Bitcoin surged over 8% last week, marking the third straight weekly rise, while taking the price to fresh record highs. After starting the previous week at 108.3K, the price pushed higher, breaking above the tough 110K resistance and reaching the 118K level. BTC extended those gains over the weekend, and at the start of the new week, hit a fresh record level of $122k.

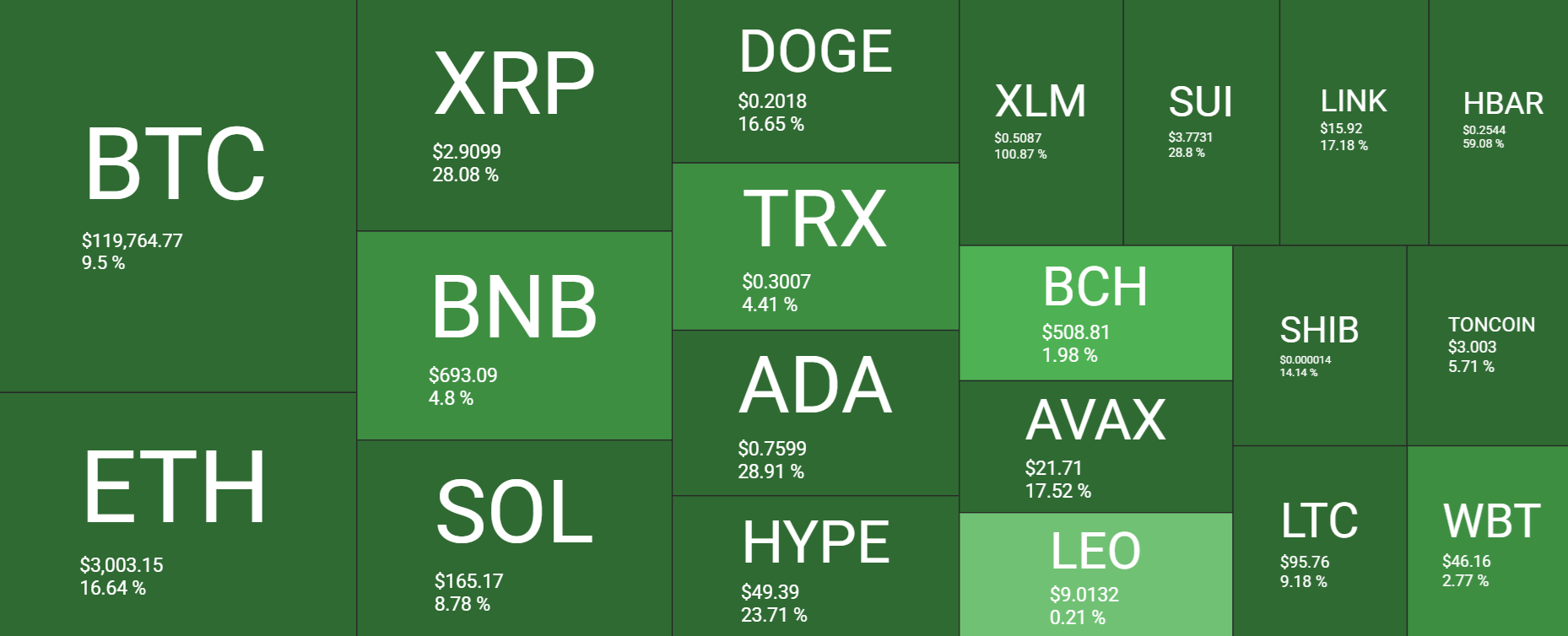

The crypto space was a sea of green with substantial gains seen across the board. Ethereum and Ripple outperformed, rising 16% and 24% respectively. SOL and BNB rose 6% and 4%, respectively. Meanwhile, in the smaller altcoins, ADA rose 25%, DOGE 16%, and XLM 87%.

The crypto market capitalization rose to $3.72 trillion, up from $3.3 trillion last week and marking its highest level since September last year. Meanwhile, the Fear and Greed index jumped to 68, into Greed territory, up from 50, Neutral last week, and marking the highest level since May.

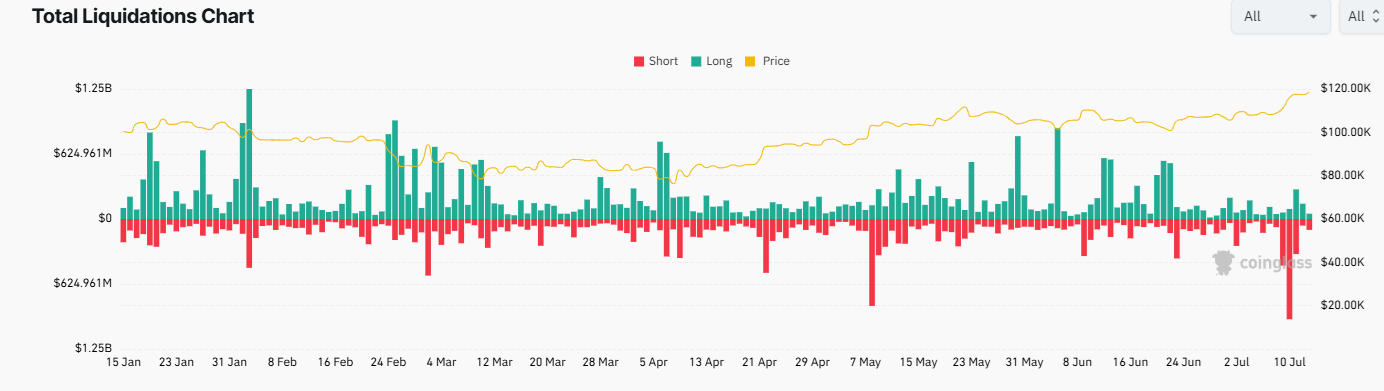

The surge in the price of Bitcoin on Thursday, which saw the price break above 110k, sparked a wave of short liquidations that totaled almost $1 billion. This marked the largest short liquidation event this year. Bitcoin accounted for $655 million. According to BTC trader Byzantine General, this was a record liquidation in recent years, and strong British Q for BTC on the derivatives market.

The massive short squeeze and record inflows from BTC ETFs lifted Bitcoin almost 10% over the past 7 days.

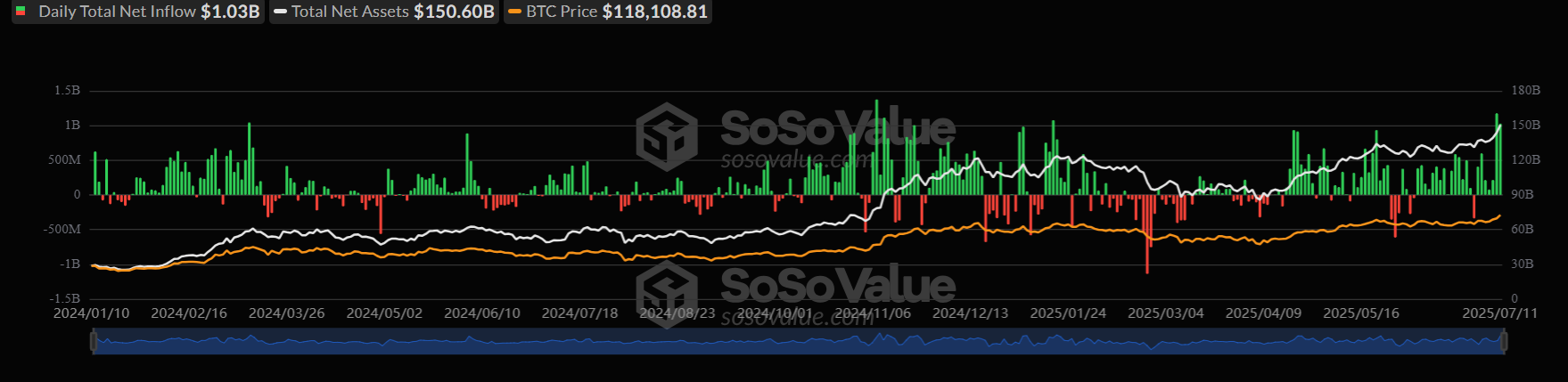

Bitcoin institutional demand breaks records

Bitcoin ETFs posted a sixth straight day of net inflows on Friday, fueled by a massive $1.03 billion in net inflows and $1.18 billion on July 10th, the second largest daily inflows since the debut. This has taken net assets across all Bitcoin ETFs to $150.60 billion, with the segment now representing 6.43% of Bitcoin’s total market cap. The impressive growth highlights institutional demand as a clear marker of conviction. Strong and persistent BTC demand could keep the BTC price supported.

Bitcoin treasuries add to the bull run

Bitcoin treasury companies, which are corporate vehicles that raise capital in actual debt markets and then deploy it into spot BTC, have been growing in number, adding significantly to the Bitcoin demand picture. Quarterly inflows into Bitcoin treasury companies reached $15 billion in Q2, with 145 firms now pursuing this strategy.

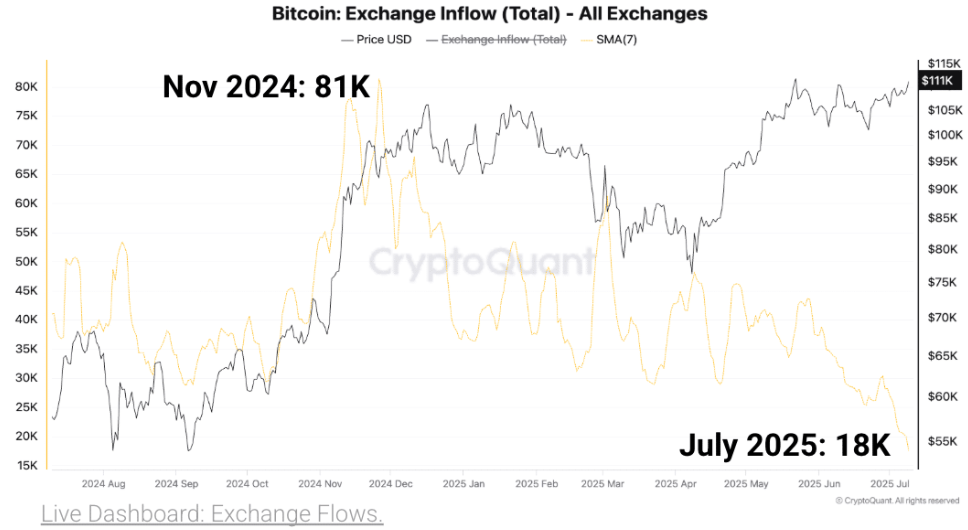

Muted sell pressure in spot markets

Muted sound pressure in the spot market is adding to the catalysts for the bull run. Unlike the Q2 rally from 75K to 100K, which attracted selling pressure, this time the rally hasn’t seen a notable spike from sellers. The exchange inflow metric measures the overall incoming BTC supply from custodial wallets to offload. Comparing the Q4 2024 BTC price surge, which attracted 81K BTC in sell-off, the current pump saw pressure fall further to 18K BTC.

Signs the BTC rally is just starting

Google Trends, which can be used to assess retail involvement, shows that the Bitcoin topic was still not popular in the US and was significantly below the peaks of 2020 or even November 2024. This suggests a lack of retail euphoria. Should retail euphoria take hold, this could send prices even higher before a peak is seen.

Using the trading frequency and position size to gauge retail participation can be a valuable tool in understanding whether smaller market participants are entering. According to CryptoQuant, this metric hasn’t seen a retail surge since March last year, which mirrors earlier cycles. For instance, in February 2021, retail jumped into Bitcoin, but soon encountered rejection at the 60K level.

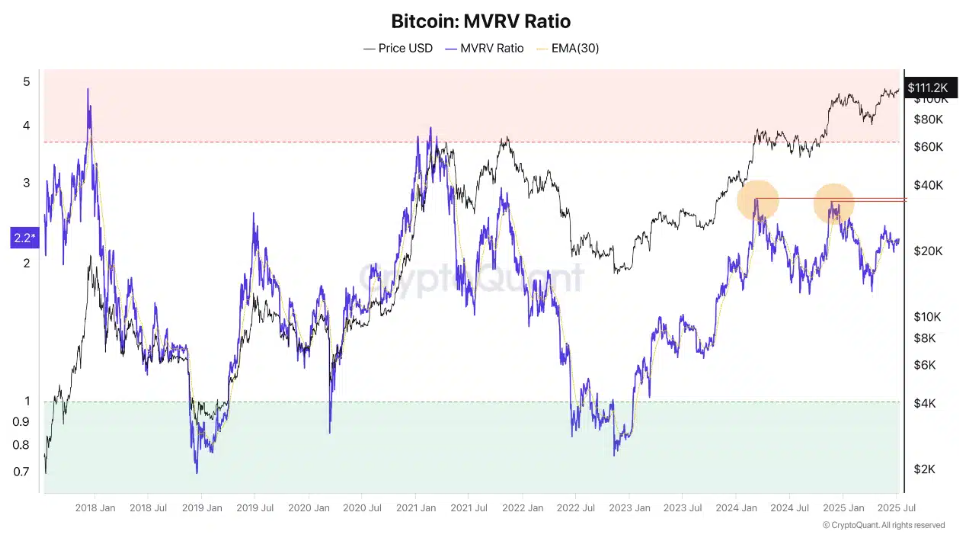

Other data demonstrates how market sentiment is notably different from previous market tops. The MVRV ratio exceeded 2.7 in March and December 2024. On the 11th of July, the metric was around 2.2, a sign of healthier market conditions.

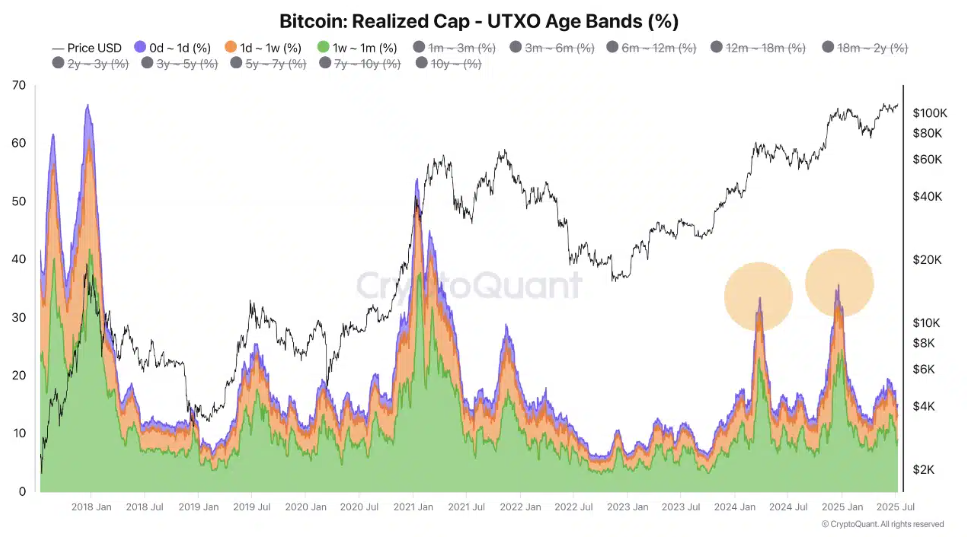

Another important metric is the UTXO age bands, which analyze how long each Bitcoin remains unspent. The data shows that 15% of the Bitcoin supply belongs to short-term holders (STH) wallets, holding coins for under a month. This figure is usually closer to 30% around cycle peaks.

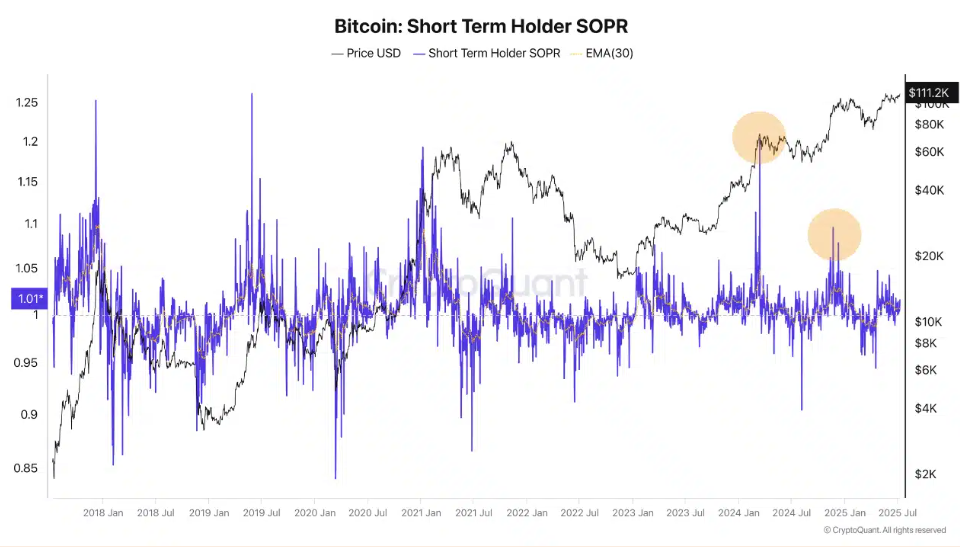

Furthermore, the short-term holder (STH) SOPR showed that holders were not sitting on large profits, which suggests there is minimal sell pressure from profit taking from STH Bitcoin wallets.

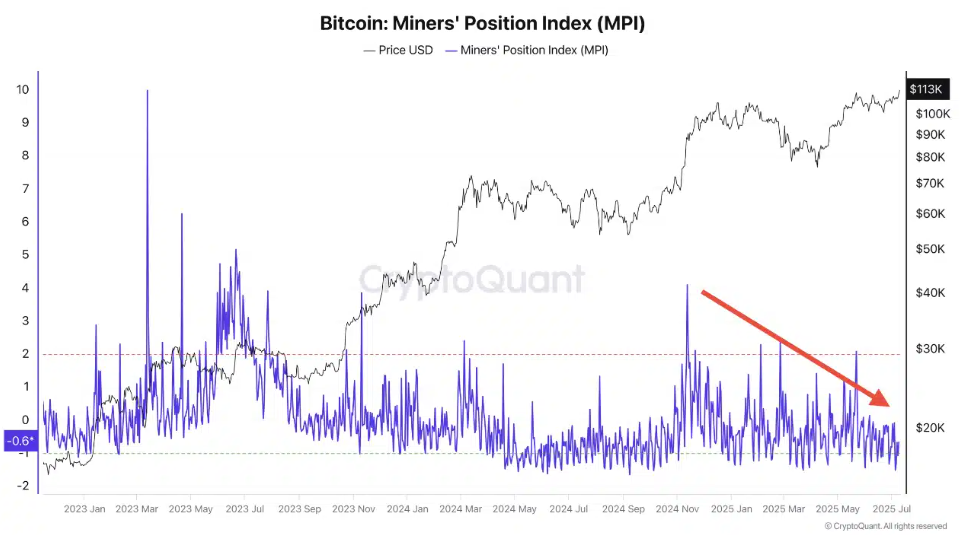

Finally, the Miner position index has been trending lower since November 2024, suggesting reduced selling pressure from miners. Mining companies have tended to accumulate Bitcoin rather than sell it as they expect prices to rise.

Overall, there are few signs of market bull exhaustion or widespread profit taking. Should these conditions continue, Bitcoin’s price could trend higher in the coming months, potentially towards 150K as the next target level.

Macro backdrop

Last week, macro factors including the 50% tariff on copper imports, a delay in reciprocal tariffs until August 1st, and Nvidia hitting a $4 trillion market cap appeared to drive crypto performance, helping Bitcoin to an all-time high.

BTC wallet movement, quantum computing concerns

Last week, 80,000 BTC valued at $8.6 billion were transferred from a pay-to-public-key-hash wallet to a modern SegWit address. These coins, which have been dormant since 2011, were not transferred to any exchanges for sale, which may explain why there was only a brief and shallow dip in the market price before BTC went on to make fresh all-time highs.

However, this transfer was notable because it was the largest single-day transfer of Santoshi era coins, sparking speculation about the motive behind it, along with some concerns about the potential for quantum computing to compromise Bitcoin’s cryptographic security.

Quantum computing has been highlighted as a potential existential threat to Bitcoin, estimating that up to 4 million BTC could be vulnerable in the future. While some institutions have raised concerns about the possible impacts of quantum computing on crypto assets, this is not an imminent threat, with advanced quantum machines today still needing to advance significantly to compromise the cryptography that secures blockchains like Bitcoin.

Crypto Week

The US House of Representatives has announced that this coming week, July 14th, will be the first “Crypto Week”. This week, legislators will consider three key pieces of US policy on digital assets: the Clarity Act, the anti-CBDC surveillance state act, and the Genius Act. The House Republican seeks to pass these bills to provide the sector with improved regulatory clarity, whilst also safeguarding privacy, free market competitiveness, and individual sovereignty.

More clarity over legislation is expected to make the crypto space more appealing to institutions and corporations, further improving the demand outlook.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.