Crypto markets have matured. What used to be a speculative niche has evolved into a global trading ecosystem with deeper liquidity, better infrastructure, and more sophisticated participants. One of the clearest signs of that change is Crypto-TradFi convergence: crypto capital increasingly being used to participate in multiple asset classes, not just crypto itself.

For crypto traders, it is a practical shift that affects opportunity, risk management, flexibility, and trading discipline.

Crypto is becoming deployable trading capital

In early crypto cycles, capital was often trapped inside crypto-only venues and strategies. Today, crypto can function more like deployable trading capital. That means your starting point can remain crypto-native, while your opportunity set expands beyond crypto-only phases.

In a converged environment, the focus changes from “What can I trade with my crypto?” to “Where is the opportunity right now, and how do I express it efficiently?”

*Trading involves risk. T&Cs apply.

1) Opportunity rotates across asset classes

Market cycles do not move in a straight line. Crypto can lead during certain periods, but macro regimes often push leadership elsewhere. Sometimes U.S. indices trend while crypto chops sideways. Sometimes Gold becomes the cleanest expression of uncertainty. Sometimes FX moves become the headline driver. Competitive spreads and stable trading conditions help keep the edge in the setup rather than losing it in execution.

Convergence gives traders the ability to rotate with opportunity instead of waiting for one market to react.

Practical examples of rotation thinking:

- When crypto is range-bound, a major index may offer clearer trend structure.

- When macro uncertainty rises, Gold can become a more direct “risk sentiment” expression.

- When liquidity tightens, correlations can spike, so reducing exposure across the board may matter more than picking the perfect coin.

This approach is less about constantly switching instruments and more about refusing to force trades when your primary market is not offering high-quality setups.

2) Flexibility improves decision-making

Many crypto traders have experienced the same frustration: you spot opportunity outside crypto, but acting on it involves friction. New accounts. Transfers. Conversion costs. Delays. Missed entries.

A unified, multi-market environment reduces that friction. With fewer operational barriers, your decisions can become more strategic.

Flexibility also helps when your thesis is right but timing is messy. Instead of exiting entirely, you can adjust exposure, hedge, or diversify the book. That is a more professional posture than “all in” or “all out.”

3) Risk management shifts from prediction to exposure control

Trading cryptocurrency rewards conviction, but it also punishes overconfidence. Convergence encourages a risk mindset built on exposure control rather than perfect prediction.

Instead of trying to forecast every headline, you can focus on managing what you can control, your position size relative to volatility, your maximum daily or weekly drawdown limits, your correlation risk when markets move together, and the balance between directional trades and protective positioning.

When you can access multiple markets, “risk management” becomes more than using a stop loss. It becomes portfolio thinking. You are deciding how much risk you want on, where you want it, and how quickly you can reduce it if the regime changes.

4) Multi-market access helps manage drawdowns without going flat

Crypto traders often treat drawdowns as an all-or-nothing moment: either hold through it or go flat. Convergence adds more options.

Instead of exiting positions entirely, traders can manage exposure dynamically:

- Reduce total risk while keeping a core long-term thesis intact,

- Hedge specific risk factors rather than abandoning the market,

- Rotate into instruments that can behave differently under stress.

This is especially useful during “mixed tape” markets where crypto headlines are noisy but macro indicators are driving liquidity and sentiment.

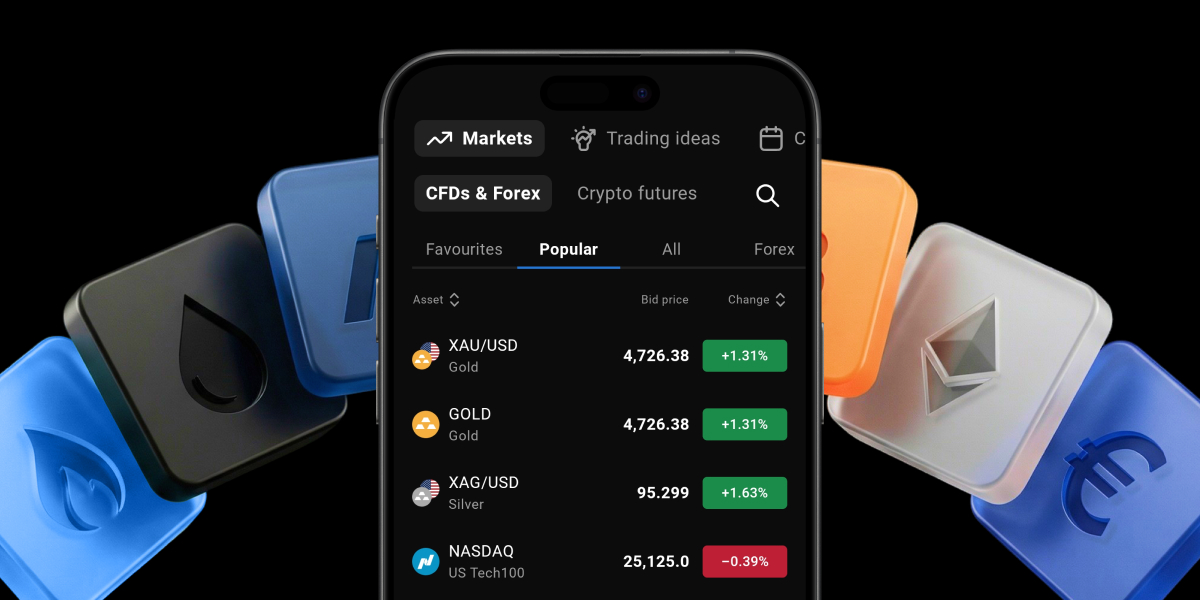

5) Gold, indices, and equities become actionable reference points

Many crypto traders already watch traditional markets for context. Convergence makes that context tradable, not just informational.

Gold can reflect uncertainty, real yield expectations, and defensive positioning. Major indices can reflect global risk appetite and liquidity. Large-cap equities can reflect themes crypto traders care about, such as tech momentum and innovation cycles.

When these reference points are in the same environment as your crypto trading, you can respond faster and manage your book with more precision.

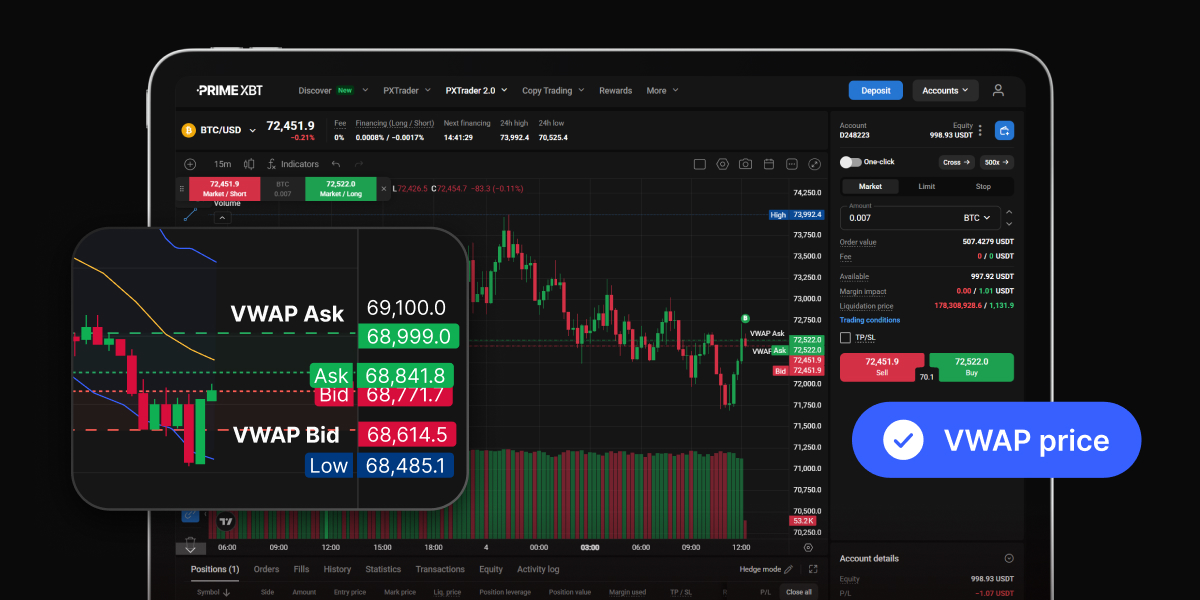

6) Unified environments reduce friction and improve capital efficiency

Friction quietly destroys performance. Not because the strategy is bad, but because execution becomes inconsistent.

Unified environments can help reduce account fragmentation, repeated conversions and transfers, tool switching and monitoring overload and delayed reaction time during fast markets.

When markets and tools converge, capital can be deployed more efficiently, and discipline is easier to maintain. That is a major advantage for traders who treat trading as a process, not an impulse.

7) Convergence supports more professional trading behaviour

Professional trading is not about being perfect. It is about being consistent.

Convergence makes it easier to behave professionally because:

- You have more than one market in which to find quality setups,

- You can manage exposure rather than making all-or-nothing decisions,

- You can build repeatable workflows across markets using the same tools.

PrimeXBT views convergence as a natural outcome of crypto’s maturity and evolving trader needs. Traders want flexibility, better capital efficiency, and tools that support disciplined decision-making across market regimes.

*Trading involves risk. T&Cs apply.

How to use convergence without overcomplicating your trading

If you want the benefits without chaos, keep it simple:

- Rather than trying to trade everything, consider one or two “satellite markets” to complement crypto. For example, this could be a major index and gold. (In fact, a good starting mix is usually one major index + gold + one core FX pair — all are widely traded TradFi instruments where competitive spreads and stable trading conditions can make process-driven execution easier)

- Use scenario rules to guide exposure. For example, you might want to reduce risk when volatility expands.

- Standardize execution. Use predefined sizing, stops, and limits to reduce emotion and improve consistency.

- Track performance by process, not just P&L. Review whether you followed your rules.

Convergence is not about trading everything. It is about trading smarter, with more options and better control.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.