When it comes to diversifying an investment portfolio, you might ask yourself if Ethereum is a good coin to purchase in 2023. Despite the recent market volatility and uncertainty in future price predictions of the #2 Cryptocurrency, Ethereum is still in demand on the Crypto market, as more users display high interest in this asset.

While the majority of HODLers and Crypto enthusiasts have their own reasons to consider Ethereum a good investment, it is vital to understand what role Ethereum really plays in the Cryptocurrency ecosystem, so you can determine if it is a good investment or not.

Ethereum Overview

Today (7 March 2026) Ethereum (ETH/USD) is trading at $1789.46 per ETH, with a market cap of $216160142358 USD. The 24-hour trading volume amounts to $27511731755 USD. ETH price has changed by 1.9% in the last 24 hours. Ethereum’s circulating supply is 120713090 ETH.

The basics of Ethereum

Ethereum isn’t just a digital currency that allows transactions on a peer-to-peer (P2P) basis between market participants, it is also the largest blockchain network providing a framework for the creation of smart contracts.

A smart contract is a software program that is coded on the blockchain. These software programs can be used to further build complex independent systems, also know as decentralized applications (dApps).

Such dApps running on these systems reserve the ability to create various financial services, gaming platforms, as well as non fungible tokens, widely familiar to the public as NFTs. As a whole, such services are known as decentralized finance products, i.e. DeFi.

As of today, the Ethereum blockchain counts thousands of dApps running on smart contract systems, creating enterprise level solutions, and exerting tremendous influence on businesses around the globe.

Financial overview of Ethereum

The native Ethereum token ETH (Ether) is widely considered and adopted by traders, investors, and other market participants as the second Cryptocurrency in the world after Bitcoin. Just like Silver coming second to Gold based on it’s historical value.

Yet this strong position of ETH among thousands of other digital currencies was not always like this. Let’s go back a few years ago to paint the full picture of Ethereum’s history.

Historical highlights

Way back in 2015 when Ethereum was just launched, it’s price ranged anywhere from $0.45 – $2.5 in the first 6-7 months, and over time, traded at it’s highest of approximately $1,246 over the following 5 years.

In April 2021, ETH price rose above $2,500, then suffered a slight dip, before reaching a new peak price of $4,000 in May, and climbing to an all-time high of $4,733 later in November. This was largely down to the Ethereum “Merge”, which was much anticipated by the community and market participants.

The Merge

Ethereum’s merge, commonly referred to as “The Merge”, took place on 15 September, 2022. The goal of this process was to combine the initial execution layer “proof of work” (also known as the “Mainnet”) with the “proof of stake” consensus mechanism, the “Beacon Chain”.

The Merge and the switch to the new “proof of stake” mechanism opened the door to greater scalability and increased security for the system. Additionally, reducing the energy consumption by as much as 99.95%.

This way, approving more transactions on the Ethereum blockchain network became faster, with higher volumes, and less energy consumption levels.

Further performance and setbacks

Unfortunately, Ethereum price did not perform as expected, and the token suffered a downfall as the so called “Crypto winter” took it’s toll with rising inflation, interest rate hikes, and global economical problems surging.

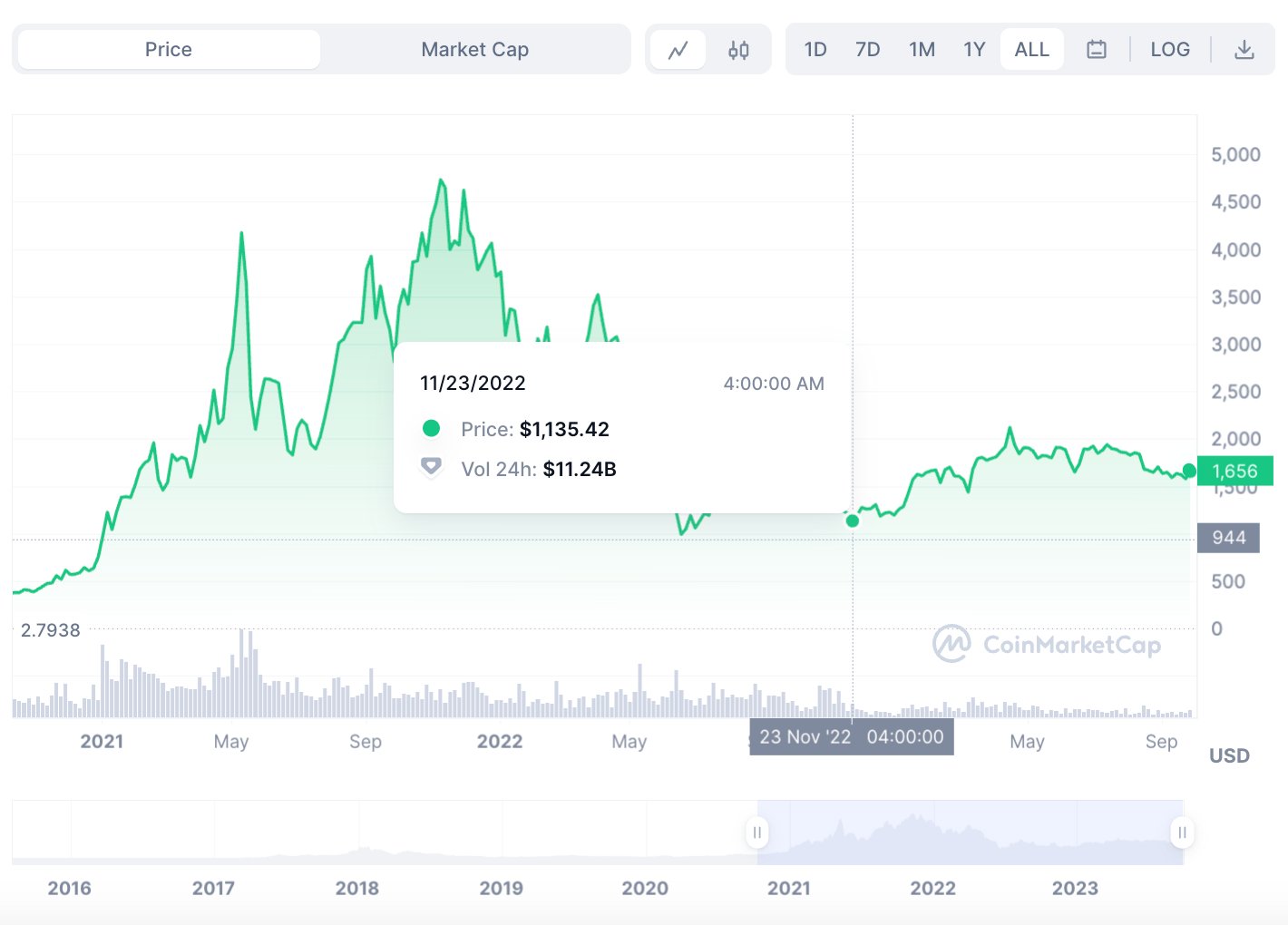

Falling as low as $1,471 on 16 September, right after The Merge, and subsequently reaching a years low of $1,135 in November, Ethereum’s current price has bounced back, now ranging around $1,600.

Market cap

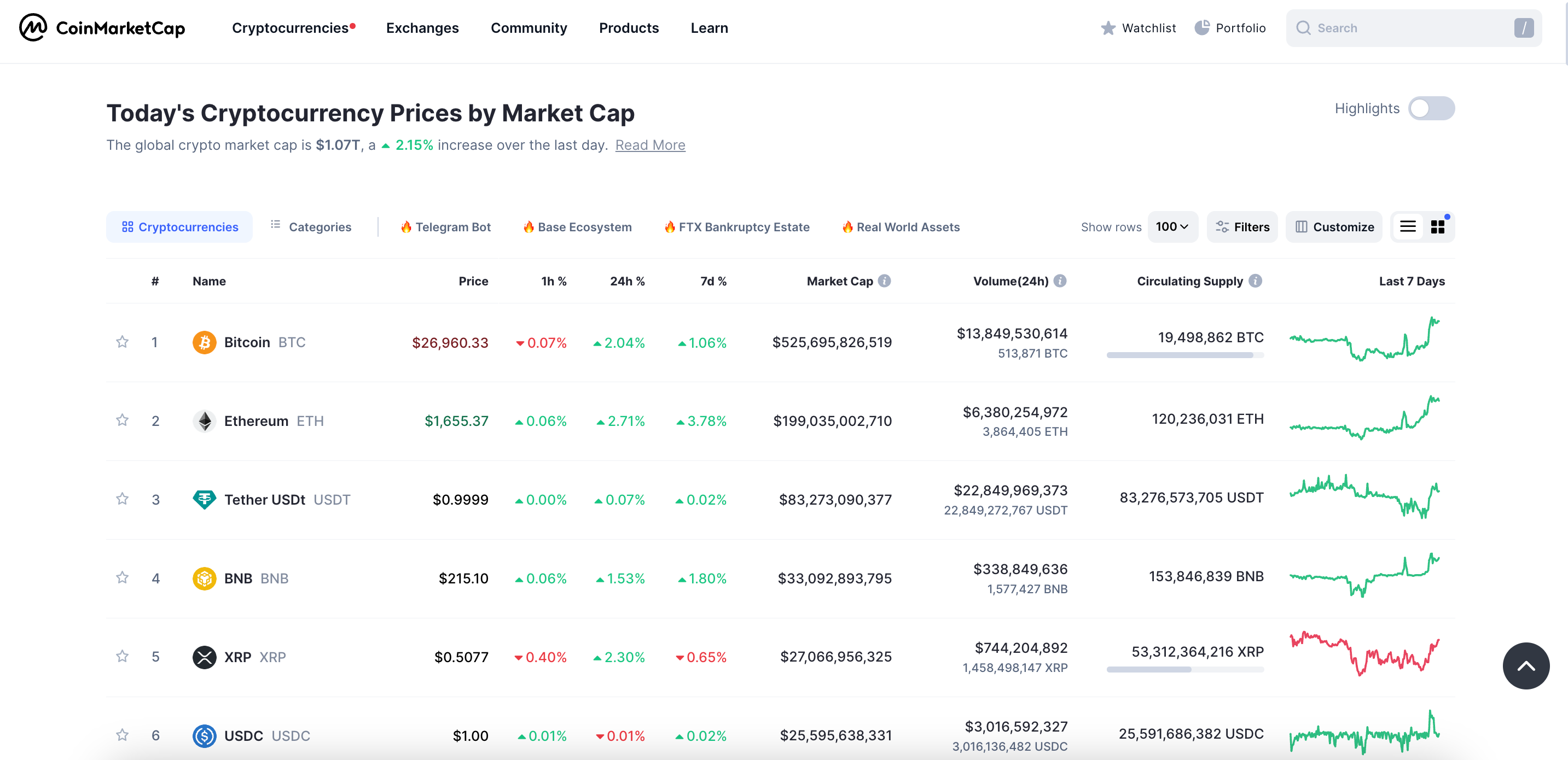

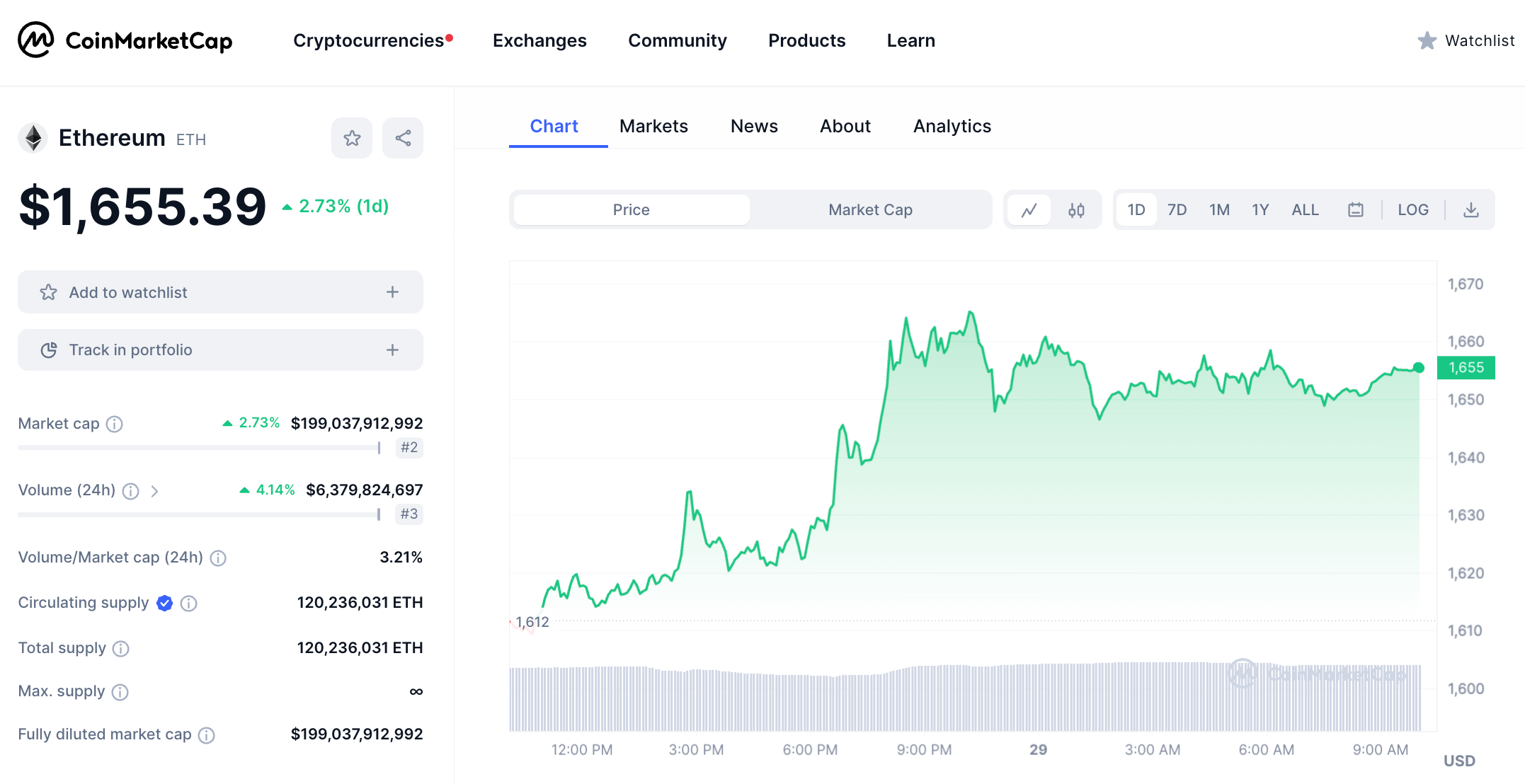

Despite the incredible rally being followed by a significant drop in price, ETH’s historical performance secured it’s place as a leading Cryptocurrency.

With a solid market cap of $199B, ETH proudly places second after Bitcoin, with an astonishing daily (24H) trading volume of $6.3B.

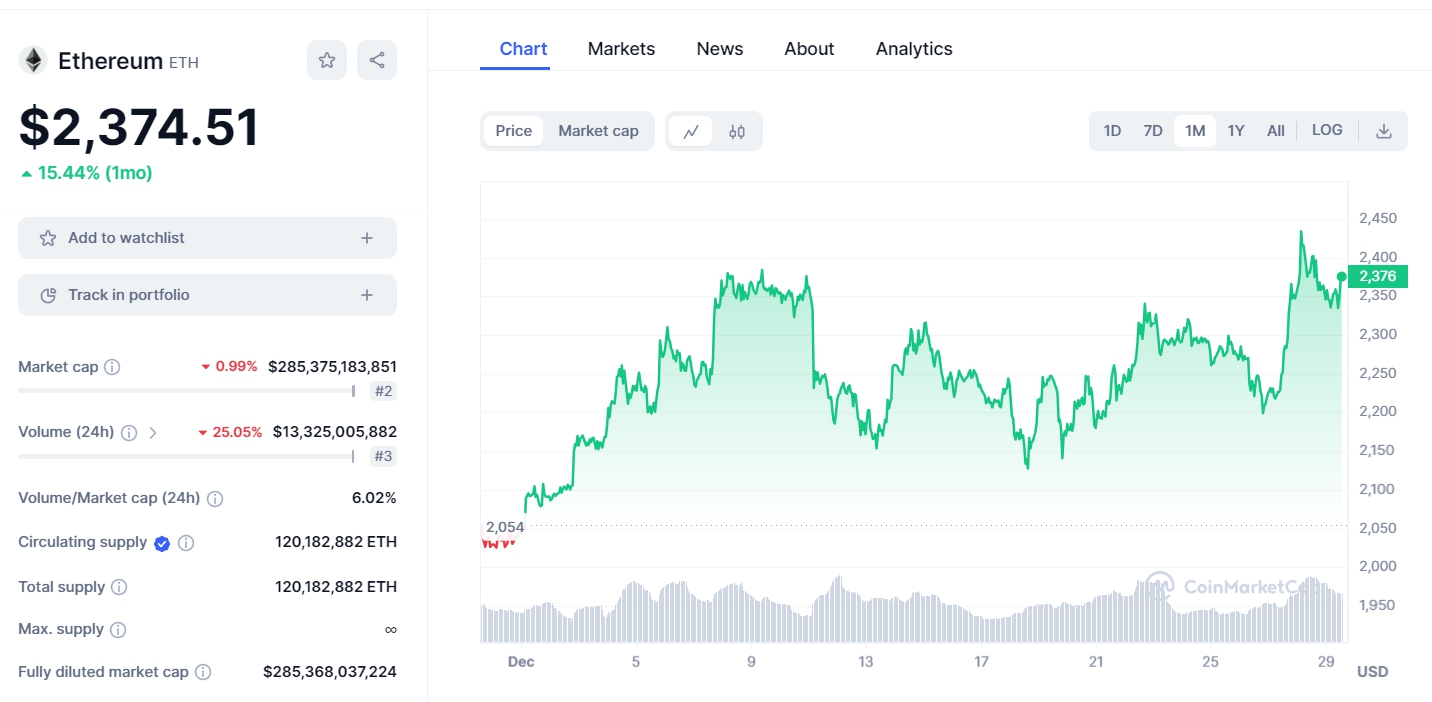

Ethereum jumps 15% in a last month

Reasons to buy Ethereum in 2024

Unpredictable market moves and their consequences, which may affect the value of a coin you decide to invest in, should always be treated with attention and evaluated according to your personal risk tolerance.

A well-thought-out investment plan, accompanied by a research-driven approach, and a cautious strategy, will reduce the potential dangers of losing money.

On the other hand, there are always key factors which grant some assets advantages over others, and position them on the Cryptocurrency market as strong leading performers, making them more secure choices.

Ethereum has many positive attributes. Here are just a few for you to truly comprehend why investors buy Ethereum, and consider it a wonderful asset to hold in 2024

Ethereum could be a world computer

Ethereum’s technology of smart contracts, based on it’s own blockchain alone, unlocks nearly infinite scalability in creating decentralized applications with their own economics. These do not require central authorities to “govern” the business, and allow involved parties to connect directly via a peer-to-peer (P2P) network of computers instead of a single access point.

This potentially makes Ethereum a super computer system comparable to the internet, which connects millions of users across the world through a global network.

Increased adoption and interest in this technology over the past years, within the Crypto world and beyond, serves as evidence that Ethereum is a good investment for the future.

Ethereum will give us tokenization

Ever since NFTs where introduced to the world, various countries have assessed the veritable capability of blockchains to tokenize not only art, but parts of their own economy.

Studies show that the next decade may become the first to see GDP (Gross Domestic Product) stored and transacted on the blockchain, as much as 10% globally, if not greater.

While these studies are limited to future predictions, and are yet to take place, we can observe historical events of tokenization taking place today.

A Swiss bank Sygnum transferred the legal ownership rights of the 1964 Pablo Picasso painting “Fillette au béret” to the blockchain, braking the digital asset into 4,000 tokens which where later purchased by a number of investors.

What makes this case so interesting, is that the Swiss bank tokenized the use of intellectual property, not just the piece of art itself.

This and other similar events demonstrate that Ethereum attracts investors on a whole new level of interest, and that the use of Ethereum in 2023 and onward will remain relevant.

Ethereum can run uncensorable apps

Your online social media accounts like Twitter (X), Instagram, YouTube or Facebook, don’t provide you with absolute control in regards to content and information you post publicly for your followers or friends.

They, along with many other corporations, reserve the right to filter, modify, remove, permanently delete, or do anything else with any information posted on personal accounts or public channels that does not correspond or resonate with the companies’ or local governments’ vision or moderation rules.

Ethereum, on the other hand, provides the ability to create uncensorable apps that are not controlled by central authorities, thus allowing community participants to freely share and exchange information with each other.

If we are speaking of globalisation and availability, Ethereum’s technology provides exactly this – unsencorable applications.

Ethereum is a host for innovation

Innovation comes when products and services provide unique solutions to existing problems. But the real game changing innovations take place when a system is set up to prevent issues humanity may experience in the future.

The multiplicity of projects built around the Ethereum smart contract system, and the variety of niches they comprise (electricity solutions, health care, local and corporate businesses, etc), open doors to never seen before changes society has been in need of for so long.

Diversification – Ethereum, Bitcoin & more

While Bitcoin is limited to a total market cap of 21 million coins, Ethereum is limitless. Limitless in market cap, development perspective, possible solutions, and so much more.

As a currency, Bitcoin was designed to allow users to hold and exchange stored value, as well as pay for products and services. Ethereum provides smart contract technology and all it’s benefits, tokenization and more, acting as more than just a digital currency for exchange.

And just the fact that Ethereum can be used to pay transaction fees, unlike many other Crypto assets, gives in an advantage in the Crypto market space.

5 Reasons not to buy Ethereum in 2024

Ethereum’s seemingly unlimited number of positive attributes doesn’t mean it’s perfect for investment. As with any other digital currency, it has it’s flaws. So, let’s dig a little bit deeper into the cons of Ethereum.

A rapidly developing system like Ethereum includes potential implementation risks. As more upgrades happen, increased technical risk and possible failure in the deliverance of complex products arise. It is nearly impossible to create such a large system free of security threats.

Ethereum security threats

In 2016, Ethereum faced a serious security incident, leading to loss of approximately $70 million in user funds. Just imagine a young project launched a year before facing such a critical incident?

An Ethereum smart contract called DAO (Decentralized Autonomous Organization) raised a total of $150 million, and suffered a hack attack due to a poorly developed code neglected by the development team at the time.

This incident prompted a series of smart contract security improvements, that led to code enhancement and the subsequent “Hard Fork”.

The hard fork

The Hard Fork rolled back Ethereum’s network history to before the so called DAO hack. This allowed Ethereum allocated within this smart contract to be moved to a different one, providing users with the ability to withdraw their funds.

Unfortunately, such rollbacks contradict the basic concept of blockchains to be resistant to censorship and immutable. Because of this, there was debate among the community whether the hard fork was an acceptable decision provided by the developers as a resolution.

Eventually, the community split, and those who did not accept the hard fork supported only the pre-forked Ethereum blockchain, which was later renamed to Ethereum Classic (ETC).

The global Ethereum network we know and use on a daily basis today, kept the original name.

The future of the blockchain

The DAO hack revealed to the Ethereum team, and to the public, what major issues required immediate attention to secure the blockchain’s future. Luckily, the development perspective was foreseen and steered in the right direction.

Talented management by Vitalik Buterin (co-founder of Ethereum) and the developers ensured the survival of the blockchain, which later became the pillar of blockchain technologies, Cryptocurrencies, and DeFi itself.

Yet, hackers’ attention still remains fixed on the Ethereum network, and any other potential weaknesses which could make it an easy target to exploit.

Ethereum killers

Though smart contracts are Ethereum’s “first born”, it is not the only network that currently develops this technology. Other market leaders like Cardano and Solana have also displayed increased interest.

Both the Cardano and Solana networks are implementing various approaches to developing smart contracts, to compete with Ethereum as it’s rivals.

The key difference between the two is the vision of how smart contracts could be improved, and how they must be upgraded to perform more efficiently in contrast with Ethereum’s.

The Cardano approach

Cardano has adopted an academic approach towards development, and implemented a careful strategy hoping to minimise potential implementation risks.

The focus of this methodology is to exclude and minimise potential hard forks, similar to the one Ethereum suffered back in 2016, which followed a critical security incident.

Slow but steady progression should provide sufficient time for in-depth research in the field of security measures, to prevent potential breaches and setbacks.

The Solana approach

On the other hand, Solana sees the future of smart contracts in scalability and operational speeds.

This approach focuses mainly on the provision of financial instruments in decentralized applications, that require the execution of thousands of payment operations, and the approving of transactions, without latency and deceleration.

Without a doubt, this strategy makes Solana one of the leading networks in the niche of smart contract development, and one possible Ethereum killer.

More reasons not to buy Ethereum in 2024

Security threats, strong competitors, hard forks, hack attacks – combined, they all create a complex counterweight of reasons not to buy Ethereum in 2023.

Yet, despite the “dark side” of Ethereum, it remains a leading digital asset, as well as a developer of blockchain technology, smart contracts, and all the relevant instruments and tools included.

Investment strategies for Ethereum

By far, risky investments rarely bring desired results and commonly lead to loosing money. Proper and timely utilisation of different investment strategies, suited to specific market conditions, may help you avoid making poor decisions.

Dollar-cost averaging

It is well known that battling market volatility in an attempt to reduce its impact on your portfolio, by catching the best Ethereum prices, can be a tiresome task. A good strategy to minimise the element of luck in such conditions is “dollar-cost averaging”.

By investing the same amount of money, at regular time intervals, over a certain period of time regardless of price, you will lower the average cost of the total amount of Ethereum bought.

This strategy is a good fit for novice investors, who lack the necessary experience to analyse and choose the most opportune moments to buy Ethereum.

Swing trading

For a more experienced trader familiar with fundamental and technical analysis, one of the best options is the “swing trading” strategy. Though this approach may involve more risk when investing.

With this strategy, you can apply a trading style aimed at capturing short and medium-term profits over a period of a few days or weeks.

Yet, by accurately analysing the current Ethereum price and predictions of it’s future fluctuations, you can benefit from “swinging” your investment in the right direction.

Holding long-term

If short-term ethereum price prediction distresses you, there is always an alternative path to investing.

As Ethereum remains a strong performer and a perspective asset, holding it “long-term” may relieve you from the routine duty of monitoring the market minute-to-minute.

This strategy allows you to benefit the most from profits gained over an extensive period of time, to minimise your risk, and avoid the majority of losses that may come with trading during extreme market volatility.

Concluding thoughts

Ethereum as a digital asset, and a blockchain network, plays an immense role in the formation of the Cryptocurrency ecosystem and industry as a whole.

The emergence of smart contracts within the Ethereum network paved the way to decentralized finance (DeFi) and thousands of dApps that provide unique solutions to users and businesses across the globe.

Moreover, Ethereum as a coin performed incredibly well, withstanding extreme market conditions, fluctuations, and volatility over the years. Firmly placing it in a position to challenge other Cryptocurrencies for the top spot, along with Bitcoin.

If you’re looking to make a short or long-term Ethereum investment, but hesitate on the question “Should I buy Ethereum in 2023?”, analyse Ethereum as a whole, not just an asset to hold. Only then will you be able to make the most informed decision.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.