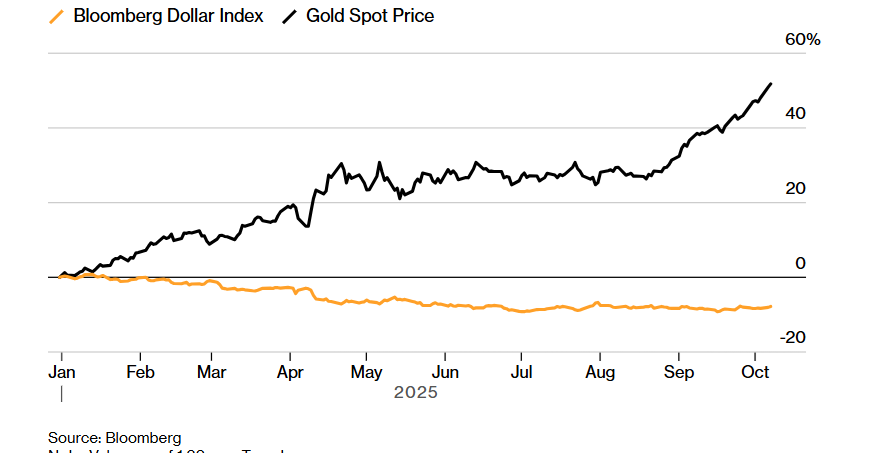

Gold is extending its rally, rising for a fifth consecutive day and surging past $4,000 an ounce to a record high of $ 4,049 at the time of writing. The precious metal now trades up 45% so far this year, outperforming all asset classes.

Why is Gold trading at record highs?

A combination of safe-haven demand, Fed rate cut expectations, and central bank buying has lifted gold into uncharted territory, and silver is also approaching a key historical resistance level.

The latest leg higher in the gold rally is driven by safe-haven demand, reflecting rising uncertainties surrounding the ongoing U.S. government shutdown and debt levels, as well as fiscal and political uncertainty in other major economies, including France and Japan.

Meanwhile, expectations that the Federal Reserve will cut interest rates further are also supporting non-yielding gold. After resuming rate cuts in September, expectations that the Federal Reserve will cut rates by 25 basis points in the October meeting sit at around a 95% probability. The Fed is cutting rates to support a weakening labor market, but it is doing so while inflation remains at 2.9% YoY, still well above the Fed’s 2% target level.

Central banks keep buying Gold.

In addition to expectations of rate cuts and geopolitical tensions, strong central bank buying is another supportive factor. According to the World Gold Council, central banks added 15 tonnes of gold to their reserves in August, marking the 16th consecutive month of accumulation, as they diversify their reserves and reduce their dependence on the US dollar. The People’s Bank of China added to its gold reserves for an 11th straight month.

The World Gold Council survey revealed that 95% of central bank respondents anticipated global gold reserves would increase over the next 12 months and over a five-year horizon, which is expected to further support gold prices.

Comparisons to 1973

These figures come as Bridgewater Associates hedge fund founder Ray Dalio noted that gold’s rise reflected fears surrounding the US currency. The US dollar has weakened against every major currency this year and is on track for its largest annual decline since 1973.

What’s particularly notable about Gold’s resurgence is that it’s rising in tandem with stocks in a pattern similar to that seen in the 1970s.

Meanwhile, U.S. Treasury yields are also falling, which reduces the opportunity cost of holding gold. The 10-year yield has fallen to 4.13%. A fall below 4% could trigger a sharper decline in yields, further supporting gold.

Gold technical analysis

XAU/USD has broken out above its ascending channel on the 4-hour chart, in a bullish move, reaching a high of 4049.

The 50 & 200 SMA are reinforcing the trend’s strength. However, the RSI is overbought on multiple time frames, indicating that a pause in the rally could be on the cards or a short-term pullback.

With blue skies above, buyers will target the next round number at $ 4,100. Support can be seen at 4000, the psychological level and upper band of the channel, followed by 3941, the weekly low. Below here, 3800 comes into play.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.