Ethereum (ETH) and Wrapped Ethereum (WETH) are two digital assets that have become increasingly popular in the world of decentralized finance (DeFi). While both assets share many similarities, they have essential differences between ETH WETH that are important to understand. This blog post will explore the nature, use cases, interoperability, price, and centralization of ETH and WETH and how they differ. Whether you’re new to cryptocurrency or a seasoned investor, this post will help you better understand these two assets and how they fit into the larger DeFi ecosystem. Depending on the decentralized application, you may or may not need to use the wrapped Ether.

What is WETH?

Wrapped Ethereum (WETH) is a token that represents Ethereum (ETH) on decentralized finance (DeFi) platforms and other Ethereum-based applications.

WETH enables ETH to be used as collateral, traded on decentralized exchanges, or used to participate in DeFi protocols that require ERC-20 tokens.

How Do Wrapped Ethereum Work?

Here’s how it works:

Wrapping ETH: To convert ETH into WETH, a user can deposit ETH into a smart contract that will issue an equivalent amount of WETH.

Trading WETH: The resulting WETH can now be traded on decentralized exchanges as an ERC-20 token, allowing for easier and more efficient trading of ETH.

Using WETH in DeFi: WETH can also be used as collateral for loans, for participating in yield farming, and for other DeFi protocols that require ERC-20 tokens.

Unwrapping WETH: If a user wants to convert their WETH back into ETH, they can send the WETH back to the smart contract, which will then release an equivalent amount of ETH.

Why Do We Need WETH?

WETH provides an essential bridge between Ethereum and DeFi, allowing ETH to be used in new and exciting ways while maintaining its underlying value and utility. In other words, you usually convert it into WETH for utility in a DeFi system.

Advantages and Disadvantages of WETH

Advantages of Wrapped Ethereum (WETH):

- Interoperability: WETH enables ETH to be used as collateral or traded on decentralized exchanges that only support ERC-20 tokens.

- Increased liquidity: By converting ETH into WETH, it becomes easier to trade ETH on decentralized exchanges, increasing its overall liquidity.

- Access to DeFi: WETH enables ETH holders to participate in DeFi protocols that require ERC-20 tokens, unlocking new investment opportunities and use cases for ETH.

- Better price discovery: By allowing ETH to be traded on decentralized exchanges, WETH can help improve price discovery for ETH, leading to more accurate pricing information.

Disadvantages of Wrapped Ethereum (WETH):

- Counterparty risk: When converting ETH into WETH, the user relies on the smart contract and its creators to hold and manage their ETH. If the smart contract has vulnerabilities or is hacked, the user’s ETH could be at risk.

- Gas fees: Wrapping and unwrapping ETH into WETH requires paying gas fees, which can be high when the Ethereum network is congested.

- Complexity: For some users, wrapping and unwrapping ETH into WETH may need to be clarified or more manageable, potentially limiting its adoption.

- Centralization concerns: WETH is created and managed by a centralized entity, which may be a disadvantage for those who prefer fully decentralized solutions.

How to wrap and unwrap ETH?

If you are going to wrap and unwrap ETH, there are a few things that you need to understand:

Wrapping ETH into WETH:

- Connect your wallet: Connect your Ethereum wallets, such as MetaMask or MyEtherWallet, to the platform where you want to wrap your ETH.

- Deposit ETH: Send the amount of ETH you want to wrap to the platform’s deposit address.

- Receive WETH: The platform will issue an equivalent amount of WETH to your Ethereum wallet.

Unwrapping WETH into ETH:

- Connect your wallet: Connect your Ethereum wallets, such as MetaMask or MyEtherWallet, to the platform where you have your WETH.

- Send WETH: Send the amount of WETH you want to unwrap back to the platform’s unwrap address.

- Receive ETH: The platform will release an equivalent amount of ETH to your Ethereum wallet.

It’s important to note that wrapping and unwrapping ETH into WETH requires paying gas fees, which can be high when the Ethereum network is congested. Before wrapping or unwrapping ETH, research and understand the platform and smart contract you will use to ensure that it is safe and trustworthy.

The Main Differences Between ETH and WETH

Ethereum (ETH) and Wrapped Ethereum (WETH) are both digital assets, but they have some key differences:

- Nature: ETH is the native cryptocurrency of the Ethereum blockchain, while WETH is an ERC-20 token representing ETH.

- Use cases: ETH is primarily used for transactions, paying for gas fees, and as a store of value, while WETH is used as a medium of exchange on decentralized exchanges and as collateral in decentralized finance (DeFi) protocols.

- Interoperability: ETH is only sometimes easily tradable on decentralized exchanges or usable in DeFi protocols, as these platforms often require ERC-20 tokens. WETH solves this problem by allowing ETH to be used in these contexts.

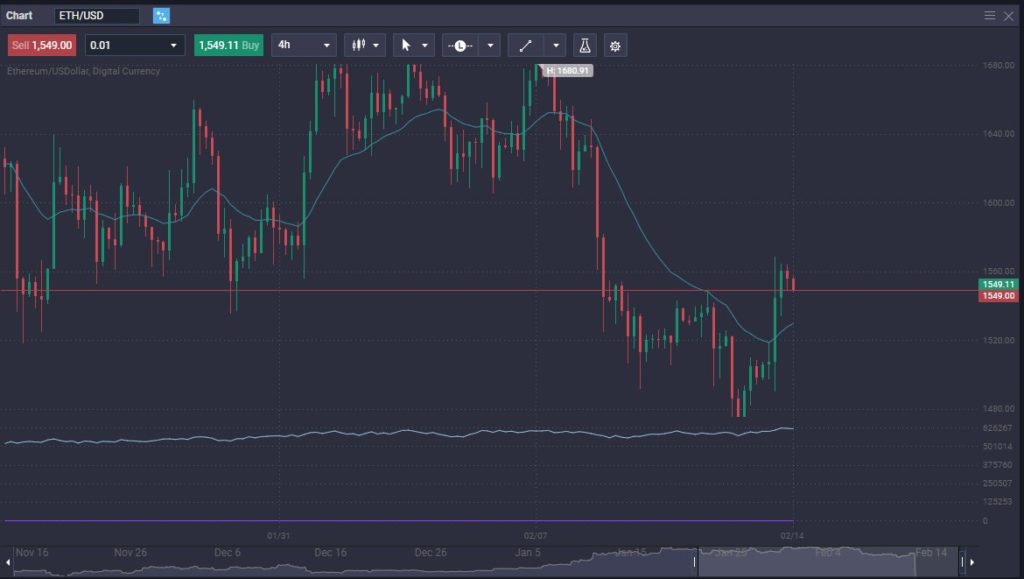

- Price: The price of ETH and WETH will generally track each other, but there may be slight differences due to supply and demand dynamics on different platforms.

- Centralization: ETH is a decentralized asset, while WETH is created and managed by a centralized entity. This may be a disadvantage for those who prefer fully decentralized solutions.

WETH vs. ETH: Which is better?

WETH vs. ETH, which is better? ETH and WETH are both valuable assets but serve different purposes and characteristics. ETH is the backbone of the Ethereum blockchain, while WETH is an ERC-20 token that provides additional utility and liquidity for ETH holders. In other words, it depends on what you are trying to do.

Conclusion

In conclusion, Wrapped Ethereum (WETH) and Ethereum (ETH) are two digital assets that play different but complementary roles in the world of decentralized finance (DeFi). WETH provides a more easily tradable and usable form of ETH in the DeFi ecosystem. At the same time, ETH serves as the native cryptocurrency of the Ethereum blockchain and is widely used for paying gas fees and participating in the Ethereum network.

Each asset has advantages and disadvantages, and the decision will depend on the specific use case and individual preferences. When using WETH, it’s essential to know the additional costs associated with wrapping and unwrapping and the potential risks associated with centralized management. On the other hand, ETH’s decentralized nature and wide use in the Ethereum network can provide greater security and decentralization.

Overall, both WETH and ETH are essential assets in the DeFi ecosystem, and understanding their differences is crucial for anyone looking to participate in this growing field. Whether you are new to cryptocurrency or a seasoned investor, this post has hopefully provided a deeper insight into the nature, use cases, and differences between WETH and ETH.

Furthermore, it should be noted that the price difference between WETH and ETH should be nothing or close to it. However, depending on the network, there might be more supply or demand, which could affect the price. However, as the two are 1:1 correlations, they are typically used interchangeably. Wrapped tokens are not a necessity but a valuable tool in some protocols.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.