Bitcoin is holding steady around the 98k level after choppy trade in recent sessions and as investors adopt a cautious stance ahead of US inflation data which could provide further clues on the outlook for interest rates.

Bitcoin is remaining in its 90k to 100k trading range, which it’s been trading within over the past few weeks. While optimism surrounding a more crypto-friendly environment under incoming president Donald Trump lifted prices above 100k to record highs, crypto markets have since been subject to profit-taking and some concerns regarding the outlook.

Bitcoin has fallen 2% so far this week, falling to 94.3k on Tuesday as over-leveraged traders were liquidated. While such pullbacks are typical and healthy in a bull market, the sell-off also came alongside concerns surrounding Google’s new quantum chip, Willow, and its potential to crack blockchain networks and breach the security that protects Bitcoin.

Google’s Willow chip is a significant step forward in quantum computing. The revolutionary processor claims to take minutes to solve a problem that would take the world’s fastest supercomputers 10 septillion years to complete.

Currently, the Willow chip has 105 qubits, significantly advancing computer technology. However, to crack the Bitcoin blockchain, experts say a quantum computer chip needs 200 million to 400 million qubits. The technology is still some way from doing this, so it is still far from being able to penetrate Bitcoin security. Bitcoin remains secure.

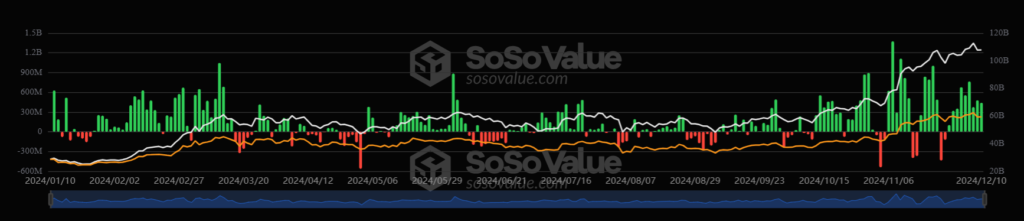

Bitcoin ETFs see net inflows for a 9th day!

Yet despite Bitcoin’s price move lower and concerns surrounding its outlook, institutions are seen buying the dips, which is a positive sign for the outlook. Bitcoin ETFs saw positive net inflows of $439 million on Tuesday, marking the ninth straight day of net inflows. The total net assets of US Bitcoin ETFs have reached $107.76 billion, accounting for 5.65% of Bitcoin’s total market cap and surpassing addresses associated with Satoshi in holdings.

How could US inflation data impact Bitcoin?

Attention is now turning to US CPI data, which is expected to show that inflation rose 2 2.7% YoY in November, up from 2.6%. Meanwhile, quote CPI is expected to hold steady at 3.3%. The data provides further clues about the Fed’s path for interest rate cuts in the coming year. Hotter-than-expected inflation could see investors lower rate cut expectations in 2025.

The market is currently pricing in an 86% probability of a 25 basis point rate reduction in December and expects around one week after the next quarter year.

A lower interest rate environment is more beneficial for risk assets such as Bitcoin, given the increased liquidity.