Dogecoin, developed back in 2013 by Billy Markus and Jackson Palmer, arose as a meme coin featuring the Shiba Inu dog from an internet joke, gradually earned interest across the Cryptocurrency community as a sustainable asset, with a massive market cap of over $9 billion today.

Reaching an all time high price of $0.5811 per meme coin in May of 2021, it subsequently lost nearly 90% of its total worth by June 2022, falling to a minimum price of $0.05301.

Despite the price of Dogecoin dropping in value along with many other Cryptocurrencies during the so called Crypto winter, its exceptional performance as a meme coin flared debates within the community regarding the future outlook of DOGE surpassing the $1 mark.

Although opinions vary, and there is no consensus over Dogecoin price predictions, Сrypto enthusiasts remain optimistic while analysts predict unpromising forecasts.

Dogecoin overview

At the outset of Dogecoin’s creation in 2013, software engineers Billy Markus and Jackson Palmer placed the blockchain protocol on the open-source and now decommissioned Luckycoin Cryptocurrency.

- Luckycoin (LKC) was a hard fork of LiteCoin (LTC), which in turn was a hard fork of Bitcoin.

The main idea was to deride the increasing spread of competitor coins, well known to the public now as Altcoins, which attempted to capitalise on the incredible success of Bitcoin.

That was the moment when the “joke was played”. A joke that, in reality, had no intent to gain such mass adoption within the Crypto space.

After the official launch, Doge coin (DOGE) became quite popular among the Crypto community due to its low price (starting at approximately $0.0002496) and availability to utilise it as a payment method, to tip content creators on various social media channels for their work.

By 2021, Dogecoin price launched for the moon, giving birth to several other Shiba Inu dog meme coins. Shortly after Markus and Palmer abandoned the project, further development was ceased, as Dogecoin moved on to exist on its own with the support of the Crypto community.

Financial overview of Dogecoin

As the social media hype grew around the Dogecoin, the token’s price began its unstoppable movement upwards.

- This phenomenon on the Cryptocurrency market is known by the expression “To the Moon”. Traders use it to express their anticipation of any Crypto assets extreme bullish uptrend.

First steps

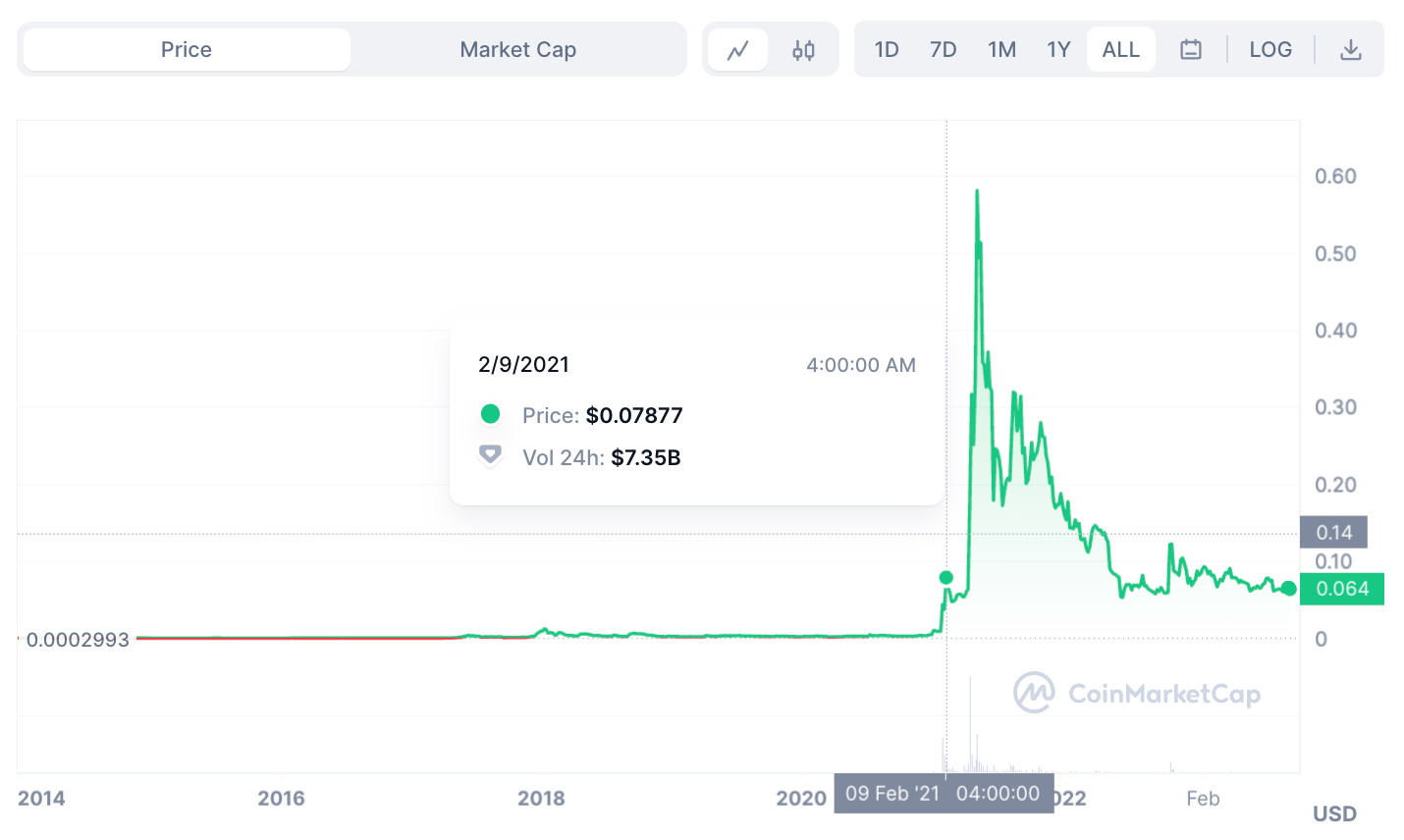

On 9 February, 2021, Dogecoin price tested its very first all-time high of $0.07877, with a subsequent temporary rollback.

This bull market action revealed the extreme price potential of the meme token.

Dogecoin multiplied in value by over 300% in a matter of just 1.5 weeks. The unprecedented performance attracted the attention of none other than Tesla CEO, Elon Musk.

Patronage

And further success was not far off, after Musk made a post on Twitter publicly declaring his support of the Dogecoin Cryptocurrency.

As the Cryptocurrency rally gained momentum and the “Dogecoin news” swept across the internet, Musk’s support in the following months caused the Dogecoin community to grow remarkably.

At this point, on 21 April, 2021, a new all-time high market price of $0.317 was in effect.

The big game

Growing market demand attracted many investors whose primary goal was to buy Dogecoin, not just for the opportunity to HODL a meme Cryptocurrency asset, but to diversify their portfolio with a good investment.

By 7 May, slightly over 2 weeks after DOGE price tested “uncharted waters”, the Crypto market experienced another wave of volatility.

The positives of this market action exploded Dogecoin’s price, allowing it to climb to its all-time high of $0.5811 per coin!

At its peak, Dogecoin increased by a total of 2328% from its initial price upon launch back in 2013, and traded at extreme volumes like $28.62 billion within 24 hours, with $75.26 billion in market capitalization.

Downfall

Unfortunately, the positive market sentiment didn’t last long for Dogecoin.

Greed prevailed, as early investors began to aggressively lock in and collect profits. The massive sell off caused the Dogecoin price to drop to $0.3257 in a matter of 3 weeks.

A situation Elon Musk couldn’t miss out on. He also hadn’t expected Dogecoin to display stable performance, stating on live TV days later that Dogecoin was just another “hustle” for quick gains.

Factually renouncing his favour towards Dogecoin as a serious long-shot investment, despite showing support previously.

Additional burden

Dogecoin price resumed it’s infamous fall, as the Crypto winter took its subsequent toll. It affected all Crypto markets, bending the will of late comers, and causing them to lose hope that DOGE could recover.

As of late December 2022, Dogecoin price has stabilised, and now trades at an average price range between $0.08 and $0.06.

With an average 24-hour trading volume of $218 million, Dogecoin price predictions seem to raise doubt among the community and Crypto analysts whether or not it will see another ascent.

Factors influencing Dogecoin’s price in 2023

As 2023 comes to a close, with never-ending uncertainty in Cryptocurrency markets, users and analysts continue looking into Dogecoin historical data, to determine possible factors that may be affecting its price in 2023.

Demand above supply

As per the standards of any economical system, the defining factor of an asset’s value is defined by the interest to supply ratio.

In other words, Dogecoin’s price cannot rise above its current levels until the demand for it is outweighed by the existing supply.

Unfortunately, when reality hit the scene, and the social media hype ceased to draw interest towards Dogecoin as a meme token and a joke, experienced investors stepped in to take their share of interest, plunging the coin into a constant loop of value chasing.

Vision above blind faith

Nowadays, unexperienced investors are willing to invest money into digital assets just by hearing investment advice from someone they consider a reliable source.

Blindly following a so called expert, they disregard the importance of running their own research and executing proper technical analysis of the market and the asset they wish to acquire.

This leads to irrevocable consequences, like losing their investments when the “expert” strategy goes wrong, or worse, when their financial guru dumps the market and his followers.

It is crucial to remember that doing your own research based on a thorough investigation of the subject is more valuable than anyone else’s expertise.

Such blind investment decisions, among other factors, limit Dogecoin as a perspective digital asset.

News agenda

Any news transmitted via the internet, TV or live streams, may serve as a call to action, making novice or unprepared investors jump on an investment that is portrayed to be profitable, timely, or wise to make at the time.

The Dogecoin community collectively dove into speculations over its price predictions, its market cap, and how they may affect the future of Dogecoin. This resulted in massive investments that failed to follow a scientific or academic approach, ending poorly, as the performance of the token brought collateral damage to investors.

Are there any other factors affecting Dogecoin price?

Another factor that affects Dogecoin, and can limit its price from reaching new heights, is a lack of personal evaluation of risk tolerance.

Some take the time to do due diligence and perform necessary technical and fundamental analysis of Cryptocurrency prices and past performance. They lay aside the noisy news and speculations, to focus on the future results they wish to achieve with Dogecoin.

But, at the end of the day, they fail to estimate what their personal risk appetite is. The main danger of this mistake is losing more money than you can afford.

Moreover, investors with such stories eventually build a negative picture around the Dogecoin Cryptocurrency and their experience with it. This leads to decreased trust in the project, and even more speculation that destroy any prospects of a brighter future for the coin.

Is $1 a psychological or practical DOGE price barrier?

One way or another, each project is limited by internal or external reasons. The ability to surpass these limitations defines it as a successful and a sustainable system, or asset.

Dogecoin has faced many obstacles on its way to becoming one of the most popular Crypto assets in the world.

But besides popularity, an asset requires value. Dogecoin price history is long and rich, yet, until this day, Dogecoin still struggles to break the $1 barrier.

The possibility of reaching the $1 mark is fully related to the Dogecoin market cap and the Dogecoin network mining potential.

Contrary to popular opinion, it has nothing to do with a psychological barrier, as the public sentiment is not based on actual development processes.

Estimated calculations

Each year, Dogecoin developers mine approximately 5 billion DOGE coins. This number is achieved by solving new blocks. Each new solved block provides a miner with a reward equal to 10,000 DOGE per minute.

This way, an estimated 10 years will be needed to mine a total of 180 billion coins. And since the current price of Dogecoin is not even 50% from its all-time high, we may be waiting until 2032 for DOGE to hit $1.

Therefore, speaking from a computing perspective, the Dogecoin price forecast of $1 or slightly above is more than realistic, without substantial changes to the Cryptocurrency markets and participants of the blockchain network.

Historical attempts to reach $1

Over 10 years, Dogecoin made several attempts to break its maximum price and reach the $1 mark. Here are a few worth mentioning:

All-time high

- On 7 May, 2021, Dogecoin reached its all-time high of $0.5811.

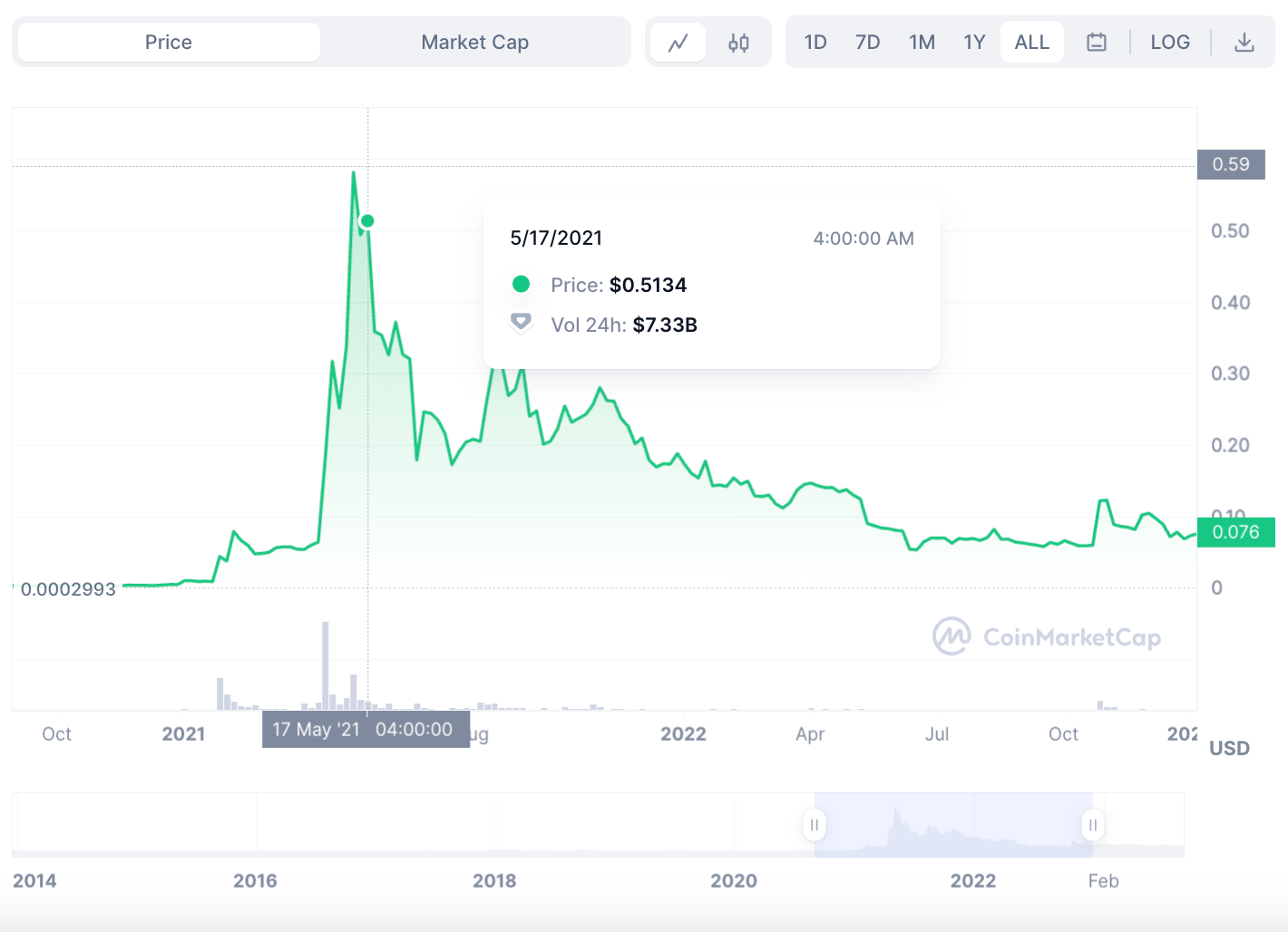

Return from the rally

- Just after the best rally for the token, it attempted to regain momentum after a short setback on 17 May, 2021, closing at $0.5134.

Come back

- After failing to secure the price in mid May, Dogecoin took a short break, before rising to $0.3196 on 17 August, 2021.

Resisting the winter

- As the Crypto winter started taking its toll, Dogecoin withstood the hit by securing a price of $0.2801 on 1 November, 2021.

Testing grounds

- After a continuous “floor dance” amidst the Crypto winter, Dogecoin took its chance to test $0.1226 in late April 2022.

Expert opinions and predictions

The Dogecoin community and many other market participants look eagerly to the future fulfilment of DOGE price prediction.

As the market starts providing highly volatile periods more often and opens opportunities for growth, many industry experts continue to run Dogecoin price analysis.

CoinCodex

CoinCodex have taken a cautious approach, drawing conclusions while predicting Dogecoin price action, and suggesting a short-term vision for 2023.

They predicted the token would reach $0.096137 by late April and $0.109626 by late May. CoinCodex refrained from loud statements by keeping a neutral position, with 21 indicators giving bullish signals, and just 9 giving bearish signals.

Thus excluding any possible forecasts of Dogecoin reaching the $1 mark anytime in the near future.

DigitalCoinPrice

DigitalCoinPrice came up with a long-term Dogecoin prediction that provided an average of $0.18 in 2023, $0.22 in 2024, and $0.32 in 2025 (information based on historical data).

Taking an even bolder step, they predicted that Dogecoin price for 2030 could reach $0.94, before breaking past the $1 mark in 2031, to secure a potential $1.30 price point in the same year.

CoinPriceForecast

CoinPriceForecast were more conservative and bear-oriented in their Dogecoin price prediction.

They have estimated that Dogecoin could reach $0.114 by the end of 2023. Additionally, giving a Dogecoin price prediction for 2025 that presumes it will close the year at a potential price of $0.1608, before attempting to reach and secure $0.2361 by the end of 2030.

Concluding thoughts

By far, one of the most fascinating Cryptocurrencies existing on the market today is Dogecoin, made even more incredible by the interesting path it has taken since its creation in 2013.

A stunning ongoing rally, and exceptional performance over the years despite the setbacks, made it a top 10 CoinMarketCap featured token. Moreover, it’s a coin that has made the whole Crypto community debate its value, and where it will break the barrier of $1 per coin or not.

Though the mining force and development route of its network has already secured its future and the realisation of this forecast, not all experts share this position, and remain somewhat conservative even in long-shot predictions.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.