Cardano, the 8th largest cryptocurrency by market cap, has experienced significant gains in recent weeks. However, ADA/USD has also been underperforming BTC/USD at the start of 2024.

Key Takeaways:

- Cardano lags behind Bitcoin in early 2024, sparking debate on its growth potential.

- Bitcoin’s halving event boosts its price, while Cardano struggles, highlighting market cycle effects.

- Cardano’s tech upgrades, like Plutus V3, could drive its price independently of Bitcoin.

BTCUSD has rallied over 16% since the start of the year and is up 110% over the past 12 months. In contrast, ADA/USD has fallen 5% since the start of the year and has risen 50% over the past 12 months.

Does this lag behind Bitcoin mean that there could be more upside to come, or is it being left behind in the doldrums?

BTC Halving & Altcoin Season

The fourth Bitcoin halving event is expected to take place in Apil and has been partly responsible for BTC/USD’s surge above $50,000. The event, which reduces Bitcoin supply, has helped boost BTC/USD to levels last seen in April 2022.

Yet while BTC/USD trades at 18-month highs, ADA/USD continues to trade below $1, a level last seen in April 2022, promoting speculation over whether Cardano should have rallied higher on the back of Bitcoin’s rally.

Historically, halving events have influenced the price not only of Bitcoin but also the wider crypto market, which means that the altcoin season could soon be here. The reduction of supply in Bitcoin, while demand remains constant, often leads to fresh all-time highs in the following bull cycle.

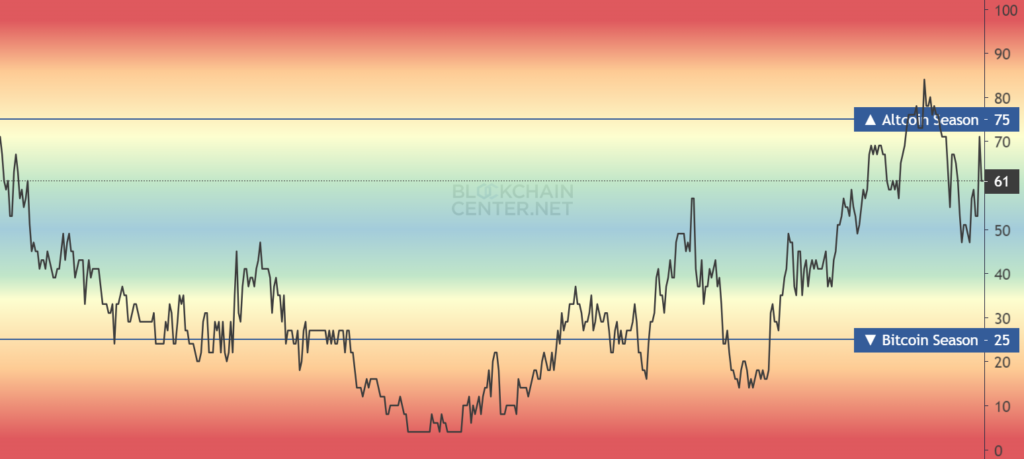

While Bitcoin has risen above the psychological $50k level in anticipation of the halving event, data from Blockchain Center suggests that it is not altcoin season yet. The Altcoin Season index is 61. Altcoin season comes when 75% of the top 50 coins perform better than Bitcoin over the last 90 days, affecting Bitcoin dominance and helping altcoins surge.

While historical performance is not a guarantee for future price movements, it does highlight the importance of monitoring Bitcoin’s price movement and its influence on altcoins.

According to Portfolio labs, the current correlation between ADA and Bitcoin is 0.69, which is considered to be moderate. This means that the two cryptocurrencies have some degree of a positive relationship in their price movements. So, a bullish move in Bitcoin could positively impact the Cardano price, but this is not the only driver for Cardano.

Improving Cardano fundamentals

Behind the scenes, Cardano has been focusing on improving its technology and onboarding real-world use cases. Last year, the Vasil hard fork meant the network could support a larger volume of transactions, while smart contracts are faster and cheaper to run.

Just last week, founder Charles Hoskinson announced the next big upgrade to the Cardano network, emphasizing the importance of Plutus V3. This marks a significant step forward in the evolution of the Cardano ecosystem, opening the door to new possibilities for developers and users.

Following the announcement, ADA/USD rallied over 8%- highlighting the extent to which ecosystem development influences the price.

Conclusion

Cardano’s rise to $1 could be influenced by its correlation to Bitcoin ahead of the April halving event. But other factors, such as network upgrades, speculation of a discounted value, and technical resistance at $1, could influence ADA/USD movements.

Sources

Altcoin Season Index: Is it Altseason right now? (2023, December 15). Blockchaincenter. https://www.blockchaincenter.net/en/altcoin-season-index/

ADA-USD vs. BTC-USD — ETF comparison tool. (n.d.). PortfoliosLab. https://portfolioslab.com/tools/stock-comparison/ADA-USD/BTC-USD

Abbas, M. (2024, February 15). Cardano’s Monumental Shift: Chang Hardfork and Plutus V3 Upgrade. BNN. https://bnnbreaking.com/tech/cardanos-monumental-shift-chang-hardfork-and-plutus-v3-upgrade

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.