Bitcoin is back as the crypto winter that saw BTC/USD fall 77% to a low of around $16,000 is well and truly over.

Bitcoin has skyrocketed over 450% from its recent low of $16,000 in late 2022. On March 5, BTC/USD rose above the 2021 high to $69,191, a fresh all-time high. The price then surged past $70,000 on Friday, March 7, and reached $71,700 on March 11, continuing its upward trajectory without looking back. This rally has also boosted other cryptocurrencies, such as Ethereum, which has crossed the $4000 mark.

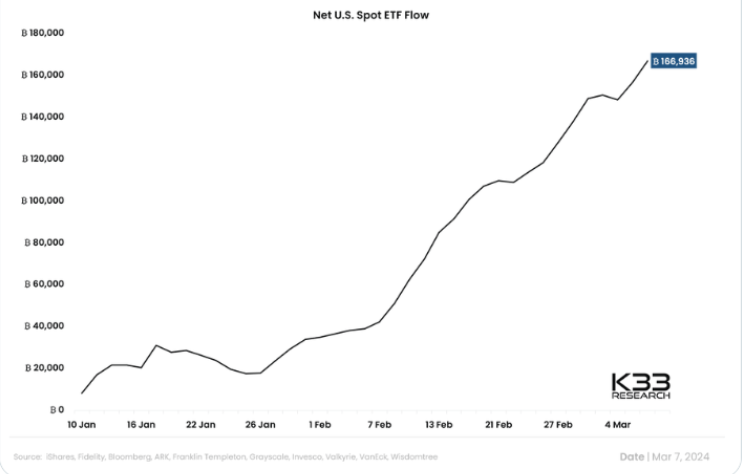

ETF net inflows

The latest leg higher came following the Securities and Exchange Commission’s spot Bitcoin ETF approval on January 10. Spot BTC ETFs track the price of Bitcoin but don’t require the buyer to hold the actual Bitcoin token.

Big names such as BlackRock, Fidelity, and Invesco started offering the product, flinging the door open to institutional investors. The involvement of instructional investors has not only driven demand but also given legitimacy to the market, attracting more retail traders into the crypto space.

Spot ETFs have now recorded over $9 billion in net inflows since becoming available in early January.

Bitcoin halving

Demand for Bitcoin is surging just ahead of the Bitcoin halving event, which will occur at the end of April and see the Bitcoin supply slashed by 50%. This event occurs every four years and makes new Bitcoins scarcer. Should demand remain constant and supply be reduced, BTC/USD will likely rise further.

Related: Bitcoin Halving Shedule

With the halving event comes the expectation of the beginning of the crypto bull market. In the previous Bitcoin halving cycles, the price has typically reached a fresh all-time high in the 18 months following the halving event. Given the ETF news, Bitcoin is reaching new all-time highs even before supply has been affected. Some analysts believe that this could help Bitcoin break six figures this year.

Source: Tradingview

How high will bitcoin go?

So, the million- or even billion-dollar question is how high Bitcoin could go.

Chamath Palihapitiya, a former Facebook (Meta) executive and Bitcoin investor since 2010, said on the All In Podcast that he believes we are just at the beginning.

This is a view that other Bitcoin and crypto market watchers are echoing.

Samir Kerbage, chief investment officer at Hashdex, said, “Once $70,000 is breached, the next natural target is $100,000, and if history rhymes, we could see Bitcoin testing $200,000 to $300,000 through 2025 when another correction could be triggered and lead to a higher low.”

When will Bitcoin hit $100,000?

No one knows for sure whether Bitcoin will rise to $100,000 or not.

Over the past decade, Bitcoin has risen from $800 in January 2014 to $42,000 in January 2024. This marked a rise of 5150%, which breaks down to a 135% annualized return across the past ten years. If Bitcoin were to experience a similar growth rate, it could reach $98,700 in January 2025 and rise to $100,000 in February.

Yet, while there is undoubtedly a bull case, there are also plenty of skeptics who consider Bitcoin to be nothing more than a bubble that could just as quickly lose its value.

Sources

https://decrypt.co/220800/bitcoin-price-another-all-time-high-above-70000

https://coinpedia.org/price-prediction/bitcoin-price-prediction/amp/

Related Blog Articles