Trading in Dogecoin has become a noteworthy facet of the diverse cryptocurrency landscape. As a leader among meme-based cryptocurrencies, Dogecoin, characterized by its Shiba Inu logo, has carved a significant niche for itself. Originally intended as a playful venture, the coin has attracted serious interest and has been instrumental in inspiring the launch of many other dog-themed digital currencies.

What is Dogecoin (DOGE) Trading?

Dogecoin trading is the speculation or investing in Dogecoin in hopes of gaining financial profit. Dogecoin has captured many headlines as it gained over 13,350% from its inception at one point. Dogecoin is often ranked in the top 15 cryptocurrencies in market capitalization, even though it has no actual use and scarcity.

There are a couple of ways to trade Dogecoin. You can buy it from an exchange and hang onto it, hoping it will rise in price. You can keep it on the exchange or put it into a wallet to keep it safe. Other people also will trade on exchanges, flipping Dogecoin for quick profits.

However, one of your biggest problems is the chain of custody. If you are simply trying to speculate on price fluctuations, you will be much better served using a broker like PrimeXBT, as you are doing a pure price play. You are trying to get in and out of the market at the best price possible and are not worried about hanging on to the crypto.

Furthermore, you can trade with leverage and in both directions, making shorting the market possible.

What is the History of Dogecoin?

Dogecoin was launched in December 2013 by American Jackson Palmer and compatriot Billy Markus. The duo wanted to harness the ability of blockchain to facilitate peer-to-peer transactions centered around a community.

The pair suggested they intended to start Dogecoin as a dig at Bitcoin. The face of the brand is a Shiba Inu, the famous “Doge.” Dogecoin quickly became a hit on social media platforms such as Twitter, Reddit, and Tik-Tok. Some of the people who have been influential in promoting the idea of Dogecoin include Gene Simmons of KISS, Snoop Dogg, Elon Musk, and GameStop.

In 2015, Jackson Palmer left the Dogecoin community when he announced that he felt it became “toxic.” However, by 2017 it had achieved a market value of $2 billion. In the middle of 2021, Dogecoin reached a market cap of over $50 billion and a market value of more than $9 billion. The ultimate goal for Dogecoin was to reach a value of $1.00 per coin, but that has yet to be realized.

How Does Dogecoin Trading Work?

Dogecoin trading is similar to other forms of trading, such as stocks and commodities, as it speculates or invests in a cryptocurrency in the hopes of profiting. Dogecoin is like any other cryptocurrency. You take custody of the coin in a wallet and buy or sell it in an exchange.

Dogecoin is slightly different from many other markets because it is based solely upon popularity and not necessarily on a use-case scenario. In other words, the coin serves no other function than to trade, with a handful of exceptions in the real world that are willing to accept Dogecoin as payment. The NBA’s Dallas Mavericks were a high-profile company willing to accept Dogecoin, as well as Tesla, depending on Elon Musk’s mood at any given moment.

What Moves the Price of Dogecoin?

To profit off of movements in Dogecoin, you need to understand some things that can push the market back and forth. Some of the possibilities include, but are not limited to:

- Supply and demand: Supply and demand is the fundamental reason price will move in any asset, and Dogecoin will not be any different. However, you should note that Dogecoin has no maximum supply, and 10,000 are minted every minute.

- Hype: Perhaps the biggest driver of the price of Dogecoin will be hype. Often, somebody like Elon Musk will tweet about the coin, and the market goes crazy. This serves no fundamental reason to believe that adoption is coming, but meme coins don’t necessarily work like that. It’s all about pumping the market so you can take profits.

- Adoption: Occasionally, somebody will say they are willing to accept Dogecoin as payment. We have seen the NBA’s Dallas Mavericks and Tesla become high-profile companies willing to accept Dogecoin. Occasionally, somebody else will step on board, which typically has a positive effect on the coin.

- Overall crypto attitude: Crypto markets tend to move in the same general direction, so if Bitcoin rises or falls, it will often drag the smaller markets in whatever direction it chooses. Dogecoin is an extraordinarily risky asset, so risk appetite needs to be strong for it to be attractive.

How to Analyze Dogecoin’s Price Movements?

Just as with any other market, you will need to find a way to analyze price movements and trends. There are two main ways to do this: technical analysis and fundamental analysis.

Technical analysis studies price movement on a chart through patterns, trends, indicators, and support/resistance levels. By studying the past, it is thought that buyers or sellers may be more apt to get involved at a specific price. Also, by studying the trend, you understand that price is rising or falling over time.

Fundamental analysis takes a more economical approach. For example, the fundamental analysis includes supply and demand, corporate balance sheets, and the like. In the world of Dogecoin, it is a bit different in that fundamental analysis focuses more on use case adoption and whether or not Dogecoin is being “hyped” on social media.

Legislation and adoption on exchanges can also come into the picture for fundamental analysis of Dogecoin markets, as governments worldwide are starting to pay more attention to crypto. Furthermore, as Dogecoin was listed at more exchanges, the price was higher as it suggested there would be more people trading it.

Long or Short-Term Dogecoin Trading? Which Is Better?

When you start trading Dogecoin, you need to consider whether or not trading or investing is a better route to your financial goals. You can invest long-term or trade the assets in the short term.

If you feel that Dogecoin will be widely adopted, you may choose to invest. However, there is nothing inherently scarce about Dogecoin, so in this case, you may be better off thinking of it more or less as speculation. Speculation is almost always geared more toward shorter-term trading, but that does not necessarily mean intraday trading.

Having said that, if you choose to hang onto Dogecoin for the long term, you will wish to store it in a wallet. This keeps it off-chain and means you have access to your funds while protected. That being said, you should note that crypto in general, especially these “meme coins,” are highly volatile, so be prepared to ride through extreme volatility bounces. Losses and gains of 70% in a short time are not unheard of.

If you are speculating on price only, CFD markets are the way to go. You do not have to worry about custody, and it’s simply a matter of a couple of clicks to get your position filled. You can go long, short, and of course, use leverage. Furthermore, you do not have to worry about storage. Most Dogecoin traders are of the shorter-term variety, as it is a pure price play. Very few people believe that Dogecoin is going to revolutionize digital payments.

What Are the Dogecoin Trading Pairs?

Dogecoin is traded like any other asset, which is traded in terms of US dollars. DOGE/GBP would be Dogecoin traded in terms of British pounds. Furthermore, DOGE/EUR is traded in terms of Euros.

When you are trading Dogecoin pairs, you are hoping it rises or falls against the fiat currency, for example, the US dollar. For example, you buy DOGE/USD at $0.071, hoping the price will go higher. By the time you close out the trade, DOGE/USD is trading at $0.09, making a net profit of $0.019 per coin.

Some of the other trading pairs can also include stablecoins and other cryptos. For example, a widespread Dogecoin pair is the DOGE/USDT pair, which is Dogecoin quoted in terms of Tether. DOGE/BTC is Dogecoin quoted in terms of Bitcoin, DOGE/ETH in terms of Ethereum, and so on.

How to Trade Dogecoin

If you want to trade Dogecoin, there are a handful of steps that you need to go through to make the transaction happen. It’s a relatively straightforward process, but there are some things to pay attention to. Trading Dogecoin is much like treating any other asset.

Step 1: Open a Trading Account

You will first need to open up a trading account with a respected broker like PrimeXBT. A little information and a few minutes are all it takes to open your account.

Step 2: Fund Your Account

The next step is to fund your account. At PrimeXBT, we take Bitcoin deposits. If you do not own any Bitcoin, don’t worry; you can buy it directly on the platform.

Step 3: Choose Your Trading Size

Once you get your account funded with your Bitcoin, you must decide how much you are willing to risk. Money management is crucial when trading volatile assets like Dogecoin, so you must consider this part of the process seriously.

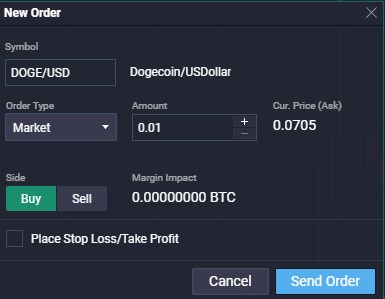

Step 4: Buy or Sell Dogecoin

You will now decide whether or not you believe the market will go higher or lower. With a CFD broker like PrimeXBT, you can profit regardless of direction, as you can “short” the market, allowing you to benefit from falling prices. Furthermore, you can use leverage, meaning that you do not have to put up all of the necessary money for the transaction, allowing you to turbo boost gains.

Step 5: Confirm the Trade

Now that you have decided which way to trade Dogecoin, a dialog box will pop up asking you to confirm the trade. Once the parameters look correct, you authorize the transaction, and it enters the market.

Dogecoin Trading Strategies

If you are going to trade Dogecoin, you will need a trading strategy. While nothing works 100% of the time, there are some tried-and-true strategies that people have used for decades in various financial instruments. This section will take a look at some of the most popular ones.

The Single Simple Moving Average Cross Strategy

Perhaps one of the most straightforward trading strategies is the “single simple moving average Cross strategy.” This strategy involves plotting a moving average on a chart and buying or selling an asset every time it crosses. For example, you could plot a 50-day moving average on the chart by Dogecoin every time it breaks above that moving average and conversely sell it every time it breaks below it.

RSI Divergence Strategy

The RSI indicator, or “Relative Strength Index,” is an indicator that shows up in its own window, telling the trader when a market is overbought or oversold. It draws a line between 0 and 100 to show these conditions.

As a general rule, if the price goes above the 70 level, the RSI suggests that the market is overbought, and you should either think about selling or taking profit if you are already holding the market. On the other hand, when the line crosses below the 30 level it is considered to be oversold, suggesting that you should be either buying or taking profit on a short position.

Dollar-Cost Averaging

“Dollar-cost averaging” is a tried-and-true method for those wishing to take advantage of longer-term swings. You can split up your purchases to build a more significant position for the longer term. You can only do this in a market that you expect to rise over the long term, so you should keep that in mind.

If you believe that Dogecoin will have mass adoption and should continue to strengthen over the longer term, you would add a little bit more to your position when it dips in value. Alternatively, some people will simply purchase the market every time they get paid, once a month, etc.

Tips for Dogecoin Trading

When trading Dogecoin, there are a few small tips you can keep in the back of your mind to make your journey much safer and hopefully much more profitable.

- Only risk which you can afford to lose: As with any investment or trade, you should never risk any more capital than you can afford to lose.

- Understand the cycle of crypto: Understanding how crypto is going generally goes a long way toward being profitable. After all, most crypto moves in the same direction over time.

- Social media: If you are going to trade Dogecoin, you need to keep up on Twitter, Reddit, and TikTok, as they have an outsized influence on what happens with the price.

What Are the Advantages of Dogecoin Trading?

Dogecoin can be a very profitable endeavor. However, you should also remember that it’s not necessarily made to become an investment. That being said, there are some significant advantages, including:

- Volatility: Massive amounts of volatility can be good when you catch it heading in your direction. Dogecoin can move quite wildly at times, and if you are correct in your analysis, profits can add up rather quickly.

- Low barrier to entry: Dogecoin is an extremely cheap coin, meaning that you can start trading it with little in the way of trading capital.

- Volume: Surprisingly, Dogecoin has caught on with the crypto community, meaning there is plenty of volume in the markets, so liquidity is rarely an issue.

What Are the Disadvantages of Dogecoin Trading?

While trading Dogecoin can be highly profitable, there are some significant disadvantages to trading this market for the wrong type of trader. This includes:

- Massive volatility: While offering quite a bit of opportunity to profit, massive volatility can also provide a lot of danger. In a massively volatile market like Dogecoin, gains and losses can come quickly.

- “Greater fool theory”: It should be noted that this asset started as a joke. In other words, as the price of Dogecoin continues to climb, one has to be conscious of the “greater fool theory.” This is when you buy an asset assuming somebody will come along and pay more for it later without worrying about any underlying value.

- Social media influence: Dogecoin has a lot of influence from social media, which is a bit of a double-edged sword. When the right people are hyping the market up, owning is a great thing. On the other hand, when social media influencers disappear, Dogecoin has very little to prop it up.

Why You Should Dogecoin Trade with PrimeXBT

If you are interested in trading Dogecoin, or any other assets, PrimeXBT is an excellent option. There are multitudes of reasons you may wish to trade at PrimeXBT, not the least of which is the ability to diversify assets. Leverage is also a significant factor when it comes to trading at PrimeXBT as well.

A few of the major highlights include:

- Leverage: The generous leverage allowed at PrimeXBT allows traders to magnify their wins, allowing for much greater price appreciation than what would generally be available.

- Long or Short: As you are trading the CFD markets, you can benefit from the price in both the uptrend and down trending markets, thereby opening up a world of opportunities not ordinarily available on spot exchanges.

- Diversification: The ability to trade not only Dogecoin but other crypto markets, commodities, fiat currencies, and indices allow for the trader to diversify their global asset holdings truly. In other words, there are many more opportunities here than in a “crypto-only” exchange.

- Copy Trading: If you are unsure how to go about trading the markets or simply do not have the time, copy trading is available at PrimeXBT.

Conclusion

In conclusion, Dogecoin is considered a “mean coin,” meaning that it is a purely speculative asset. This is not to say that it cannot attract some type of longer-term use-case scenario, but right now, that looks very unlikely. This does not mean you cannot make money trading Dogecoin, but you need to understand that it does not have the same type of future Bitcoin.

With this being said, you must be very cautious about position sizing and care about how much you risk. Crypto markets are volatile, to begin with, and a market like Dogecoin is like the crypto market on steroids at times. A sudden Tweet or mention on a social media platform can send the market skyrocketing, but it can also fall quickly.

There may be uses for Dogecoin in a well-balanced crypto portfolio, but it should not be the majority of your holding. Quite frankly, it is just far too volatile to be relied upon for steady and easy gains.

What is the best way to trade Dogecoin?

Unless you plan on “buying and holding,” the ideal way to trade Dogecoin is to use the CFD market, forgoing the custody issues and all of the hassles involved in dealing with wallets. This furthermore offers more profit potential as you can benefit from both the rising and the falling price. Leverage also adds more ability to gain.

Can I directly buy Dogecoin?

Some exchanges allow for the buying of Dogecoin with US dollars and other fiat currencies, but typically it is done through a CFD or a broker.

Can I sell my Dogecoin for cash?

In theory, yes. That being said, it is a digital transaction that needs to be converted to fiat currency when you withdraw your funds.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.