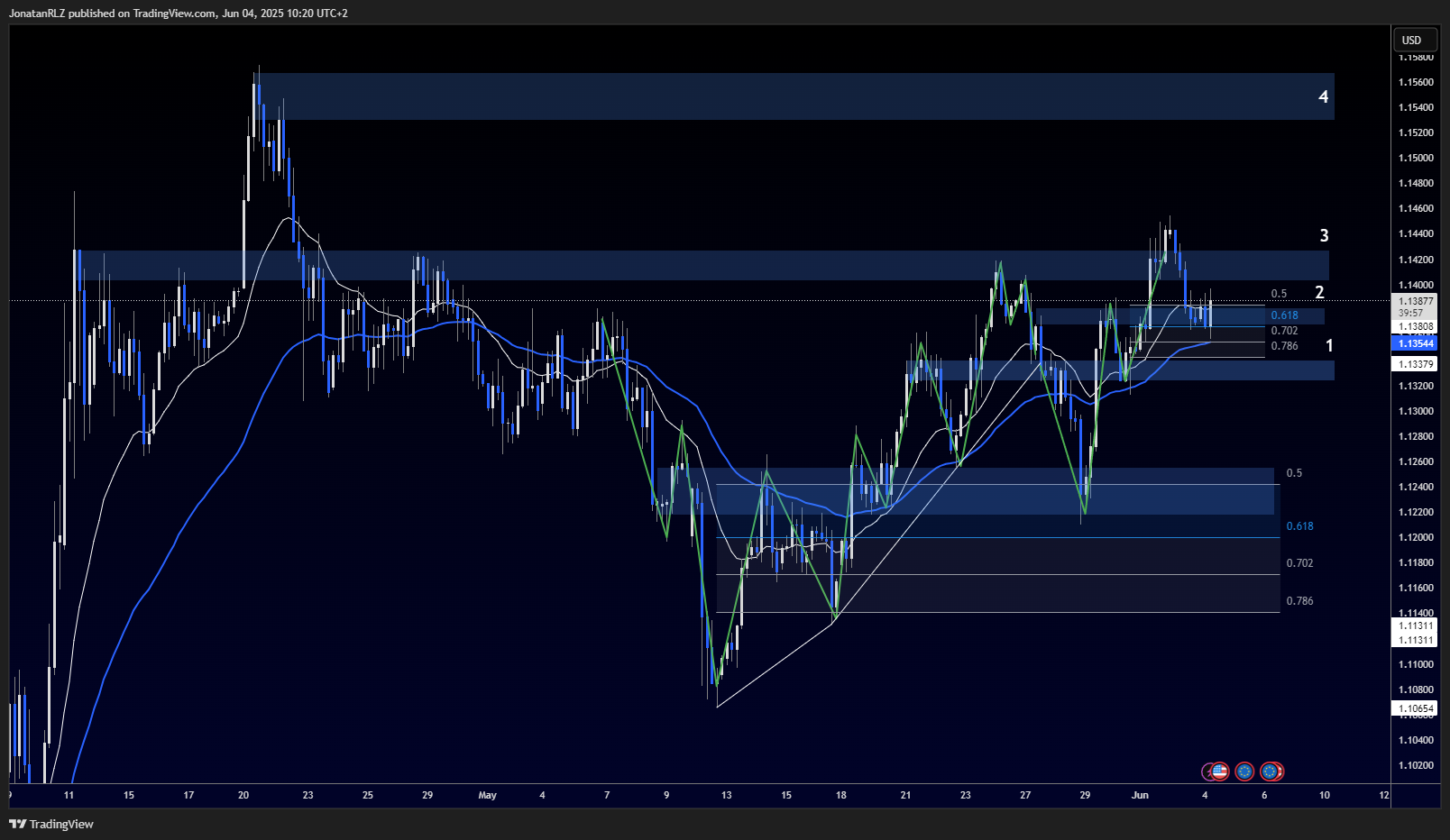

EUR/USD has reclaimed the 1.1200 high time frame support zone, which also aligns with the 50 percent retracement of the most recent impulse leg. This is a key structural shift that suggests the pair could be entering a new market phase, potentially forming the beginning of a bullish cycle not seen in nearly three years.

That said, EUR/USD is currently facing local resistance around the 1.1400 region, marked as number 3. This area has been tested before and is once again acting as a near-term cap on price. Above this, the broader range resistance sits near 1.1650, marked as number 4, while the reclaimed support at 1.1200 is marked as number 1. Together, these levels could define a potential range structure in the coming days unless we see a breakout.

Macro event risk looms

Traders should be mindful of major catalysts ahead. On Thursday, the European Central Bank (ECB) will announce its latest interest rate decision, followed by the US non-farm payrolls (NFP) data on Friday. Both events are likely to generate significant volatility in EUR/USD and could serve as breakout or reversal triggers depending on how price reacts.

The daily timeframe still shows a bullish trend structure, with price printing higher lows. However, the current swing high near 1.1400 could potentially form a lower high, which would be a warning sign for bulls. Recent price action around this resistance zone showed a fake-out on lower time frames, suggesting this area is acting as a strong ceiling for now.

On the 4-hour chart, EUR/USD is showing a clean bullish structure. At the time of writing, the current 4-hour candle is about 40 minutes from closing, and if it closes as it’s shaping up to, it would print a bullish engulfing candle off the 0.618 Fibonacci retracement. This confluence also includes a close above the 50 percent retracement and support from the 20 EMA, a potentially bullish technical signal.

If this structure holds, the next upside level to watch is the 1.1420 zone, marked as number 3. A confirmed break above that level would shift focus to the 1.1540 resistance area, marked as number 4. A sustained rally through both zones could open the door for a retest of the 1.1650 highs.

For now, EUR/USD remains structurally bullish across both high and low time frames. However, with major economic events just ahead, traders should prepare for volatility and be ready to adjust if the structure shifts.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.