Why crypto traders are expanding into traditional markets

Crypto markets can be fast and exciting, but they can also be unpredictable. Price action is often driven by hype, memes, or short-lived narratives rather than fundamentals, and that can make consistent trading difficult.

That’s why many experienced traders don’t limit themselves to crypto alone. They’re expanding into traditional finance (TradFi) markets to diversify their exposure, trade real-world events, and access asset classes that move on macroeconomic data rather than social media sentiment.

This isn’t about abandoning crypto. It’s about adding more tools to your trading toolkit and having options when crypto markets go quiet or choppy.

Trade what actually moves the world

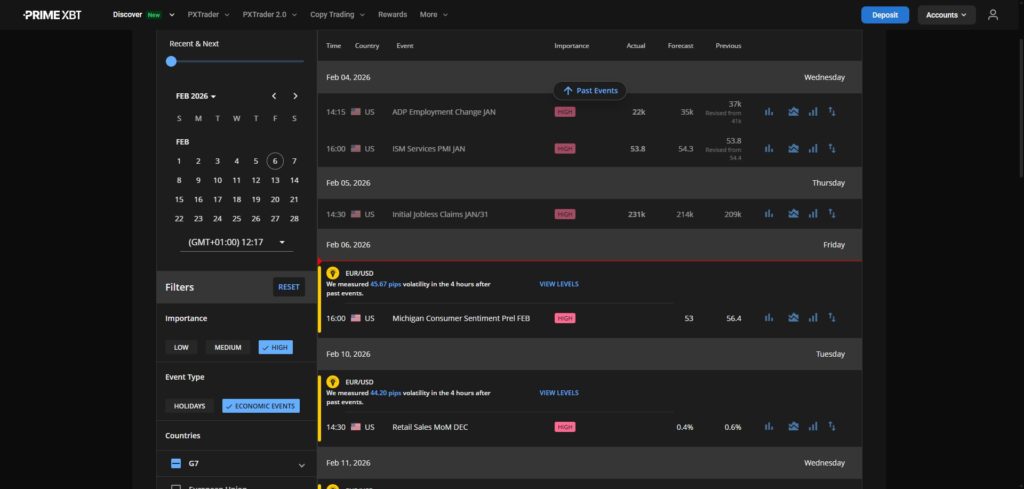

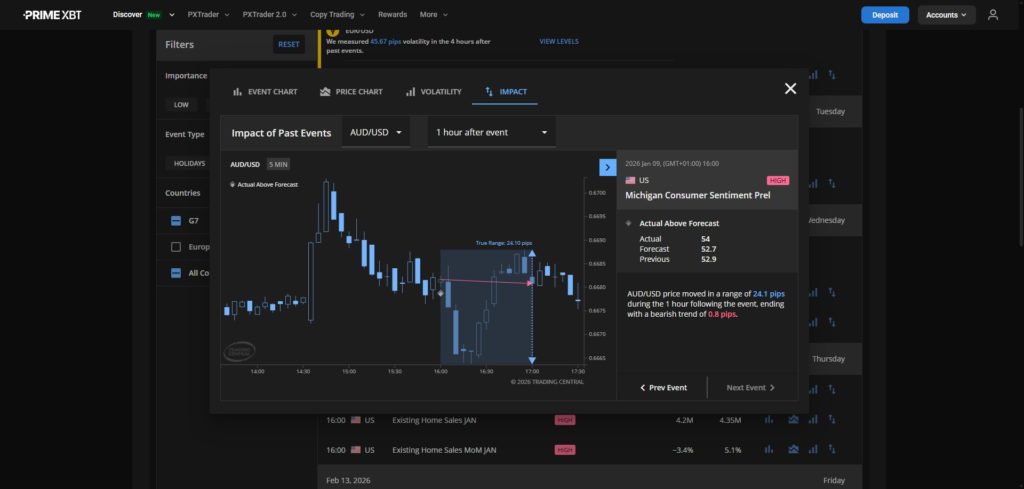

Inflation data, interest rate decisions, tariff announcements, elections, geopolitical tensions. These events move markets every day, and they tend to impact traditional assets first.

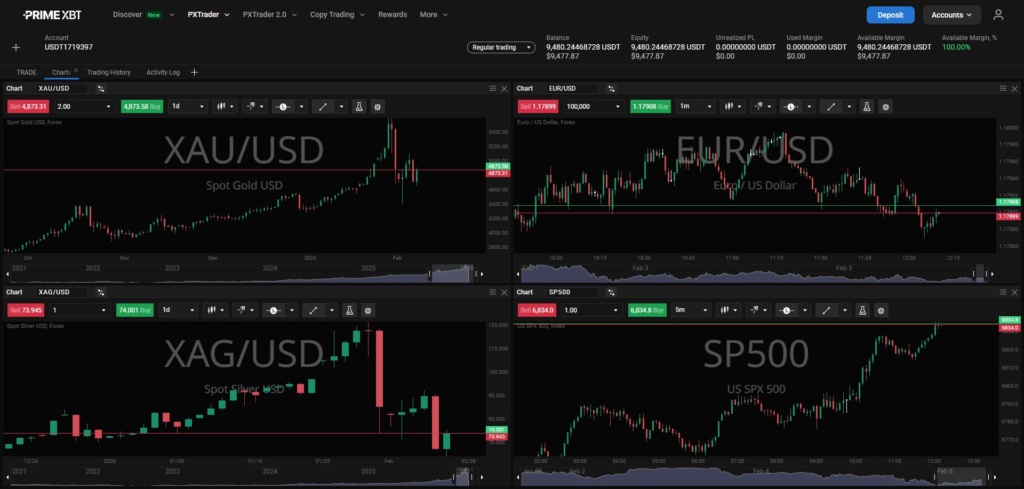

Gold reacts to inflation expectations and risk sentiment. Oil moves on supply shocks, geopolitics, and global demand. Stock indices reflect economic growth, earnings, and capital flows. Forex (FX) markets are driven by central bank policy and global liquidity.

Unlike assets that move on social media trends or short-lived narratives, these markets are shaped by real data and real decisions, which makes them easier to analyse and plan around.

Why experienced traders diversify into TradFi markets

Diversification isn’t about trading everything at once, it’s about having options.

By expanding into traditional markets, you can trade global macro events that shape economies, use gold and oil to position around inflation and supply dynamics, and access stock indices tied to economic growth and risk appetite. You’re no longer dependent on a single asset class, and you gain exposure to markets where price action is driven by scheduled events and verifiable data.

When crypto is quiet or choppy, global markets are often moving.

From speculation to structure

Some crypto assets can produce fast moves, but they’re often driven by sentiment rather than fundamentals. That can make them difficult to trade consistently, especially when narratives shift without warning.

Traditional markets work differently. They’re anchored in macroeconomic data, influenced by policy decisions and capital flows, and move around scheduled events like central bank meetings, earnings releases, and economic data prints. For traders who want more structure, that predictability can be valuable.

This is why many traders see traditional markets as a natural addition to their trading.

Why consistency matters

Chasing hype can work in the short term, but it’s difficult to sustain. Markets driven by narratives and sentiment can turn quickly, often without warning.

Traditional markets offer something different. Because they move on scheduled events and macroeconomic data, they give traders repeatable setups and clearer structure to work with. For many, that structure makes it easier to develop a consistent approach over time.

Crypto is important, but it’s not the whole picture

Crypto will always be part of the market, and for many traders it’s where they started. But staying in one asset class means limited options when conditions change.

Traders who expand into traditional markets can adapt more easily, diversify their exposure, and access assets that move on real economic drivers. Going beyond crypto isn’t a step away from opportunity, it’s a step toward more of it.

Start trading global markets

At PrimeXBT, we offer access to crypto, gold, oil, indices, and Forex from a single account, so you can choose where to trade based on market conditions.

Explore our TradFi markets and see how traders are diversifying with global assets.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.