Bitcoin fell over 3% across the past seven days amid a volatile week. The price started the week at 114k, rising to a peak of 116.3k on Monday before falling 10k to a low of 106.3k on Thursday and recovering to 110k by Friday. The largest cryptocurrency has slipped to 107k at the start of the new week.

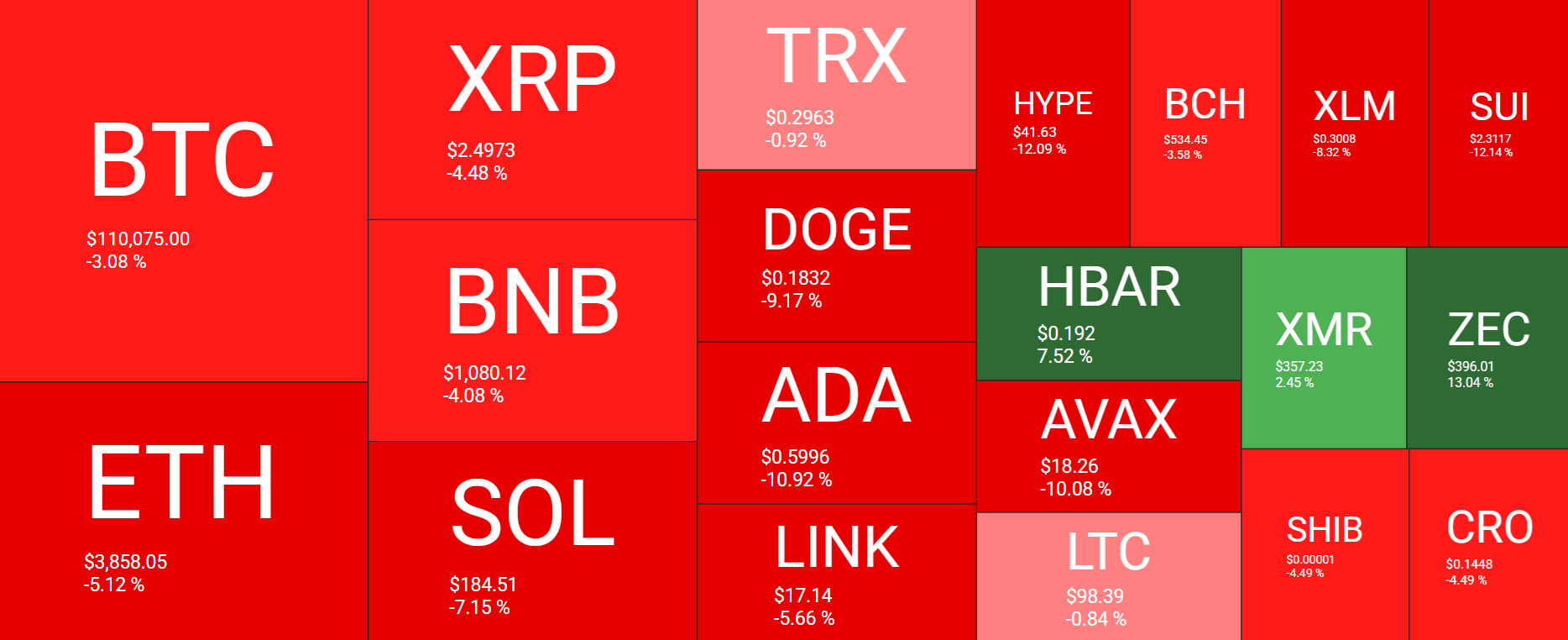

Major altcoin also fell sharply last week, with Ethereum dropping 5% below 4000 to current levels at 3800. Solana dropped 7% below 185 despite the launch of SOL ETFs, while ADA tumbled 10% over the past week. There were pockets of strength in HBAR, ZEC, and XMR, with gains.

The total cryptocurrency market capitalization fell from a peak of $3.92 trillion last Monday to $3.6 trillion at the time of writing, as it approaches the October 17 low of $3.53 trillion.

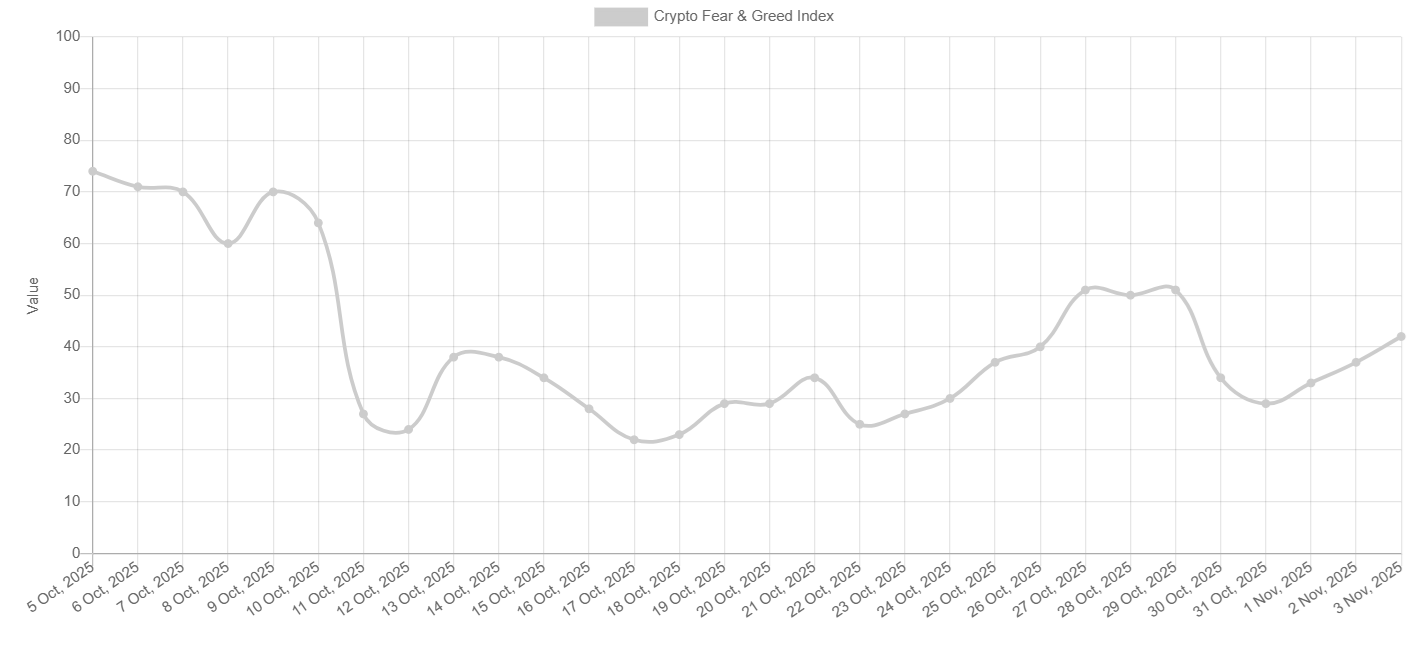

Sentiment analysis shows a renewed sense of caution as the Fear and Greed Index fell back into Fear territory. Sentiment had risen to Neutral territory last week at 51 before falling to a weekly low of 29 on Friday. The sentiment gauge has improved slightly to 42 at the time of writing. When fear dominates, investors tend to sell, often leading to price declines. However, historically, periods of Fear or Extreme fear can present buying opportunities.

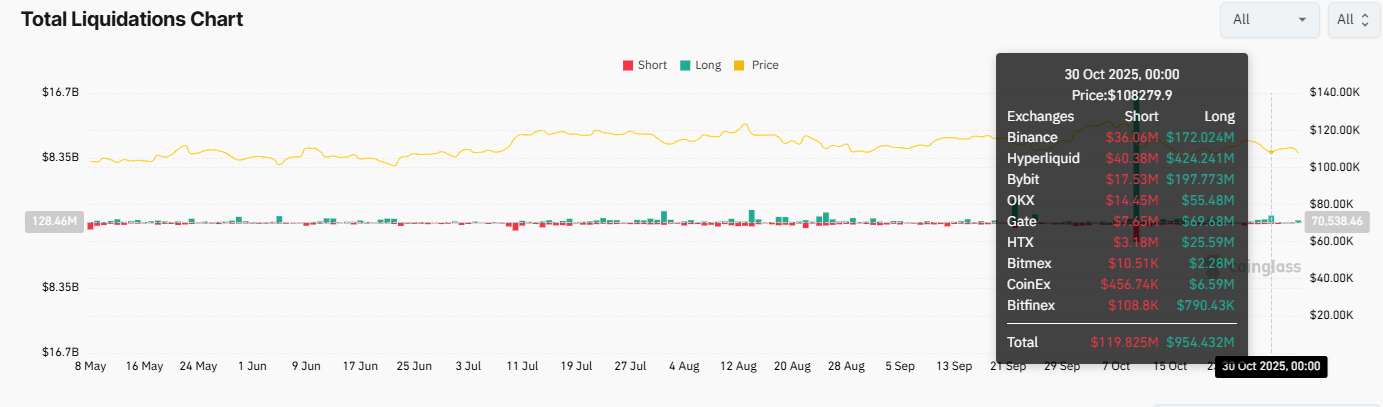

Liquidations spike

When Bitcoin fell sharply to 106.3k, the selloff sparked a wave of liquidations. $1.2 billion in crypto positions were liquidated across 24 hours, with $954 million of those being long positions. This market is the largest liquidation event since the record-breaking 10 October wipeout.

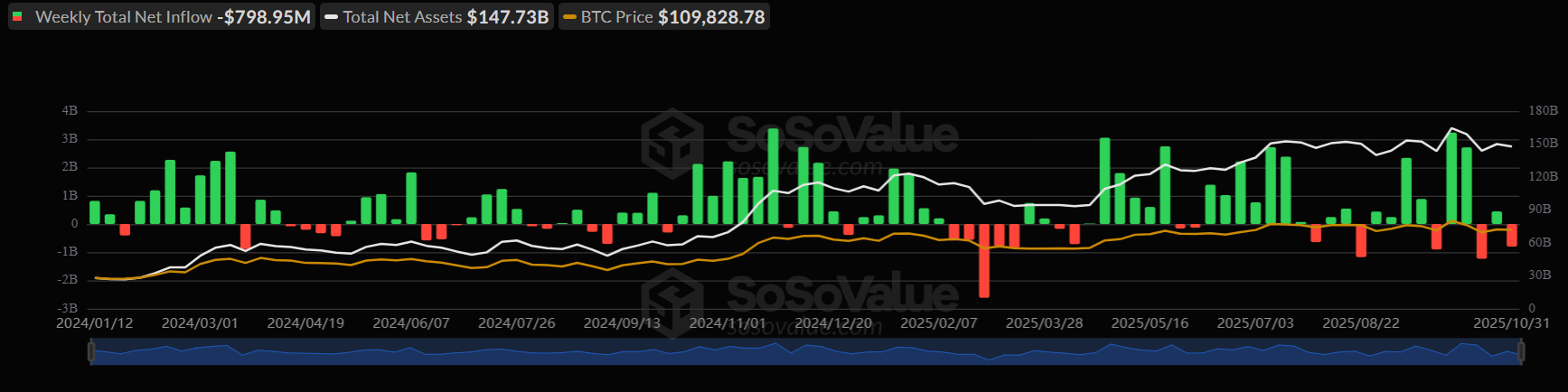

BTC institutional demand drops

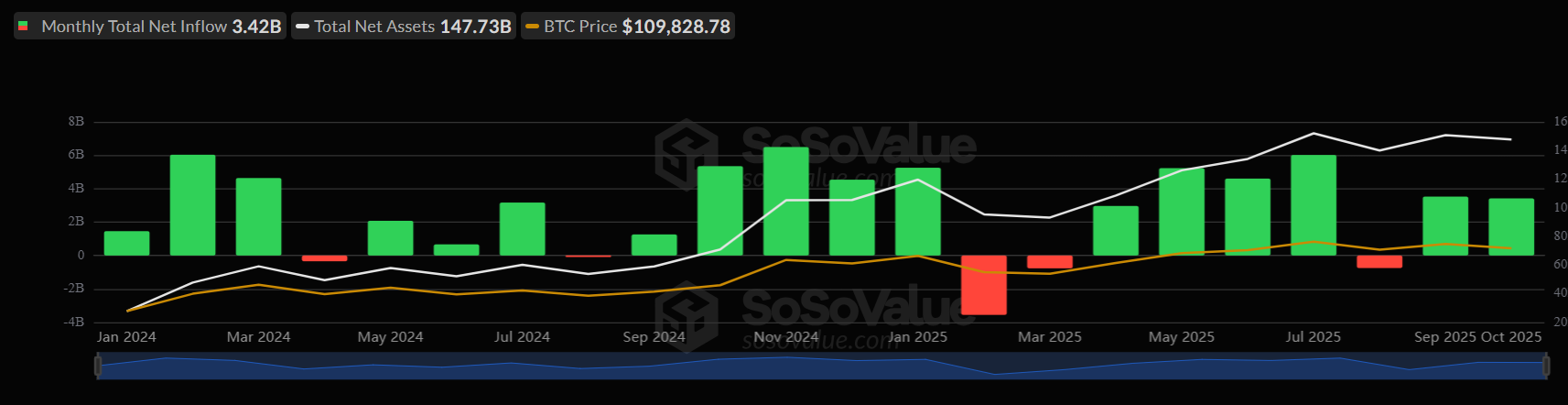

Bitcoin institutional demand showed signs of weakness last week. While BTC ETFs booked modest net inflows across the first three days of last week, these were wiped out — and more—by net outflows on Friday. Across the week, BTC ETFs booked net outflows of $798.95 million.

Whilst recent demand has been weak, BTC ETFs saw inflows of $3.4 billion in October, in line with September, which saw inflows of $3.55 billion.

Macro backdrop

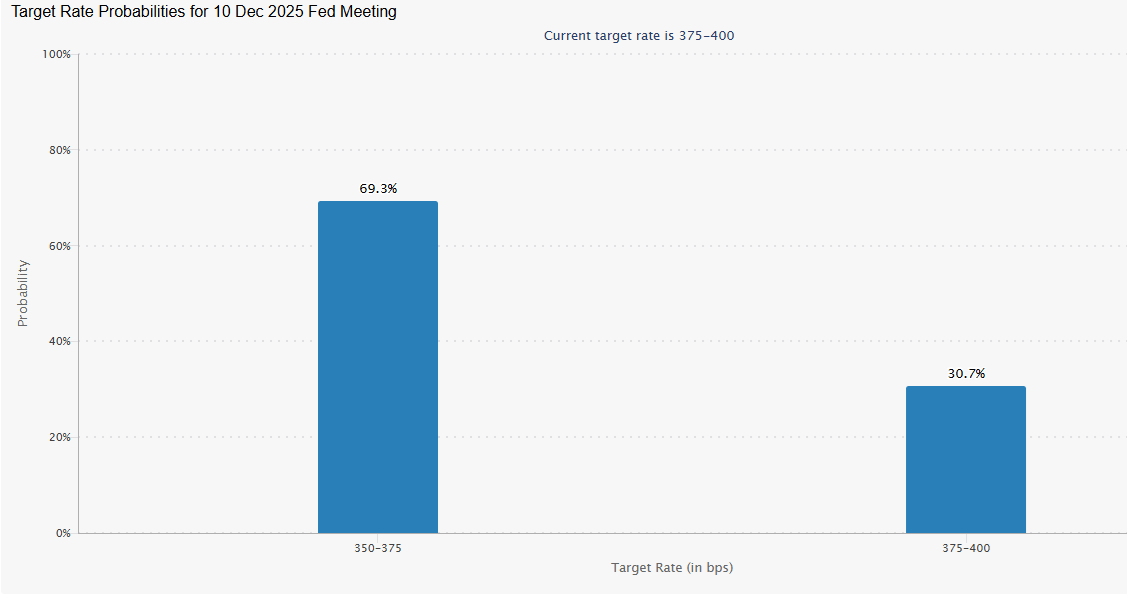

Bitcoin started the previous week on the back foot. After facing rejection at a key resistance level, the price fell lower across for days, dropping $10k to a low of 106.3k on Thursday. The selloff coincided with the Federal Reserve cutting interest rates by 25 basis points to 3.75%-4%, in line with expectations. However, Federal Reserve chair Jerome Powell pushed back against expectations of another rate cut in December, warning the market to show restraint and saying that the December rate cut was not a foregone conclusion.

As a result of the hawkish stance, the market lowered December rate cut expectations from 90% ahead of the FOMC rate decision to 69% currently. The hawkish stance lifted the US dollar and accelerated the selloff in crypto.

US ADP payrolls and US ISM PMIs will be in focus this week to provide further insight into the health of the US economy amid the ongoing US shutdown.

President Trump and his Chinese counterpart, Xi Jinping, met on Thursday, with the meeting deemed successful. While an all-out trade deal wasn’t reached, Trump lowered tariffs on Chinese imports to 47% and China resumed soybean purchases and resolved rare-earth issues. The meeting eased trade tensions further, but this failed to lift the crypto market.

Long Term Holders are still selling, but at a slower pace

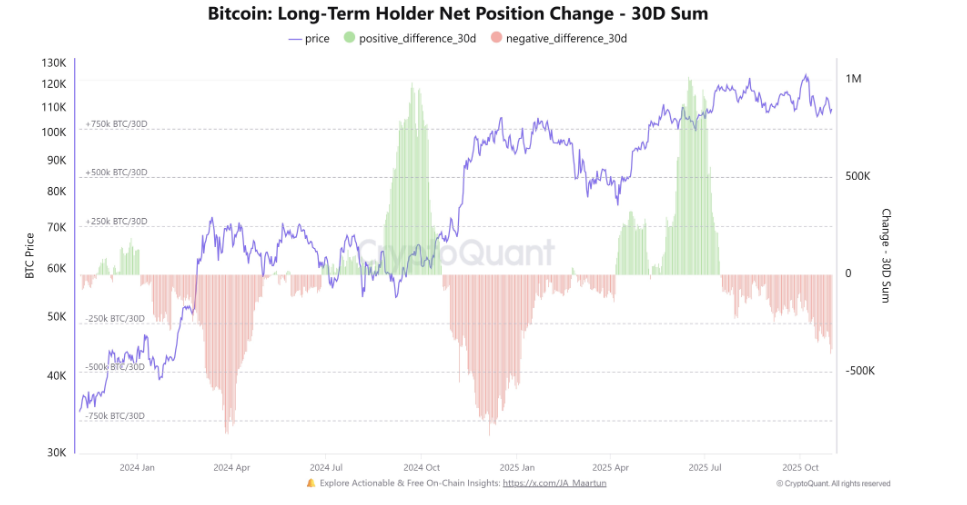

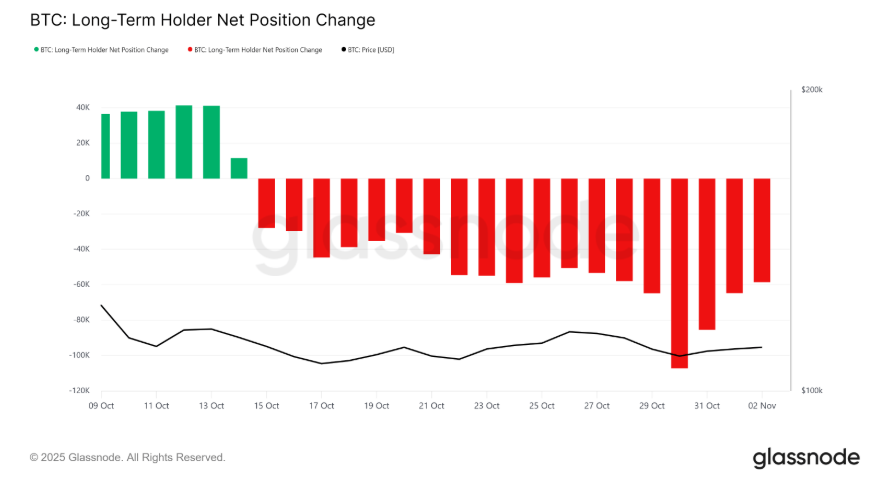

Recent on-chain data shows that long-term holders continued to move out of their positions. According to the long-term holder net position change metric, which tracks the net buying or selling behaviour of Bitcoin long-term investors over a 30-day period, LTHs are still selling, which is a source of concern.

The chart shows that around 400,000 BTC appear to have been sold by long-term holders over the past 30 days, one of the most influential Bitcoin investor groups.

However, more recently, the pace of sales has slowed, declining by 46,000 BTC in recent days. This reduction could mark a potential shift towards longer-term conviction, providing a cushion against downward pressure.

When LTHs rein in their selling, this would be a move towards a local bottom; it typically indicates renewed interest and smart money positioning for the next cycle.

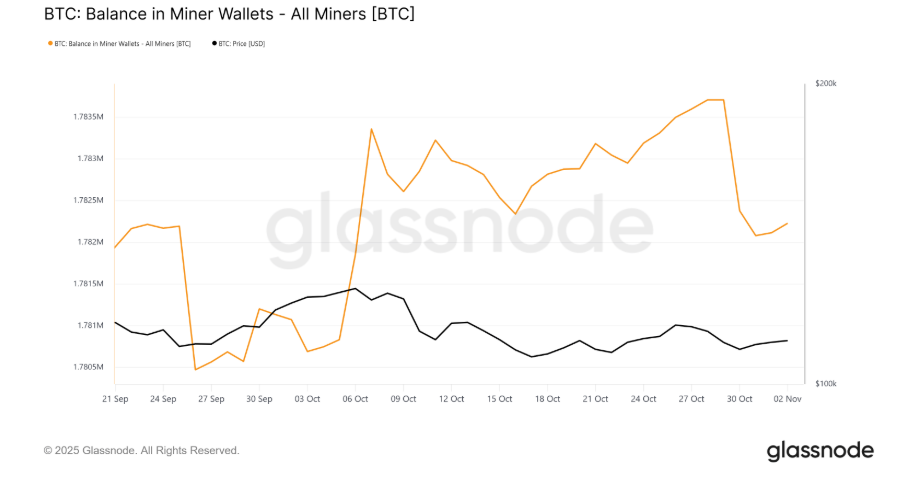

Miners are selling

However, Bitcoin miners appear to have stepped into the selling previously held by LTHs. Bitcoin’s failure to rise above 115k prompted miners to sell approximately $172 million worth of Bitcoin, the largest outflow in nearly six weeks. This suggests that some miners are seeking to lock in profits amid the ongoing price instability.

While the amount appears modest compared to Bitcoin’s total market capitalization, mining activity often signals near-term sentiment shifts. The latest wave of selling reflects bearishness and a cautious approach amid volatile market conditions.

If miner selling intensifies, BTC could fall lower, triggering short-term liquidation pressure and adding to investor uncertainty.

Worst October in years, but are there reasons to be positive?

While hopes were high for a bullish “Uptober”, the rally never took off, and Bitcoin did not have the anticipated bullish month. Global economic uncertainty and a record liquidation event structurally derailed any momentum. After booking 3.5% losses across the month, this was the third October in 12 years that prices fell.

While November is also typically a strong month for Bitcoin, there is certainly reason to be cautious about leaning too heavily into seasonality. So are there other signs that the balance could swing more favorably?

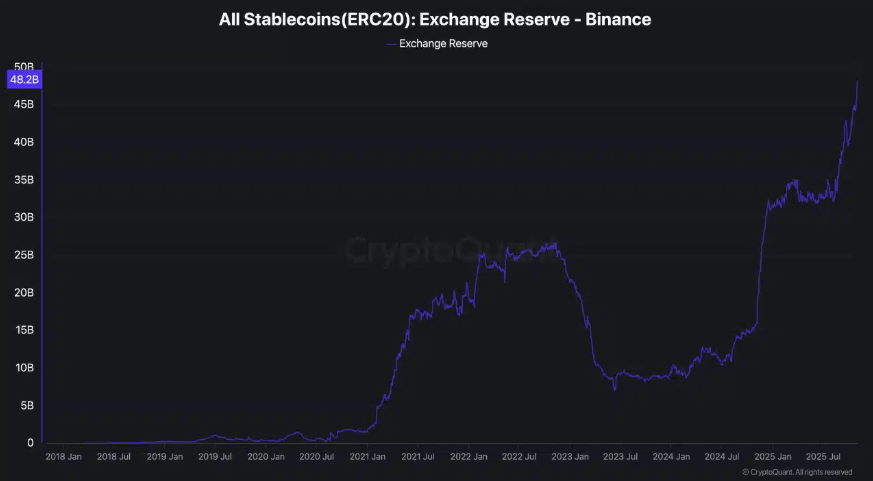

The Total Stablecoin Supply is rising and has risen above $250 billion. On Binance alone, the supply of ERC-20 stablecoins was at $48.8 billion. Despite shaky, fearful market conditions and price action, the rapid rise in stablecoin suggests that investors may be preparing to enter the market.

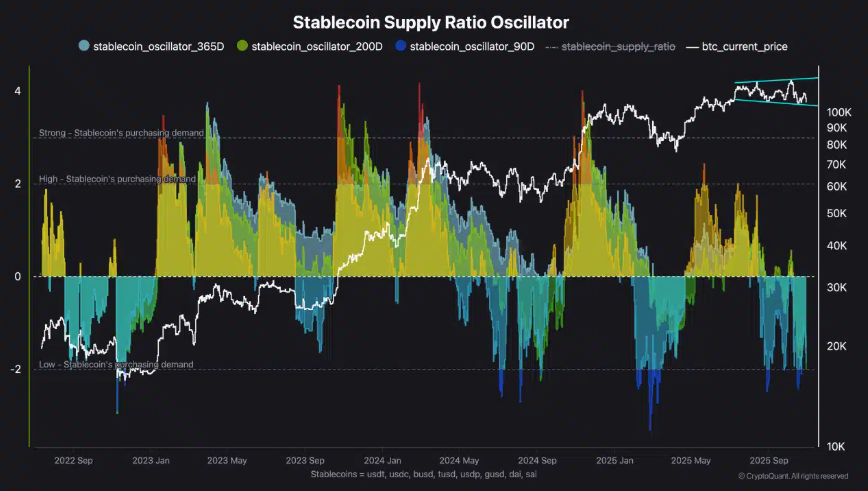

The Stablecoin Supply Ratio (SSR), which is Bitcoin’s market cap divided by the stablecoin market cap, also supports this view. The SSR has fallen into negative territory, indicating that stablecoin liquidity outweighs Bitcoin’s current valuation. Historically, this reading has coincided with local market bottoms. These local bottoms were not usually immediate, but took a while to establish, so patience may be required.

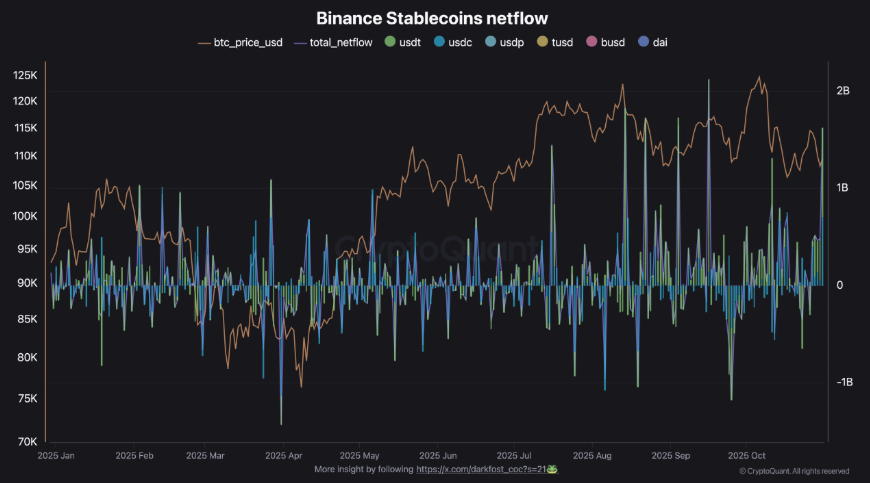

Binance Stablecoin Netflows posted a 5-day run of positive flows with the highest inflows reaching $1.6 billion on October 31. This could be another signal that investors are positioning to re-enter the market.

Q4 rally delayed rather than denied?

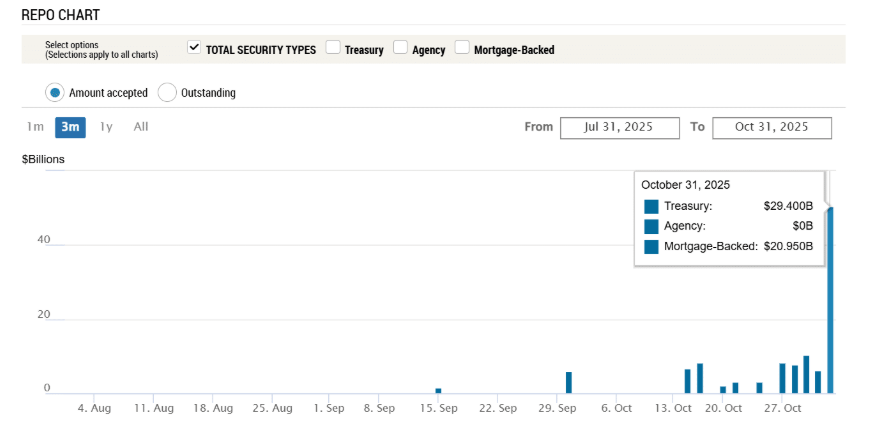

While October was a disappointment, the Q4 rally may just be delayed as Bitcoin looks to liquidity. The Federal Reserve injected $24.4 billion into the US banking system through the overnight repo operations on Friday, marking the largest single-day move since the dotcom era. This reflects growing stress in short-term credit markets.

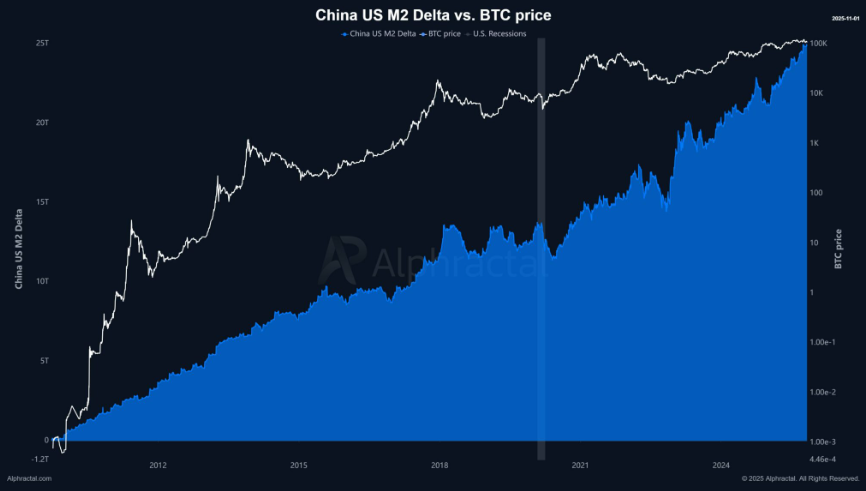

At the same time, China’s central bank deployed a record cash infusion to boost its domestic banking sector. The People’s Bank of China (PBoC) increased liquidity in a bid to keep lending active and prevent credit tightening.

These coordinated liquidity moves can signal a turning point for global risk assets, including Bitcoin. Historically, a simultaneous liquidity boost from the Fed to the People’s Bank of China has preceded major Bitcoin rallies. The 2020-2021 bull run happened alongside aggressive monetary easing after the COVID-19 outbreak.

As global liquidity continues to grow, the environment could become positive for Bitcoin. Falling US interest rate combined with an expanding money supply favours risk-taking.

However, the rally may depend on what comes next. The next several weeks will show whether central banks maintain support or prioritise inflation control, which could set the trajectory for BTC across 2026.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.