Bitcoin traded quietly, with price action slow in the previous week. It started last week at 68,400 and briefly spiked above 70k before falling modestly lower throughout the week. The pair reached a low of 66,600 on Friday before edging back up towards 68k across the weekend. Bitcoin continues to trade within a tight range between 60k and 70k, within which it has traded since March.

Altcoin market movements were diverse this week. While Ether fell by 2%, XRP declined by 3.5%, Cardano dropped by 3.4%, Dodge fell by 7%, and PEPE fell by 10% after reaching a new all-time high. In contrast, Solana rose by 0.5% and Toncoin rose by 4%, showcasing the varied performance within the altcoin market.

Social volumes fell sharply last week, with discussions about crypto diminishing compared to the previous week. Social volumes for Bitcoin fell 19%, while social volumes surrounding Ether fell 45% after the sharp uptick in the previous week surrounding ETH ETF approval.

Zooming out, the month of May witnessed a significant recovery for Bitcoin, with a rise of 11% following a 14% dip in April. Ether, however, outshone Bitcoin, surging 24% in May after a 17% fall in April. This impressive performance can be attributed to the Securities and Exchange Commission’s approval of spot Ether ETFs earlier in the month, which boosted investor confidence and drove up the price.

The approval of spot Ether and Bitcoin ETFs this year has indeed had a positive impact on crypto prices. However, the presence of a complex macro backdrop has seemingly limited the extent of this impact, resulting in sideways price movements.

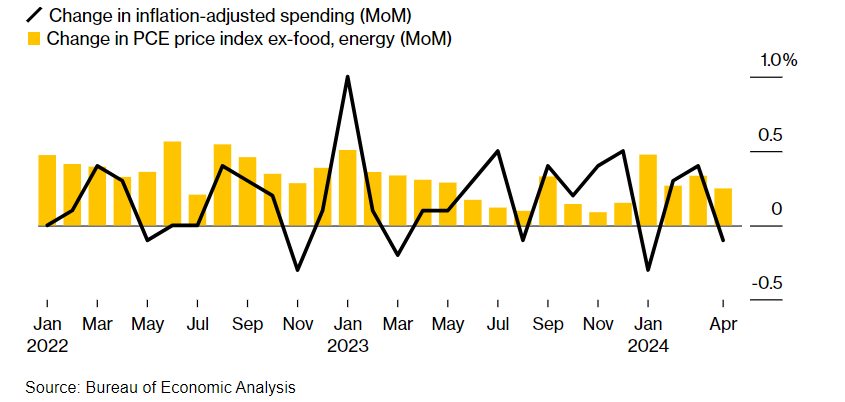

Core PCE inflation data

The core personal consumption index (PCE), the Federal Reserve’s preferred measure for inflation, held steady in April, suggesting the central bank may maintain high interest rates. Core PCE rose by 2.8% year-on-year in May, in line with April and expectations. On a monthly basis, core PCE eased to 0.2% from 0.3% in April, a development that aligns with market expectations. This data is a crucial indicator of the broader economic context that influences the crypto market.

The market has been concerned about sticky inflation this year, especially as inflation rose in Q1. While there was some relief that inflation wasn’t higher, it wasn’t significantly lower either. The longer inflation lingers around the 3% level, the harder it will be for the Fed to make the case for a rate cut.

The data comes after Federal Reserve speakers reiterated the view that they need to see inflation easing further towards the Fed’s 2% target before considering rate cuts. The market is pricing in a 53% probability that the Fed will cut rates in September, up from 50% prior to Friday’s data. The market remains doubtful over the Fed’s ability to cut rates several times this year, with a second rate cut of 45% priced in compared to 42% prior to the data.

Given the tighter liquidity conditions, a high rate for a longer environment is less beneficial for risk assets, including cryptocurrency.

Supply headwinds

While the messy macro backdrop has meant that crypto has struggled for direction, supply headwinds have weighed on Bitcoin’s price, and several supply concerns are looming:

- Mt Gox repayments worth around $9.8 billion,

- Gemini distributions worth around $2.2 billion,

- Cash settlement of FTX estate worth around $14.5 to $16.6 billion.

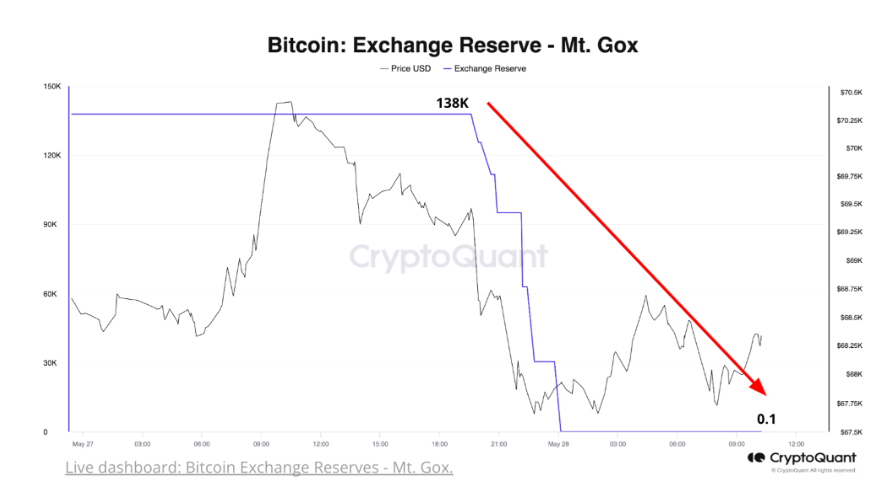

Mt Gox repayments have been attracting the most attention within the Crypto space, particularly given that there are still some questions surrounding when the settlement from the FTX estate will be made available. This is because they depend on court approval of the reorganisation plan. In March, a briefing pointed to the first interim distribution by the end of 2024.

Meanwhile, the Mount Gox Rehabilitation Trust appeared to have moved almost 138,000 Bitcoin from their cold wallet storage this week. This could be a sign that reimbursements are imminent. However, the final deadline is not until October 31, so there is still some time. The impact that the reimbursement could have on Bitcoin is difficult to predict because it depends largely on what the creditors, who are in line to receive the reimbursement, choose to do with the distribution they receive.

In many cases, creditors inclined to sell have already sold their claims to third parties. Given their early support and adoption of the token, the other creditors may opt to hold their Bitcoin rather than sell.

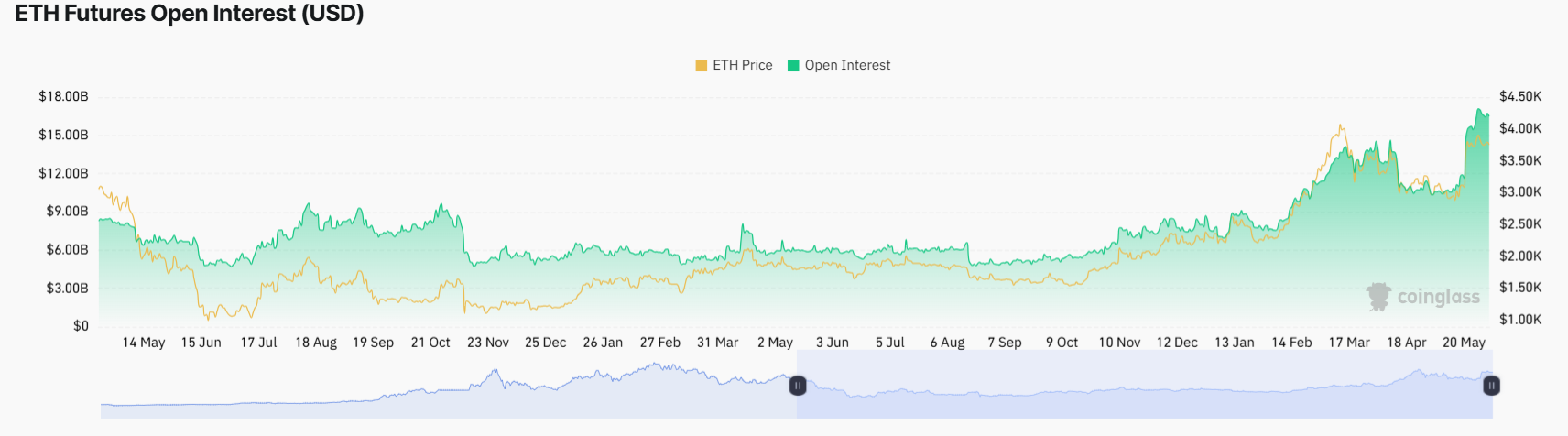

ETH futures Open Interest reaches record levels

Attention remains on Ether as spot ETF issuers have started to submit amended S-1 filings required for the spot ETH ETFs to launch following their approval last month. Netflow levels remain uncertain and could be just 20% of the flow levels we have seen in spot Bitcoin ETFS.

While Ether fell modestly last week, it still holds most of its gains booked the week before. Amid the ETH/USD market activity, Ether derivatives have seen an increase in activity, and ETH’s future open interest has reached record levels. The open interest (OI) in Ether options is hovering around ATH levels. On May 28, the total open interest in Ethereum’s future was $17.05 billion.

High open interest in Ethereum futures and options contracts indicates increased trading interest from institutional and retail investors. The great OI can result in higher volatility.

Institutional crypto flows rise

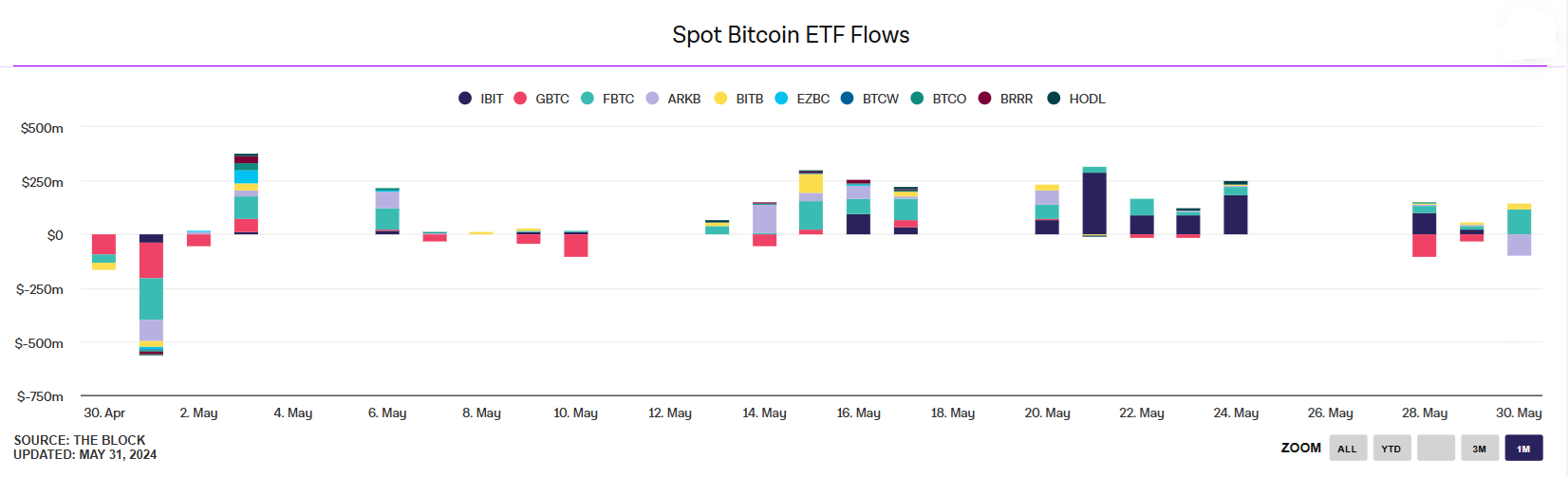

While Bitcoin hasn’t seen much price action lately, interest in Bitcoin hasn’t dipped; the data suggests the contrary, with BTC ETF interest rising again over the past week.

Bitcoin ETFs continued to attract net inflows on May 31, marking the 14th straight day of net inflows, just short of the record 17-day run. This indicates sustained investors’ interest in gaining exposure to Bitcoin. If rising interest in Bitcoin ETFs continues, it could lead to Bitcoin becoming more mainstream, fueling greater adoption.

Inflows weren’t evenly distributed, with Grayscale and Ark registering net outflows. This suggests that investors are looking toward newer entrants in the spot Bitcoin ETF market. Bitcoin remains the most favoured asset by institutions. Of note is that Grayscale outflows have slowed in recent weeks. Last week, Grayscale registered $15 million of outflows, bringing total outflows to $17 billion.

Meanwhile, data from Coinshare’s digital asset report showed that Ethereum was the standout performer, with $36 million purchased by institutions, the highest amount since March, as the spot ETH ETF approval sparked renewed interest from large players. However, this was still insufficient to offset Ether’s outflow over the past year. Year-to-date YTD outflows reached $22 million. However, ETH bulls will hope that the ETF developments will reverse this overall trend.

Week Ahead: US NFP, ECB & BoC rate decisions

US equities fell last week, marking the first weekly selloff after five weeks of gains. The tech-heavy Nasdaq 100 fell 1.1%, and the S&P500 fell -0.5%, as tech stocks showed signs of being overextended after months of solid gains. While the US core-PCE report helped stem the selloff, the market is still jittery over when the Fed may be able to start cutting rates.

The coming week is set to be a key week for data releases. Among the data points to watch are the ISM PMI surveys from the manufacturing and services sectors, JOLTS job openings, ADP private payrolls, and jobless claims data. The key report will be the US non-farm payroll released on Friday.

The jobs report should provide clues on the strength of the labour market and wage growth, offering more clues on whether the Fed can cut rates in September.

In addition to US data, ECB and BoC rate decisions will be in focus. The ECB is widely expected to cut interest rates from the record high of 4% to 3.75%. However, the central bank could adopt a hawkish tone given the tick higher in inflation and record low unemployment. EUR/USD is holding steady at 1.0850 after a flat performance last week.

The BoC will also announce its interest rate decision and the market is pricing in an 83% probability of a rate cut, up from 66% on Friday following weaker-than-expected Canada GDP data. USD/CAD is hovering around 1.3650 at the start of the new week.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.