The DAX 40 (formerly DAX 30), also referred to as the DAX Index, is a prevalent trading market for CFD traders worldwide. It is a highly tracked index by both equity and Forex traders. Acquiring the skill to trade the DAX provides an opportunity to profit from the German economy’s potential strength or vulnerability.

What is DAX 40?

The DAX 40, or the DAX Index, is an index of blue-chip companies in Germany. These are the largest companies listed in Germany on the Frankfurt Stock Exchange. It is short for the Deutscher Aktien Index 40, which was established with a base value of 1000 in 1988.

The DAX originally was the top 30 companies in Germany but has added another 10 to become the DAX 40 as of September 20, 2021. This allows for a larger base of companies to draw from, in the hopes of representing the overall German economy more fairly.

The DAX is performance-based, meaning that it incorporates company dividends, capital income, and cash outflow, which are included in the net stock price. The index calculates the stock price of these top 40 companies, to give a reading of the overall market strength. Other such examples would be the Dow Jones Industrial Average in the United States or the Nikkei 225 in Japan.

Traders can see very quickly as to whether or not the overall health of the German stock market is one from a strengthening basis, or if it is fading by watching the DAX. By using the CFD market, you can express your opinion on where the price will go.

The DAX 40 Companies

The companies that make up the DAX 40 are some of the most widely recognized global brands. This includes Volkswagen, Adidas, Siemens, and many others. The German index is comprised of companies that have a minimum free float of 10%, a legal or operating base inside Germany, and a listing in the Prime Standard segment, which is a stringent set of transparency rules.

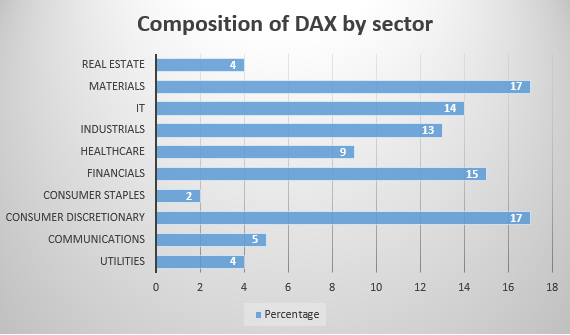

There are also stringent demands on these companies to submit financial reports regularly, have audited earnings reports, and have minimal capital requirements. The following chart shows the size of each sector in the DAX as of the end of 2021.

How Is the DAX 40 Index Calculated?

The DAX 40 uses the free-float methodology, meaning that it takes into consideration readily available shares, and it does not take into account shares that are untradable, such as those owned by governments, and therefore are blocked.

It is a market-cap-weighted index, so companies with higher market capitalization will have more of an influence on the reading. The DAX does not allow any single company to account for more than 10% of its value.

DAX 40 price history

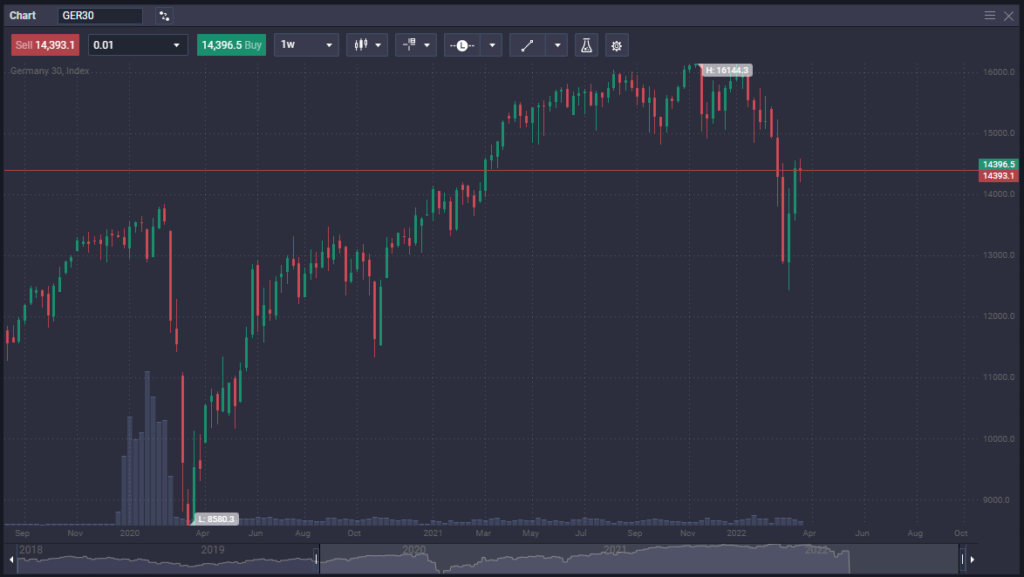

The following chart notes some of the major events in the history of the DAX 40, showing fundamental drivers that have caused negativity in the index.

Chart courtesy of Tradingview

DAX 40 trading hours

The DAX 40 can be traded around the clock with PrimeXBT, with only the “settlement hour” being an exception. The DAX trades from Monday to Friday worldwide, being closed on the weekend. The trading hours will be limited if you are looking to trade DAX-listed stocks or ETFs, as they are limited to local business hours.

What Drives the DAX 40’s price?

Understanding what drives the price of the DAX 40 is crucial to being a successful DAX 40 trader. The fundamentals that come into the picture will include both internal and external factors as Germany is a major exporter of goods around the world.

Exchange rates

One of the big external influences on the DAX Index is the exchange rate of the Euro. Quite often, there is a negative correlation between the DAX and the Euro, with one rising while the other falls. This is mainly due to international trade, in which many of the leading companies in Germany have large amounts of goods exported.

International sales will be greatly influenced by price, so therefore if a German manufacturer is trying to sell overseas, as their products become more expensive due to currency fluctuation, it can hurt company profits. Alternately, as the Euro falls in value, it makes German goods more affordable for those in other countries, leading to larger profits.

Individual company performance

As with all market cap-weighted indices, the bigger corporations can move the overall index. While a 10% decline in one of the smaller companies may not have much of an influence, one that is worth 6% of the index most certainly will be more of a factor in the overall calculation.

Socio-political events

Sociological or political events can have an impact on the DAX, much like any other index. The DAX will be sensitive to those issues that impact Germany directly, although they can be events that are more global in scope.

For example, war breaking out in Ukraine had an overall negative impact on the index, as risk appetite evaporated globally. The German economy was also going to be threatened by the ensuing energy concerns as Germany relies so heavily on Russian natural gas.

Another example can be as simple as when a political party wins an election. If the party runs on a more pro-business stance, it will often send the shares of companies in the country soaring.

What Are the Benefits of DAX 40 trading?

Trading the DAX comes with many benefits. This is because of the dynamic personality of the German economy, one of the world’s strongest. Some of the largest companies in the world are found there, and as a result, it is a good move for the trader to try to benefit from this economic strength.

- German economy: Trading the DAX is a way to trade the overall health or weakness of the German economy. This will mitigate the inherent risks of owning a single stock.

- Go long or short: By trading the DAX, you can go long or short of the index much easier than you can a single stock, as there is no need to borrow the underlying asset.

- Liquidity: The DAX is one of the most heavily traded indices in the world. Because of this, it offers great liquidity and allows easy buying or selling of a position.

- Position sizing: Trading an index via CFD markets allows the trader to size their position in ways that owning a portfolio of stocks cannot.

- Hedging: Trading the DAX allows a trader to hedge against losses in longer-term stock positions that they may already own.

- Leverage: Trading the DAX offers leverage in several different instruments.

What Are the Drawbacks of DAX 40 trading?

While the DAX is one of the largest markets in the world, the truth is that not everything is perfect. The trading of any asset can bring with it a certain number of risks, and the DAX has a few specific ones.

- Time zone risks: Keep in mind that although you can trade the DAX markets around the clock in several instruments, it is worth noting that a large portion of the moment happens during local German time.

- Currency risks: As mentioned previously, the Euro can have an outsized effect on the markets. If you are to trade the DAX, you also need to keep an eye on the Euro. Luckily, PrimeXBT offers this market for you.

- Local politics: You must understand any ramifications that local politics can have. If you are to be successful, understanding the different political outcomes in the German system and its effects on business will be useful.

How to trade DAX 40

As with many financial instruments, there are multiple ways that one can go about benefiting from price fluctuation. This of course is going to be no different for the DAX 40. As it is one of the world’s premier financial indices, you have multiple options to take advantage of. Before you do though, you need to know the pros and cons.

DAX CFDs

Contract for difference (CFD) markets offer a simplified way to trade the DAX. These are instruments that mimic the underlying price action of the market, without anyone taking actual ownership of it. Two parties agree on a price, with the buyer either gaining the profits or paying the losses when the trade is closed. These are what we offer at PrimeXBT.

These contracts also allow position sizing in ways that most others do not. The CFD market is leveraged, meaning that you can trade a larger position than normally available, with only the deposit margin, typically a small percentage of the overall size of the trade. This allows for much larger profits but also brings more danger if not used responsibly.

DAX futures

The DAX 40 also trades in the futures markets. The futures markets also allow for leverage and have an expiry date. The futures markets have an exchange that all orders flow through and have standardized contract sizing.

While the futures markets are suitable for some traders, it should be noted that the position size and required margin deposits can make them unsuitable for others. For a futures contract, you are better off having a larger account.

DAX options

Options are available for the DAX, both in the index, as well as stocks listed in Frankfort. The options markets can be very lucrative but are more complex than other markets. They are time-based bets on whether or price is going to rise or fall.

They are often used as a hedge against other positions, meaning that one might buy a “put”, which is a bet on price falling, while the same trader holds long positions in the market. The result is that the gains from the put will mitigate some or all the losses from the original position.

DAX stocks and ETFs

The DAX is a group of stocks, so of course, you have the possibility of trading single stocks to benefit from a rise in the German economy. However, you need to be able to do the financial research for each company you wish to invest in and run the risk of any issues that they may have.

They are also Exchange Traded Funds (ETF) available. They can mimic the entirety of the DAX 40, a specific sector, or a multitude of other possibilities. These are often used to get exposure without having the concentrated risks of owning a single company. However, they are not usually levered products, and only trade while the exchange is open.

DAX 40 Trading Strategies

If you are going to trade the DAX 40, you need to understand a few trading strategies. While traders should develop their strategies, there are some basic ones that you can build from that have stood the test of time. Make sure to use money management and backtest each one to find a starting point for yourself.

DAX 40 swing trading

Swing trading is a common strategy for index traders, including in the DAX. The gist of this strategy is to catch longer-term moves by buying on dips that turn higher or selling markets that have started to fall after being in an overbought condition.

The benefit of this type of trading is that you are trying to catch bigger moves. This takes patience but allows for traders to hold onto positions that run farther. The trick is going to be identifying when the market is swinging either higher or lower. However, these trades can run for days, if not weeks, allowing for bigger profits.

DAX 40 breakout trading

Breakout trading is a form of trading that tends to do quite well in indices. The DAX is like any other market in the sense that it tends to consolidate for a time before moving higher or lower. Once the market finds a range that it trades back and forth from, the trader will wait to see it leave that region. Once it does, the trader simply follows the market.

For example, if the DAX were to trade in a 100-point range between €15,000 and €15,100 levels, a trader could wait for a move outside of this range. After a while, the DAX breaks higher, closing at €15,180 on the hourly chart. At this point, the trader buys the market.

DAX 40 scalping strategy

Scalping is the process of taking small profits at a time out of a market. The biggest barrier that you will face is whether the markets have enough liquidity to do this. The liquidity can be best observed by the spread or difference between the ask and bid prices.

If the market spread is low enough, it makes short-term trades for a few points possible. In the DAX, it is quite common for traders to take these trades, as the spread is tight. These trades can last a few minutes, to as little as a few seconds.

Tips for DAX 40 Trading

To benefit from trading the DAX, there are some things you should keep in mind to be profitable. The DAX trades much like any other index but has a few special quirks about it that you may find helpful to keep in the back of your mind.

- The Euro: Pay attention to the exchange rate of the Euro. If it starts to strengthen too quickly, it can be bad for exporters, which make up a large portion of the index. The opposite can be true as well.

- European Central Bank: Make sure to know when major announcements are coming out. As a rule, it is best to not initiate a trade around these times.

- Follow local news: Make sure you have news sources available before trading the DAX, as local politics and economic news can move the markets.

- Money management: Money management strategies are just as important for trading the DAX as they are for any other market. Make sure you understand the risks.

- Trade a system: By having a well-planned out system to rely on, you know what, where, and when of any potential trades.

Why Trade DAX 40 With PrimeXBT

While trading the DAX can be done in various forms, PrimeXBT allows you to do so in the CFD markets. The advantages of trading the DAX via this market are numerous, especially here. The ability to trade based upon an entire economy simplifies the process, and PrimeXBT makes it especially so.

- CFDs: This allows the trader to place suitable position sizes according to their account size with much more ease than other instruments.

- Online platform: PrimeXBT uses an online platform, meaning that you can trade from anywhere using a browser and internet connection.

- Funding with Bitcoin: PrimeXBT accepts Bitcoin for deposits. This allows traders to grow their crypto in yet another way.

- Leverage: PrimeXBT allows leverage on all positions, including any that you take in the DAX.

- Go short: Shorting the DAX is just as easy as buying it using our CFD market. There is no need to “borrow” shares or anything like it. The platform does all of the processes “under the hood.”

What time can you trade DAX 40?

You can trade the DAX 40 around the clock with a small settlement period. The index runs Monday through Friday, as do other indices.

Is DAX good to trade?

Yes, the DAX is one of the more popular indices to trade around the world, thereby making it liquid and widely followed. It has a strong correlation to various fundamental factors that can be widely followed such as currency movements and economic announcements such as German GDP.

Is DAX 40 the same as GER40?

Yes, the DAX 40 is the index that the GER40 CFD represents. It is a contract for difference market that mimics the performance of the actual index, with the added benefit of position sizing flexibility, negative balance protection, and additional leverage.

How do I open a trade on DAX?

By opening an account at PrimeXBT, you will have access to our world-class online platform. By looking in the “CFD” list, you will find GER40. Click the “Trade” button and fill in the necessary details in the popup window to place your trade.

What correlates with the DAX?

The most prominent correlation is between the value of the Euro and the DAX. Typically, it is a negative correlation as a cheaper Euro allows for exports to expand, as goods become cheaper for major customers outside of the European Union.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.