Stocks rallied for the second week in a row in the new year 2023, with tamer CPI numbers out of the USA further fuelling optimism for risky assets for this year. On Thursday, the much-anticipated US CPI numbers came in line with expectations, with the December reading falling 0.1%, its biggest drop since April 2020. On an annual basis, headline CPI rose 6.5%, while core CPI increased 5.7%, also in line with expectations. This marks the 6th month of consecutive decline in the rate of inflation, which brought cheers to the markets, leading stocks, gold, and even crypto prices higher.

The S&P and Nasdaq each posted their second consecutive positive week in 2023 and best weekly performance since November. The tech-heavy Nasdaq was the outperformer for the week, building on the gains it had in the week before to rise another 4.82%. The S&P advanced 2.67%, while the Dow added 2%.

The only casualty to this was the US dollar, which has fallen by more than 2%. The DXY dropped further to 101.80, breaking the 103 support which has held for about a month, this could pave the way for further weakness in the dollar to come, with the next support likely to be the psychological support at 100, as expectations for a reduced rate hike to only 25-bps in the upcoming 31 January-01 February Fed meeting gains traction.

With dollar weakness looking like the narrative of the year, Gold shone brightly, rising above $1,900 to $1,920 for a weekly gain of 2.8%, while Silver was largely unchanged for the week as investors continued to feel conflicted over the direction of the industrial metal as experts continue to warn of a recession this year. However, both precious metals are opening the new week higher as the dollar has weakened further.

Oil rose strongly after a week of consolidation as China’s reopening has progressed smoothly, prompting experts to upgrade the demand for energy from China. Both Brent and WTI Crude rose more than 7% last week, and are flat at the start of this week at the time of writing.

While all risky assets rose last week, cryptocurrencies took the crown of being the most sensational, with the prices of crypto assets gaining a whopping 20% on average. Prices rose especially sharply on Friday night after rumour that a fund had purchased a large call option worth $4 billion on BTC.

The price of BTC jumped around 10% on the revelation, popping from $19,500 to $21,300 within an hour of the rumour, with its sharp jump also pulling up the price of all other altcoins. GALA was the star of the week again, rising more than 50% after a collaboration with some celebrities was made known, after tripling in the week before. However, other altcoins were not far behind, with popular coins like XRP, MATIC, and even large caps like ETH gaining around 20% in the week.

What factor could have contributed to the sudden pop in crypto prices?

More Positive Newsflow Buoys Crypto Prices

Other than the benign US CPI numbers, the crypto market has other good reasons to cheer, two of which are the discovery of around $5 billion worth of liquid assets that beleaguered exchange FTX can return to creditors, as well as the court approval for Binance to purchase the assets of Voyager Digital, another crypto lending firm impacted by the FTX bankruptcy.

The price of BTC punched above $21,000 as whales regained interest in BTC after the recent spate of more positive news surrounding the industry. The amount of shorts liquidation on Friday surged to the highest since July 2021, showing that most retail traders were caught on the wrong side as a slew of negative headlines influenced traders to short the market and eventually get caught out as whales were accumulating, unbeknownst to them, but regularly featured in our weekly reports. The total amount of liquidations in the market topped $721 million, which is the highest value in recent times.

This again speaks volumes of the importance of on chain data as our weekly report last week has hinted that the market rally could have legs and traders should be wary of shorting because of the on chain data we had called out, rather than to depend on headlines or what influencers were saying.

BTC and ETH Pump More than 20% As Whales Return

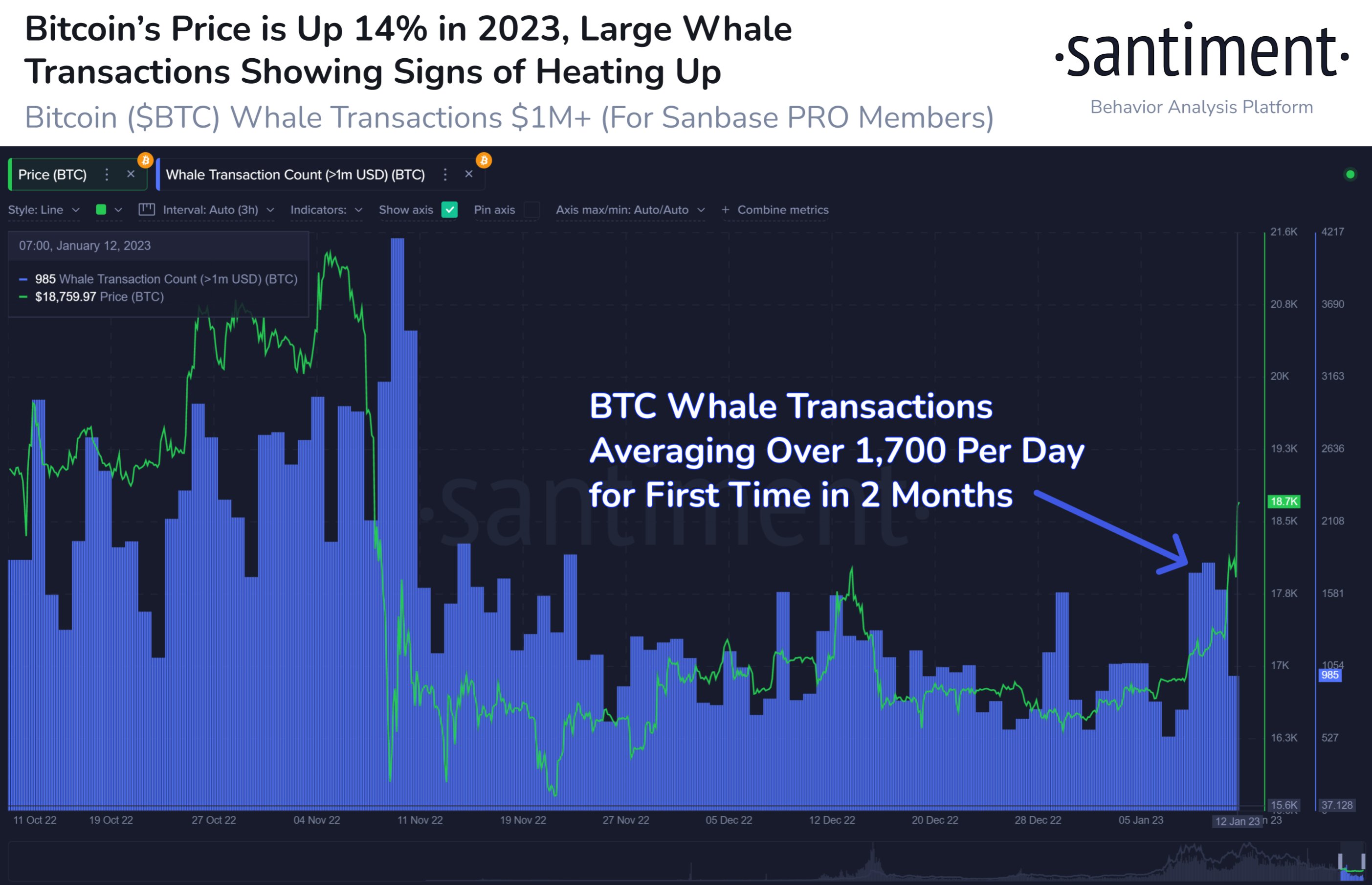

Early last week saw BTC transactions worth more than $1 million rebounding back to levels last seen in November 2022, which can be seen as a sign that whales were merely taking a break in December for the year-end holidays and are now back in the market since the new year has arrived.

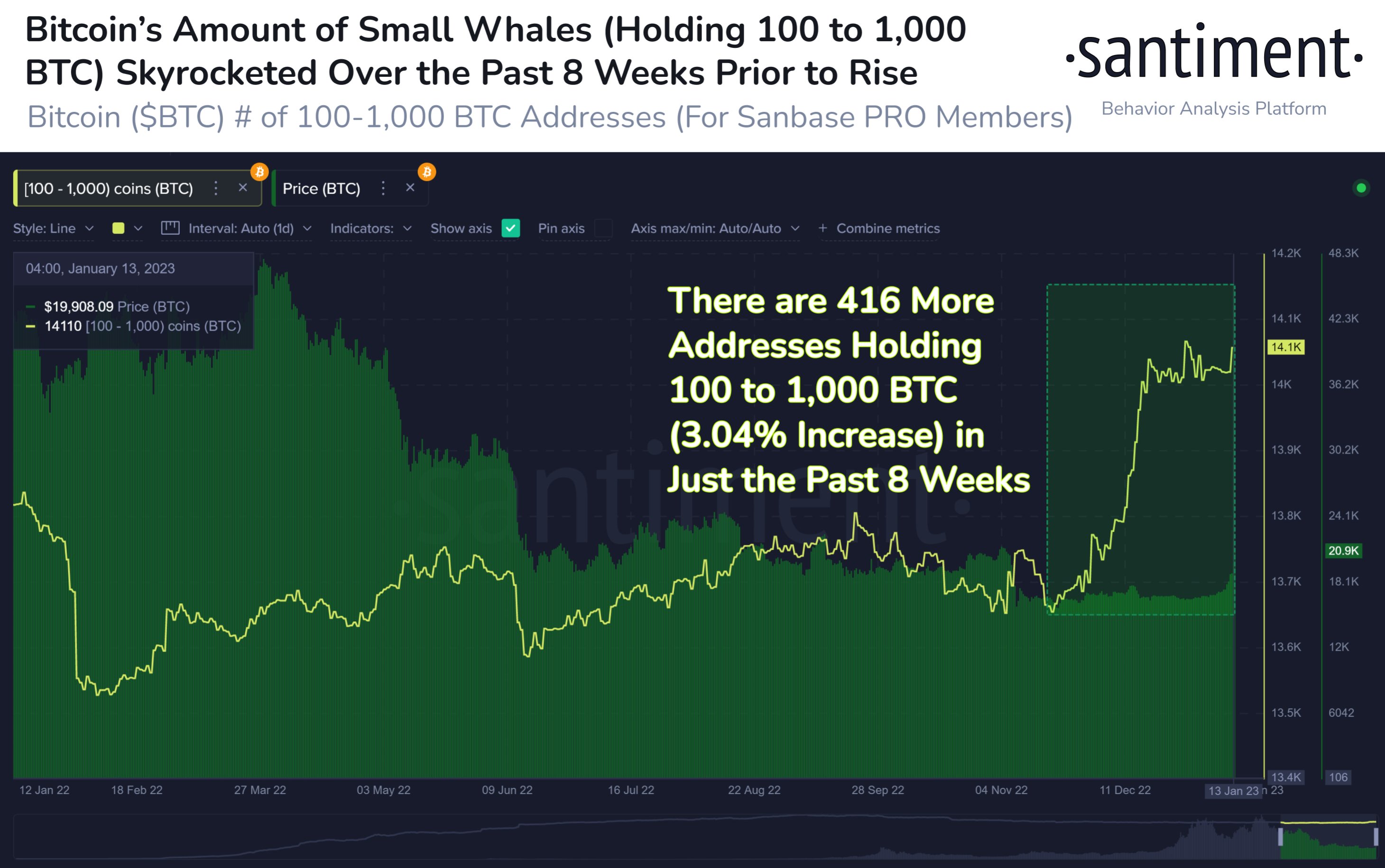

Other than whale transactions picking up, the number of new whale wallets also gained by 416 over the past two months when the price of BTC was consolidating, quietly accumulating the asset when the masses were concerned about negative headlines. This means that new funds have entered the market to buy BTC and these new buyers could be responsible for the amazing pump in BTC since 2023 which has seen the price of BTC jump 25% in just two weeks.

BTC starting to heat up

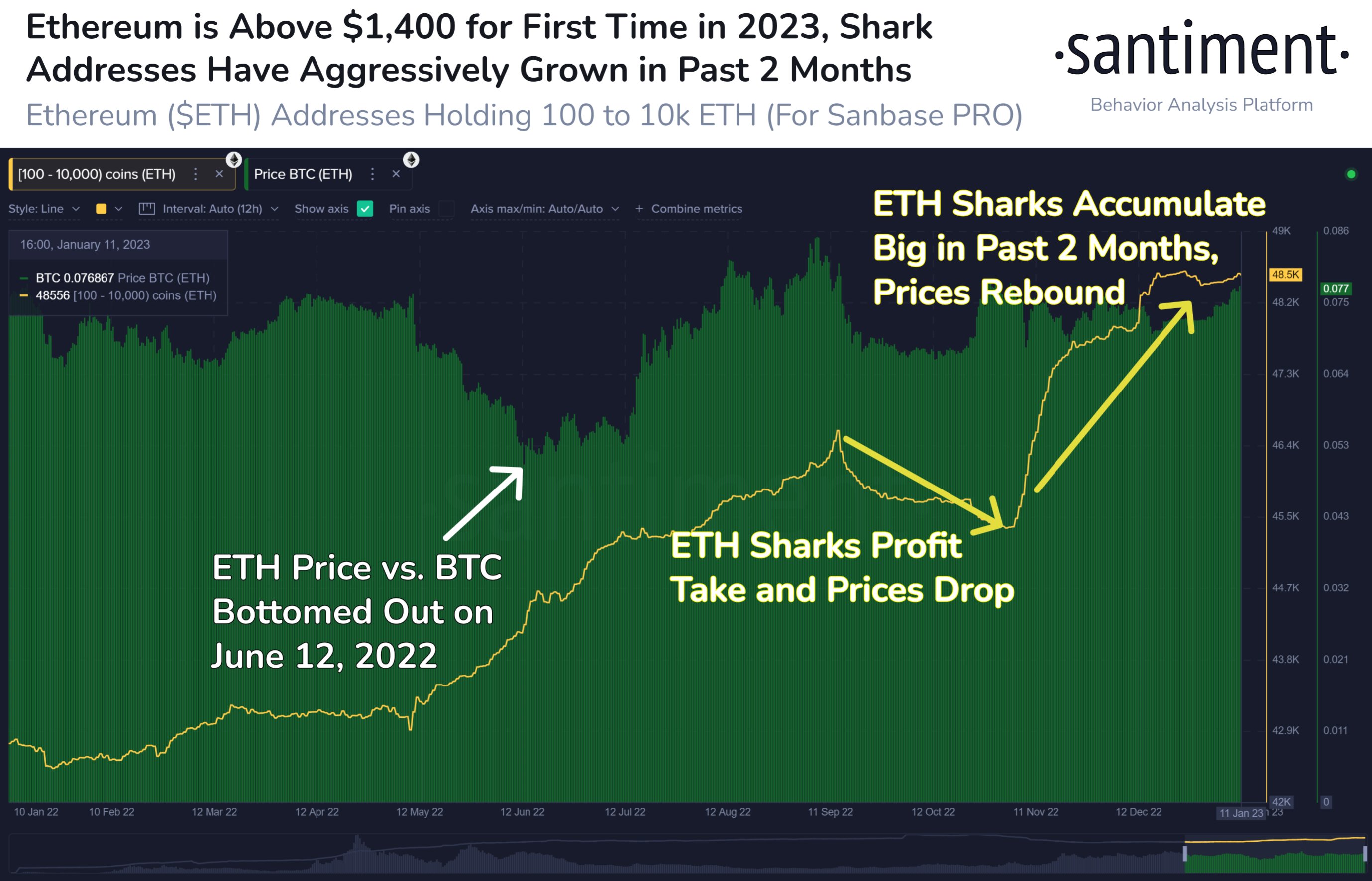

Similarly, it is the same situation with ETH as the number of shark addresses have recovered to levels last seen in February 2021. 3,000 new shark addresses (wallets holding between 100 to 10,000 ETH) have been added to the network over the past 2 months, taking the total number of such addresses to 48,556, another sign that new funds are aggressively buying ETH as well.

The phenomenon of new sharks and whales coming in to accumulate BTC and ETH in the spot market is a very welcome and important development after a terrible 4Q2022 and bodes well for the crypto market.

Number of SOL Users Recovers as Price Stays Supported

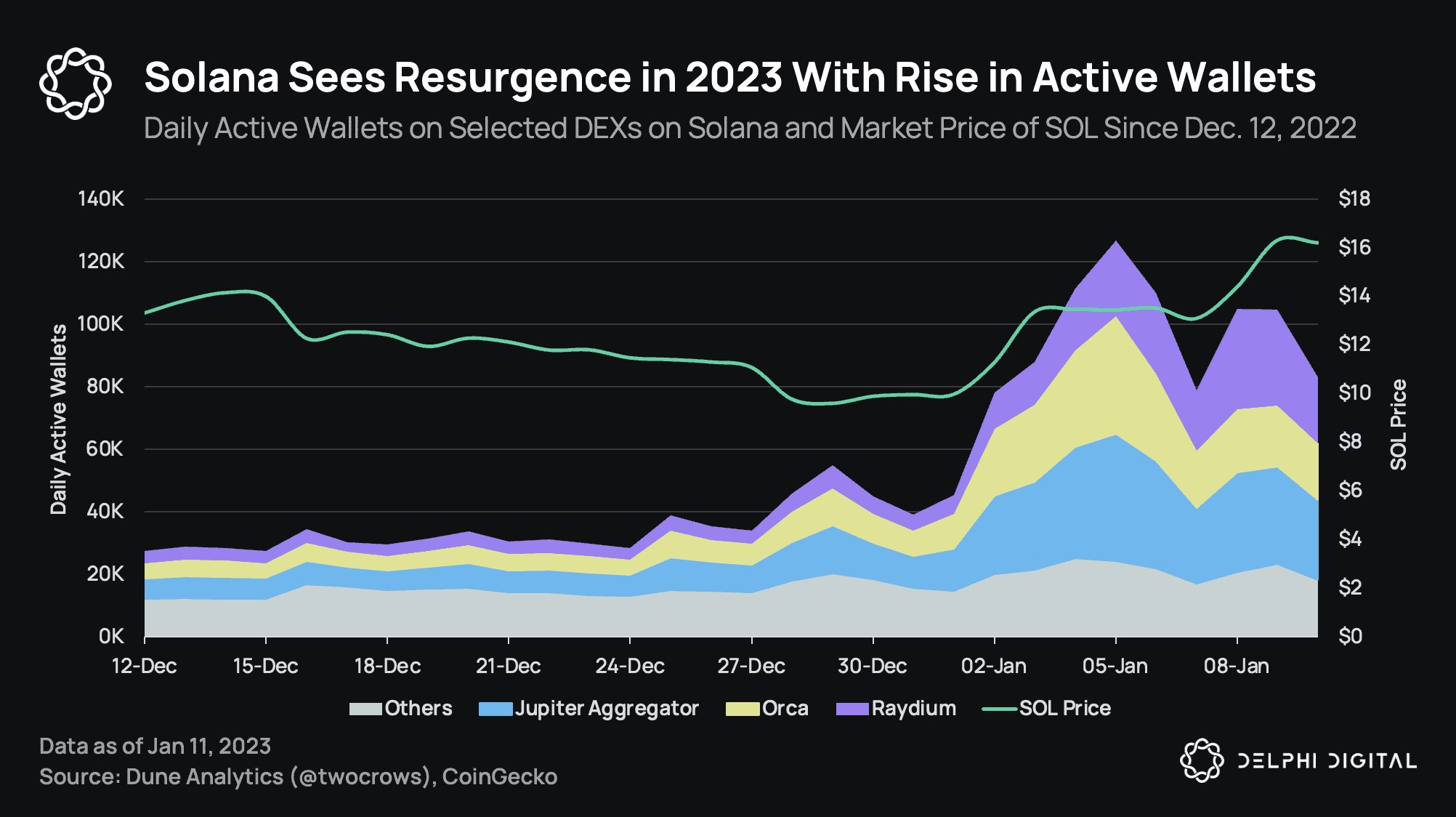

The new year 2023 has even been good to the shelled out coins like SOL which had fallen 97% in 2022. As the new year arrives and Vitalik speaks out to defend the blockchain that has been negatively impacted by the FTX fallout, the price of SOL has been able to maintain its new higher price after having doubled in the first week of 2023.

According to data, the total number of active wallets interacting with SOL DEXs have increased 83% from almost 45,000 per day to 83,000 per day since the turn of the year, showing that the SOL ecosystem is quickly recovering its active usership as crypto users shrug off its connotation with the FTX people. Much of the increase has come from active wallets interacting with Raydium, Jupiter, and Orca, with interactions with Raydium increasing a cool 251%. This shows that the SOL ecosystem is still alive, and it may not be wise to write off this blockchain yet.

The uptick in active wallets continued to reflect in the price of SOL, gaining further upside over the weekend where it jumped to around $25, clocking yet another magnificent gain of more than 50% for the week as SOL’s massive short squeeze continues to play out.

BTC Breaks 200-day MA Amidst Higher Funding Rate

However, despite all the positive developments, some sign of euphoria is beginning to emerge as the average BTC funding rate across all exchanges is moving higher, which could imply that retail traders who mostly missed out on buying the dip in the past two weeks may have jumped into the market over the weekend to try and play catch up. As such, there is a chance that the market may pull back to remove some froth.

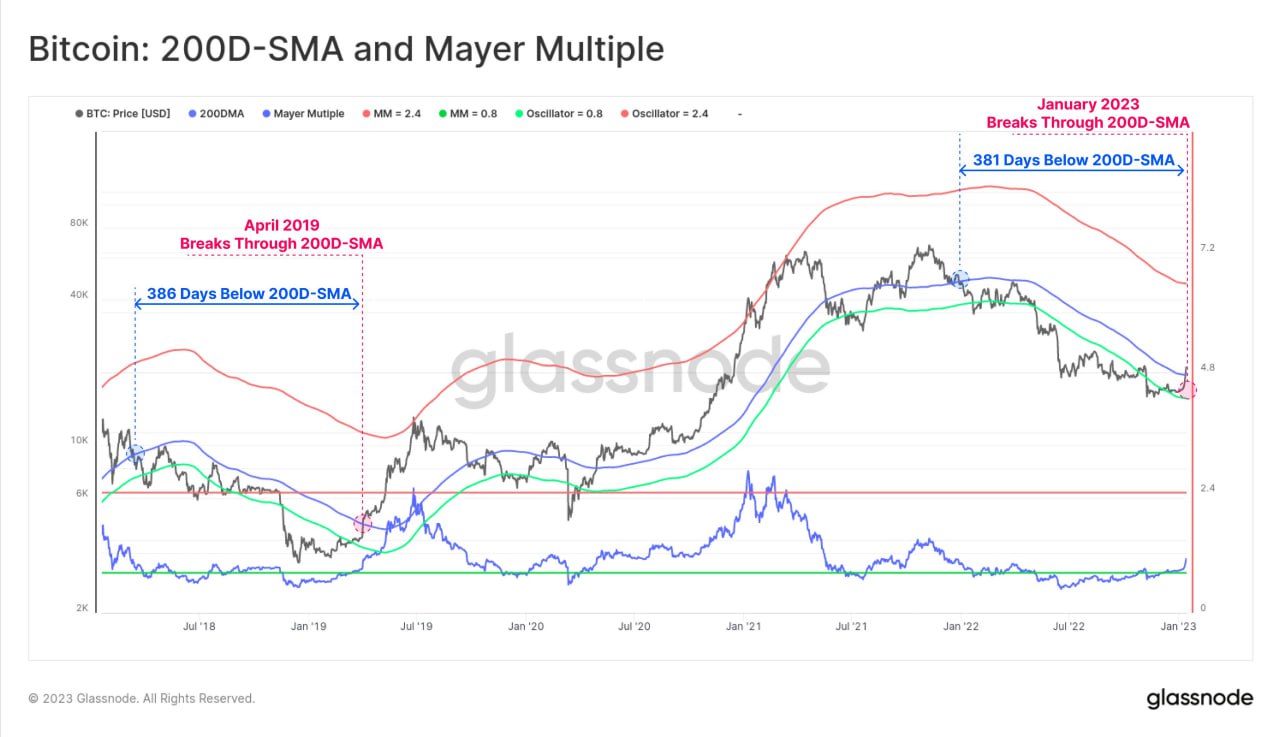

However, with the price of BTC having moved above its 200-day MA in its strong push higher, pullbacks may be shallow as astute traders have started to compare this very strong move up with a similar shoot up in April 2019 which saw the price of BTC merely consolidate at its newfound higher level without any deep pullback. Should this play out like April 2019, the price of BTC may have a lot more upside before it sees the next sharp pullback. We will only know with time if this time will play out like that of April 2019.

With the macro picture this year looking much better for risky assets than last year when dollar strength prevailed, unless another black swan event occurs, the chance of this move mirroring that of 2019 is there as retail sentiment at the start of the year was excessively bearish.

As for the traditional markets, the major risk event this week should be coming from the Bank of Japan (BoJ), which will be deciding on its monetary policy. While it should only impact the traditional currency markets, especially the yen, a more hawkish-than-expected move or narrative from the Japanese central bank could impact all risky asset’s performance in the short term as the yen is the most used funding currency. A more hawkish than expected BoJ may temporarily send markets falling especially if leverage is high as traders may wish to return borrowed yen due to higher borrowing costs. This meeting will be on Wednesday morning Japan time, which is late Tuesday night in the USA.

Other than the BoJ, Wednesday also sees the release of the US PPI number which may move the markets, albeit having a smaller impact than the CPI numbers.