In 2020, the Securities and Exchange Commission (SEC) accused Ripple, the blockchain developer and XRP cryptocurrency creator, of selling XRP in an unregistered security offering to investors and profiting $1.3 billion. Ripple argued that XRP was not a security and shouldn’t be treated as one.

Key Takeaways:

- The SEC accused Ripple of selling XRP illegally, sparking a lawsuit that could change cryptocurrency laws

- A court partly sided with Ripple, saying XRP isn’t always a security, which affects its legal status and market price

- The lawsuit’s next steps could lead to a settlement, potentially affecting XRP’s value and future cryptocurrency regulations

In a partial ruling in July last year, both parties were semi-victorious with the court ruling that XRP (and therefore cryptocurrency) was not considered a security when sold to the public on an exchange, but it is considered a security when sold to institutional investors.

Why is the case important?

Not only is the case impacting XRP’s price, which is most notable compared to Bitcoin. But, the final outcome of this case could shape the future of digital asset regulation and have far-reaching implications for the broader crypto industry and the regulatory landscape.

Latest developments in the XRP vs SEC case

Last week, on February 20, the discovery phase in the legal battle between Ripple and the Securities Exchange Commission ended. This was the final date for both parties to gather and exchange relevant information. It marked the day that Ripple was to comply with a court order to hand over its audited financial statement and institutional sales contracts.

As this key phase has closed, attention now shifts to upcoming dates and circulating rumors that a settlement could come soon, which could determine the future direction of the altcoin.

The key dates in the XRP vs SEC case are:

March 13: SEC files remedies-related brief

April 12: Deadline for motions opposing remedies proposals

April 29: Final remedies deadline, the court determines penalties for Ripple’s institutional sales, which the SEC wants to be set at a hefty $770 million.

The final verdict may not be made until August 2024. However, if the two parties reach a settlement, the long-drawn-out lawsuit could end sooner, possibly as soon as April. A settlement could offer both parties a clear resolution and end rising legal costs and uncertainties.

However, some argue that the damage has already been done to XRP. Even if Ripple wins, its reputation and XRP’s market cap have been significantly damaged, raising questions about the longer-term outlook.

Furthermore, the SEC could appeal any ruling in favor of Ripple or even pursue other legal avenues to prolong the case and fuel uncertainty.

How is the XRP price affected by the case?

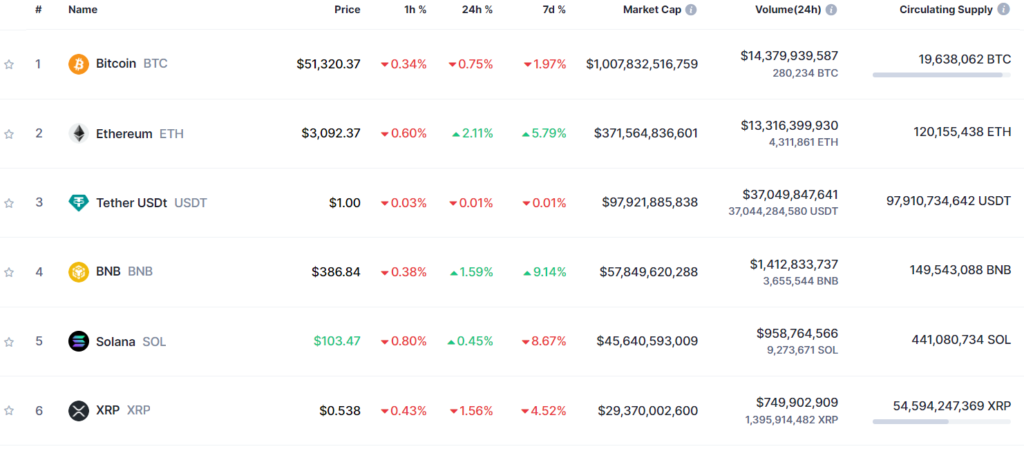

In 2020, when the legal problems with the SEC started, XRP was the third-largest cryptocurrency by market cap. This is no longer the case. According to coinmarketcap, XRP has fallen to the sixth largest cryptocurrency by market cap, below the likes of Solana, Tether, BNB, Ethereum, and, of course, Bitcoin.

The July 2023 ruling resulted in the XRP/USD price almost doubling. However, much of those gains have since been given back.

A decisive Ripple win could spark strong demand for XRP, leading to a bull run. Whereas a loose could hamper Ripple and the broader industry’s progress while resulting in the implementation of stricter rules

Conclusion

XRP vs. SEC’s legal fight concluded the discovery stage on February 20 and looks ahead to the next key date in March. Rumors are also circulating that the two sides could settle, potentially as soon as April, which could end rising legal costs and uncertainty. A settlement could lift XRP/USD, but some worry that the damage has already been done.

Sources

https://crypto.news/traders-watching-xrp-in-ongoing-ripple-sec-case-nuggetrush-is-bullish/

https://coinpedia.org/news/ripple-vs-sec-attorney-reveals-key-details-on-the-next-important-date/

https://dailycoin.com/ripple-vs-sec-case-is-in-the-endgame-these-are-the-key-dates/

Related: