- SEC approves spot Ether ETFs

- Why is ETH falling after approval?

- Worries over high US interest rates hurt Bitcoin

Bitcoin is falling for a fourth straight day, dropping to 67,000 as concerns of high interest rates for longer in the US offset news of spot Ether ETF approval.

While Bitcoin is sitting flat across the week, it has fallen over 6.5% across the past four days, with losses of 3.5% in the past 24 hours alone.

In contrast, Ether is trading around 1.2% lower today amid some profit-taking but has had a stellar week, booking gains of just 18%. ETH rose earlier in the week on expectations that the Securities and Exchange Commission (SEC) would approve the application of several major exchanges to list spot Ether ETFs.

SEC approves spot Ether ETFs

On Thursday, the US regulator approved rule changes supporting ETFs that track Ether for several groups, including BlackRock, Fidelity Invesco, and Ark Invest. Further approvals may be needed before the product can launch.

This marks a significant shift in the SEC’s stance after months of silence on the issue. It is a crucial step toward offering Ethereum access through ETS, similar to the Bitcoin ETF approved in January.

Why is ETH falling after SEC approval?

Interestingly, Ether’s price is falling despite the news, which could be for several reasons. Firstly, it could be argued that Ether has rallied over 60% this year on the optimism of Ether ETFs being approved. Therefore, the actual approval sparks a buy-the-rumour, sell-the-fact movement.

Secondly, although ETFs have been approved, they still haven’t been cleared to launch, which could take weeks or months. As a result, there haven’t been ETF new capital inflows. When these massive capital inflows start in the first few weeks, this is when we could see Ether surge higher.

There are also concerns that Grayscale’s announcement of its plans to convert its Grayscale Ethereum trust into a spot Ether ETF could result in significant outflows, as was the case with the approval of the spot Bitcoin ETFs in January.

High US interest rate concerns hurt Bitcoin.

Meanwhile, Bitcoin trades under pressure as concerns of high interest rates for longer remain a key pressure point on the crypto markets.

Data yesterday showed that U.S. business activity grew at the fastest pace in two years, largely reflecting stronger growth in service providers. The strong data comes after hawkish Federal Reserve minutes earlier in the week, in which some policymakers said they were even open to raising interest rates further. The minutes came after a string of Federal Reserve officials warned that interest rates must stay high for longer to tame inflation.

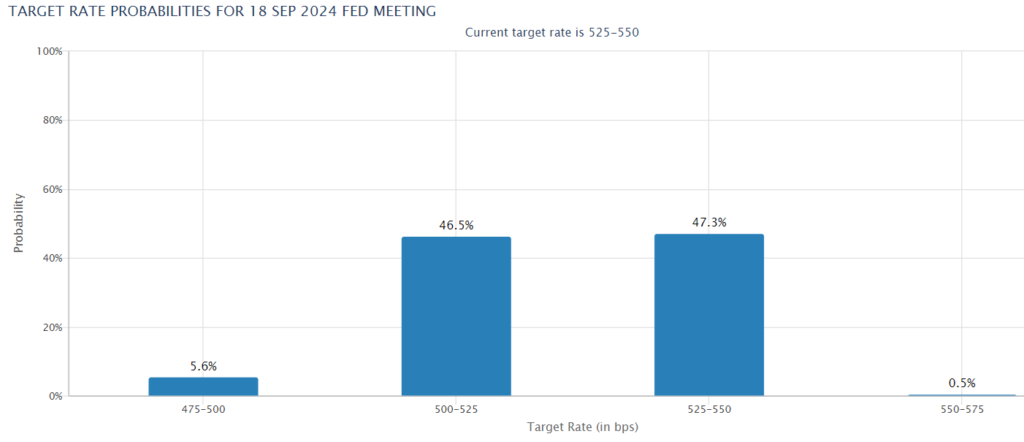

According to the CME Fed watch tool, traders are now pricing in a 47.5% probability that the Fed will leave rates unchanged in September, up from 35% just a week ago.