Bitcoin is holding steady at around 67k after losses in the previous session. The largest cryptocurrency has traded down around 2% so far this week in anticipation of a tight presidential election and a more gradual pace of Fed rate cuts. Trading volumes in the crypto market remain relatively subdued amid increased risk aversion.

While recent polls had pointed to Republican candidate Trump holding a slight edge over Democratic nominee Kamala Harris, the polls are still tight. Trump has maintained a pro-crypto stance throughout the campaign. However, there are also concerns that Trump’s macroeconomic policies could be inflationary, which would mean a more gradual pace of rate cuts from the Federal Reserve. A more gradual pace of rate cuts is less beneficial for liquidity and does not bode as well for riskier assets such as crypto.

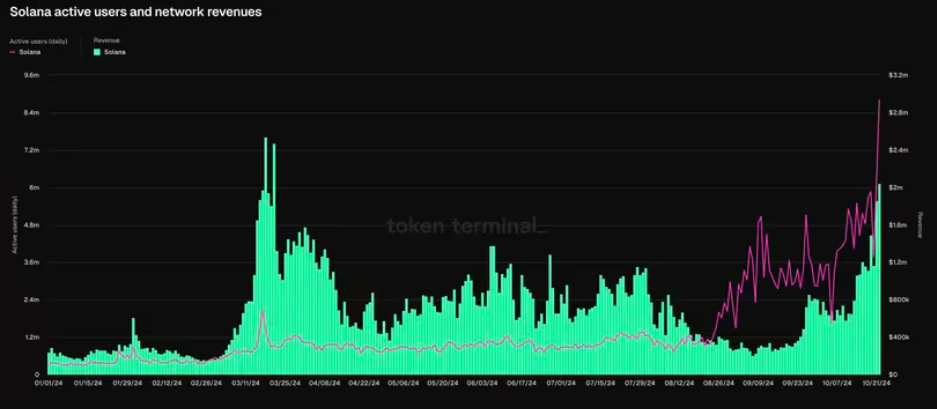

Solana outperforms in crypto.

Solana is outperforming the crypto market this week, rising 4.5% to an almost three-month high above $170 and extending 11% gains from the previous week. The rally comes as trading volumes have ramped up, with Solana trading volumes up 16% over the past seven days. The coin’s circulating supply has increased by 0.6% to $470.01 million.

While the broader cryptocurrency market is consolidating this week, Solana continues to charge higher. Solana reached a new all-time record high against rival layer-1 network Ethereum, surpassing the 0.064 level, which was reached in August. Relative strength against Bitcoin is also at its highest level in over two months.

Memecoin frenzy boosts Solana activity.

The impressive price action comes alongside resurgent speculative activity in meme coins spurring a jump in network revenues. The latest frenzy is for AI meme coins, which are predominantly based on the Solana network.

AI coins have seen explosive interest over the past few weeks, with many reaching over $100 million in market capitalization. One such example is Goatseus Maximus which skyrocketed to over $600 million market cap from zero in just two weeks.

Network revenue and open interest rise

This latest AI frenzy has driven blockchain activity on Solana to record highs. Network revenue from transaction fees has risen above $4 million a day, close to the record seen in March this year. Network revenue has posted a tenfold increase since early September lows. Meanwhile, active users on the chain increased to a record high of over 8 million.

Separately, open interest on Solana futures rose over 18 million, equivalent to $3.09 billion. This is the highest amount since January last year, according to Coin Glass data. In the past four days alone, open interest has increased by 3 million. Open interest is a great way to determine if new money is entering the market.