Ever since Bitcoin managed to break out of its range at the lower end of the $9,000 mark it has been on a strong and seemingly steady rally. The coin has come to the forefront of the cryptocurrency space and stolen the attention away from an altcoin season that seemed to be brewing.

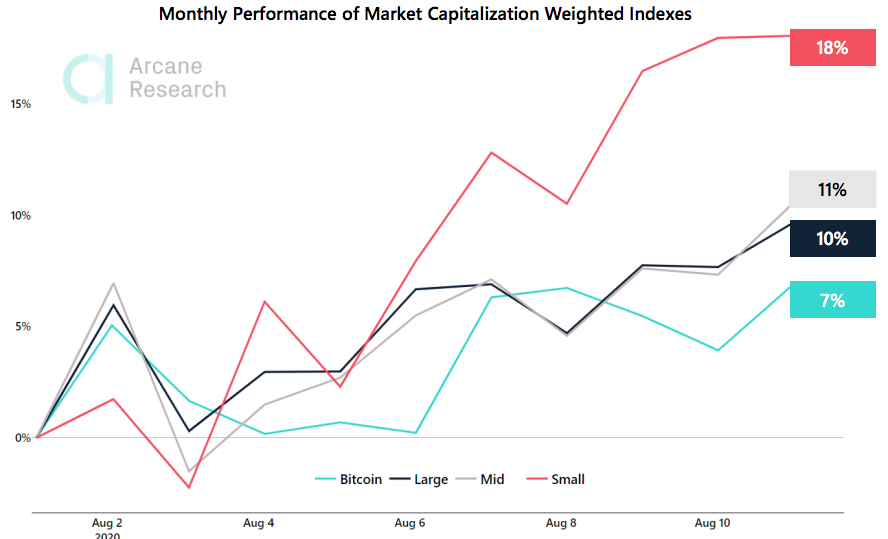

That being said, the altcoin drive has eased off more than dies away and there is still good sentiment for some of the bigger altcoins that are riding on the coattails of Bitcoin. But, as of to prove that there is still a lot of action for other coins, even the smaller capped ones, the best performing index thus far in the month has been the small capped coins by some distance.

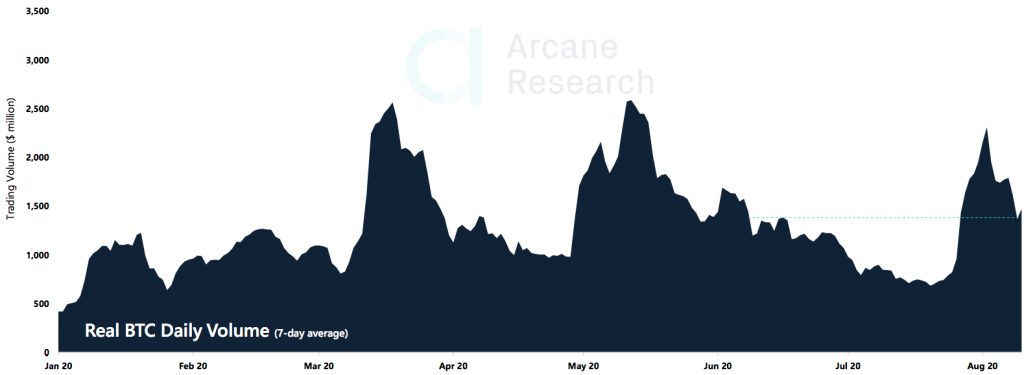

Altcoin may also be coming back into focus as the volume for Bitcoin trading has dropped off significantly having spiked with the price and indicated a powerful rally. The dropping in volume may be another sign that altcoins are coming back into focus.

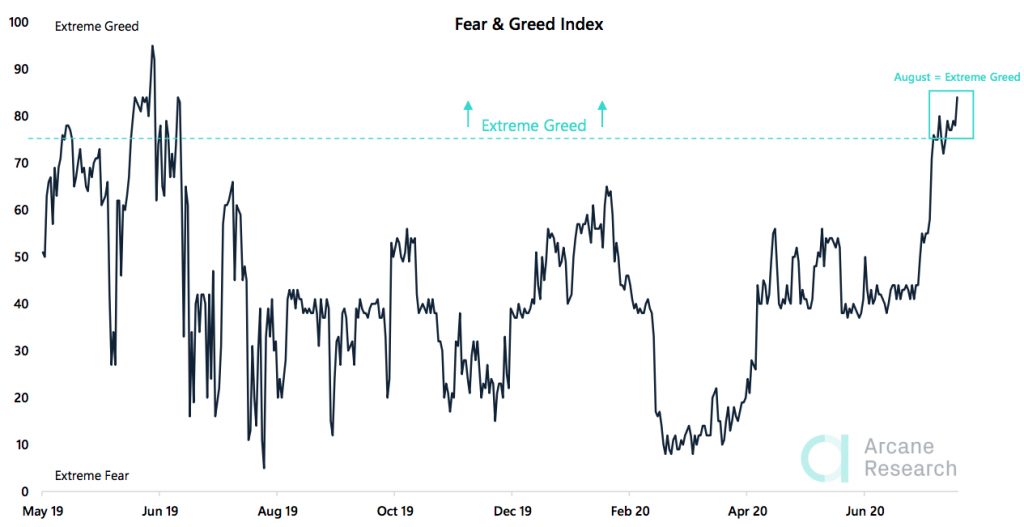

All of this Bitcoin action — which has seen the coin touch the reaches of $12,000 recently — has pushed the market dramatically into extreme greed. During the $9,000 range binding, Bitcoin’s market showed signs of fear, or neutrality, but that has changed.

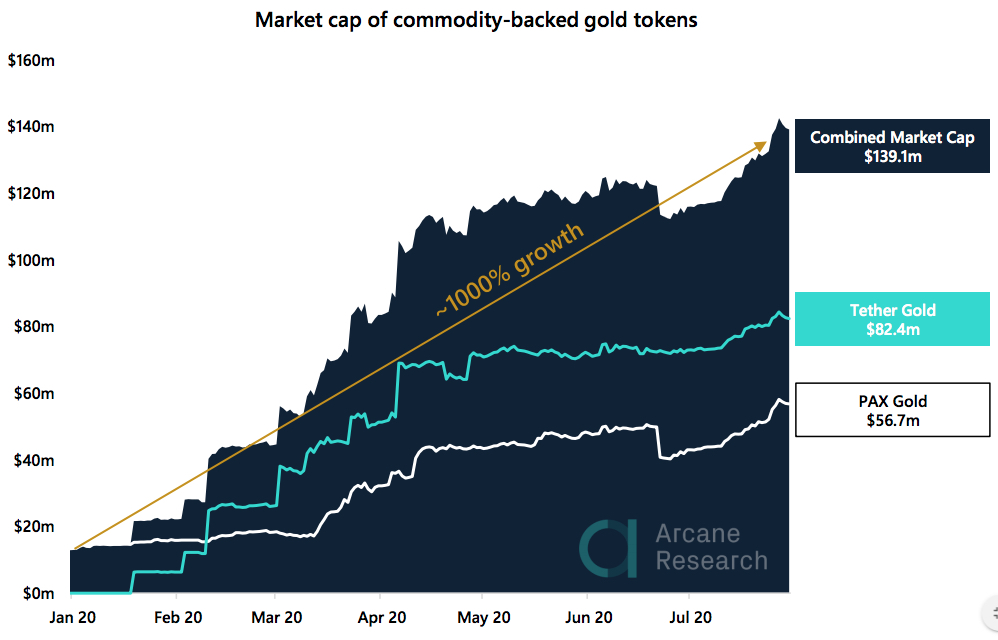

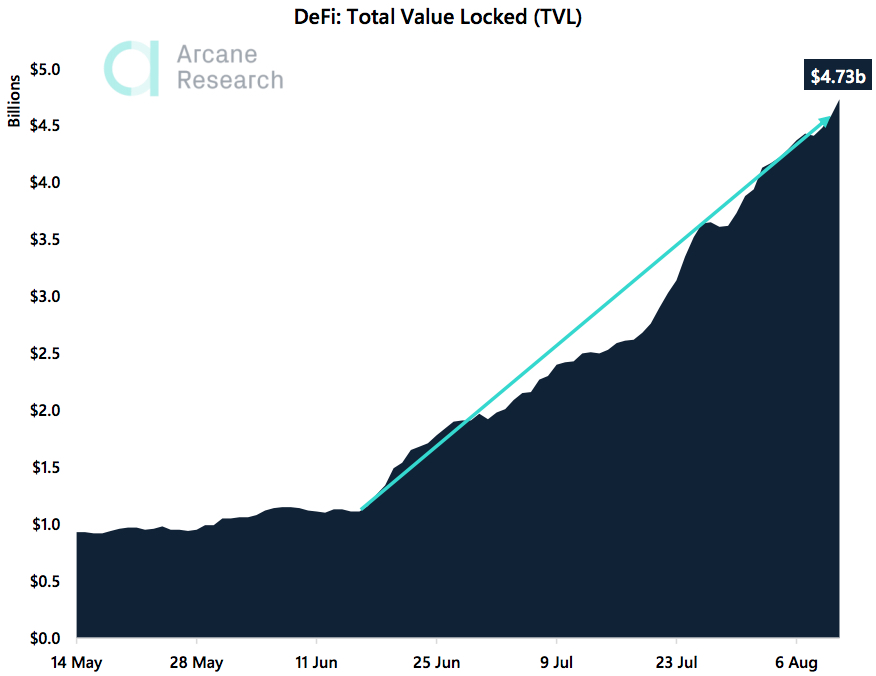

In more niche crypto markets, the market cap of commodity-backed gold tokens has surpassed the $100 million mark while the total value locked in the burgeoning DeFi space has now approached $5 billion after an incredible rally since the start of June.

Stablecoin balances are also rising on exchanges having peaked at the height of the March market collapse. The balances on exchanges dropped significantly from that high, but it looks to be growing again.

Bitcoin Still Breaking Up, Sparking Crypto Market FOMO

Having made it across the $12,000 mark twice since last Sunday, there seems to still be a lot of life left in the current Bitcoin rally that took the coin from around $9,000 to this new mark in a matter of weeks.

It was a long time coming as Bitcoin struggled in a tight range under $10,000 but quickly broke the five-digit market only to smash through the $11,000 position too. Bitcoin has fallen back just under $12,000 at time of writing, but looks to still have life left in it.

This has however caused problems with the growth of the altcoin market which was taking off in the wake of Bitcoin’s lack of action though June and July. Many major altcoins were rallying, and some of the smaller ones too were showing big jumps. This has been lessened, although the coins are still on the up.

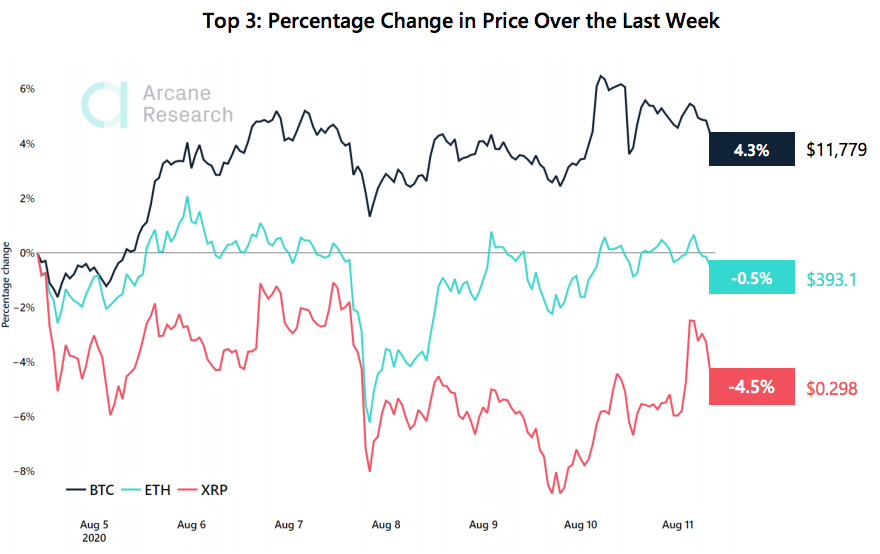

The likes of Ethereum and XRP managed to reap in gains of between 30-40 percent last week, but this week they are slightly in the red having lost half a percent in the case of Ethereum, and nearly five percent when it comes to XRP.

On the other hand, Bitcoin has made almost fiver percent in gains since August 5th, and even more interestingly, its correlation with gold is also much bigger at the moment. The correlation is now the highest since the market crash in March, when the correlation jumped as both assets dumped hard.

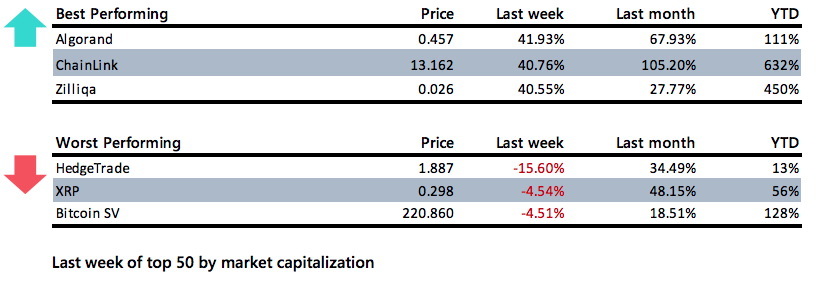

However, even though Bitcoin is pushing the boundaries for the cryptocurrency market, there are still some altcoins that are showing huge gains. For example, Chainlink is now the fifth most valuable cryptocurrency, not including stablecoin Tether, after it hit a new all-time high. Part of this has to do with the fact that many major DeFi names have integrated Chainlink’s oracles lately.

ChainLink has reached this new all-time high thanks to 40 percent gain this week, and an over 100 percent gain in the last month alone. In the year thus far, it has increased in value by over 600 percent.

While ChainLink and Zilliqa are probably not considered small caps, this index has had the best of the month so far even though it has seemingly been a month for Bitcoin in the last 11 days. The small cap coins are back in the lead having made 18 percent gains in just these last few days.

This is an already better performance than the month of July where they only managed 12 percent gains over the whole month. However, Large Caps and Mid Caps are continuing their strong performances from July and just surpassed 10% returns in August while Bitcoin is actually lagging behind, up only 7 percent.

Extreme Greed Reaches New Yearly Peak

August has been characterized by an extremely greedy market as the entire month, baring the first day, saw the Fear and Greed Index race into the extreme Greed category. The Fear and Greed Index is now at 84, after pushing above 80 for the first time in over a year.

The generally good market performance across altcoins first, and then Bitcoin following, has pushed this measure beyond its reach and made it exciting for traders and investors, and easy to get carried away.

However, extreme greed is also a dangerous metric as these periods usually don’t last long and they usually fall away to fear as the market corrects so it can be seen as a warning sign for what is to come next.

In fact, a look over the Bitcoin volume could be indicating that the rally may be slowing again as it has topped out and is falling back. The BTC daily trading volume has been dropping and is now back to levels last seen 9in early June when the coin was range-bound.

This may also be down to the altcoins that are still rallying beside Bitcoin, such as ChainLink, whose spot price was 70 percent higher than Bitcoin this weekend and was the most traded coin on the platform on Sunday.

However, there is a sign that volume is trying to bounce back for Bitcoin as indicated by a sharp and small upturn seen late on Monday.

Digital Gold On The Rise Following 2020 Gold Rush

This year there has been a surge in gold-backed digital tokens with both Paxos and Tether launching these tokens. These tokens have also done incredibly well and have seen massive growth as they surpass $100 million.

PAX Gold was the first regulated gold token, it launched back in September 2019. Each token was set to represent a fine troy ounce, held in a London vault.

Its biggest competition, The Tether Gold token, on the other hand, was launched this January and represents the ownership of one troy fine ounce of physical gold, held in a Swiss vault.

Tether Gold, even off the back of its own USDT success, saw its market cap quickly surpass the market cap of PAXGold and has maintained its position as market leader ever since. But a lot of this has to do with the rise in popularity of physical gold amidst the global uncertainty since COVID-induced fiscal stimulus was introduced, and the gold price

has soared from $1515 to above $2000 this year.

The strong returns in gold have led to increased demand for gold-backed tokens. The current market cap is at $139.1m, up 983% this year. The total Tether Gold supply is currently valued at $82.4 million, while the PAX Gold supply is valued at $56.7 million.

Additional Growth Across The Crypto Market: DeFi And Stablecoins

While gold-backed tokens are getting more popular, they do not hold a candle against the rise in DeFi in this past year so far. Part of the reason for the growth in this sector is the growth in yield farming that has pushed massive amounts of cash into the ecosystem.

Ever since Compound launched its governance token (COMP) in June, the ecosystem has been in a continuous uptrend, growing a staggering 326% since June 16th, from $1.1 billion to $4.7 billion

The DeFi lending market has seen the largest growth, accruing a total of $2.9 billion in TVL with Maker accounting for $1.5 billion of the value.

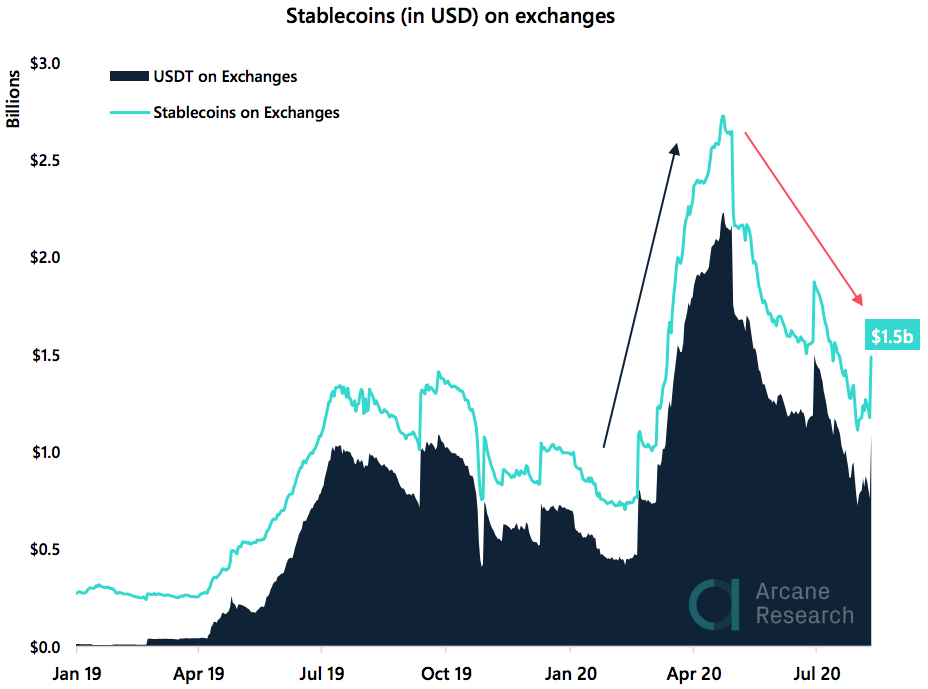

Stablecoins are also an interesting arena worth looking into as they too are on the rise having fallen back from a massive surge in the Mid-March market crash. The Bitcoin collapse highlighted the value of stable value and saw over $2.5 billion in stablecoins on exchanges.

This figure dropped through June and July, but it looks to be back on the rise. An increase in the stablecoin balance on exchanges could possibly indicate that the demand for stablecoins is increasing as traders are eager to realize profits.

The current total stablecoin balance is at $1.5 billion with USDT accounting for 73% of the total stablecoin balance on the exchanges.

In the News

Bitcoin Investing Institutions Show Up On SEC Paperwork

A list of at least 20 major institutions filed paperwork with the SEC last quarter which showed that they had invested in the popular Grayscale Bitcoin Trust(GBTC), which allows institutional investors to get involved in BTC.

Facebook’s Cryptocurrency Competitor Novi (Formerly Calibra) Looking To Regulators

The Office of the Comptroller of the Currency (OCC) closed its comment period for proposed rules on ‘National Bank and Federal Savings Association Digital Activities’, but of the 90 responses it received, one of them was from a company called Novi, clearly looking to court the regulators.

Russia No Longer Eyeing A Total Cryptocurrency Ban

A new bill signed in Russia has seen the total ban of cryptocurrencies put off and saved the country from blanketing its regulations in an anti-Bitcoin bias. However, there are still stringent controls on cryptocurrencies being used like money.

Information provided in PrimeXBT’s market report includes data provided by Arcane Research, in addition to other internal market research.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.