Bitcoin rose 7% last week, marking the fourth straight week of gains. BTC started the week at 97.7k before rising to an all-time high of 99.6k on Friday and slipping across the weekend. The largest cryptocurrency trades +1.5% on Monday at 98.3k.

Positivity was seen across the crypto space last week, with Ether and Solana both rising over 7%, while XRP was a standout performer, jumping 33%. Stellar Lumens (XLM) emerged as the top-performing cryptocurrency, up 178%. However, there were some outliers, with Sui falling 13%, Popcat facing significant selling pressure, dropping over 18%, and Dogwifhat booking a 14% decline over the past seven days.

Macro backdrop

The crypto space received a boost from news that SEC Chair Gary Gensler would be stepping down on January 20th next year. This helped Bitcoin push higher, and XRP outperformed. Gensler has led a crackdown on the crypto industry over the past few years, which resulted in the SEC filing suits against Coinbase and Ripple over the nature of cryptocurrencies as securities.

The listing of options on US spot Bitcoin ETFs also boosted the market.

Options on spot Bitcoin ETFs

Options on spot Bitcoin ETFs began trading on Tuesday on BlackRock’s’ Bitcoin Trust IBIT, and then options for another five spot Bitcoin ETFs started on Wednesday. According to data from Bloomberg, Wednesday’s spot BTC options turnover centered heavily on IBIT, which accounted for around 96% of listed spot Bitcoin options volumes. This is most likely linked to the fact it’s the largest spot Bitcoin ETF with more than double the assets of the second largest Grayscale Bitcoin trust.

The listing of options on Bitcoin ETFs represents the first US-regulated access to options on spot Bitcoin products, which will likely be transformative for the space in the long term. Options bring various benefits, including enhanced risk management and more cost-effective exposure, opening the door to investors who may not otherwise get involved.

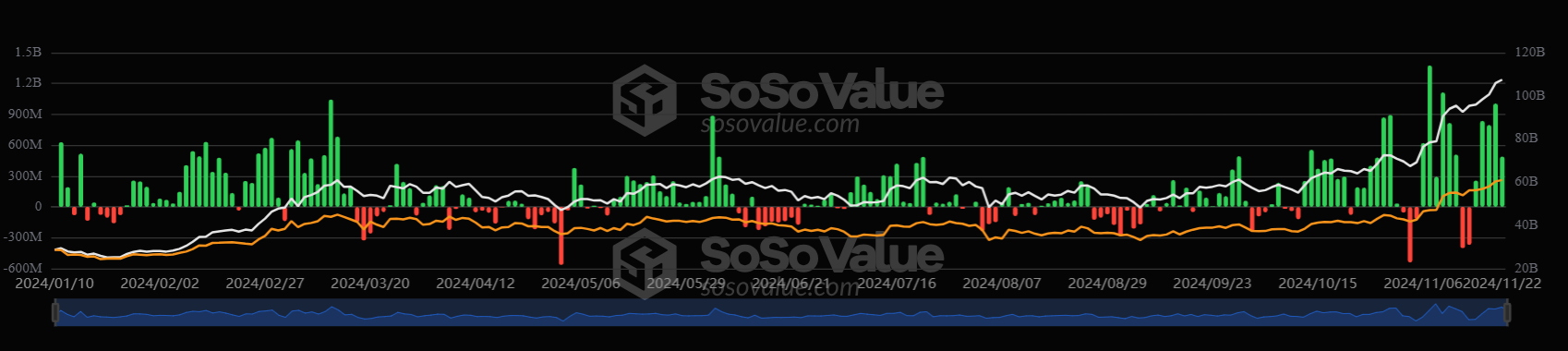

BTC ETFs see a record weekly inflow

US spot Bitcoin ETFs experienced a very positive week, with net inflows of $3.38 billion, a record weekly inflow, and the seventh straight week of inflows.

Breaking this down on a daily basis, spot Bitcoin ETFs saw inflows every day last week, including $1 billion worth of inflows on Thursday.

Unsurprisingly, BlackRock’s IBIT, the world’s largest Bitcoin ETF, saw the largest inflows most days, tracking $500 million of inflows on Wednesday, Thursday, and Friday.

Corporate inflows

A slew of announcements from corporate buyers has also boosted Bitcoin. MicroStrategy acquired 51,780K BTC, which is equivalent to $4.6 billion. Meanwhile, MARA Holdings completed a $1 billion offering of convertible notes used to acquire Bitcoin. Other companies, such as Metaplanet and Semler Scientific, have also recently announced Bitcoin acquisitions, with more companies planning to follow suit. Corporate inflows will likely represent an increasingly important source of capital inflows.

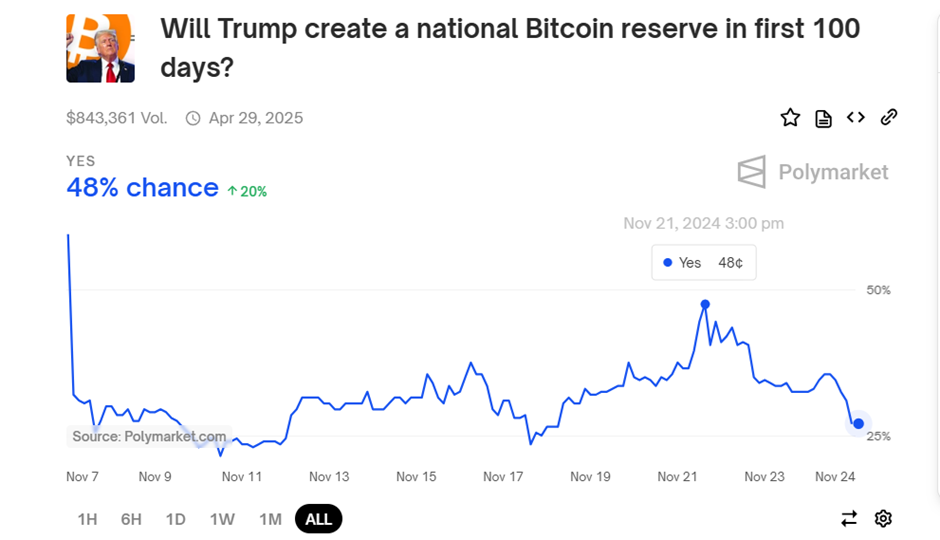

Bitcoin Strategic Reserve bets rise

Rising expectations of the creation of Strategic Bitcoin Reserves have also supported Bitcoin. Poly market positioning priced in the odds of strategic Bitcoin reserves being created within Trump’s first 100 days in office, peaking at 48% on Thursday, up from a low of 22% on November 17th.

The rise in the odds came shortly after the introduction of the Pennsylvanian Bitcoin Strategic Reserve Act, which allows the state treasurer to invest up to 10% of certain funds in Bitcoin. According to the state’s 2023 treasury annual investment report, these funds in question manage around $51 billion in assets combined, so an allocation of 10% would estimate a $5.1 billion investment in Bitcoin.

Other fundamental drivers have also boosted Bitcoin, including China’s legalization of crypto ownership and Bitwise filing for SOL ETFs.

Can Bitcoin push past $100k?

As Bitcoin flirts with $100k, the big question surrounding the current rally is whether it can continue and surpass $100k. A couple of warning signs suggest that a local top could be in at least in the short term.

The relative strength index is over 70 in overbought territory. Historically, RSI levels above 70 proceed short-term corrections as traders book profits.

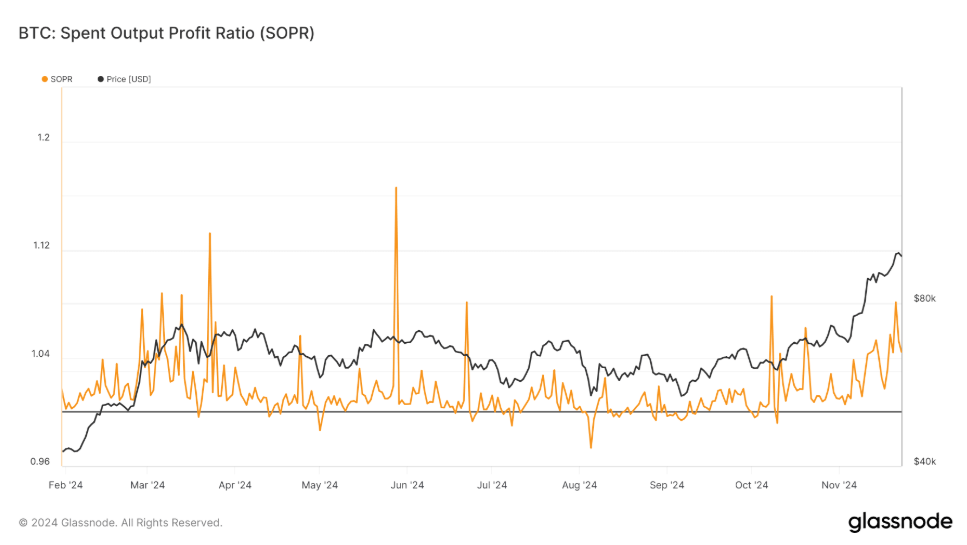

The Spent Output Profit Ratio paints a clearer picture of market behavior. The SOPR, which measures if the coins moved on the chain are profitable, has been rising alongside the price of Bitcoins. The SOPR value rose to 1.08 in the past week, indicating high levels of realized profit. Historically elevated SOPR levels often coincide with local tops as investors book profits following the bullish run. A sudden drop in the SOPR would signal increased selling pressures and could trigger a broader correction. At the time of writing, the Bitcoin SOPR was around 1.04.

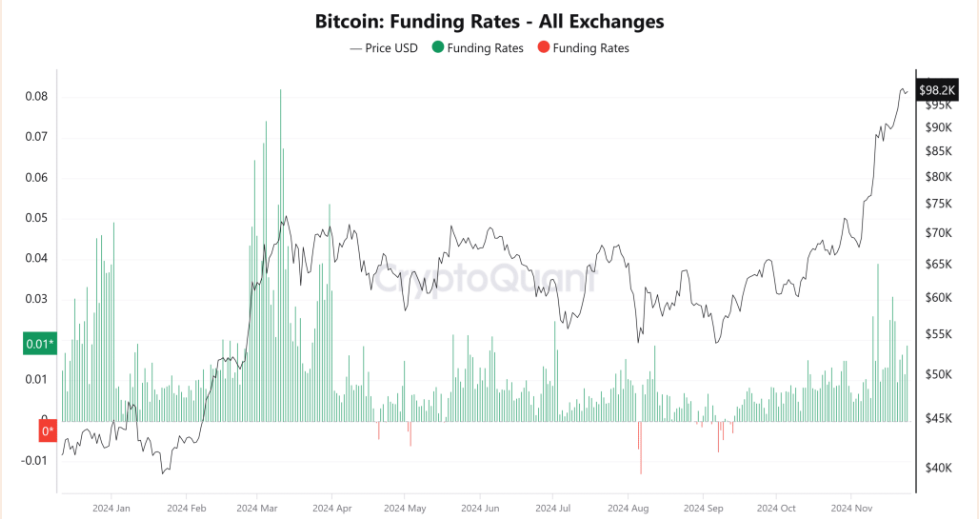

Bitcoin’s funding rate chart also showed a sharp increase across major exchanges, another red flag. Funding rates are positive when long positions dominate the market, and excessively high rates suggest over-leveraging. Funding rates are approaching levels last seen in the 2021 bull market peak, suggesting that speculative enthusiasm could be overheating.

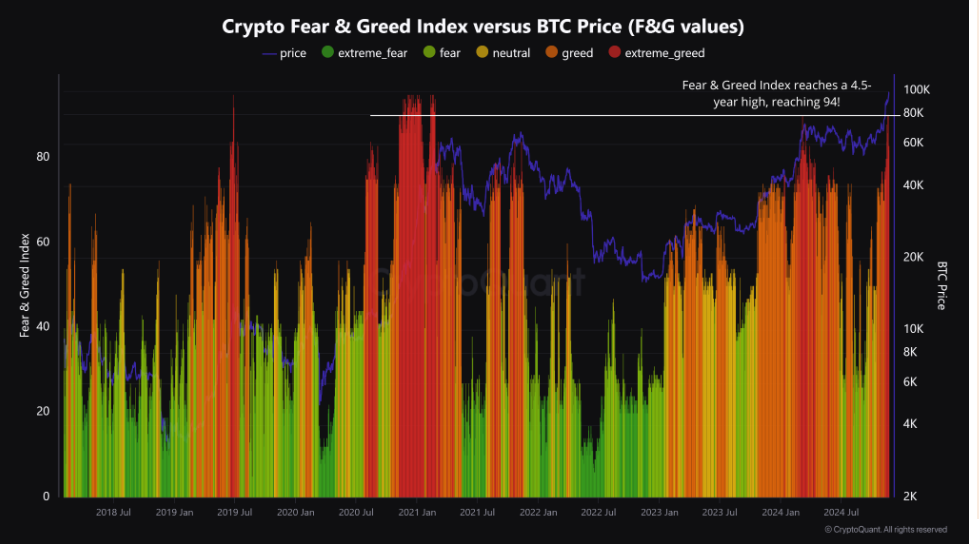

Bitcoin’s fear and greed index hit a 4.5-year high of 94, mirroring the trend that was seen in 2020. The extreme greed level of 94 was hit in November 2020. The extreme levels of greed in the market hint at a pullback in the coming week, especially if momentum rolls over.

While there are reasons to believe that Bitcoin could see a pullback in the near term, the fundamental picture remains positive for gains to continue towards the end of the year.

Bitcoin whales stay determined

Between optimism surrounding a crypto-friendly trump administration, strong institutional inflows, and a spike in activity among Bitcoin whales, Bitcoin still has the potential to rise above 100k.

Last week saw a spike in activity among Bitcoin whales, with on-chain data pointing to the whales accumulating over 40,000 BTC in just 96 hours. This move coincided with Bitcoin reaching its all-time high, adding momentum to the narrative.

Strong Bitcoin activity typically reduces the available supply of Bitcoin on the open market, which keeps pushing the Bitcoin price higher.

Week Ahead

As the new week kicks off and 100,000 remains in focus, the market is digesting Trump’s nominated pick for Treasury Secretary – Scott Bessent. Bessent, who founded hedge fund Key Square Capital, has previously shown enthusiasm over Trump’s support for crypto in an interview back in July.

Bessent is considered a more moderate candidate and is expected to help push through tax reforms and a less strict crackdown on trade, which could be a supportive environment for riskier assets such as Bitcoin.

Fed minutes & core PCE

the release of fed minutes and core PCE, the fed’s preferred gauge for inflation, could see the market swing its attention back towards the economic calendar, at least for a short while. The minutes from the meeting where the Fed cut interest rates by 25 basis points and could provide further clues over the outlook for Fed rate cuts.

Meanwhile, core PCE is expected to take higher to 2.8% annually, up from 2.7%. Hot inflation could fuel bets that the Federal Reserve or cut interest rates at a slower pace across 2025. The market is currently pricing in a 56% probability of a 25 basis point rate cut in December, down from 75% just a month ago.

A lower interest rate environment is typically more beneficial for risk assets such as Bitcoin. However, more recently, the Trump narrative has overshadowed concerns over slower interest rate cuts and a stronger U.S. dollar, which is trading at a 2024 high.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.