Bitcoin tumbled over 5% last week, Snapping a three-week winning run. BTC rose to a two-month high of 66k on September 29th before tumbling lower at the beginning of last week. It reached a low of just below 60k on Wednesday before stabilising until the end of the week. Bitcoin is recovering towards 64k as the new week begins.

Altcoins were also a sea of red last week, with Ether and Solana dropping 8% and BMB dropping 5%. XRP tumbled 16% across the week on news that the SEC would appeal a decision in the long-running SEC vs Ripple court case.

Bitcoin and the crypto markets reacted badly to Federal Reserve chair Jerome Powell’s speech on Monday, which was more hawkish than expected and misreports on X regarding FTX distributions as well as escalating geopolitical tensions. Last week also represented one of the busiest weeks for token unlocks for some time, with $1.6 billion in value, equating to more than three times more than the average over the past eight weeks.

These factors could explain the heightened market volatility seen in crypto compared to other asset classes, particularly given the low liquidity due to Golden Week in Asia.

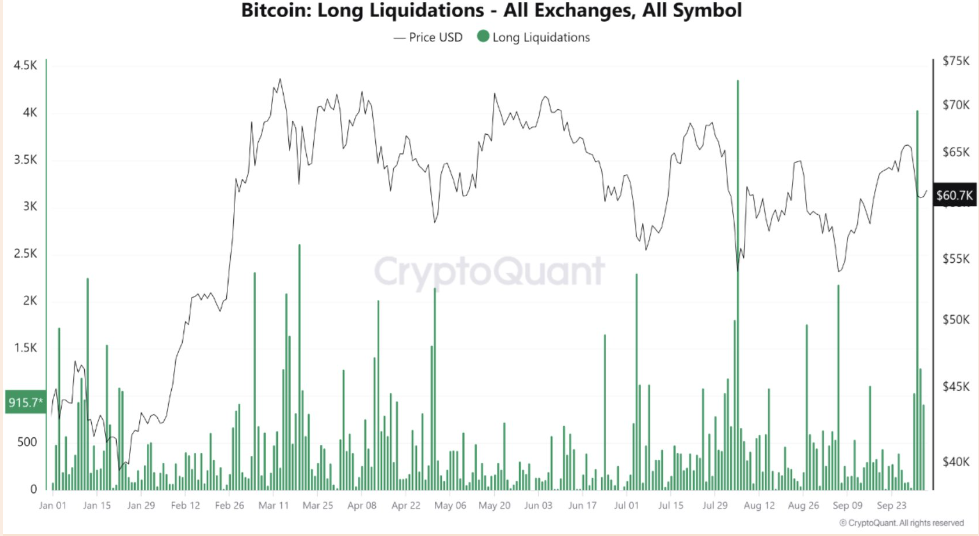

Liquidations

The selloff in Bitcoin last week resulted in more than $700 million in long liquidations – the highest weekly level since early August. The recent liquidation of long positions may have established a local bottom, indicating that BTC could be set for a move upwards, which is what we are seeing at the start of this week. Key liquidity levels remain strong, between 68.9k and 69.3k above the current price and 56.8k and 58.4k below the current price.

A new liquidity cluster was also emerging around the 66.5k to 66.8k zone, suggesting that the price could target this area soon.

Bitcoin ETFs saw outflows

According to SoSo Value data, Bitcoin ETFs saw an outflow of $301.54 million in the previous week, ending a three-week run of inflows and after inflows of $1.1 billion in the week prior, which marked the strongest weekly inflows since mid-July.

Breaking the data down further, Bitcoin saw ETF outflows of $242.53 million on Tuesday, October 1, as the Bitcoin price tumbled to 60k. This was the largest BTC ETF outflows since early September.

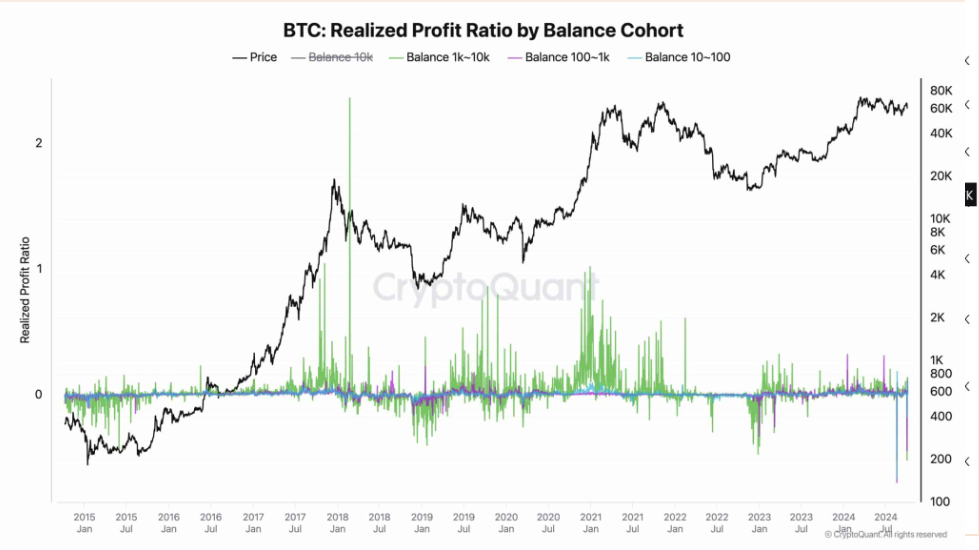

Bitcoin Whales

Large Bitcoin holders—whales have shown historically low levels of profit-taking, which is often considered a show of confidence in future price growth. Whales have distributed their BTC across different addresses, with 1975 addresses now holding between 1000 and 10,000 BTC. Even though there has been some recent selling, whales are taking minimum profits compared to previous cycles, which further supports the view that Bitcoin will rise from here as they seek to maximize gains.

Macro backdrop

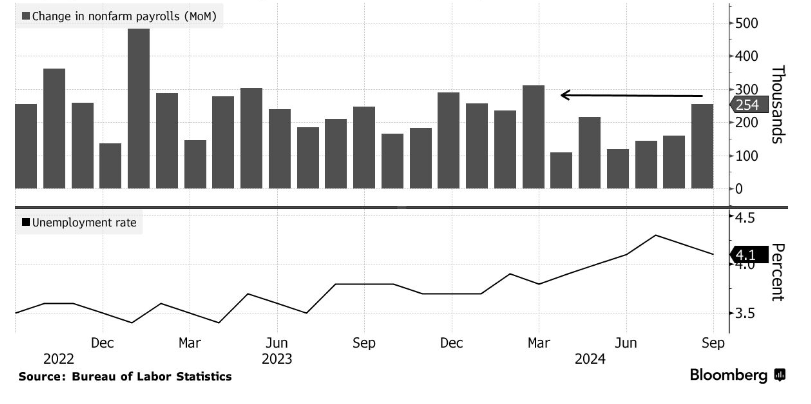

Federal Reserve chair Jerome Powell spoke at the National Association for Business Economics on September 30th and signaled towards the Federal Reserve cutting rates by 25 basis points at the coming meetings rather than another 50 basis point cut that the market had been expecting. Following his comments, the market reined In its expectations for an outsized rate cut in November to 40% from 60%. Expectations for an outsized then were lowered further to just 5% following Friday’s stronger-than-expected nonfarm payroll report.

The US NFP smashed expectations with 254,000 jobs added in September and upward revisions of 72,000 across the two previous months, highlighting resilience in the US labour market. Unemployment unexpectedly ticked lower to 4.1%, and average hourly earnings unexpectedly increased by 0.4% month on month or 4% annually.

While the data suggests that the Fed will likely opt for a methodical and steady pace of rate cuts, it also indicates that the US economy is showing little signs of a hard landing, which is good news for risk sentiment. As a result, Bitcoin jumped 2% on Friday, while the Nasdaq 100 closed 1% higher and the S&P 500 was up 0.75%.

Disbursements

Rumours circulated that the embattled exchange FTX would start distributing as much as $11 billion to creditors on October 1, creating fear, uncertainty, and doubt (FUD). There have been examples of how concerns surrounding disbursements and actual disbursements have weighed on the Bitcoin price in recent months after distributions from Mt Geox, the German government, and the US government in June and July.

Despite the FUD and rumours, the truth was a little different. FTX’s legal team is set to attend a court hearing on October 7 to finalize the repayment plan.

If approved, the plan administrator will set an effective date to begin distributions. Smaller claims under $50,000 will receive funds within 60 days from the effective date, which is likely to be in Q4 this year. larger claims may not see distributions until Q1 or Q2 of 2025. There are also a series of additional hearings on October 22, November 20, and December 12 to resolve ongoing issues relating to the Chapter 11 process.

Geopolitical tensions

Tensions in the Middle East remain a risk for markets and market sentiment. An escalation of tensions at the start of last week saw Bitcoin drop sharply in line with equities and other riskier assets while gold trended higher, suggesting that Bitcoin remains a risk asset rather than a safe haven asset. Adding evidence to this, the correlation between Bitcoin and the S&P 500 has risen year to date, most likely due to the improving liquidity environment as central banks start to cut interest rates.

Should tensions show signs of easing, or at least not escalating further, this could help fuel a recovery in Bitcoin at the start of the week.

Week Ahead

Heading into the new week, geopolitical risks remain present and could impact the broader market mood. News surrounding the FTX disbursements will also be awaited, as will US macro-economic data and FOMC minutes for further clues about the Fed’s outlook for interest rates.

China returns from its week-long Golden Week holiday on Tuesday, which could see increased market liquidity.

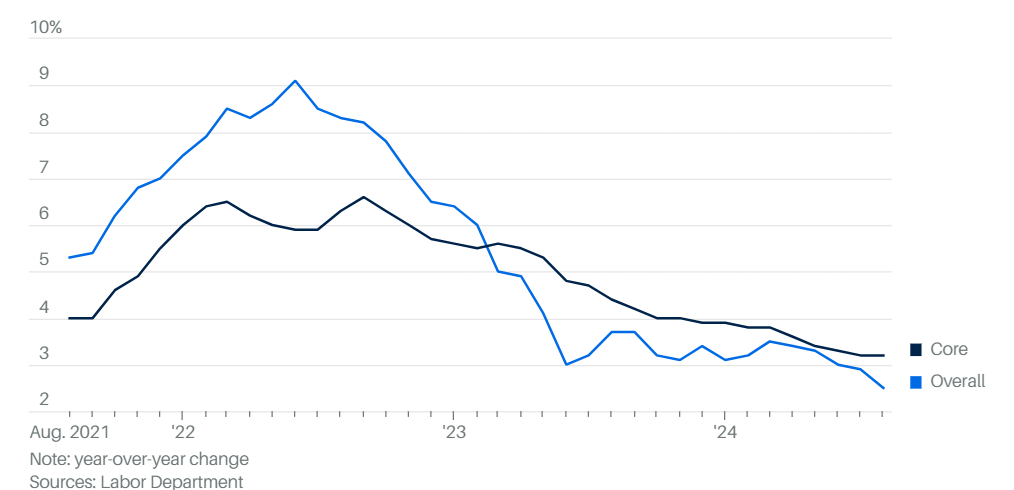

US inflation data

Thursday’s inflation data is expected to show that price pressures continued to cool at the end of Q3. The data comes after a strong nonfarm payroll report, and together, the figures will shape expectations around the pace of the Federal Reserve’s rate cuts in the coming month. Inflation (CPI) is expected to ease a 2.3% YoY in September, down from 2.5%. Should inflation cool in line with forecasts, it could continue to fuel expectations of 25 basis point rate cuts supporting the market mood and demand for riskier assets such as Bitcoin.

However, should prices rise faster than expected after the stronger-than-forecast jobs data, the market might start to question whether the Fed’s ability to cut rates as planned over the coming months. This could send Bitcoin lower.

FOMC meeting minutes

The minutes of the September Fed meeting will also be published on Wednesday, with investors looking for clues about how officials see the pace of rate cuts in the future. Further insights into the factors that led policymakers to cut rates by 50 basis points will be noteworthy. Meanwhile, investors will also get the chance to hear from several Fed officials, including Neal Kashkari, Raphael Bostic, and Lorie Logan.

HBO documentary

At 9 pm ET on October 9, an HBO documentary titled Money Electric: The Bitcoin Mystery is set to air with producers claiming to have cracked the mystery of Bitcoin’s anonymous creator, Satoshi Nakamoto. Speculators on the poly market betting platform place a 38% possibility of the late Len Sassaman, a cryptographer, being revealed as the true identity.

The documentary itself may not be market-moving, given that Bitcoin has matured into a resilient network and community that no longer depends on its enigmatic founder. However, should there be movements in the 1.1 million Satoshi Bitcoin holdings, this could create some volatility in the market. An influx of Bitcoin onto the market could lead to significant price drops.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.