Bitcoin has extended its recovery from Monday’s 97.750 low, pushing above 106k, despite the Federal Reserve leaving interest rates on hold. Altcoins across the board are moving higher, with Litecoin being a notable outperformer.

In the FOMC meeting on Wednesday, the Federal Reserve left interest rates on hold at 4.25% to 4.5% in line with expectations but adopted a slightly more hawkish tone. The central bank noted strong growth and a resilient labour market but also acknowledged a lack of progress in bringing inflation back to the 2% target. Federal Reserve chair Jerome Powell signaled the central bank was in no rush to continue cutting interest rates until the data deemed it necessary.

The Fed pointed to uncertainty surrounding the outlook for interest rates due to ongoing policy changes in the US. The prospect of the Fed pausing rate cuts could signal a bearish bias for Bitcoin and other risk assets.

Meanwhile, BTC ETF inflows were weak for the second straight day amid yesterday’s Fed’s rate decision. Spot Bitcoin ETFs recorded $92.09 million in inflows on January 29, a second straight day of sluggish demand. BTC ETFs saw just $18 billion in inflows on January 28th.

However, it’s also worth noting that, according to Santiment data, the number of Bitcoin wallets holding between 100 and 1000 BTC reached 15,777, a new all-time high and a sign of sustained confidence among mid-sized whale investors.

Meanwhile, US economic data today was more of a mixed bag. While US Q4 GDP was weaker than forecast at 2.3% annualised, below the 2.6% forecast. Jobless claims fell to 207k from 223k

Still, while the macroeconomic backdrop is nothing to cheer about, the broader crypto landscape is seeing encouraging developments, particularly since Trump returned to the White House. Washington has seen a flurry of crypto developments, from President Trump’s executive orders to the SEC’s crypto task force.

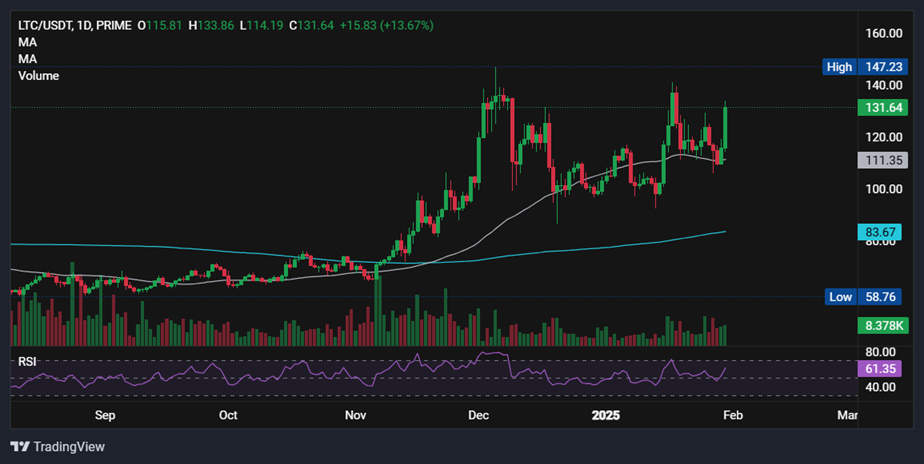

Litecoin soars on ETF optimism

Outside the major coins, Litecoin has surged over 13% as the US Securities and Exchange Commission officially acknowledged Canary Capital’s 19 b-4 filing for a spot Litecoin ETF.

According to Polymarket, a decentralized prediction market, there is now an 87% probability that the SEC will approve Litecoin based ETFs this year.

There is now a period for public comment, following which the SEC has up to 45 days to issue a decision. If necessary, it can extend this time to 90 days. It could also take a full 240 days to review.

Previously, SEC chair Gary Gensler delayed crypto ETF approvals, pushing decisions to the final deadline. However, since his departure, the regulatory environment has changed, and acting chair Mark Uyeda has been more open to crypto-related products, encouraging a slew of ETF applications.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.