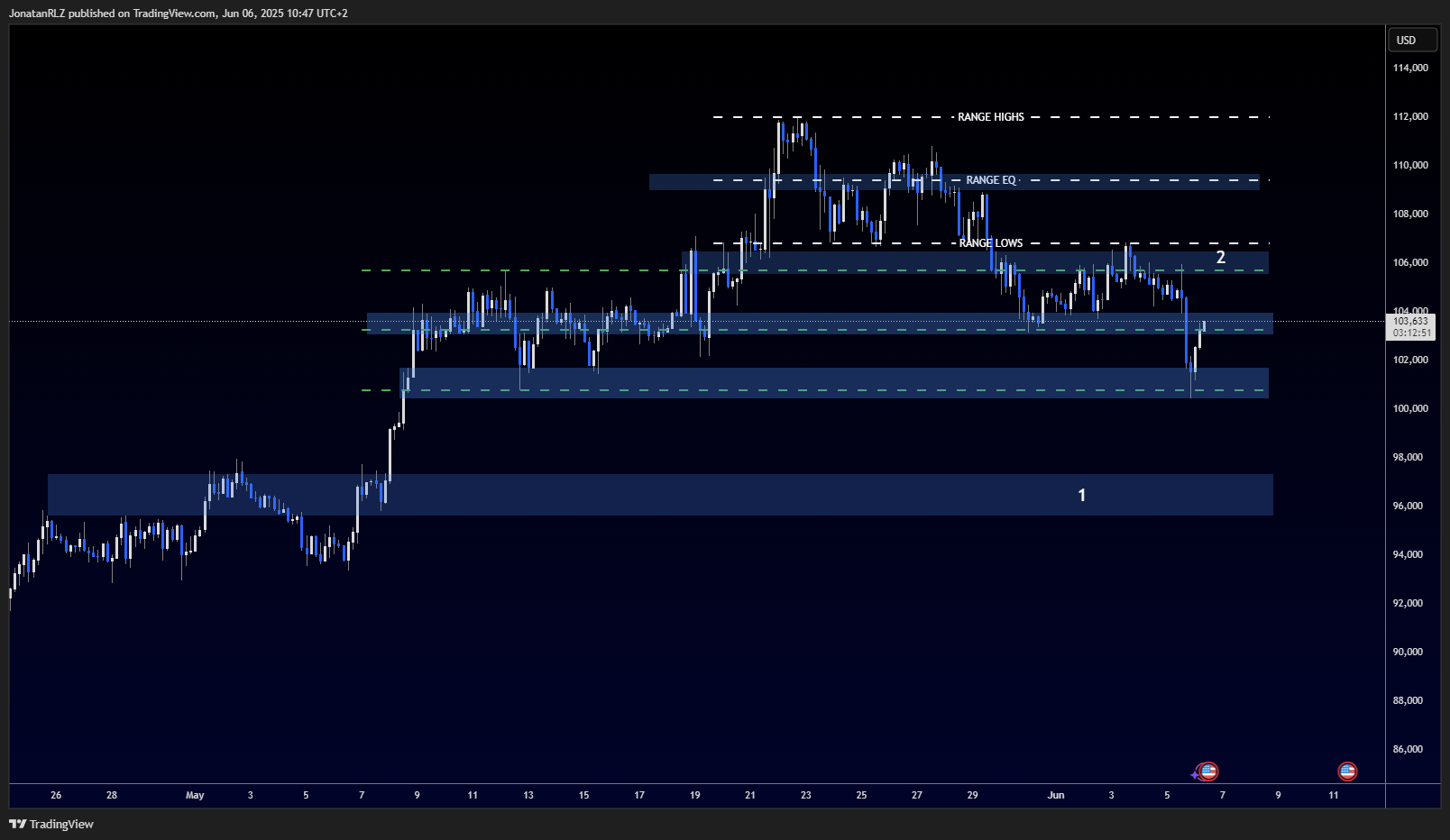

With the US non-farm payrolls, NFP, report due today at 12:30 GMT, all eyes are on Bitcoin and whether the current structure will hold or shift. On the 4-hour chart, we can identify two clear range structures. The first range is marked with white dotted lines, while the second, more recent range, is shown using green dotted lines.

At the end of May, Bitcoin dipped from the upper range into the lower green range. Following yesterday’s jobless claims report, price briefly spiked lower into range support, just above the psychologically significant 100,000 level. That test held, and price is now trading near the range equilibrium at around 103,000.

This puts Bitcoin in a pivotal position.

The next move will likely depend on today’s NFP figures. A move lower could take us back toward support at 96,000, marked as number 1, a level that would need to hold for a higher time frame bullish structure to remain intact. A more constructive scenario would see Bitcoin hold above the 106,000 level, marked as number 2, which aligns with the current range highs and former support from the upper range.

In the short term, resistance sits at 104,000 just above current price, and then again at 106,000. These are the two levels bulls need to reclaim to regain short-term control.

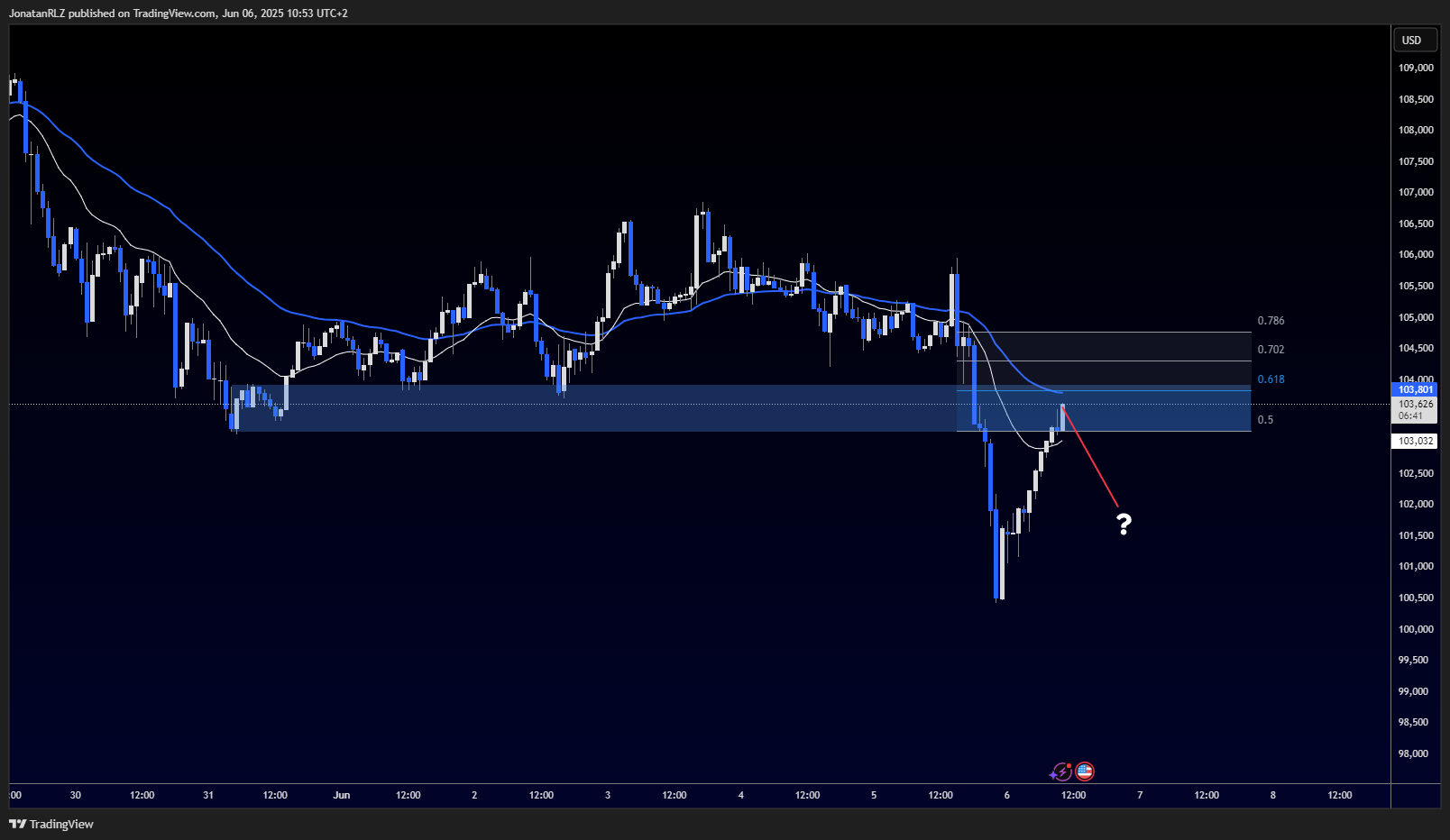

Zooming into the 1-hour timeframe, Bitcoin is testing a resistance zone around 103,500. This area aligns with both the 0.618 and 0.50 Fibonacci retracement levels of the latest move down. Adding further weight to this zone, we also have the 1-hour 20 and 50 exponential moving averages stacked in this region.

This makes 103,500 a key intraday level.

If Bitcoin can reclaim this resistance before the NFP release and establish a move higher, it would be a sign of early strength. However, rejection here followed by lower trading into the data would put pressure back on range support. In that case, the structure would need to hold above 96,000 to maintain broader high timeframe bullish alignment.

For now, Bitcoin remains inside a well-defined range. Today’s NFP print is likely to determine whether price breaks out or breaks down, setting the tone for the weeks ahead across global markets.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.