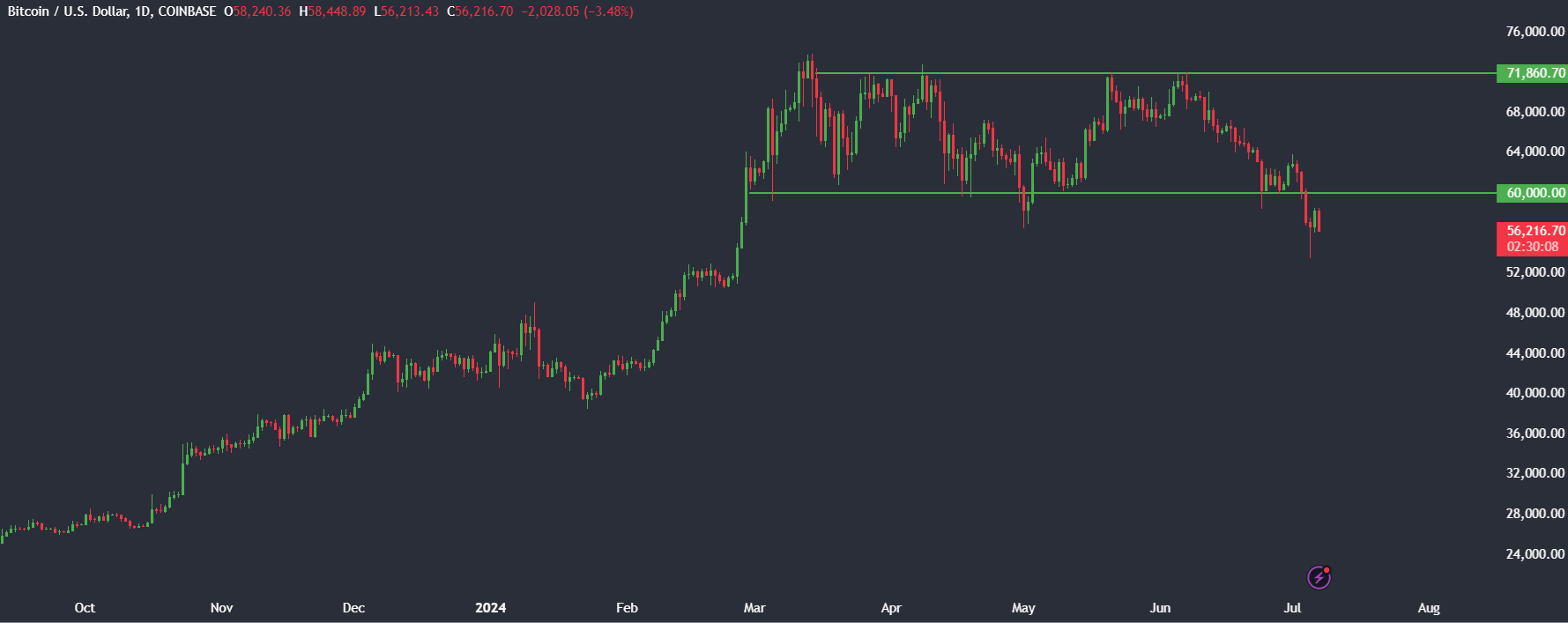

Bitcoin fell 7.7% last week, marking the fourth straight weekly decline and its largest weekly decline in almost a year. Bitcoin has fallen over 20% from its recent high of 72,000, meaning the largest cryptocurrency is on the verge of entering a bear market. Bitcoin started last week at 60,880 before tumbling lower to 53,550, a level that was last seen in late February. Bitcoin has recovered from that low but remains vulnerable at 56,000 as the new week begins.

Cryptocurrencies across the board plunged last week. Ethereum dropped 12%, slipping below 3000 to a low of 2950. Meanwhile, BNB fell 13.8%, and XRP 10%. Solana fell, but by less than its peers, dropping 3%. Meme coins were more mixed, with Pepe dropping 20% of its value, but TRX managed to gain 1.6%.

Mt Gox disbursements fuel selling fear

Bitcoin fell sharply, dropping as much as 8% on Friday at one point as Mt Gox, the world’s leading cryptocurrency exchange before it collapsed into bankruptcy a decade ago following a hack, said that it had begun to return Bitcoin and Bitcoin cash to some of its creditors. 140,000 Bitcoin worth $9 billion will be returned.

According to data from Arkham Intelligence, on Thursday and Friday, Mt Gox moved billions of dollars in Bitcoin from its crypto wallets ahead of the repayment memo. Over 47,000 Bitcoin worth $2.7 billion were moved from an offline cryptocurrency wallet associated with Mt Gox to Britbank. This Japanese crypto exchange is listed among those that support repayments to Mt Gox users. Mt Gox wallets continued to hold around $7.5 billion, or 138,985 coins, yet to be paid out.

The market is fretting that given Bitcoin’s sharp rise over the past decade, many of the beneficiaries of the crypto windfall will likely cash out, increasing supply. Furthermore, the accelerated selling of Bitcoin could suggest that some are trying to get ahead of the selling curve.

However, 140,000 Bitcoin accounts for 0.7% of the 19.7 million Bitcoin in circulation. The sale could result in some selling pressure, but enough liquidity should be available to cushion the intense sell-off over the summer months.

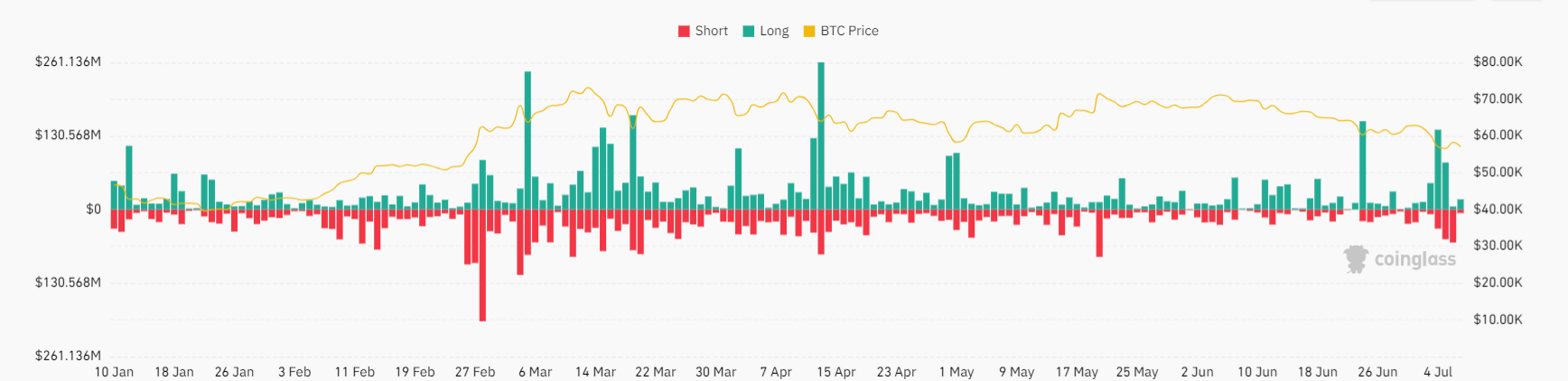

Bitcoin liquidations

Last week’s sell-off triggered large daily liquidations for crypto traders on Thursday and Friday, with long positions bearing the brunt of the liquidations. The total Bitcoin long liquidations on Thursday were $141.49 million, the highest level since June 24.

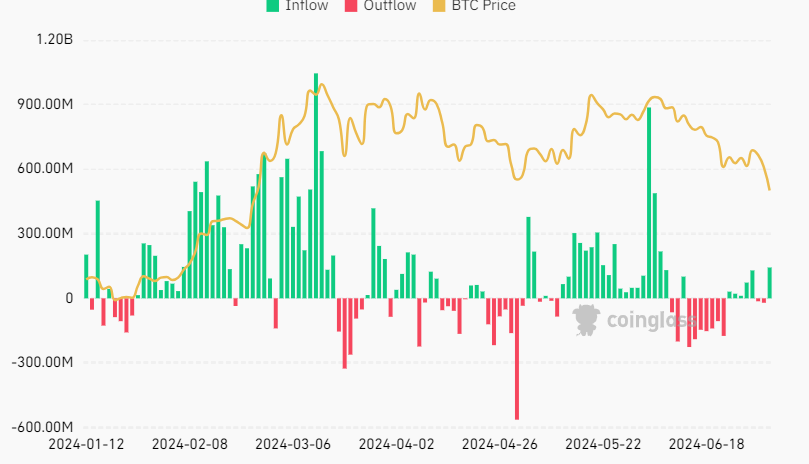

ETF sees dip buying

However, what was also interesting about the move is that the recent downturn in Bitcoin’s price appears to present an attractive opportunity to ETF investors who have bought the dip. On July 6th, Bitcoin spot ETFs experienced a record inflow of $143.1 million, the largest net entry in a month. The Fidelitit’s spot Bitcoin ETF was a standout performer, with $117 million in inflows. This was followed by Bitwise, with $30.2 million; however, the Grayscale Bitcoin trust saw outflows of $28.6 million.

Meanwhile, BlackRock’s Bitcoin spot ETF holdings surpassed 38,000 Bitcoin after inflows of over $66 million across the first week of July. ETF buyers are proving to be resilient, and there are no signs of panic. Instead, the recent market volatility has created buying opportunities that are being seized by institutional investors, which points to lasting confidence in the long-term potential of Bitcoin.

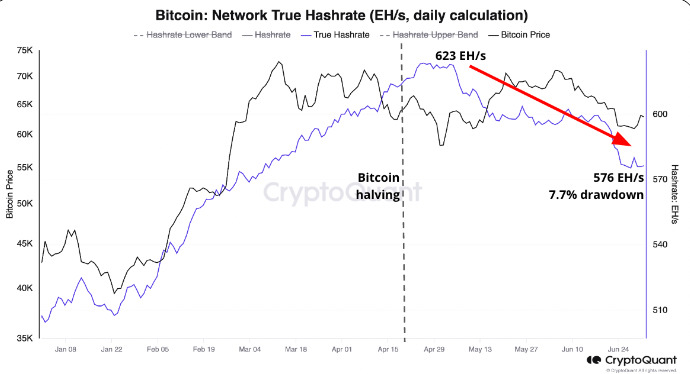

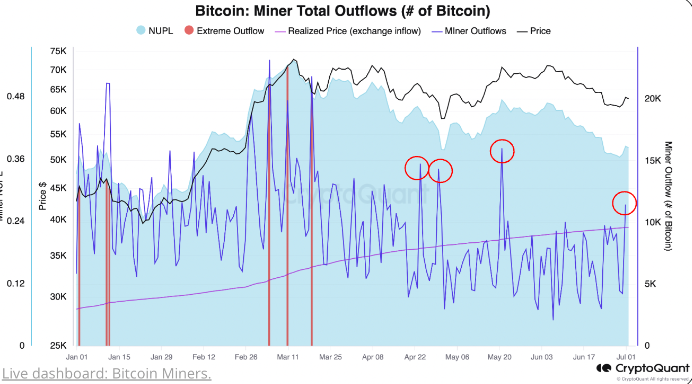

Miner capitulation

There are signs of miner capitulation, which could indicate a bottom in the Bitcoin price along with the ETF dip buying. Miner capitulation is when some miners halt operations or liquidate some of their Bitcoin Reserves. This is usually owing to unsustainable financial pressures such as reduced profitability, which have historically coincided with significant Bitcoin price bottoms.

CryptoQuant noted a considerable decline in the Bitcoin hash rate following April’s halving event. The hash rate measures the total computation power used to mine Bitcoin. It dropped by 7.7% to a four-month low.

This marks the longest decline in the hash rate since December 2022, when the FTX exchange collapsed, and Bitcoin’s cycle bottomed as the less efficient miners shut off their equipment due to unprofitability.

Low Bitcoin prices and reduced reward post-halving have led to decreased profitability. As profitability falls, miners have been moving Bitcoin out of their wallets at a faster pace. Daly miner outflows have surged to their highest level since May 2021, suggesting miners are selling their Bitcoin reserves.

Finally, miner revenue per hash, the hash price, remains near an all-time low. This metric directly affects miners’ revenue. Persistently low hash price levels add to the financial difficulties that miners face, pushing them further toward capitulation.

Miner capitulation, indicated by falling hash rates, underpayment of miners, increased BTC outflow, and a low hash rate, is often a precursor to the price bottom.

Stocks & Gold rise, USD falls as Fed rate cut bets rise

The other point to note is that the sharp decline in Bitcoin comes amid an improving economic backdrop, which sent stocks higher and the USD lower. The tech-heavy Nasdaq 100 rose 3.5% across the holiday-shortened week, its strongest weekly performance since late April, to a fresh all-time high. The S&P 500 rose 1.95%, and the Dow Jones rose a more modest 0.66% amid a lack of tech stocks that led the rally. Meanwhile, the USD fell almost 1% last week in its steepest selloff since early March, and Gold rallied over 1.4% towards 2400, posting its largest weekly gain since late March.

The market reacted to soft US data across the week. The ISM services PMI contracted at the fastest pace since November 2021, while continuous jobless claims rose for a ninth straight week. The US non-farm payroll also revealed a weakness in the US labour market. Unemployment unexpectedly ticked higher, wage growth slowed, and job creation saw a steep downward revision for the previous two months.

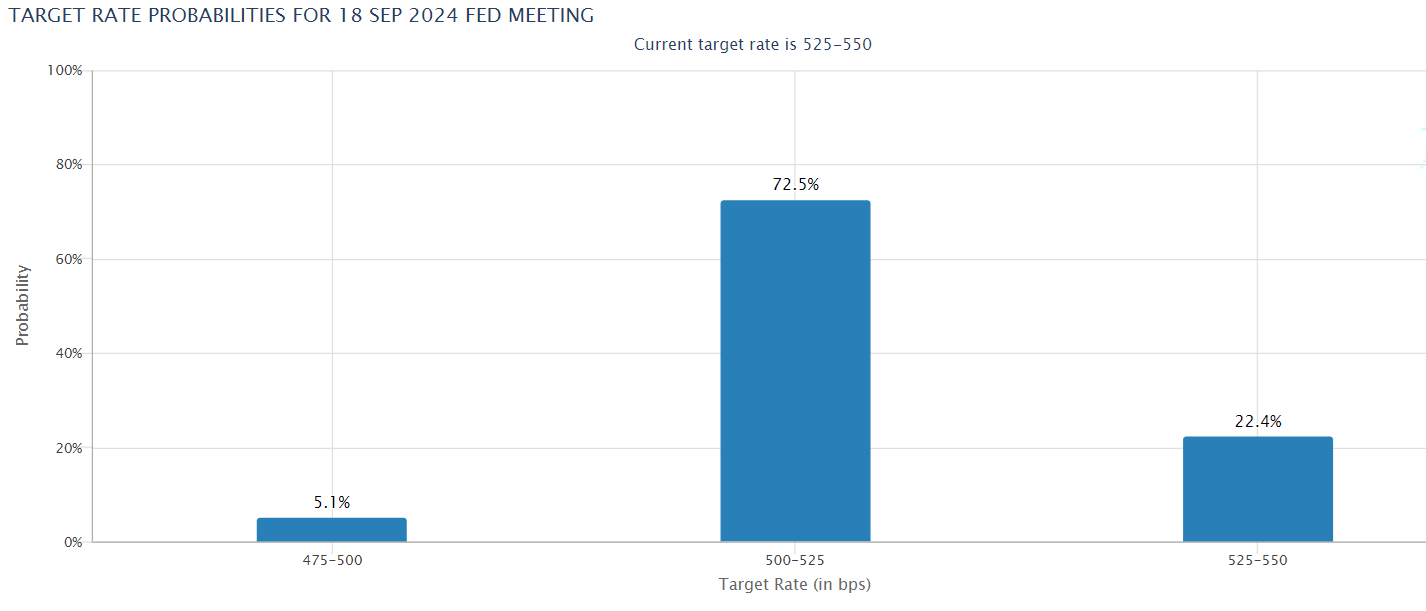

The data pointed to a softer economy and slowing labour demand, which, combined with a more dovish-sounding Federal Reserve Chair Jerome Powell, has boosted expectations that the Fed will start to cut rates sooner. The market is now pricing in a 75% probability of a Fed rate cut, up from 56% at the start of last week. A lower interest rate environment is typically more beneficial for risk assets such as Bitcoin due to the higher liquidity levels.

Looking ahead: US CPI, Fed Powell testifies, ETH ETF final approval?

This week, the focus will be on the upbeat US inflation report, which comes after the non-farm payroll showed signs of moderation last week.

Inflationary pressures have been a concern for both the markers and policymakers maybe showing signs of easing. The NFP report showed that wage growth is easing, and the ISM prices paid index, considered a good lead indicator for price rises, reported lower-than-expected figures. Easing inflation will add to the view that the Fed could cut rates soon and may support the markets, potentially helping gold prices rise, and stocks to fresh all-time highs.

Cooling inflation and a more dovish-sounding Federal Reserve Chair Jerome Powell, who will testify before Congress this week, could also help boost demand for riskier assets, such as crypto, after the bloodbath last week.

Specifically related to crypto, the market will be keeping an eye on whether the US SEC gives the ball approval for spot Ether ETFs to start trading. Initial approval was granted in June, boosting the ETH price to a peak of 3970. However, final approval was expected last week. 8th July has been circled as a possible date for final approval. ETH has since given up all the ETH ETF-inspired gains.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.