This is, of course, a substantial change for the mining ecosystem which has to now deal with a lot less profitability, but the greater impact on the market is still to be seen. The movement before the halving was bullish and positive, and now, following the event, the momentum is still bullish — but the volatility is back.

Bitcoin managed to cross $10,000 before the halving, and while it has not seen that level again, it has dropped to the lower reaches of $8,000 but also managed to get back close to $10,000.

It also looks like the halving is pushing the designation of Bitcoin more towards being an asset and less of a currency, and this move is actually helping the coin decouple from other assets, notably stocks, as the narrative that Bitcoin is a hedge against the currency market conditions gains more momentum.

There is also a new record set for 2020 in regard to trading volume, which is also often seen as a positive metric for bullish tendencies. To add to this, there is also good news coming from the futures market. There are signs of fewer leveraged positions, which indicates that the market is less vulnerable to violent liquidation loops like those seen in March.

In regards to the miner movements post the halving, there has not been a massive capitulation as was seen from the Bitcoin forks — Bitcoin Cash and Bitcoin SV — earlier this year. But these two forks have benefited from being more profitable and have attracted some of the miners who left Bitcoin to boost their own hashrate.

DeFi is another area that has benefited as there has been a spike in the BTC locked into this application which most probably related to Maker accepting WBTC as collateral now, leading to clever solutions from market participants.

Bitcoin Drops Slightly After Halving

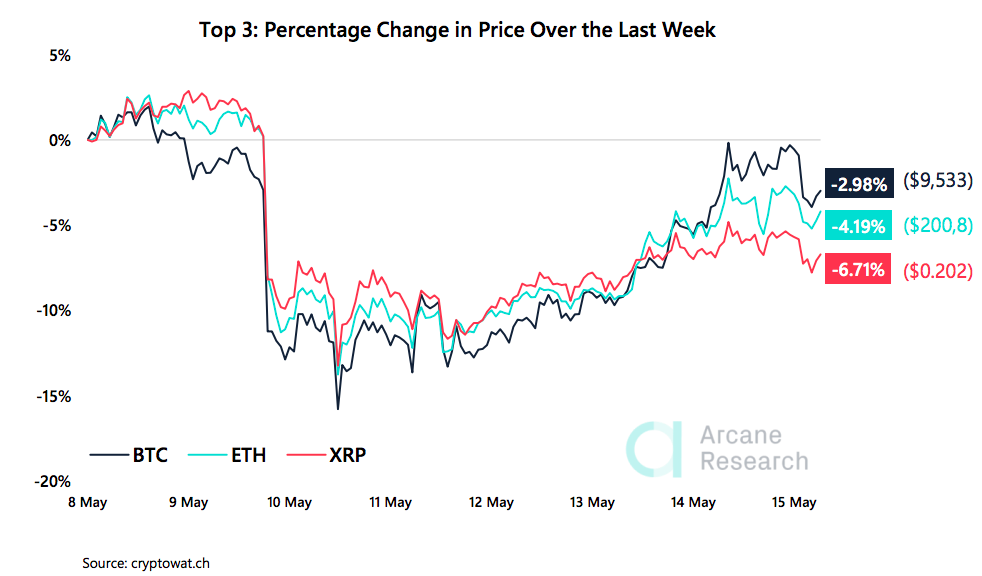

The general cryptocurrency market, and of course the Bitcoin market, has seen an impact from the halving, but the overall loss from Tuesday’s event saw Bitcoin close the week only 2 percent down. There was however a strong bit of volatility as the price dropped off, and slowly climbed back up after the halving.

However, the dump that came about closest to the halving actually came on the weekend before the halving. Looking closely at the chart for the top three coins, it is hard to pin the actual event as the notable fall was part of the speculative sell off before the halving.

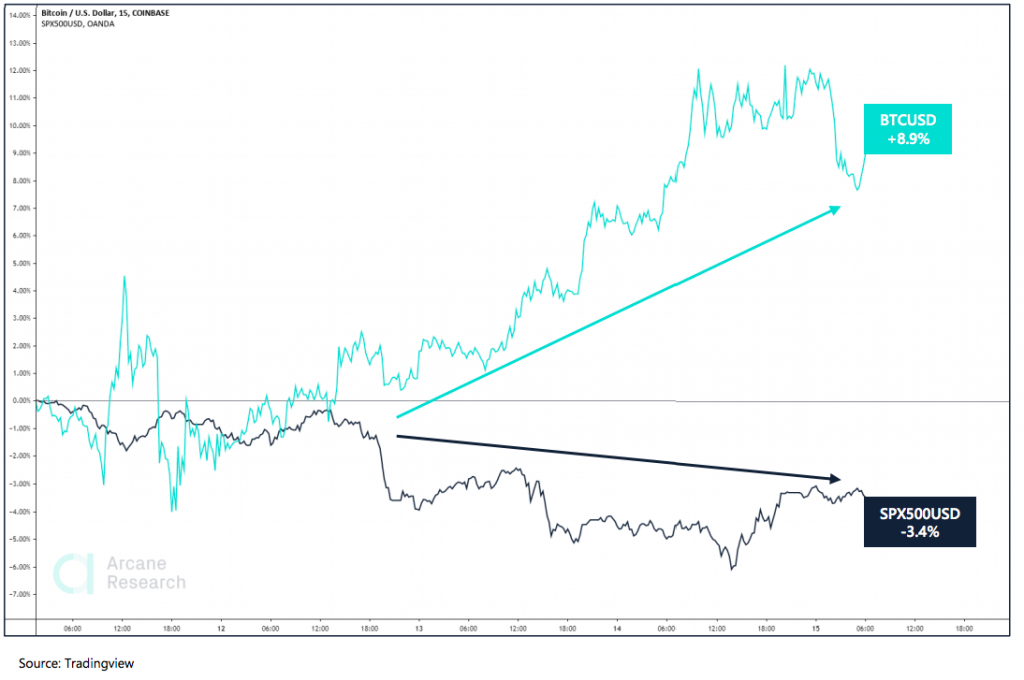

But, what is a little more evident from the market moves this week is that the correlation with the stock market is falling away and a full decoupling could be coming after two months of correlations.

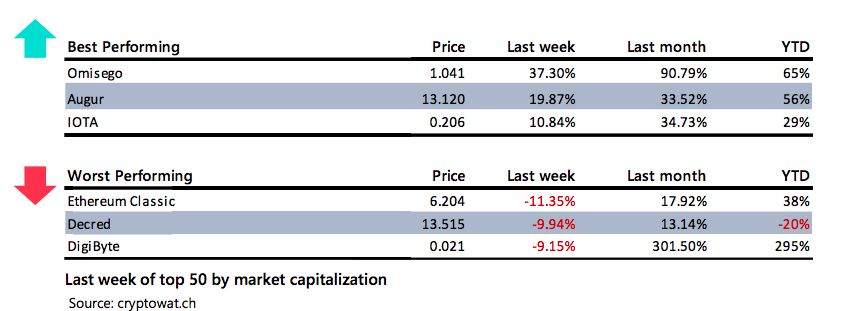

Looking at the altcoin markets, there have been some decent gains for a few coins that are a little lesser-known, but IOTA has produced the third-best performance of the week with a gain of 10 percent. Then, there have also been a few losses that are about 10 percent, but even with all the volatility this week — it has not been too steep.

How Obvious Is The Decoupling?

It has been thought that Bitcoin and the stock markets were not all that correlated, in fact, many thought that Bitcoin would act as a hedge in the face of dovish Federal Reserve monetary policies. But, when the Covid-19 induced market panic struck, there was a real collapse in the Bitcoin market that mirrored the stocks.

Some put that down to the fact that Bitcoin had welcomed in institutional investors, and these same investors quickly pulled out when the market fell. And, since then there has been an obvious correlation.

This week there is further evidence that the markets are uncoupling as the week has been a good one for Bitcoin while the performance of the stock markets have been a little more down. If this continues through the Pandemic, and into the halving, the notion of Bitocin being a hedge could really come true.

Uncertainty Returns As Coin Halves

The market had, last week, managed to return to a position of greed for the first time in months — it was last seen at that level in February. But, it was short lived as the fear has returned and may have to do with the uncertainty that comes with the halving. Mostly, investors feel it will be a good thing, but that is more the long term than the weekly short term.

The Fear & Greed Index is now down to 44 and the market is getting fearful after a volatile week too, pushing towards a neutral state again.

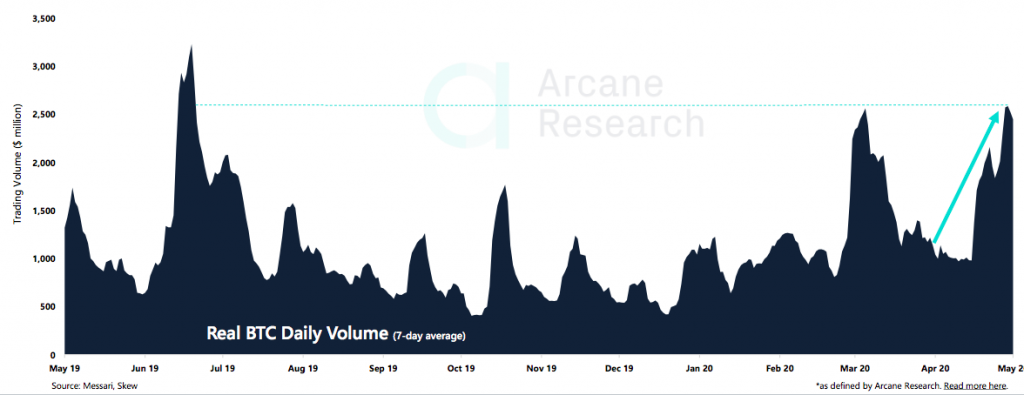

Even though the fear is back, there is a bigger metric that is showing positive signs, but this metric is also higher in times of uncertainty and volatility too. Bitcoin trading volume usually shows an interest in the state of the coin, but that interest can also be a sell off.

However, The 7-day average real trading volume reached its highest levels seen in the year despite the last week being volatile as well. This volatility has been paired with high volume with several trading days with volume between $2-3 billion which led to the high 7-day average. The last time this was seen was in July 2019, when the Bitcoin price peaked.

It was also at a level just a little higher than the volume seen on the sell off from the middle of March madness where the market collapsed and caused a massive sell off.

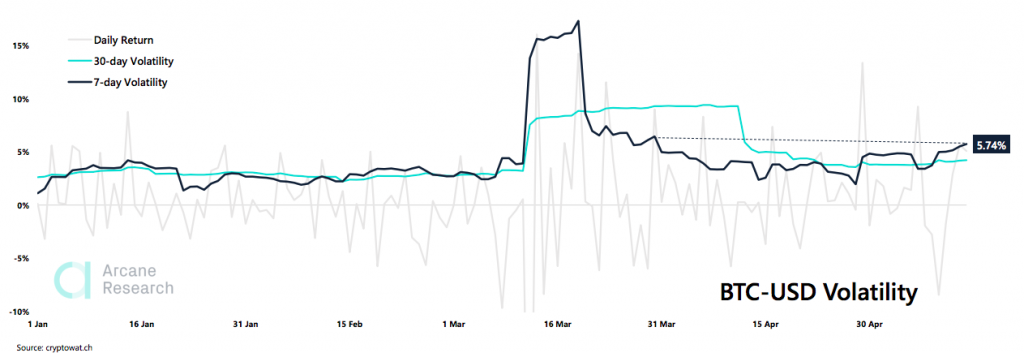

The high volume has also seen high volatility and this volatility this week has managed to match the levels of March where the market was collapsing and bouncing incredibly.

This week also had both large price drops and strong price gains — like in March, but for different reasons — and resulted in increased volatility for Bitcoin. The 7-day volatility is now pushing upwards as BTC tries to decide which way to continue. This week’s volatility levels have not been seen since the end of March, but not quite at the level of the collapse in the market.

Futures Market Has A Chance In Interest

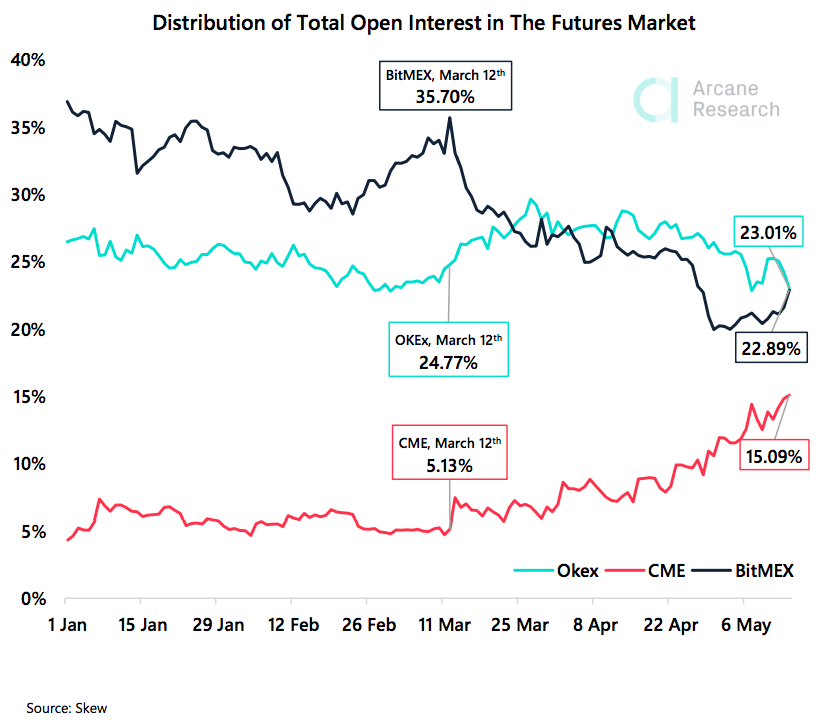

The futures market, also aligned to the traditional and institutional investors who were thought to have pulled out of the market after the market collapse, seems to have taken a turn around as there has been a recent steady growth of relative institutional interest.

CME currently accounts for 15% ($499 million in real terms) of the total open interest. And this CME open interest fluctuated between 4 to 8% prior to the March crash, but the crash also showed a big and visible trend shift as CME has been gaining market shares ever since.

This upward spike in interest could be that professional money managers are looking at Bitcoin again after the crash seeking to allocate cash into a rather scarce asset class that is being labeled as a hedge for the future issues in the markets.

Additionally, billionaire hedge fund manager Paul Tudor Jones made a big announcement for crypto stating that he held between 1-2% of his portfolio in the CME bitcoin futures as an inflation hedge.

This alone, assuming that Tudor Jones holds 1.5% of his portfolio in Bitcoin, means he alone would account for $75 million worth of open interest on CME, according to data from Forbes.

But, this still means more than $400 million worth of open interest held by other investors, so that Jones is not the only one moving the interest but he may well be attracting them back in.

Strong Support Has Saved The BTC Uptrend

After a big pullback last weekend in the markets, it looked like the uptrend for Bitcoin was about to end and a turn around to a downtrend appears. However, the support zones from last week have seemingly mattered to the Bulls.

Bitcoin never managed to push up to the yearly high, and in fact it fell to the lower $8,000 area.

But, this was a good thing and acted as strong support, and the price rebounded quickly, which was also vital.

If there is to be more bullish moves then the Bitcoin price needs to hold this support level so that there is no bearish drop. And, as it stands the momentum still looks strong for the bitcoin price and a push up to the yearly highs is likely.

Forks Take Advantage

Looking at the impact of the Bitcoin halving, there has not been that much of a problem for the miners of the major coin, even though some have dropped off. But the smaller forks of Bitcoin — Bitcoin Cash and Bitcoin SV — have managed to pick up these miners and help them gain back some of their own lost hash rate.

Bitcoin Cash held an average relative hash rate of 3.4% prior to all halvings. Following all halvings, this relative hash rate shrank to 2.46% of the relative hash rate. A 28% reduction in hash rate.

Bitcoin SV held an average relative hash rate of 2.39% prior to all halvings. Following all halvings, this relative hash rate was reduced to 1.75% of the relative hash rate. A 27% reduction in hash rate.

In The News

Hedge Fund Legend Paul Tudor Jones Hold 1-2% BTC in His Portfolio

After mentioning that he suggested a small investment to his clients in Bitcoin, the hedge fund legend Paul Tudor Jones has now outlined he has invested somewhere between 1% and 2% of his assets in bitcoin. He did make mention that there are concerns about Bitcoin, but the potential is good enough to back it a bit.

JP Morgan Welcome Coinbase and Gemini as First Crypto Clients

JO Morgan, once the biggest detractor of Bitcoin, has added its first cryptocurrency exchange customers, these customers are well known US exchanges, Coinbase and Gemini, the latter founded by Tyler and Cameron Winklevoss.

Less Than 1 Percent Of FinCEN’s Suspicious Activity Has To Do With Crypto

More than 70,000 crypto-related suspicious activity reports have been filed since 2013, but the Financial Crimes Enforcement Network (FinCEN) has said that the mention of crypto makes up just 0.59% of the more than 12 million reports since 2013.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.