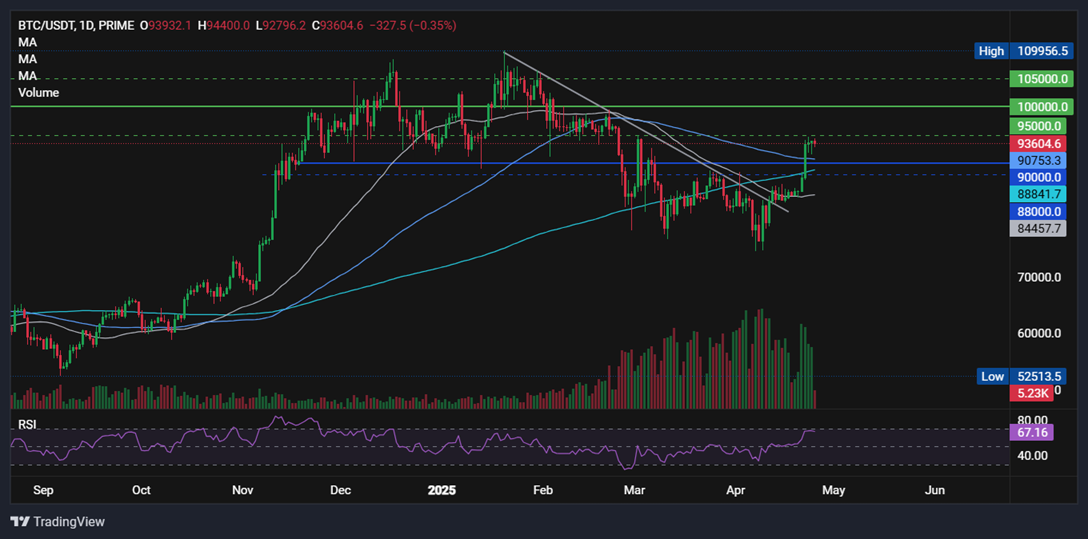

Bitcoin is holding steady on Friday, as bulls pause just below 94k after six days of gains. The world’s largest cryptocurrency is up 10% this week, marking its strongest weekly rise since mid-January, just prior to President Trump’s inauguration.

Bitcoin wasn’t alone in booking strong gains this week. Cryptocurrencies across the board have risen, with the total crypto market capitalisation reaching $2.9 trillion, up over 9% over the week.

US equities are also set for a positive week amid hopes of a US- China trade deal despite China denying any recent discussions. However, reports are circulating that China is considering exempting some goods from its 125% tariffs on US imports. The tech-heavy US Nasdaq booked gains of 2.74% on Thursday, its third straight daily gain, and is on track to rise 5.4% this week. However, the USD is also set to rise this week, snapping a 4-week losing run, while safe havens like Gold are on track to fall after reaching a record high of $3500 earlier in the week.

The improving market mood, combined with a surge in Bitcoin ETFs and whale demand, could help BTC rise towards 100k sooner rather than later.

Bitcoin ETFs experienced huge inflows this week as institutional demand returned with a vengeance. By Tuesday, BTC ETFs had seen $2.68 billion in net inflows, marking the largest weekly inflows since early December. ETFs have consumed nearly 25,000 BTC in just three days.

21 Capital to rival Strategy

Corporate newsflow is adding to upbeat sentiment after three major companies—Tether, SoftBank, and Cantor Fitzgerald—unite to launch a Bitcoin accumulation company called 21 Capital. The company, which will have a new CEO, Jack Mallers, as chief executive, could rival Strategy.

21 Capital will launch with 42,000 bitcoins in assets, making it the second-largest public Bitcoin holder after Strategy. SoftBank will provide a $900 million investment, and Tether will contribute around $1.5 billion to the corporate treasury.

This could be considered a validation of MSTR’s bitcoin strategy model and a bullish signal. The move would also increase demand for Bitcoin from high-profile entrants.

XRP rises with SEC & ETF optimism in focus

As Paul Atkins assumed his role as Securities and Exchange Commission (SEC) Chair this month, optimism is growing surrounding a potential SEC vote to withdraw its appeal in the Ripple case.

Optimism about a favourable legal conclusion is also boosting interest in XRP. Active addresses are on the rise, jumping by 67.5% between April 19 and 20, which was just ahead of Coinbase’s launch of XRP derivatives products. These are typically considered a stepping stone towards spot ETFs. According to Polymarket, the odds of an XRP-Spot ETF approval by the end of the year rose to 72%.

XRP technical analysis and levels to watch

XRPUSD is attempting to break out of its multi-month falling channel. The price holds above its 200 SMA and it is testing the 50 SMA resistance. A rise above here and 2.29 the 387.25 fib retracement level 2.50 into play ahead of 3.00.

Immediate support is seen at the 200 SMA and the falling trendline at 1.98.

*Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.