-weighted, and therefore you need to understand that specific stocks may have much more influence on the index. Familiarize yourself with the biggest companies of an index, and make sure to monitor those stocks to understand where the index may be going. It isn’t uncommon for just ten stocks to determine where the price goes overall.

As with all markets, placing a stop loss is crucial, and index trading should never be done without using one. The CFD market allows for precise position sizing, so you should take advantage of that as well.

Understanding when the underlying cash index is open is also important because typically that is when you see the most volatility. For example, the US 30 can be relatively quiet during the Asian trading session, but as soon as New York comes online, it starts moving rather quickly.

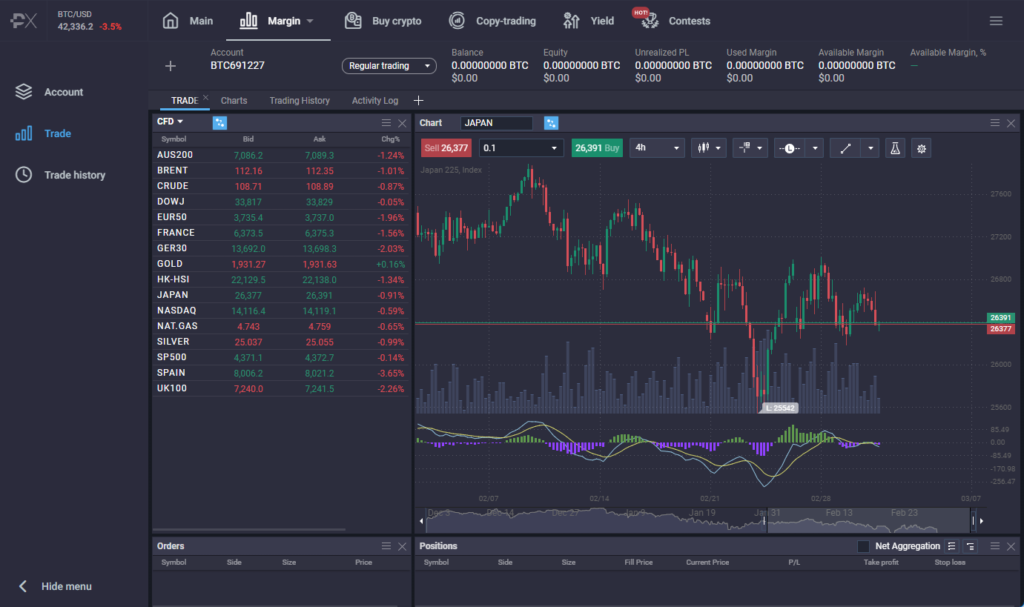

Why trade indices with PrimeXBT?

The most obvious reason you should trade indices with PrimeXBT is that you have access to the largest indices around the world, as well as more than 100 other markets. PrimeXBT also offers copy trading, allowing you to follow successful indices traders easily through our web-based, world-class platform.

The leverage offered at PrimeXBT is also higher than many of our competitors, allowing traders to benefit from movement in the market. By offering such leverage, successful traders can profit immensely from this benefit.

PrimeXBT allows traders to benefit from crypto movement, as deposits are done in Bitcoin. Furthermore, there are multiple cross rates in the cryptocurrency markets available with us.

Final Thoughts

Index trading offers a structured way to engage with financial markets, providing exposure to broad market movements while mitigating individual stock risks. With the right strategies, traders can leverage indices to capitalize on market trends and build a resilient trading portfolio.

By focusing on education and data-driven decisions rather than speculation, traders can navigate index markets with confidence. Whether you are a beginner or an experienced investor, understanding the fundamentals of index trading will help you make informed trading decisions in 2025 and beyond.

Can I profit from index trading?

Yes, but it takes work. You must be able to find areas of supply and demand, and of course, be able to read the market direction. The most important thing is to pay attention to risk and reward, making sure that you are always aiming for more reward than you are risking.

Are index futures derivatives?

Yes, all futures markets are derivatives regardless of what they are representing.

How can risk be hedged with stock index futures?

If the trader owns stock in the index, trading the index futures in the opposite direction ensures that if their stocks fall, they will be protected because of the gains made in the futures market. This is typically done for those traders that are planning on hanging on to a stock position for a significant amount of time.

What is the maximum leverage I can have trading index CFDs?

Brokers offer leverage according to any regulation that they fall under or simply choose. At PrimeXBT, we offer 100 times leverage.

Can I sell futures before expiry?

Yes, you can sell futures at any time you wish to exit the position. It is quite common for traders to “take profits” well ahead of the end date for the contract.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.