Bollinger Bands are among the most popular technical analysis indicators used on the market today. This channel indicator was created by John Bollinger of Bollinger Capital Management in the 1980s. Traders can design their Bollinger Bands trading strategies based on the bands’ movement. When used in conjunction with price chart patterns, candlesticks, and other technical indicators, it can be part of a successful and profitable trading strategy and a great way to make money fast.

Bollinger Bands Definition

The Bollinger Bands is a technical analysis tool that monitors price and volatility of a financial asset such as stocks, forex currencies, or cryptocurrencies like Bitcoin. The tool uses moving averages and volatility to generate a graphic band on the price chart, which can expand or contract based on volatility. A wider band may indicate an imminent major price move, while a tighter band could signal consolidation.

Why The Bollinger Bands Matter

The Bollinger Bands technical indicator can be an extremely effective and helpful tool for traders interested in gaining an edge in predicting future price movements. Various strategies can be derived from the single indicator, and when used alongside chart patterns and other indicators, can be a critical piece to any winning trading strategy.

How the Bollinger Bands Works

The technical analysis indicator is composed of two plotted standard deviation lines that depending on the positive or negative movement of a simple moving average, widen or narrow away or closer to a simple moving average of the asset’s price. The wider the bands, the more significant the volatility in the corresponding price action. When the bands tighten, volatility has dropped signaling that a surge in volatility is expected and a break of the range is likely.

How the Bollinger Band Is Calculated

Bollinger Bands use a calculation based on the simple moving average, using the following formula:

BOLU=MA(TP,n)+m∗σ[TP,n]

BOLD=MA(TP,n)−m∗σ[TP,n]

Bollinger Bands often use the 20-day simple moving average to begin the calculation, then average out the close price for the first 20-days as the initial data set. The next data point on the 21st day would cause the first day to fall off, providing a standard deviation of the asset’s price. Next, the standard deviation is multiplied by two, then by adding or subtracting the amount from each data point along the SMA produces the upper and lower bands. The center band is the 20-day SMA.

How to Read the Bollinger Bands

Reading the Bollinger Bands technical indicator is easy, with some practice. By watching for when the bands narrow tightly, it often signals that a large move may be ahead. When volatility drops, it often resumes once a trading range is broken. Bollinger Bands can help forecast these large movements ahead of time, resulting in substantial profit.

The middle line consisting of the 20SMA can also in an of itself act as a signal to short or long, depending on whether the asset is trading above or below the middle line in the band.

All aspects of the Bollinger Bands, including the two outer bands and middle simple moving average, can act as support or resistance for an asset.

How to Use the Bollinger Bands

The main use of the Bollinger Bands technical analysis indicator is to spot a squeeze in price volatility. As volatility dwindles, the upper and lower bands contract and tighten, signaling that an increase in volatility is ahead and allows traders to prepare for the price action ahead.

Bollinger Bands can also be used to signal major breakouts. 90% of all price action is contained within the two bands, but occasionally a powerful move breaks above or below the bands. Traders are advised not to trade based on this signal, as it only confirms a breakout, and doesn’t indicate how far the price may climb or fall, or when a reversal may occur.

Traders may opt to use a break outside of the bands as a signal a reversal may be ahead, while others may attempt to “ride the bands” further along with the breakout, depending on the risk appetite of the trader or the strategy they are applying.

The Best Bollinger Bands Trading Strategies

Because Bollinger Bands are primarily used to watch for a reduction in volatility, and the resulting squeeze, however, additional strategies focusing on reversals, buy or sell signals, and even trading within sideways markets are possible using Bollinger Bands.

1. Identifying a Volatility Squeeze With Bollinger Bands

The most common use of the Bollinger Bands technical analysis indicator is to identify when there is a reduction or lull in volatility, resulting in a tightening of the trading range and the width of the bands. The more narrow and tight the bands become, the more powerful the move can be expected ahead. In the below example, the Bollinger Bands tightened to the tightest point in a year before an over 50% drop occurred in the days ahead.

2. Buy or Sell Signals Based on Break of Midline

The Bollinger Bands are a complex tool composed of a simple moving average and two deviations of it. The middle SMA line can act as a signal to buy or sell an asset. Traders can take a position the moment an asset’s price has crossed above – for a buy signal – or below – for a sell signal – the SMA. Traders would plan their exit on a touch of the outer band.

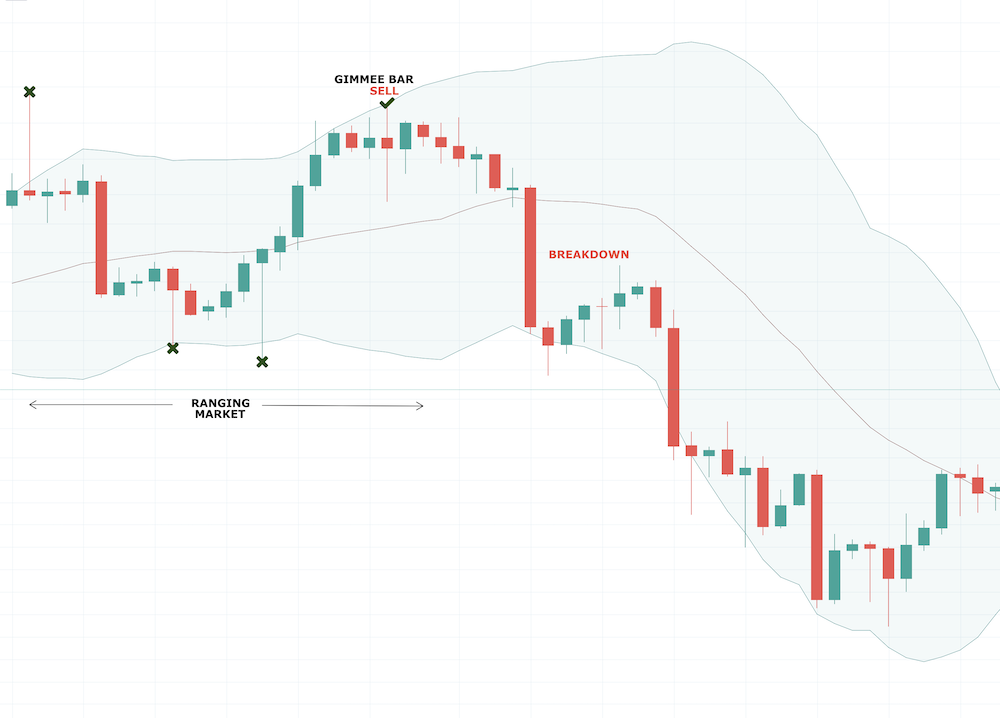

3. Succeed In Ranging Markets With Gimmee Bar Strategy

The Bollinger Bands are a great tool for trading volatility or understanding when volatility is diminishing, but its use in trading sideways markets is limited. Experienced trader and educator Joe Ross has designed a strategy called the Gimmee bar strategy using the Bollinger Bands. When the price of an asset is within a sideways trading range, and price touches the outer band, reverses, then later returns to that same outer band and the bar that touches closes higher or lower than its open leaving a wick behind – that’s a gimmee bar and a signal a trade should be taken.

4. Double Top and Bottom Reversals With Bollinger Bands

Bollinger Bands can be extremely effective in spotting reversals and double tops and bottoms. Traders can watch for a strong break outside of the outer Bollinger Band that quickly gets rejected back down. Typically when the price rises once again to touch the same outer band but doesn’t break through it, it’s a confirmation of a double top or bottom and a signal to buy or sell.

5. Shorting the Snapback to Midline

Bollinger Bands consist of a simple moving average and two standard deviations of that line. Oftentimes, traders can watch for an asset return or “snapback” to the middle line of the Bollinger Bands, and use that as a buy or sell signal. In the below example, following a breakdown, the asset snapped back to the midline twice, continuing down further each time.

6. Riding the Band Breakout on High Volume

While breakouts outside of the Bollinger Bands can often signal a reversal is near, if the breakout occurs on high volume, as much as 1.2x the normal trading volume, then traders may be able to “ride the band” higher or lower depending on the direction of the breakout. The following example shows a breakout of an asset above the upper Bollinger Band accompanied by an abnormally high volume bar, signaling to activate the trade.

Tips for Traders And Common Mistakes

The most common mistakes traders make when using the Bollinger Bands are trading breakouts of the band. Most price action – as much as 90% of all price action – takes place in between the bands. This means that only 10% of the price action has any chance of sustaining temporarily outside of the bands, making them less than ideal for trading.

The only time traders should consider buying or selling in the direction of a breakout, is if it is accompanied by a 1.2x or higher surge in corresponding trading volume.

Using the simple moving average as a signal on longer timeframes, it can be used to determine if a short or long trade should be opened. If the price of an asset falls below the SMA, it is often a short trade, while if an asset breaks above it, it is more often than not a long trade.

Conclusion

Bollinger Bands are just one of many technical indicators offered on the PrimeXBT trading platform. The platform features a full suite of built-in charting tools, with dozens of different indicators to use for traders to hone their technique and build a winning and profitable trading strategy, allowing even new traders to grow their capital quickly, safely, and easily.

On PrimeXBT, learning to day trade assets like crypto, forex, commodities, and more can be achieved simply, safely, and effectively using up to 1000x leverage.

The advanced trading platform offers professional trading tools that are easy to understand, along with extensive training materials and friendly support staff ready to help at any time. Registration takes less than a minute and there is a low minimum deposit – sign up now!