Bitcoin has grabbed the attention of the world and grown exponentially over the last decade, as it could represent a new form of decentralized money and cross-border digital currency. The ability to have a trustless payment system without a third party intermediary has many investors expecting further growth.

That being said, it is worth noting that digital assets are very volatile. Which begs the question, “Is Bitcoin a good investment?”

Bitcoin Overview

Today (24 February 2026) Bitcoin (BTC/USD) is trading at $93685.6 per BTC, with a market cap of $1860609045921 USD. The 24-hour trading volume amounts to $57695433551 USD. BTC to USD price has changed by 0.3% in the last 24 hours. Bitcoin’s circulating supply is 19855012 BTC.

Bitcoin investing: what is it?

Even though Bitcoin vastly differs from most other traditional financial assets, investing in it’s similar to investing in Stocks, Bonds and Currencies.

Gold or Shares of a company exist physically, while Bitcoin acts as a digital commodity or collectable. The first-ever recorded Bitcoin price was $0.003. Since then, Bitcoin has reached a price of $67,567 in 2021.

Longer-term, Bitcoin has consistently risen in price . If that pattern continues, this digital currency could reach as high as $500,000.

Is Bitcoin a good investment? A look back at performance

2020 was a solid year for Bitcoin, as stimulus due to the pandemic saw inflation grow rapidly. Because of this, investors started to pile into Bitcoin, treating it almost like digital gold.

As there will only be 21 million BTC, it creates scarcity, especially in the face of massive US dollar printing. Those who feared rising inflation and had cash reserves that were losing value started buying assets, with some of that flowing into the Cryptocurrency markets. This was the beginning of a significant uptrend.

However, the market got far ahead of itself in 2021, breaking above the $60,000 level and then dropped. We have seen massive selloffs previously, and Bitcoin has always managed to turn itself around.

If the Federal Reserve finds itself in a situation where it has to pivot its monetary policy due to a recession, that could be the catalyst for the next great bull run in Bitcoin.

Investing in Bitcoin in 2024: Is it a good idea?

A return on Investment of 100 million percent over the last decade suggests that investing in Bitcoin is a good idea. Timing when you will buy or sell is the tricky part of maximizing returns and profiting from the market and its high volatility.

As 2023 has shown, Bitcoin is still in the fight. However, history has shown us that every time the market drops, it is only a matter of time before it picks itself back up.

If you believe that crypto will survive, Bitcoin will almost certainly remain at the forefront. With Bitcoin, it’s a bit of a binary question. The question is, “Will crypto stick around?”, and if you consider this true then Bitcoin will as well.

Longer-term holders, also known as HODLers, may look at this as a buying opportunity because so much negativity has found its way into the crypto markets lowering the price.

Bitcoin fundamental analysis

Bitcoin and other cryptocurrencies have different fundamental analysis metrics than other assets. One of the most important ones is the network’s hash rate or amount of activity.

Another data point may be how much is kept on crypto exchanges and cryptocurrency trading platforms. Despite extreme volatility and cryptos being considered risky assets, this hash rate chart shows how steadily Bitcoin blockchain users have increased over the last four years.

At the same time, certain FTX situations have caused some to move away from storing coins on exchanges.

Will halving increase BTC price again?

The next Bitcoin halving is currently projected to occur in May 2024.

Historically, Bitcoin halving events have been associated with an increase in the price of Bitcoin. The past three halving events in 2012, 2016, and 2020 saw the BTC price surge by 9,915%, 2,949%, and 665%, respectively. This is because the supply of newly minted Bitcoins is cut in half during a halving event, which reduces the rate at which new Bitcoins enter circulation.

However, it’s important to note that past performance is not a guarantee of future results, and the cryptocurrency market is highly volatile and unpredictable.

While some investors may be anticipating a price increase following the next halving event, there are many factors that can impact the price of Bitcoin, including changes in government regulations, adoption by major corporations, and overall market sentiment.

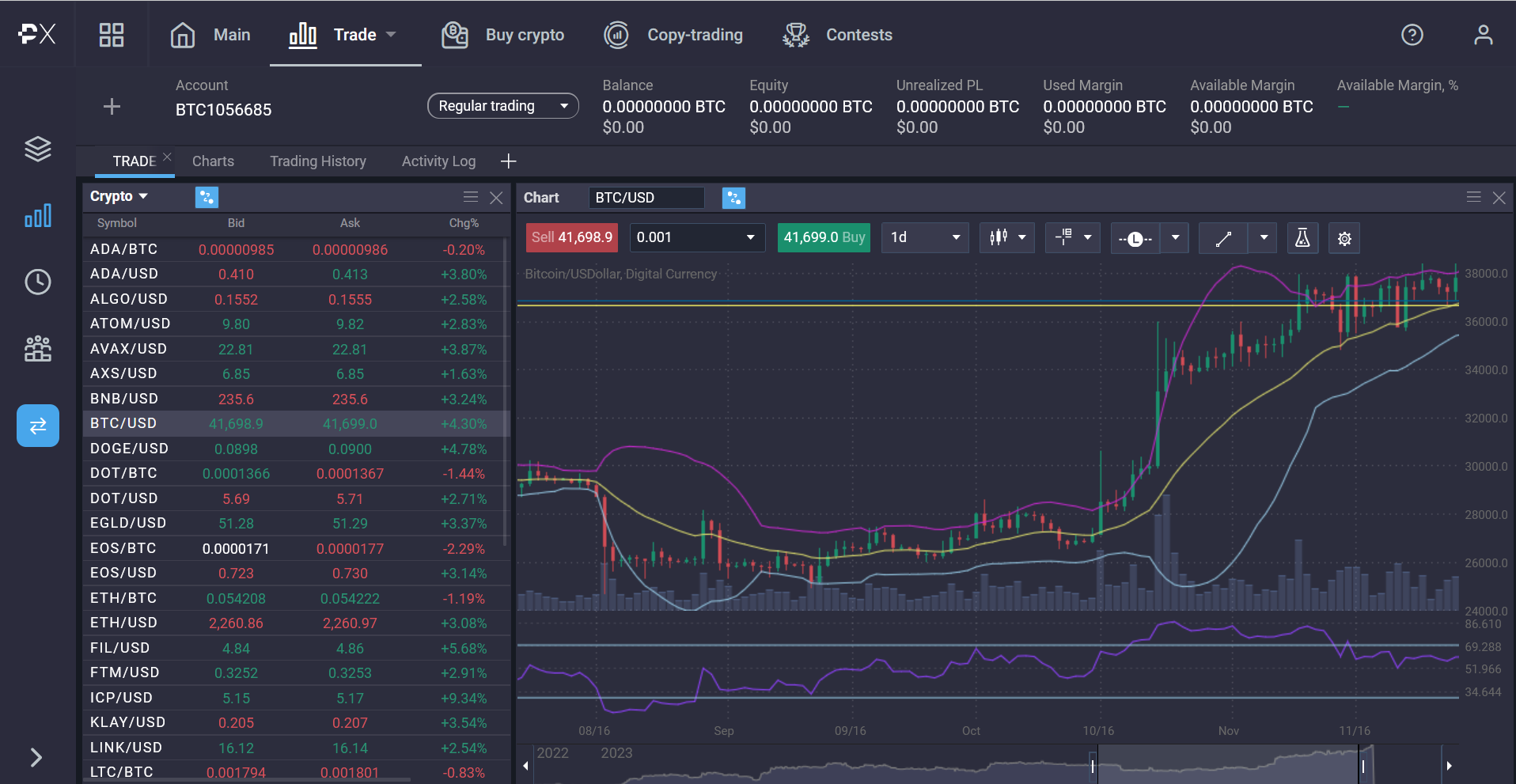

Bitcoin technical analysis

Technical analysis can be somewhat subjective, so you should keep that in mind when looking at charts. However, it gives you an idea of how the market is “leaning,” In the March of 2023 dropped to $19,000.

However in November and December of 2023 we have seen the $30,000 region seemingly being established as support. In other words, it could open up an excellent long-term buying opportunity.

It is probably worth noting that a lot of retail traders rely on technical analysis, and Bitcoin is still very much a retail trading environment. Because of this, technical analysis does tend to perform very well in the cryptocurrency markets, and Bitcoin as well.

Bitcoin sentiment analysis

Doing a sentiment analysis involves looking at several things at once. You can search the term “buy crypto” and see how much interest there is.

Ironically, the more activity you see, the closer you will probably be to the top of the price. In early 2023, sentiment dropped pretty low from this metric. That is a good thing for the cycle, as it suggests many of the “weak hands” have been flushed out.

Paul Tudor Jones, one of the most respected billionaire hedge fund managers in the world, believes that Bitcoin will beat inflation (again), comparing it to gold in the 1970s.

Most money managers and large fund managers prefer lower market risk. It has become increasingly obvious that BTC still carries significant risk.

As only 21 million BTC will ever exist, it does bring in a certain amount of scarcity, and therefore there will always be a certain amount of demand. You can also look to the US Dollar Index as a form of sentiment analysis because, as a general rule, people buy more US dollars in times of anxiety.

In times of stress, they do not buy assets out on the risk spectrum like cryptocurrency. Another market that you can use to extrapolate sentiment is the stock market. The higher it goes, the more likely we will see “hot money” flowing into crypto.

Expert expectations and Bitcoin price predictions

Some experts have gone public with what they think Bitcoin’s price will reach $250,000.

Venture capital investor Tim Draper has previously said it will hit a price of $250,000 by 2023. Obviously this hasn’t happened, but Draper is still bullish on BTC and still expects BTC to reach $250,000 albeit later.

Nigel Green, deVere Group founder and CEO, is bullish on Bitcoin but not for the same reasons as Draper. He believes that Bitcoin is the currency of AI. And he thinks that the synergy that will be created between BTC and AI will once again attract institutional investors.

What happens next with Bitcoin will come down to whether this AI/Crypto bridge is further developed and promoted.

Ways to invest in Bitcoin

Trading Bitcoin in the early years was challenging. You had to mine Bitcoin or get it as a gift from someone else. Now it only takes a few clicks to invest in Bitcoins or buy Bitcoin online. Once you have obtained Bitcoin, you can decide on various investment methods. Some of the most common Bitcoin investment strategies are:

Buy and hold (long-term investment)

Buying and holding Bitcoin involves first purchasing Bitcoin on a spot exchange or other cryptocurrency trading platform and storing it in a wallet. The wallet can either be on an exchange or in cold storage for the long term. (Cold storage refers to wallets that are not connected to the Internet.)

Although not as risky as many other forms of Bitcoin investment, it does involve risk. In 2019, Bitcoin rose from below $4000 to reach $14,000. The following year, it dropped back below the $4000 level.

In 2021, Bitcoin broke the $60,000 barrier, but by June 2022, Bitcoin was trading just below the $20,000 level. In other words, it is an extraordinarily volatile asset, so it’s worth can change quite drastically if you simply hold onto it.

In 2023 Bitcoin has reached it’s highest rate since April 2022 – more than $40,000 even though it started the year at around $16,000.

As the markets continue to evolve, the “buy-and-hold” long-term investment strategy may become much more palatable once the volatility disappears.

If Bitcoin proves of further utility either in AI applications or beyond, it should attract institutional money again.

In that scenario, Bitcoin is more likely to act like the stock market than anything else. The correlation between the NASDAQ 100 and Bitcoin during 2022 has been quite telling. In 2023 we saw this correlation continue. Is this going to be the future correlation we all watch? Only time will tell.

Trading

Instead of buying and holding Bitcoin, investors can also trade their assets at each high or low price. There are two main ways of doing this, spot trading or derivatives trading.

Spot trading involves buying Bitcoin and trying to sell it at higher prices. This is how most people think of the stock market as an example. You buy something, hoping to appreciate in value. You can jump out of the market and sit in cash if the market crashes.

If a trader buys 1 Bitcoin under $4000 and then sells it at the high in 2019, near $14,000, they gain roughly $10,000. That $14,000 that the trader now has could have been used to buy Bitcoin when it fell below $4000 yet again or at $16,000 at the beginning of 2023 and still left $10,000 sitting in the account.

However, when trading a derivative contract, the situation is quite different. To begin with, traders can use leverage to control more of an asset.

100 times leverage means that your gains could be 100 times what had been possible in the spot account. Keep in mind that it works in both directions, meaning that your losses can pile up, but simple money management is used to keep that from happening.

In the previous example, a trader could’ve made $10,000 on the way up and then $10,000 on the way back down. That would be a $20,000 gain. However, with 100 times leverage, that $20,000 gain becomes closer to a $2 million profit.

Pros and cons of Bitcoin

While Bitcoin and some digital currencies have been a wise investments so far, there are several pros and cons that you should keep in mind when considering Bitcoin as an investment.

Pros

- It has the most significant ROI out of any financial asset since its inception.

- BTC has outperformed gold, stocks, oil, etc., for the past decade.

- It was the first-ever cryptocurrency.

- The coin is digitally scarce, making it rare and valuable.

Cons

- However unlikely, it could go to zero.

- The crypto is highly volatile, so price swings can sometimes be violent.

- The regulatory outlook for BTC is still unclear.

- Bitcoin’s total value may take years to realize.

How much to invest in Bitcoin?

How much to invest in BTC will ultimately be up to you and your comfort level. The most common advice people receive when they invest in anything, let alone how to first start, is never to support more than you can comfortably afford losing.

In the future, it could reach $500,000, or it could also go to zero. There is no way to know what will happen, but with such new technology comes a binary outcome.

In other words, it will either be adopted or it will not. If it is adopted, its scarcity could make it one of the hottest assets in the world.

It could be worthwhile many investors to start small with just tiny Bitcoin increments before jumping in with a more considerable investment. Bitcoin can be purchased in any denomination, with the smallest amount being 0.00000001 BTC, also known as a “Satoshi.”

Ways to reduce the risk of your Bitcoin investment

Investing in Bitcoin, like any other investment, involves risk and obviously requires a certain risk tolerance. Here are some ways to minimize investment risk when investing in Bitcoin:

- Diversify your portfolio using asset allocation strategies: Don’t invest all your money in Bitcoin or any single cryptocurrency. Allocate your investments based on your risk tolerance and investment goals. Consider investing in different asset classes, such as stocks, bonds, real estate, and cryptocurrencies, to diversify your portfolio.

- Do your research: Before investing in Bitcoin, do your research to understand how it works, the risks involved, and its potential for growth. Stay informed about news and developments in the cryptocurrency market.

- Be prepared for volatility: The price of Bitcoin can be highly volatile and can fluctuate rapidly. Be prepared for the possibility of large price swings and avoid investing more than you can afford to lose.

- Keep your private keys secure: Private keys are required to access and transfer Bitcoin. Keeping them secure is crucial in preventing hackers from stealing your Bitcoin. Consider storing them offline in a hardware wallet or a paper wallet.

By taking these steps, investors can minimize investment risk when investing in Bitcoin and other cryptocurrencies.

Is it worth it to invest in Bitcoin?

As Bitcoin has seen as much as a 100 million% ROI over the last several years, and it has beat out all other assets, including gold, stocks, and oil, in year-to-date returns suggests that it is worth it.

While these returns have been phenomenal, there have been times when the volatility has been extreme. Remember never to invest more than you can afford to lose. Furthermore, make sure to buy Bitcoin from a reliable trading platform.

Is it smart to invest in Bitcoin?

Investing in Bitcoin has proven to be a wise decision over the longer term and should continue to be so as long as the technology remains valid and the network remains secure.

It should be noted that the network has never been hacked, so there is a lot of trust in the security. Bitcoin is also an investment that some people use to hedge against fiat currency depreciation due to central bank mismanagement of monetary policy.

Is Bitcoin a good or bad investment?

Investing in crypto assets is risky, but can be a good investment. Bitcoin is a good investment for those who wish to take a chance on financial technology that has the potential to change the world.

Being a scarce digital asset could continue to drive the value higher, and some even believe that Bitcoin and digital currencies could one day replace the US dollar as the global reserve currency. Bitcoin having a limited supply means that it is not inflationary, unlike fiat currencies.

What is the minimum amount to invest in Bitcoin?

The minimum amount to start trading Bitcoin on PrimeXBT is just 0.001 BTC. If you choose to invest, in other words, hold it for the long term and store it in a wallet, it has a similar minimum.

However, you must remember that custody is essential, so a good wallet and access to a passphrase are crucial. When you are trading Bitcoin, you tend to make more money due to the volatility of the asset. Trading the CFD market at PrimeXBT also gives you the ability to earn more due to leverage and the ability to not only buy Bitcoin but short it as well.

Should I invest now in Bitcoin?

Bitcoin is a popular cryptocurrency, making it a precious investment. It’s never too late to buy Bitcoin and start investing in cryptocurrency. You can buy it all now or dollar cost average into the crypto investment over a more extended period.

No matter how you start, either method can over evolve into trading in the future.

Can you make money from Bitcoin?

Yes, it is possible to make money from buying cryptocurrency. Many people consider Bitcoin to be a good investment due to its potential for growth and long-term value.

However, investing in Bitcoin also involves risks. It is important to do your research and invest only what you are comfortable with.

You can buy and sell Bitcoin on cryptocurrency exchanges, which allow you to exchange fiat currency for cryptocurrency. It's important to choose a reputable exchange and take necessary security measures to keep your assets safe.

Why not to invest in Bitcoin?

While investing in cryptocurrencies like Bitcoin can seem appealing due to their potential for high returns, there are several reasons to approach this market with caution.

Firstly, the crypto market is largely unregulated, meaning that investors may not have the same legal protections as they would in traditional financial markets. This can make the market more susceptible to fraud and manipulation.

Secondly, while Bitcoin transactions are often touted as secure and anonymous, there have been instances of exchanges and digital wallets being hacked, resulting in significant losses for investors. Additionally, the value of crypto assets like Bitcoin can be highly volatile, with prices fluctuating wildly in short periods of time.

This makes it difficult to predict how much your investment may be worth in the future. Overall, while some investors have had success with cryptocurrencies, it's important to approach this market with caution and be prepared for the potential risks involved.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.