Bitcoin ended last week at approximately the same level that it started, around 96,000. There was some choppiness and volatility, with the price rising to a record high of 98.9k before dropping to 91k on Tuesday and then steadily grinding higher back towards 96k. The world’s largest cryptocurrency is starting the new week just below this level at 95.3k but keeps the key 100k milestone in focus.

The picture with altcoins was more mixed. While Solana fell lower by 3%, Ethereum rallied 11%, and XRP saw a 40% gain.

Last week’s top-performing meme coins included Ski Mask Dog (SKI), which rose 335%, and Top Hat (HAT), which rose 117%. Shiba Inu rose 20% and Pepe 10%.

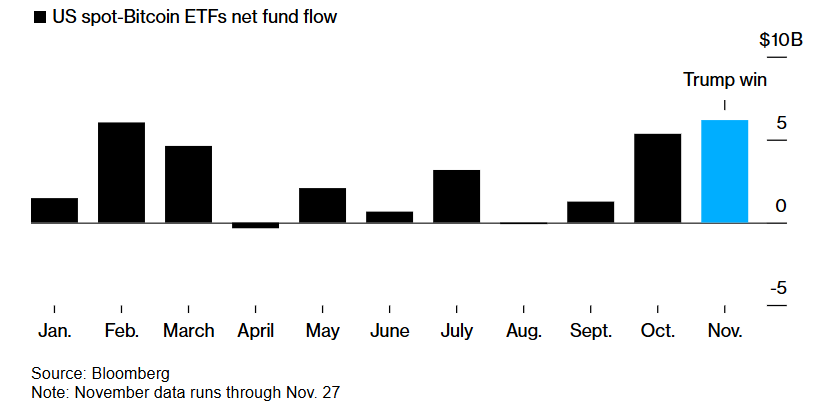

BTC ETFs post a weekly net outflow, but November saw record inflows

Institutional demand last week offered a clearer perspective on Bitcoin’s fallback and recovery. According to SoSo Value data, spot Bitcoin ETFs started the week with two straight days of net outflows totaling $558.1 million by Tuesday. This was then followed by a modest recovery in demand on Wednesday and Friday (the ETFs were closed on Thursday for the Thanksgiving holiday).

Across the week, Bitcoin ETFs experienced very modest outflows of $138.07 million, ending a seven-week run of inflows.

Yet despite those outflows, November was the strongest month yet for spot Bitcoin ETF, with a total of $6.2 billion in net inflows, according to data from Bloomberg. This surpassed the previous peak of $6 billion achieved in February amid investor euphoria over the product’s launch at the start of the year. We can expect continued inflows into ETFs, especially under a Trump administration, where it will be easier for businesses in retirement funds to own the asset.

The surge in demand for BTC ETFs in November came after Trump’s election victory. He had pledged to reverse the Biden administration’s strict stance on cryptocurrencies and create a more crypto-friendly regulatory environment.

Corporate buying continues, underpinning the price

MicroStrategy bought more Bitcoin last week, acquiring 55k BTC for $5.4 billion, and now holds a total of 386,700, around 1.8% of the total supply. Later in the week, Marathon Digital announced that it had acquired a further 703 BTC in November, taking its holding to 6,474, with $160 million available for additional purchases. MARA is the second largest corporate holder of Bitcoin after MicroStrategy. Corporate capital is becoming an increasingly important flow to consider.

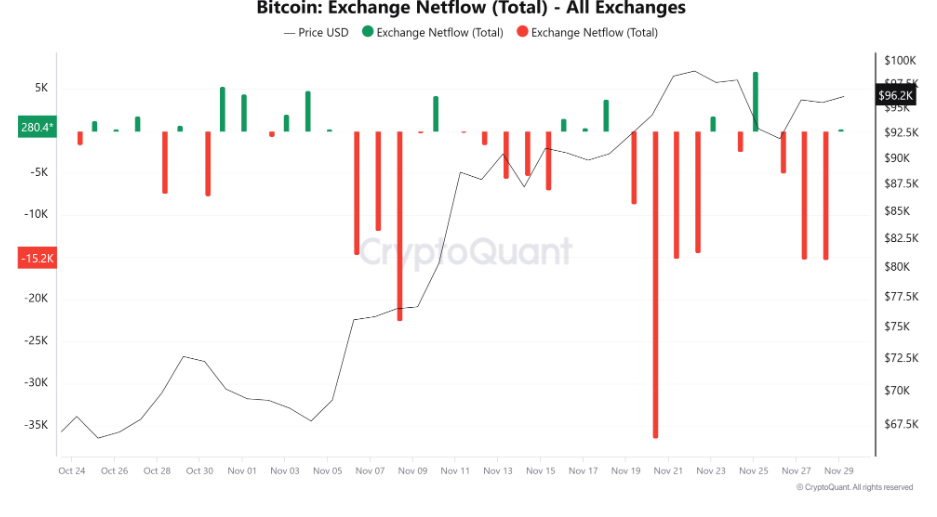

Bitcoin holders buy the dip

Data from CryptoQuant showed that holders bought back the dips at the start of last week. When the BTC price fell from Monday’s peak of 98.9k to Tuesday’s low of 91k, holders accumulated 35,449 BTC in an encouraging sign of demand. It’s worth keeping an eye on whether this trend continues.

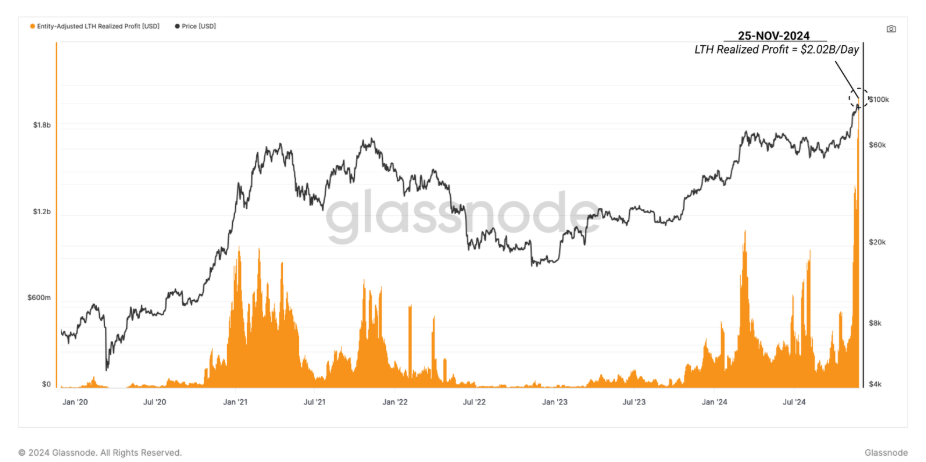

However, Glassnode’s weekly report showed that the 42% rally in Bitcoin drove long-term holders to realize an unprecedented $2.02 billion in daily profit, a new record high. The supply overhang could need a re-accumulation phase before another sustained price increase.

Could ETH enjoy a bullish December?

Ethereum rose 11% last week, heading towards 3.7k. However, the price is still some way from its record high of $4867 in 2021. Still, increasingly encouraging signals exist that the token could be on the verge of a significant rally.

Spot ETH ETFs post record daily inflows

Spot ether ETFs in the US hit a record high in daily inflows this week, surpassing spot Bitcoin ETF inflows on the same day. On November 29, $332.9 million flowed into the nine spot Ether ETFs, surpassing the previous daily record of $295.5 million reached on November 11 and ahead of spot Bitcoin ETFs’ $320 million on the same day.

This is the first time the Ether ETFs have recorded higher inflows than spot Bitcoin ETFs on a day when both saw inflows. This follows recent days when spot ether ETFs have maintained positive inflow days while Bitcoin ETFs experienced outflows. This could be showing some signs that a rotation has begun.

The pick-up in ETH ETF demand comes as the price of Ether jumped 11% last week. The coin, seen as a slow runner throughout this bull run and failing to keep up, was showing signs of playing catch up as it looked to its next target of 3.7k.

ETH’s Golden Cross brings 4k into focus

Technically, the picture is looking increasingly bullish for Ethereum this week after a golden cross bullish technical indicator, which is often considered a precursor to strong upward momentum, appears to be forming on the daily chart.

The RSI continues to support further upside while remaining out of overbought territory, and the MACD is bullish, adding to the upbeat picture.

Additionally, multiple other signs align with a breakout. Ether open interest peaked at 24.04 billion on November 28, its highest level ever. The open interest record confirms strong ETH derivative demand alongside solid record ETF demand.

Exchange reserve data also confirmed growing confidence among ATH holders. Ether exchange reserves are now at the level of US in April 2024, and the currency has booted two months of positive exchange reserves for the first time this year.

This sign is of shifting sentiment among ETH holders, which could help the price reach 4000 and beyond.

XRP outperforms

However, the top-performing major altcoin has been XRP, which has been on an absolute tear throughout the past month and has managed to flip BNB for the spot of the fifth largest coin in terms of market capitalization, at $109 billion compared to BNB’s $94 billion.

The jump in XRP comes as Gary Gensler is set to step down as head of the SEC in January and as Wisdom Tree files for Ripple XRP exchange-traded funds (ETFs) in Delaware. This marks the first step towards regulatory approval, with an S1 registration required.

Increased regulatory clarity and the broader upbeat market sentiment have spurred institutional confidence. Meanwhile, partnerships in cross-border payments underscore its utility. XRP also sees increased whale activity in rising OBV levels, which signals significant accumulation. Together, these factors could help pave the way for sustained growth.

Looking ahead

The crypto market remains focused on Trump and his plans to base the US global trade and, most specifically, cryptocurrencies. Bitcoin and its pairs fell last week when Trump’s trade tariff threats had risk sentiment, putting risky assets such as Bitcoin lower. A similar pattern is being seen on Monday as Trump threatens 100% trade tariffs on the BRIC nations should they threaten the dominance of the US dollar. And getting risk assets across the board are heading lower.

Macroeconomic data and expectations regarding the Federal Reserve’s interest rate outlook appear to have been less dominant forces in the crypto market in recent weeks. However, this could change, particularly if US data continues to highlight the strength of the economy, which could lower Fed rate cut bets.

This week, the focus will be on US non-farm payrolls and a speech by Fed Chair Jerome Powell. Any sense that the Fed will adopt an even more cautious stance to rate cuts could hurt the liquidity outlook and negatively impact risk assets such as Bitcoin.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.