Bitcoin fell 11% last week, extending losses from the previous week by 6%, dropping to a low of 80.5k, the lowest level in over 7 months. BTC has fallen over 20% in November and is down 30% from its October record high, firmly in bear-market territory. BTC has recovered from this low and risen across the weekend, trading at 85.5k at the start of the new week.

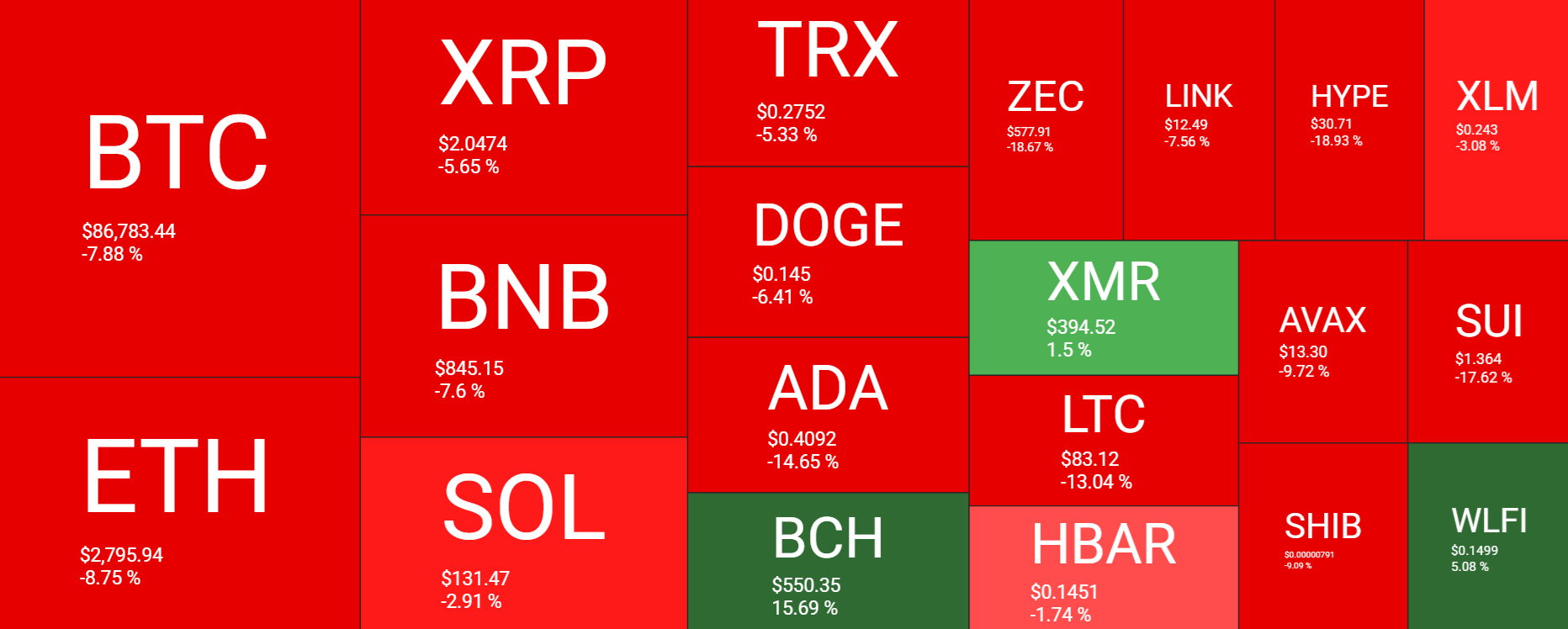

Altcoins were also under pressure last week, tracking Bitcoin’s losses. Ethereum plunged almost 9% over the past 7 days, while BNB dropped 7% and XRP shed 5.6%. SOL showed more resilience than its peers, down 2.9%. Despite the bleed out, there were some pockets of positivity, including BCH, which jumped 15%.

The total cryptocurrency market capitalisation slumped to $2.82 trillion, a level last seen in April, but has recovered slightly to $2.96 trillion at the time of writing. This is still over $1.2 trillion lower in just 6 weeks.

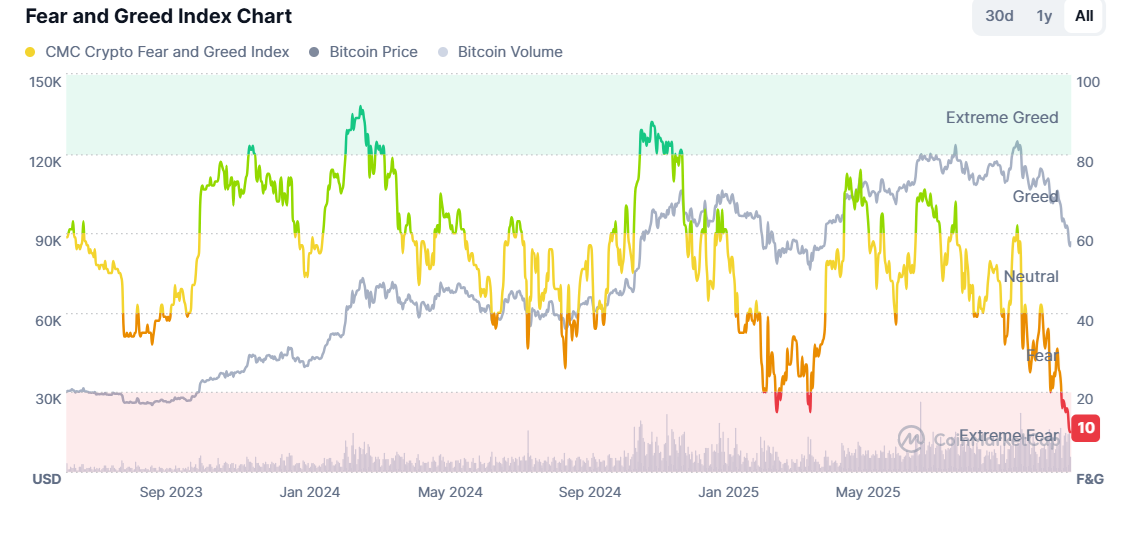

Sentiment analysis showed that the mood towards crypto remains dire at 13 on the Fear and Greed Index, up from 10 last week, according to the Alternative.me index, but down to a record low, according to the CoinMarket Cap Index. Based on historical patterns, extreme fear readings have previously coincided with buying opportunities as markets reached turning points.

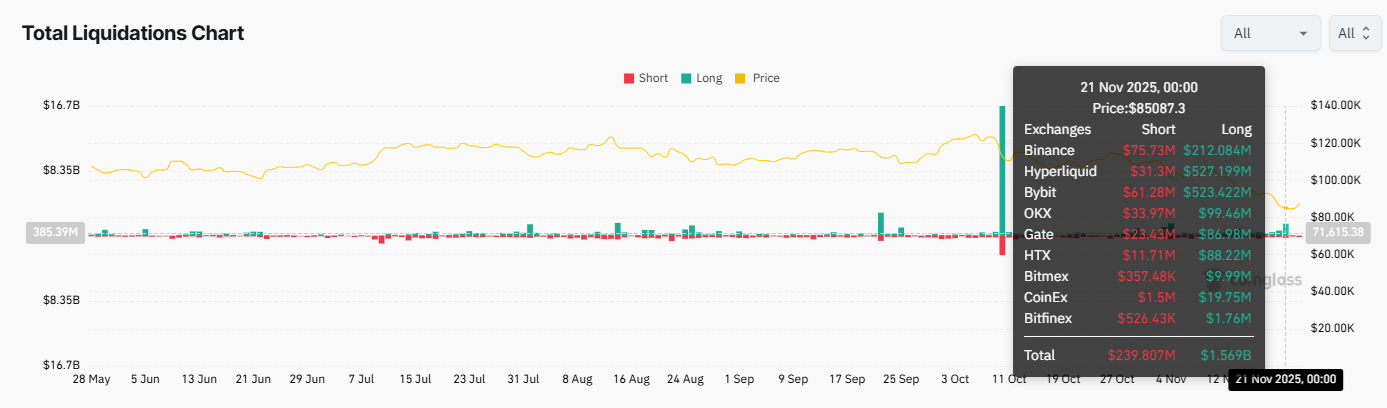

Liquidations surge as BTC falls to 80.5k

Cryptocurrency liquidations faced another massive washout on Friday, with almost $2 billion in leveraged positions liquidated as Bitcoin fell to 80.5k. Coinglass data showed that $1.57 billion of those positions were longs, while $239 billion were shorts.

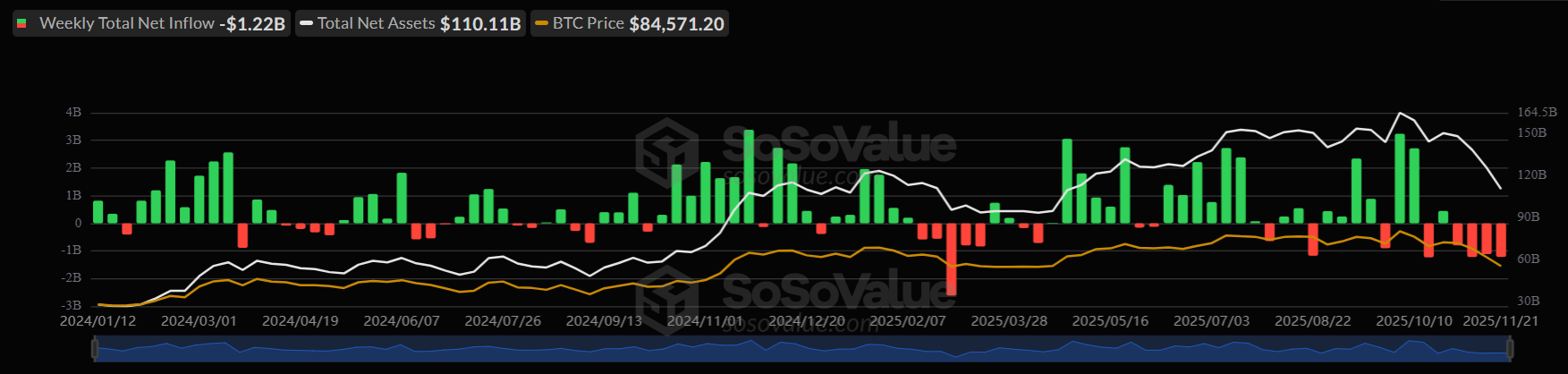

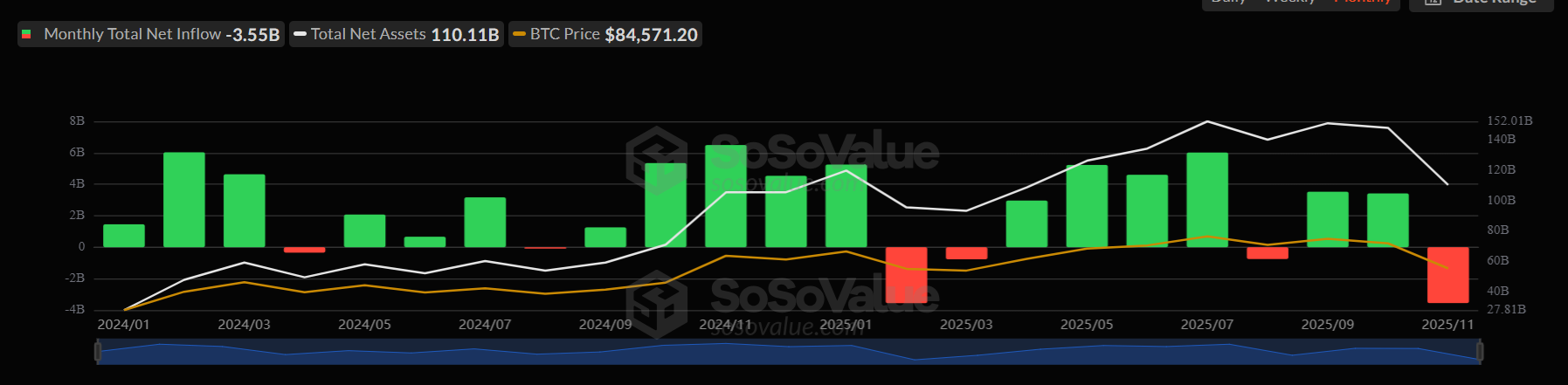

BTC ETFs post $3.55 billion in November

Spot BTC ETF shed nearly $1.2 billion in Assets last week, the third-highest total in the fund’s 22-month history, despite gaining ground on Friday. Bitcoin ETF added $238 million in investments on Friday. Last week was the fourth straight week of outflows.

November has seen $3.55 billion in net outflows, roughly the same as the previous all-time high set in February. This month, outflows are rare for the products that have been dramatically successful. However, as Bitcoin ETFs helped accelerate Bitcoin’s rise to record highs. ETF outflows have also accelerated the downside. Persistent outflows could pull BTC lower.

Macro backdrop

Bitcoin fell sharply last week as the market continued to fret over stretched valuations in tech stocks, worries over speculative hype around AI, and uncertainty about the Federal Reserve’s next move.

Not even impressive earnings and an outlook from Nvidia were able to stem the sell-off in tech stocks, as investors worry about circular investing, elevated AI spending, and the monetisation of AI bubble fears. Nvidia fell 6% last week, while the tech-heavy NASDAQ fell 2.7% last week. The Bitcoin 30-day correlation with the Nasdaq has reached its highest level in months, suggesting a tighter link. While this means that if tech stocks fall further, Bitcoin could decline more. On the flip side, any positive momentum in tech could buoy crypto assets.

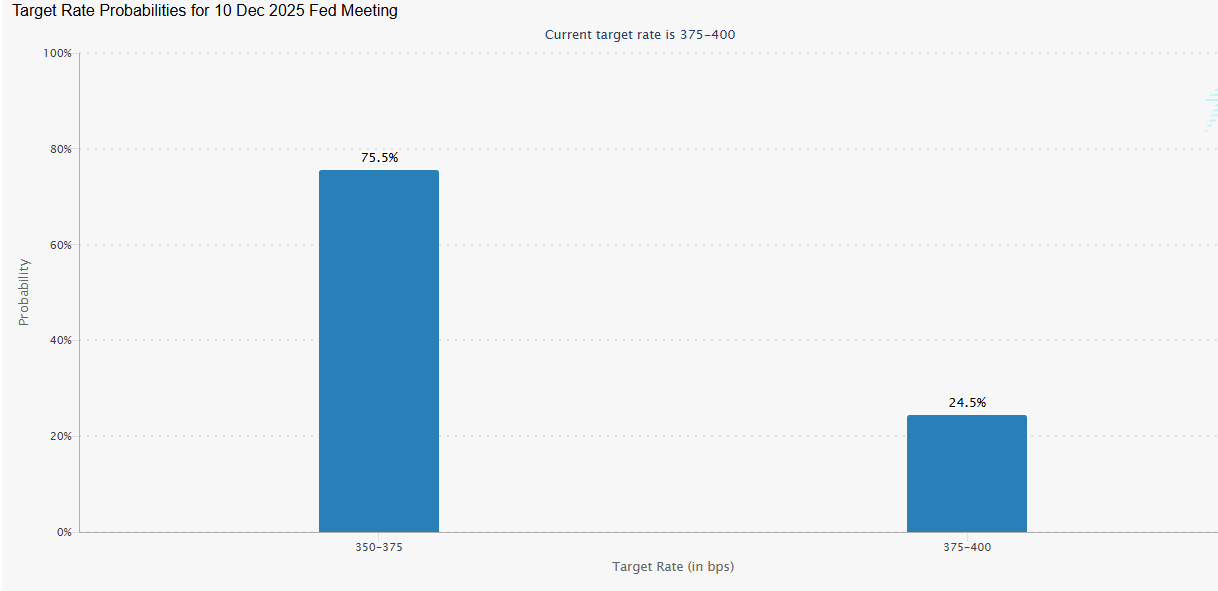

Fed rate cut expectations drop & rebound

Uncertainty surrounding the Fed’s next move has also weighed on the market. This week, the Fed minutes showed a more hawkish tone, which, combined with mixed September non-farm payrolls (+119k headline job creation but a rise in unemployment to 4.4%, the highest level since the pandemic), led to December Fed rate cut expectations dropping to just 27%.

However, dovish comments from New York Fed President John Williams, who said interest rates could fall further in the near term, boosted bets on a Fed rate cut to over 75%. This helped halt the selloff in stocks and crypto and spur a rebound. Investors will be watching to see whether this is a dead-cat bounce or a sign of more wind in its sails. The US economic calendar picks up slightly this week, but key CPI data won’t be released until after the December FOMC meeting.

While the Fed outlook remains uncertain, what is clear is just how focused the markets are on the Fed’s December meeting.

On-chain data – any sign of a bottom?

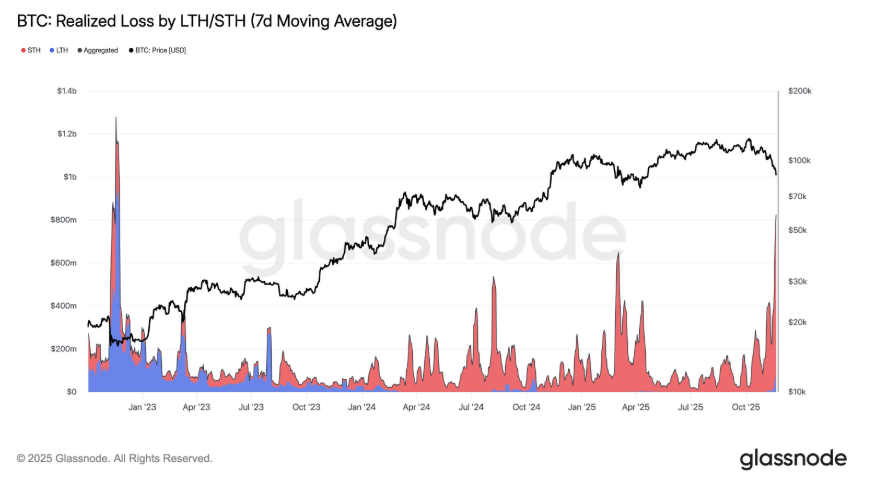

Realised losses among Bitcoin holders of such levels have not been seen since the FTX collapse. Short-term holders are driving most of this capitulation, reflecting panic selling from those who accumulated near the record high. The scale and speed of these signals indicate that marginal demand has been fully exhausted. This type of aggressive deleveraging historically marks the final phase of a downturn when short-term holders unwind en masse, long-term holders typically step in, and accumulation zones begin to form. This usually aligns with classic bottoming behaviour, which can precede a recovery.

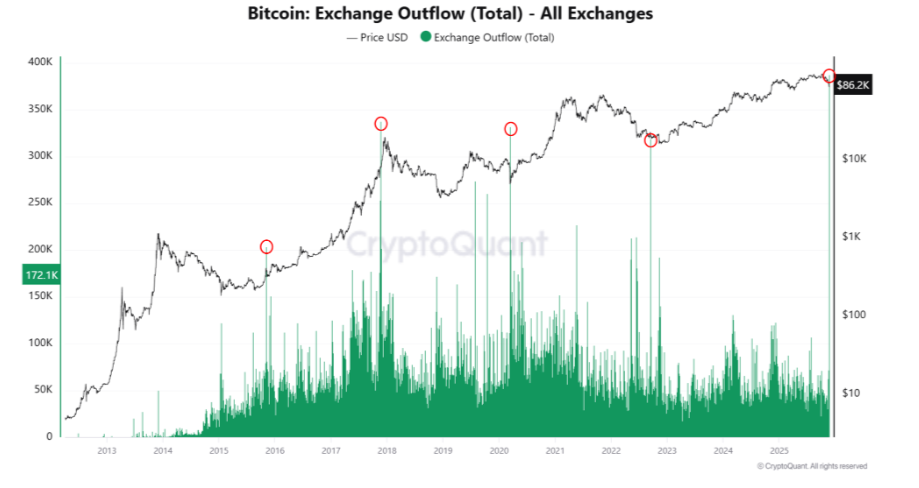

BTC outflows from exchanges

On 22 November, according to CryptoQuant data, BTC outflows from exchanges were the largest on record and the first since the cycle’s potential bottoming. In general, BTC outflows are a sign of accumulation and could point to the start of a new trend.

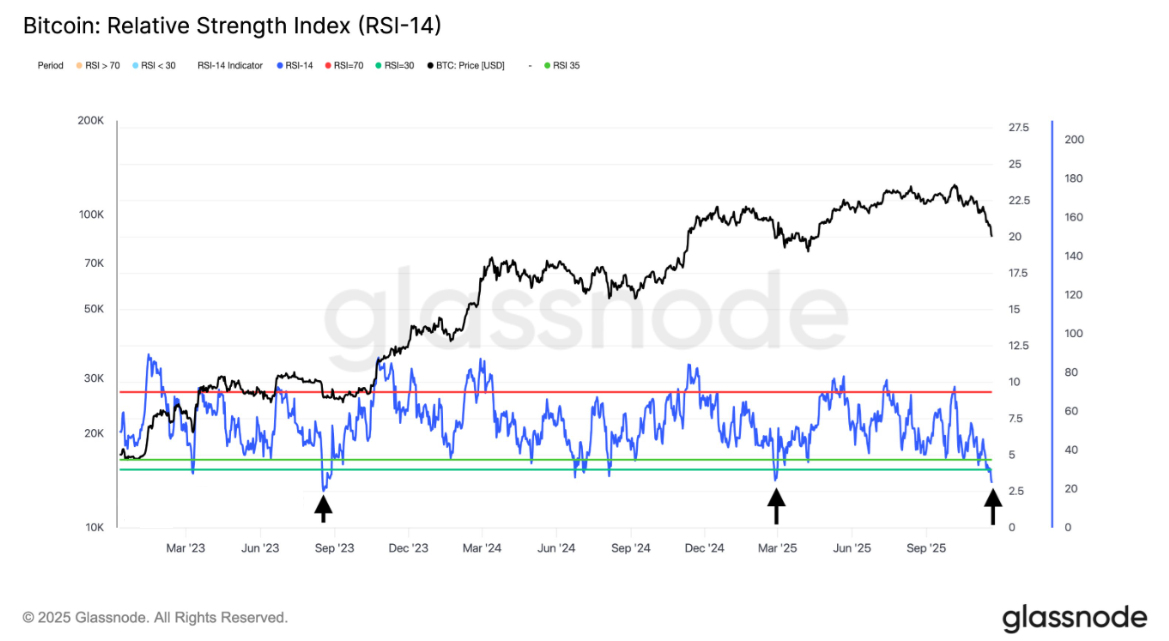

Technically, the chart also points to a possible bottom following the formation of a hammer candlestick pattern on Friday, which, combined with the oversold RSI, could signal a bullish reversal. In the past two cases, BTC bounced soon after entering oversold territory.

BTC/USD has also formed a “death cross” signal on the daily chart. This is where the 50 SMA crosses below the 200 SMA. This is typically a bearish signal. However, with Bitcoin, the indicator typically proves to be a lagging setup. For example, in September 2023, a death cross formed after a 17% decline and was followed by a 30% rise the following month. Similarly, in January 2022, the death cross occurred after a 40% drop but preceded a 15% rise.

However, it is worth noting that in February 2022, the death cross preceded a 13% bounce before a 64% decline, which is a reason to be cautious.

Conflicting signals, as MVRV suggests, there could be further downside

However, calling the bottom is challenging, as there are conflicting signals, suggesting the recent drawdown is a mere correction with a local bottom coming in the coming weeks.

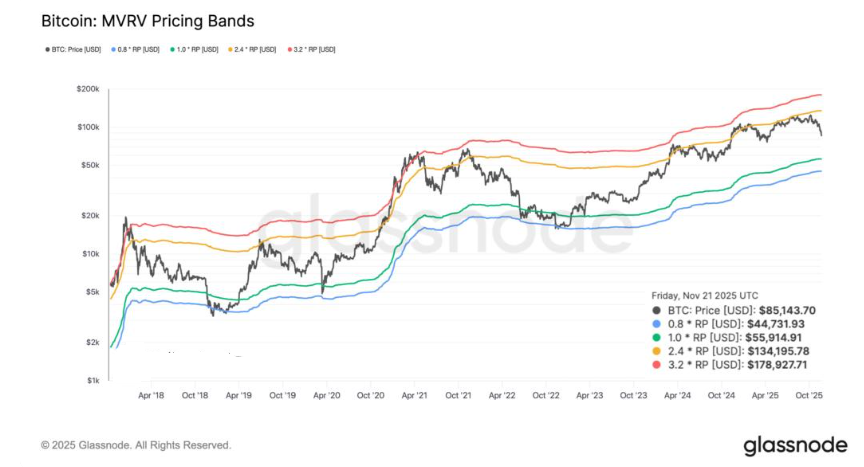

Using the MVRV Pricing Bands, derived from the Market Value to Realized Value (MVRV) ratio, indicate whether a cryptocurrency is likely overvalued, undervalued, or fairly valued relative to the average price investors paid.

Historically, the price has established bottom points when it has dipped below the 1.0x Realised Price (RP) and 0.8x RP – the blue and green lines as seen in October 2018, April 2020, and November 2022.

Using this metric, BTC could fall to $55k or $44k before launching another bullish wave.

Strategy index exclusion risks, but no forced BTC selling expected

MSCI has opened a consultation on a possible change to the rules for targeting companies whose balance sheets are dominated by Bitcoin. A final decision is due on 15 January. This puts MSTR directly in the danger zone.

Strategy is down nearly 70% to $ 177, to levels last seen in Q4 of 2024. MSTR has lost around 40% in the last month alone and is down 68% from its all-time high.

The company currently holds 649,870 Bitcoin with a leverage cost of $74,433 per coin. This means that if Bitcoin drops a further 8% off the 80k level, the company’s position would move fully into the red.

While this will likely add further pressure to the share price, it is unlikely to result in forced BTC sales by MSTR. Most of MicroStrategy’s $8 billion in debt is in convertible notes that don’t mature until 2027 through to 2032.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.