Bitcoin failed to break out of range yesterday and continues to consolidate below 113k as investors adopt a cautious stance ahead of key inflation data this week, which could provide more clues over the Fed’s future path for rate cuts.

The broader cryptocurrency market is also just modestly higher as the sector has largely lagged a broader rally in risk-driven assets. The S&P 500, the Nasdaq, and the Dow Jones all trade around record highs as traders price with greater conviction a rate cut from the Federal Reserve next week.

US inflation data to drive Fed rate cut expectations

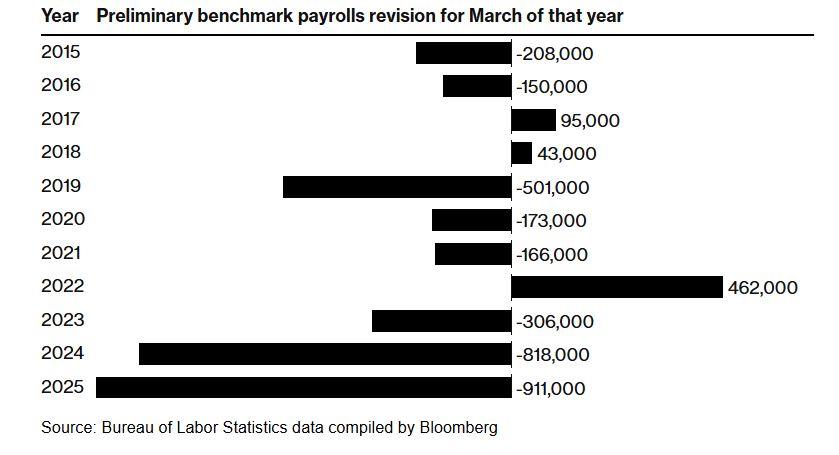

Bitcoin continues to trade within a tight range, some 10%-15% below its August record highs, as investors weigh up the trajectory for Fed rate cuts. Weak jobs data have reinforced expectations for imminent rate cuts by the Fed. Friday’s nonfarm payroll was worse than expected, and yesterday the Bureau of Labor Statistics revised its data for the year to March, showing the economy added 911,000 fewer jobs than initially reported. This weakness in the US labour market is cementing expectations that the FOMC will cut rates next week, and the market is pricing in 66 basis points worth of cuts before the end of the year.

However, US inflation data this week, in the form of PPI today and CPI tomorrow, could see the market rein in rate reduction expectations. Signs of sticky inflation could raise concerns over stagflation. While a September rate cut is a done deal, aggressive rate cuts across the rest of the year may be challenging if inflation is rising well above target. Therefore, hotter than forecast PPI and / or CPI could limit BTC upside in the near term. Risk assets such as Bitcoin often perform well in lower interest rate environments.

Could returning BTC ETF demand spur a rally?

Money is moving back into Bitcoin ETFs, and retail traders are impatiently dropping out of crypto, according to Santiment.

Spot Bitcoin ETS has seen two days of net inflows this week, putting BTC ETFs on track for a third straight week of inflows, yet the spot BTC prices remained relatively flat. Previous crypto rallies have been boosted by inflow spikes, so it’s a good dynamic to monitor.

Bitcoin treasury trouble?

However, it is also worth noting that doubts are emerging over the long-term viability of corporate Bitcoin buying, which is weighing on sentiment. Bitcoin showed little positive reaction to recent buys by major corporate holders, Strategy (MSTR) and Metaplanet.

Data from IntoThe Block revealed that Bitcoin heavy treasuries are seeing sharper declines in market capitalisation compared to their ETH or SOL counterparts. This suggests that the more these digital asset companies (DATs) expand, the more their valuation struggles to keep pace with the underlying asset.

As noted by CrptoQuant, Bitcoin buying by DATs has slowed. Strategy added 3,700 BTC in August versus 134,000 in November 2024. Other firms bought 14,888 BTC, well below the 2025 monthly average of 24,000.

Yet despite this slowdown, Bitcoin treasuries are still holding weight with holdings peaking at 840,000 BTC this year. While Strategy is the major holder accounting for 67% of this, there are almost daily announcements from firms starting or adding to crypto treasuries.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.