Cardano was late to the Crypto market compared to many others, but the altcoin Crypto asset is brimming with innovation, giving it incredible projected growth which fueled early hype and price growth. Cardano potential is still extremely high, if not higher than before, making future Cardano’s price horizon seem very promising.

The difference between Cardano and other “challenger coins” or altcoins (as they are more commonly called) is that it’s not only a virtual decentralized currency, but it is also a network that offers many of the features Ethereum’s blockchain network offers, like smart contracts.

This makes it extremely popular on the Crypto Market, with some even wondering if it has the capability to surpass Ethereum’s popularity when making a Cardano price prediction.

In this comprehensive analysis, we delve into Cardano’s price predictions from 2025 through 2030 – compiling forecasts from various analysts – and explore long-term projections toward 2050. We also examine Cardano’s technical analysis (support and resistance levels), recount major historical milestones (from its 2017 launch through Shelley, Goguen, Alonzo, and recent upgrades), and review Cardano’s ecosystem (staking, smart contracts, governance, DeFi, and real-world use cases). Lastly, we discuss macroeconomic/regulatory factors influencing ADA’s price and provide a balanced investment outlook with key pros and cons. All data and insights reflect the latest market context as of 2025.

ADA Overview

Today (15 December 2025) ADA (ADA/USD) is trading at $0.6972 per ADA, with a market cap of $24563018435 USD. 24-hour trading volume is $996839754 USD. ADA price has changed by 2.7% in the last 24h. Circulating supply is 35290300162 ADA.

Cardano Price Prediction 2025

For 2025, analysts’ ADA price forecasts vary but generally anticipate a recovery from the crypto bear market lows. Below is a table summarizing minimum, average, and maximum ADA price predictions for 2025 based on a range of industry sources:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2025 | $0.52 | $0.94 | $1.37 |

According to DigitalCoinPrice, ADA’s price in 2025 could bottom out around $0.52 in a bearish scenario. On the optimistic end, a Benzinga analysis expects ADA could average about $0.945 (nearly +79% from early 2025 levels) and even reach up to $1.376 that year. This bullish range reflects growing optimism as Cardano’s expanding DeFi ecosystem and project onboarding via Plutus smart contracts bolster sentiment. Other sources echo a similar upper bound: for instance, CoinCodex’s algorithmic prediction sees ADA near $0.70 by mid-2025, with longer-term potential up toward $1+ in subsequent years.

Analysts emphasize that 2025 could be a breakout year for Cardano if the broader crypto market rebounds. Several factors underpin the positive outlook: Cardano’s reputation for sustainability and security is attracting institutional and retail interest, and major network catalysts like Bitcoin’s 2024 halving often drive altcoin rallies the following year. However, not all forecasts are wildly bullish – some remain measured. For example, PricePrediction.net forecasts ADA averaging only around the mid-$0.80s in 2025 (with a min of ~$0.76 and max around $0.86 according to earlier projections). Such conservative estimates reflect a scenario where Cardano grows slowly without a dramatic bull run.

In summary, most 2025 predictions center around ADA reclaiming the $1 mark, with downside risk in the $0.5–$0.7 range and potential upside up to the $1.3–$1.4 level. Achieving the higher end of forecasts would likely require a strong crypto market recovery, significant user growth on Cardano, and continued technical progress on the platform.

Cardano Price Prediction 2026

Looking into 2026, forecasts diverge on whether ADA will continue its ascent or face a cooling period. Here is a summary of 2026 price predictions:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2026 | $0.46 | $1.20 | $1.47 |

Some analysts envision 2026 as a consolidation year for ADA. Benzinga, for instance, projects the average ADA price dipping to roughly $0.594 in 2026 (down from 2025’s average), with a possible low near $0.46. This implies a modest +14% ROI from early 2025 prices, suggesting ADA could retrace or stabilize after a 2025 rally. Their view is that after an initial surge, Cardano’s price might moderate due to macroeconomic headwinds or a shift in investor focus to only the most actively used platforms. Indeed, if crypto markets overextend in 2025, a pullback in 2026 is plausible.

On the other hand, more optimistic outlooks see Cardano’s growth trajectory continuing. DigitalCoinPrice forecasts ADA holding in the $1.25–$1.47 range by end of 2026, with ~$1.41 as a likely price by year’s end. Notably, billionaire venture capitalist Tim Draper has been cited sticking to a prediction of ADA ~$1.47 by end of 2026, reflecting confidence that Cardano can break through technical barriers and gain market traction. In this bullish scenario, Cardano would be building on its smart contract capabilities and potentially starting to challenge its all-time high by 2026.

The gap between low and high 2026 estimates underscores uncertainty about Cardano’s mid-term pace. A bearish case assumes that competition from platforms like Ethereum or Solana, plus any unresolved dApp traction issues, could limit ADA’s gains. A bullish case assumes Cardano’s upcoming scalability upgrades (e.g. Hydra, Mithril) and real-world partnerships begin to pay dividends, driving ADA above the $1 mark firmly. Realistically, many analysts expect ADA somewhere around $1 in 2026, give or take, with the network’s fundamental growth being the swing factor. If Cardano’s network usage and adoption accelerate in 2025-2026, ADA could trend toward the higher ~$1.4+ predictions; if not, it might languish closer to the lower ~$0.5–$0.8 range.

Cardano Price Prediction 2027

By 2027, the hope among Cardano enthusiasts is that ADA will have entered a new tier of value, potentially setting fresh highs. Here are the compiled 2027 price predictions:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2027 | $1.25 | $1.98 | $3.00 |

Sources: Several market analysts foresee ADA climbing into the $2+ range by 2027. DigitalCoinPrice analysts predict Cardano could start 2027 around $1.71 and trade up to roughly $2.09 during the year. Their expected average for 2027 is near $1.98,which would be a significant increase (~40%) over 2026 levels. This aligns with the view that 2027 might be the point where Cardano decisively breaks above its previous cycle highs. In fact, some projections consider $2+ in 2027 “really an acceptable jump” given Cardano’s progress.

Bullish commentators suggest that by 2027 Cardano’s ecosystem maturation – with numerous dApps, increased DeFi TVL, and possibly a few “killer app” deployments – could push ADA toward new all-time highs. Breaking the $3 barrier is not ruled out; for instance, if Cardano’s scalability improvements from the Basho phase (like Hydra layer-2) are fully operational by then, ADA demand could surge. A report by TokenMetrics even speculates Cardano could reach $3.33 by 2030 assuming it overcomes resistance levels, implying that somewhere in the $2–$3 range by 2027 is feasible.

On the flip side, it’s worth noting some more cautious views. If Cardano’s development were to stall or network adoption remain tepid, ADA might underperform these rosy targets. Some algorithmic models (such as CoinCodex at one point) even indicated a possible downtrend by the late 2020s in worst-case scenarios – for example, one pessimistic model showed ADA around $0.48 in 2028 if the platform did not live up to growth expectations. While such a low figure by 2027–2028 seems unlikely to many, it serves as a reminder that nothing is guaranteed.

Overall, $2.00 is a reasonable average target for 2027, with potential downside to the low $1’s in a bearish climate and upside up to ~$3 if Cardano truly thrives. By this time, Cardano’s “Voltaire” governance era should be in play, potentially boosting investor confidence as ADA holders gain voting power in the ecosystem’s future (which could positively impact price).

Cardano Price Prediction 2028

In 2028, Cardano will be in its second decade, and analysts anticipate that ADA’s value could reflect the platform’s maturity. Below are 2028 predictions:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2028 | $2.36 | $2.42 | $2.90 |

According to a forecast cited by Changelly (likely derived from PricePrediction.net data), ADA could trade on average around $2.42 in 2028, with a possible drop to a minimum of ~$2.36 and a bullish peak up to $2.62. PricePrediction’s own model is in a similar ballpark, projecting a min of about $2.39 and a max of $2.90 for ADA in 2028. These figures suggest a relatively narrow range, indicating a period of steadier growth or consolidation after the big gains of earlier years.

It’s noteworthy that these forecasts (in the $2.4–$2.9 range) would mean ADA roughly matches or slightly exceeds its previous all-time high (~$3.10 in September 2021). By 2028, Cardano’s network might be hitting its stride with respect to scalability (Basho era fully realized) and interoperability, which could justify it sustaining prices near all-time highs. The Vasil upgrade in 2022 and subsequent improvements (like Plutus V2 smart contracts) are expected to have improved Cardano’s throughput and efficiency significantly – Vasil alone reduced transaction fees ~50% and cut transaction size by 10x, greatly enhancing performance. The benefits of these upgrades would be fully realized by 2028, potentially drawing in more high-volume applications and users.

That said, other sources present alternate scenarios. For instance, CoinStats provides a more bullish 2028 outlook, suggesting ADA’s price could range between $5.29 and $5.73 (avg ~$5.51) by 2028 – a forecast far above the ~$2.5 level. Such an outlook assumes explosive growth in Cardano’s DeFi and dApp usage. On the contrary, Binance’s forecasting tool once showed a scenario of ADA averaging only $0.487 in 2028 (a steep drop), but this appears to be a highly bearish outlier likely based on short-term trends rather than fundamentals.

The consensus of moderate predictions around $2.5 implies that by 2028, ADA will have firmly entrenched itself in the multi-dollar range. If Cardano continues to onboard real-world use cases (e.g., digital identities, supply chain projects, etc.) and maintain a robust community, a price in the several-dollar range is justified. However, to break substantially above ~$3, Cardano would probably need a catalyst such as major institutional adoption or a crypto market boom akin to earlier cycles.

Cardano Price Prediction 2029

Forecasting 2029 is challenging, but it provides a window into how experts see Cardano performing at the end of the decade. Here are 2029 price predictions:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2029 | $2.68 | $4.00 | $6.00 |

By 2029, some analysts believe Cardano will experience “tremendous growth”, potentially achieving new price highs. DigitalCoinPrice notes ADA is expected to surpass $2.68 in 2029, which suggests that, at minimum, ADA stays above that level. Our compiled forecast puts a notional average around $4.00 for 2029, with a bullish case up to $6.00 or higher.

However, not all projections for 2029 are rosy. Some conservative models still caution that ADA could be under $1 if worst-case scenarios play out (for example, a stagnation in user growth or severe regulatory crackdowns). The Benzinga report’s long-term scenario is notably bearish: it forecasted an average price of only $0.341 by 2030, with a max of $0.801.

On balance, by 2029 the range of $3–$6 captures the span between tempered optimism and aggressive bullishness for ADA. If instead crypto growth plateaus in late 2020s, ADA might be closer to the lower end or even below our average estimate. This makes 2029 a pivotal year, setting the stage for Cardano’s longer-term fate.

Cardano Price Prediction 2030

The year 2030 is a landmark horizon for many crypto forecasts. By 2030, Cardano will have gone through multiple market cycles and fully deployed its roadmap. What could ADA be worth in 2030? Here’s a synthesis of predictions:

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2030 | $4.84 | $5.50 | $6.11 |

A number of industry forecasting sites converge on Cardano being in the mid-single-digit dollars by 2030. PricePrediction.net, for example, indicates a bearish 2030 target around $5.01 (min) and a bullish potential up to ~$6.11. They place the average price roughly in the $5.5 range. Similarly, Ambcrypto and TokenMetrics have cited 2030 price possibilities in the $5–$7 zone, assuming Cardano continues to execute its roadmap successfully.

On the bullish extreme, some enthusiasts and analysts foresee much higher valuations by 2030 if Cardano captures a significant share of the crypto market. For instance, certain YouTube and community speculators talk about two-digit or even $10+ ADA by 2030 given ideal conditions (mass adoption of Cardano in developing nations’ infrastructures, or a scenario where Cardano hosts the next wave of killer dApps). Indeed, CoinStats projected a scenario of ADA as high as $10.32 by 2030 under a strong bullish surge.

In summary for 2030: A reasonable expectation is ADA in the $5 range, assuming Cardano’s technology and ecosystem continue to evolve and attract users. This would still be below some other platforms’ market caps today, leaving room for upside if Cardano overachieves. Key drivers for a $5+ ADA by 2030 include: successful scaling (Hydra) which can enable high throughput, robust governance (Voltaire) giving ADA holders control (which could attract more investors due to decentralization), and thriving real-world use cases (for example, nation-state or enterprise adoption of Cardano-based solutions). If those stars align, ADA could even overshoot the $6 level.

Long-Term Cardano Price Forecast (2040–2050)

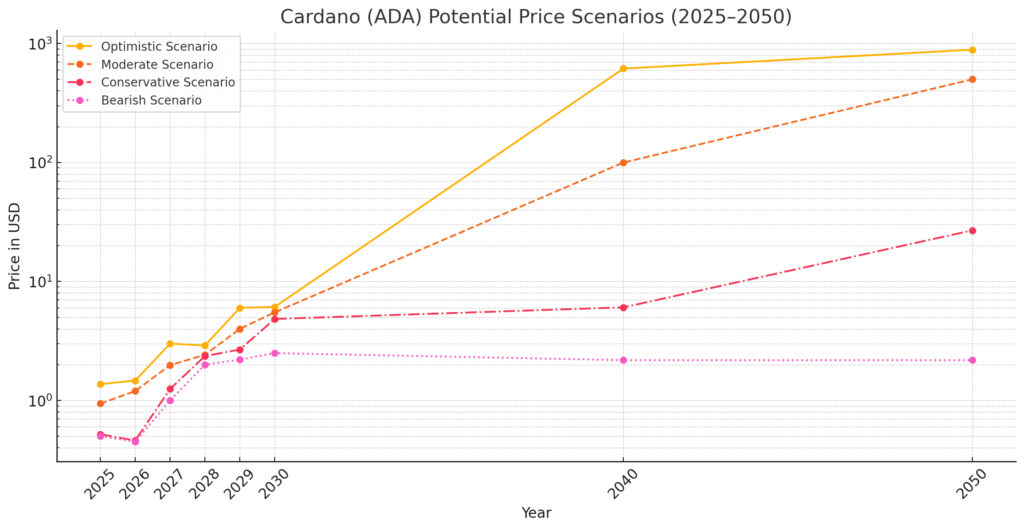

Projecting Cardano’s price out to 2040, 2050 and beyond enters highly speculative territory. Such long-term forecasts should be taken with a huge grain of salt. Nonetheless, some crypto prediction sites have ventured to imagine ADA’s distant future value:

PricePrediction.net (2050): An ultra-bullish scenario from one forecast suggests Cardano could soar into the hundreds of dollars by 2050. Specifically, ADA is projected as high as $887 by 2050 according to PricePrediction.net’s long-term extrapolation.

Changelly (2050): Another source (cited by Benzinga) gives somewhat lower – but still astronomical – long-term numbers. Changelly’s forecast table shows an average price of about $546.9 for 2050. They mention a maximum around $563 and minimum near $477 by 2050. By 2040, Changelly suggests ADA could reach the mid-$100s. Again, these are extremely optimistic visions, effectively positing Cardano might capture a large fraction of the entire crypto market value by that time.

More Conservative Views: Not everyone sees ADA going to the moon in the long run. Using more conservative growth models (for example, extrapolating Bitcoin’s historical growth rate onto Cardano), CoinCodex analysts estimated ADA could reach around $6.06 by 2040 and $26.86 by 2050. These figures treat Cardano as growing steadily but not exponentially – ADA would roughly 10x from 2030 to 2050 under this scenario. Meanwhile, one particularly bearish exchange forecast (MEXC) even posited ADA might only be about $2.18 in 205 (which would imply Cardano stagnates or fails to grow in real terms over 25 years – essentially a scenario of being outcompeted or only maintaining current value).

Given these disparate projections, what’s a realistic outlook for 2040–2050? The truth likely lies somewhere in between the extremes. If Cardano succeeds at its mission (“to bank the unbanked”, provide a global infrastructure for decentralized apps, and achieve a self-sustaining governance ecosystem), ADA could indeed be worth orders of magnitude more than today. For instance, reaching even $100+ by 2050 would mean Cardano became a foundational layer of the future internet of value, serving perhaps billions of users. This would require Cardano to continuously innovate and fend off all competitors for decades – a challenging, but not impossible, feat.

On the other hand, 30 years is an eternity in tech. There’s a reasonable chance that by 2050, the crypto landscape will have shifted in unforeseeable ways. Cardano might evolve into something very different, or new technologies (quantum computing, new consensus mechanisms, etc.) might emerge. Regulatory regimes will also mature; by 2050, government policies could either strongly support blockchain platforms like Cardano or severely restrict them. Due to these uncertainties, most analysts refrain from giving precise 2050 targets, instead painting scenarios: from ADA being virtually worthless (in a failure scenario) to ADA being a dominant currency (in a best-case scenario).

In summary, long-term projections for ADA through 2050 range from single-digit dollars to several hundred dollars. The wide span reflects the unpredictable nature of technology adoption over multi-decade timelines. Investors looking that far ahead should focus less on exact price targets and more on Cardano’s trajectory: Is the network’s usage and innovation trending upward over the years? If so, it’s likely to accrue significant value in the long run. If not, even current valuations might not hold.

Bottom line: Cardano’s long-term potential is enormous, but so are the challenges and unknowns. Caution and realistic expectations are advised when interpreting any 2050 price prediction.

Macroeconomic and Regulatory Factors Influencing ADA’s Price

Cardano, like all cryptocurrencies, does not operate in a vacuum. Its price is influenced by broader macroeconomic trends and the evolving regulatory landscape. Here we discuss how these factors impact ADA.

Macroeconomic Factors

- Global Financial Trends: In times of economic uncertainty or weakness in traditional markets, investors often look towards alternative assets, including cryptocurrencies like Cardano.

- Interest Rates and Monetary Policy: The era of low interest rates (up to 2021) saw abundant liquidity flowing into crypto. If interest rates are high (as some central banks raised them in 2022–2023 to combat inflation), investors have more incentive to hold bonds or cash, potentially reducing appetite for non-yielding assets like gold or low-yield assets like some cryptos.

- Bitcoin’s Market Cycle: As a large-cap altcoin, ADA is significantly affected by Bitcoin’s halving cycles and overall crypto market sentiment. Historically, Bitcoin’s bull markets (2017, 2020-2021, etc.) lifted ADA’s price substantially, while Bitcoin’s bear markets (2018, 2022) saw ADA draw down heavily.

- Institutional Adoption: The macro trend of institutional involvement in crypto also affects ADA. Bitpanda’s analysis noted that in 2024, Grayscale increased ADA to 20% of its Smart Contract Platform (ex-Ethereum) fund, indicating rising institutional interest. If more institutions (hedge funds, ETFs, etc.) include ADA in portfolios, it can boost demand and also stabilize price via long-term holdings.

- Geopolitical and Market Events: Events such as a pandemic, war, or major geopolitical shifts can have indirect effects. For example, in early 2020 the Covid-19 market crash briefly tanked crypto including ADA, but then the massive monetary stimulus led to a huge crypto rally later. Similarly, if a global crisis leads to currency devaluation, people in affected regions might adopt crypto more (potentially benefiting ADA if Cardano is accessible there).

Regulatory Factors:

- Securities Classification and Legal Status: A major overhang for ADA (and many altcoins) in recent times has been the question of whether it is considered a security by regulators, particularly the U.S. SEC. In 2023, the SEC, in lawsuits against exchanges like Binance and Coinbase, listed ADA among tokens it alleges are unregistered securities. If, however, ADA were deemed a security without proper registration, it could force exchanges to delist it in the U.S., impacting liquidity and price negatively. That said, Cardano is a global project – even strict U.S. action might not kill it, but it would dent sentiment.

- Regulation of DeFi: As Cardano’s DeFi ecosystem grows, it could come under regulatory scrutiny (e.g., AML/KYC requirements for DEXs or stablecoins). How the Cardano community navigates compliance (perhaps via decentralized identity integration to enable compliant DeFi) will influence whether big money feels comfortable entering Cardano’s DeFi. If Cardano can position itself as a regulator-friendly DeFi chain (thanks to its governance and identity layers), it might attract enterprise DeFi use, which would be bullish. On the other hand, over-regulation could stifle innovation or drive users to more permissive jurisdictions/chains.

Tax and Legal Recognition: Over the long term, how ADA is treated in terms of taxes can affect investor behavior. For instance, if holding ADA or staking yields gets favorable tax treatment in some countries, that could encourage more participation. Already, some countries have zero crypto capital gains (e.g., certain EU countries for long-term holds) which indirectly encourages investment. Legal recognition of Cardano in financial products (like being able to include ADA in retirement accounts, or use ADA as collateral legally) will also broaden its adoption.

Central Bank Digital Currencies (CBDCs) and Competition: Macro-regulatory trends like the rise of CBDCs could have an indirect impact. If people and governments get comfortable with digital currency through CBDCs, it might make them more open to public cryptocurrencies. Cardano could even potentially support CBDCs or national stablecoins on its network if a country chose to use an existing chain. On the flip side, if governments push CBDCs as the only allowed digital currency, they might impose stricter rules on private cryptos like ADA. We’ve seen some nations (like China) heavily restrict crypto in favor of a CBDC; if that approach spreads, crypto might be marginalized in some markets.

Environmental Regulation: As climate change becomes a policy focus, energy-intensive crypto (proof-of-work) may face regulatory pressure. Cardano, being energy-efficient, could benefit from any such shift. For example, some investment funds are prohibited from buying Bitcoin due to ESG concerns; those funds could consider ADA as an ESG-friendly crypto investment. If carbon taxes or restrictions hit mining, PoS chains like Cardano might gain hashpower refugees and community from PoW chains. Cardano’s emphasis on sustainability aligns well with the direction of environmental regulations.

In essence, regulation is a double-edged sword for ADA.

Clarity and supportive regulations can legitimize Cardano and encourage big capital inflows – for instance, if the SEC eventually categorizes ADA as not a security or a new law exempts decentralized tokens, it would remove a big cloud over ADA (the recent price suppression due to regulatory fears might reverse). On the other hand, hostile regulation can limit market access – e.g., U.S. users losing easy access to ADA on exchanges reduces demand.

From a macro perspective, Cardano’s focus on working with regulators (the Cardano Foundation actively engages with policymakers to educate them) and on identity/governance could make it one of the better-positioned chains to comply with emerging rules. This might turn regulatory compliance into a strength for Cardano, attracting institutional projects that need a compliant platform.

Macroeconomic and regulatory factors will play a significant role in ADA’s price trajectory. Bullish macro/regulatory scenario might look like: global economic uncertainty + crypto-friendly regulations + institutional acceptance = ADA demand surges. A bearish scenario might look like: strong global economy (risk-off for crypto) + stringent regulations (limiting crypto) + increased competition = ADA demand stagnates. Most likely, reality will have mixed elements. Investors will be watching developments like the resolution of the SEC lawsuits, the passage of crypto bills in major countries, and central bank policies as key signposts for Cardano’s environment.

Key Facts About Cardano (ADA)

Cardano is the world’s first ever academic, peer-reviewed decentralized blockchain solution and ADA is the native Cryptocurrency that powers that protocol.

Charles Hoskinson, Founder of Cardano and ADA

Cardano and ADA were created by ex-Ethereum co-founder Charles Hoskinson. Charles Hoskinson is yet another pioneer in the Cryptocurrency space, working to push overall adoption forward. He has played an important role in the early phases of the industry.

Although he is heavily focused on Cardano, he is also the director of The Bitcoin Education project that supports the first ever Cryptocurrency.

Hoskinson studied math and cryptography at the University of Colorado and applied his knowledge to the projects he has worked on.

As mentioned previously, the authority that Hoskinson’s name brings to the project will undeniably help the Cardano ADA price. When making investment decisions, the people involved or invested in a project can have an immediate effect on the price of the asset.

Hoskinson and Cardano’s significant potential

There’s an additional effect at play here, though. Hoskinson’s name and pedigree will inevitably attract developers to the Cardano ecosystem and blockchain. These developers will work on their own token standards and help in developing advanced features for the network at large.

The network will also obviously be hosting smart contracts and dApps that take advantage of them.

And all of these developments are fueled by ADA transaction fees. How do you think that will inform an ADA price prediction?

What is Cardano coin (ADA)? A third-generation blockchain

Cardano uses a powerful proof of stake consensus algorithm called Ouroboros to secure the blockchain. It is uniquely designed to head on address the scalability issues associated with Bitcoin, Ethereum, and other gen 1 and gen 2 blockchains.

Although it is vastly different, it more closely resembles Ethereum with its focus on smart contracts. However, it claims to offer many advanced features over other blockchains.

Cardano takes a scientific philosophy and research-driven approach and even had its product peer-reviewed by a number of universities before its release.

The development team itself is packed with some of the most respected researchers, cryptographers, and engineers.

What is Daedalus when talking about Cardano?

While ADA coin can be stored on a Ledger, Trezor, exchanges, or nearly any platform wallet, its native wallet is called Daedalus.

The project is supported by the Cardano Foundation, Input Output Hong Kong, Emurgo, and a wide variety of partners and universities.

Cardano focuses on functional programming, formal development methods, and prototyping to ensure the future of the project is sound.

It is also one of the altcoins with the most clear and well-defined roadmap. The Cardano future is bright. Learn more here .

Is Cardano a good investment or not?

Price predictions aim to provide investors and traders with a look at Cardano’s growth, continued growth and projected value. After years of going down, ADA is ready to increase in price once again and show the true potential we all know Cardano is capable of.

The new kid on the blockchain

Cardano is also fairly new, which means investors and traders can get in early, and become among the few that experience the greatest financial upside.

At the same time, making a Cardano price prediction or an ADA price prediction, to be exact, maybe a bit more challenging, though, due to the lack of historical price data.

But always do your own research or as the Crypto community says “DYOR” (do your own research).

Will Cardano hit $10?

Cardano could be on track to take out $10, and re-enter price discovery with no real resistance to speak of. How far each ADA climbs is anyone's guess.

Why is the ADA coin price going up?

The fundamental catalyst behind the surge in ADA price is the rise in the issuance of native assets on the Cardano network.

How high can Cardano go?

Most optimistic bullish long-term Cardano price forecast could be anywhere from $20 – $40

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.