The change in narrative by various central banks was welcomed by traders, with stocks celebrating the reduction of Fed hawkishness by marching higher. Even though US stocks began to retreat as earnings disappointment by Meta, Amazon, and Alphabet led investors to sell tech stocks in the middle of the week, stocks closed much higher in their fourth consecutive week of advance after a strong closing on Friday.

Two main market data from the US contributed to the buoyant market. First, the much-anticipated 3Q GDP data came in better than expected, showing a growth of 2.6% instead of a negative reading, signalling that the US is out of a technical recession.

The markets got a further boost after the core personal consumption expenditures price index (PCE) in September increased 0.5% from the previous month and 5.1% from a year ago, in-line with expectations. The core PCE is the Fed’s preferred inflation gauge and the fact that it did not increase more than expected gave investors faith that the Fed would be less hawkish.

For the week, the S&P gained 3.9% and the Nasdaq still managed to climb 2.2% higher. While some tech-giants caused a selloff midweek, Apple Inc. saved the day by rallying intensively. Despite both indices putting in a good performance, the Dow Jones index was the star of the week, rising an impressive 5.7%.

US yields began to retreat as traders started to reposition themselves to the new less hawkish tone of the Fed ahead of their November 2 meeting this Wednesday. The 2-year Treasury yield fell from 4.46% to 4.38% at one point, dragging the DXY from the heights of 114 to 109 for a loss of almost 5%, which was a steep decline for under a week. The 2-year eventually settled at 4.414% while the DXY ended the week back above 110.

On the other side of the Atlantic, the pound rose after Rishi Sunak officially became the UK’s new Prime Minister and formed his cabinet, while the Bank of Canada became the next central bank following the new less hawkish narrative, raising rates by only 50-bps against an expected 75-bps.

The ECB however, raised rates by 75-bps and announced that it was changing the terms and conditions of its targeted longer-term refinancing operations, or TLTROs — a tool that provides European banks with attractive borrowing conditions.

ECB President Lagarde further revealed that their normalization process is not finished, and more rate hikes are to be expected. However, the EURUSD fell instead of rising, as traders bet that hiking rates in the face of the economic uncertainty in Europe will be detrimental to the European economies.

Against a weaker dollar, Gold and Silver remained largely unchanged for the week, while Oil rose in tandem with the dollar’s decline. WTI Crude rose 3.4% and Brent rose 4.8% for the week. All of them are unchanged as the new week opens.

Crypto Bounces as High Value of Shorts Liquidated

Led by the stock market rally, crypto prices bounced beginning on Tuesday, making their highest percentage moves in over three months. ETH, DOGE, ADA, SOL all surged around 10% on Tuesday alone, with ETH wiping out more than $350 million in short positions with its 13% overnight jump. BTC was not far behind, rising 5% to trade back above $20,000. As already pre-warned in our last week’s report, short liquidations surged to its highest level in recent times, with more than $700 million of shorts being liquidated on Tuesday alone. This is a significant amount even by bull market standards and such an increase in buying could pave the way for more positive moves ahead.

Indeed, the momentum continued into the following days as ETH continued to lead altcoins higher after it broke out of consolidation range and rallied past $1,600 on Saturday. ETH subsequently went on to liquidate more than $500 million worth of short positions, its highest dollar-value of shorts liquidation on record.

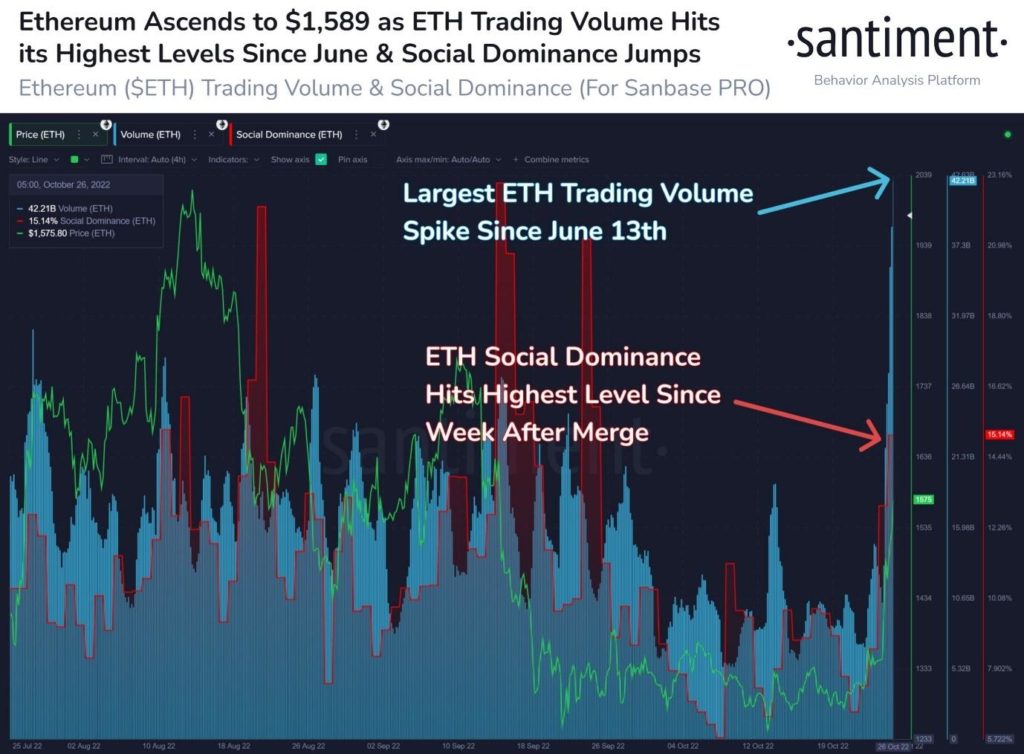

The trading volume of ETH rose in tandem with its price, rising to its highest level since June and people on social media are beginning to talk positively about ETH again as its social dominance rose to its highest level since the Merge. This time round, most of the chatter is about how ETH has become deflationary and would protect its holder’s wealth in a similar way to BTC.

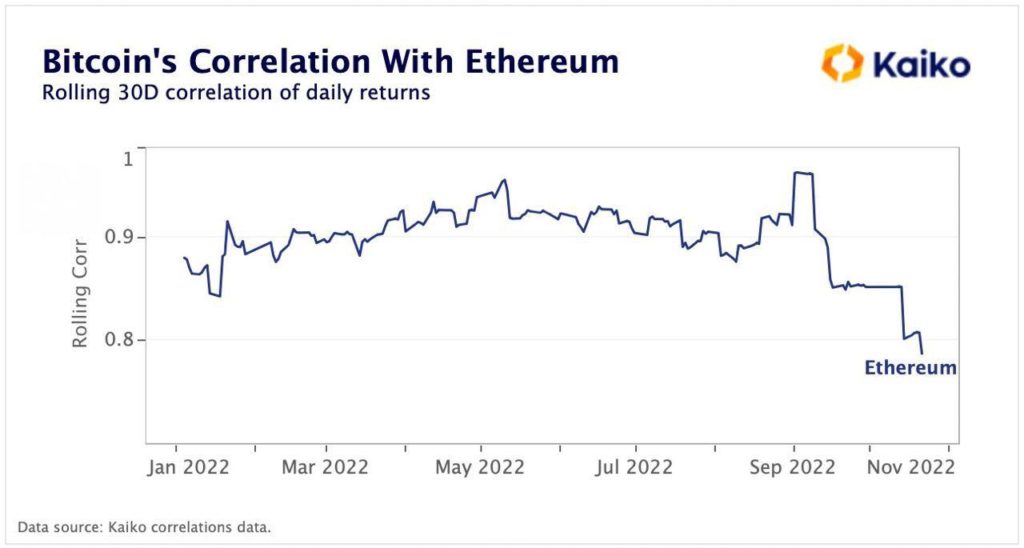

Falling BTC-ETH Correlation Hints of Altseason

As sentiment in the market changes from bearish to bullish, altcoins are faring better in percentage returns when compared with BTC, especially when the king of altcoins ETH is seeing good activity. The outperformance of ETH has caused its correlation with BTC to fall to an 11-month low, which in a bullish environment means that altcoins like ETH are holding their own instead of being beholden to the price of BTC. Such a development could be indicative of an impending altseason.

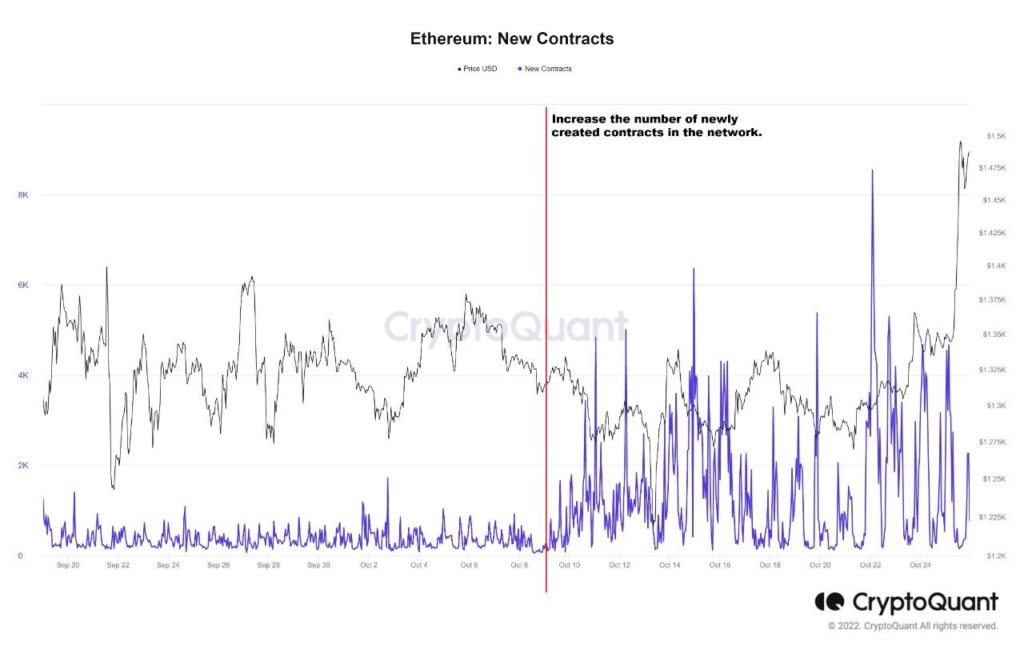

Furthermore, the number of smart contracts deployed on the ETH blockchain has increased significantly in October, which is a sign that projects are back building and utilising ETH. Should this trend continue, it bodes well for the adoption for ETH under PoS, which will ultimately translate to higher prices since the more ETH is used and burned under EIP-1559, the more deflationary ETH becomes.

DOGE Jumps as Elon Completes Twitter Deal

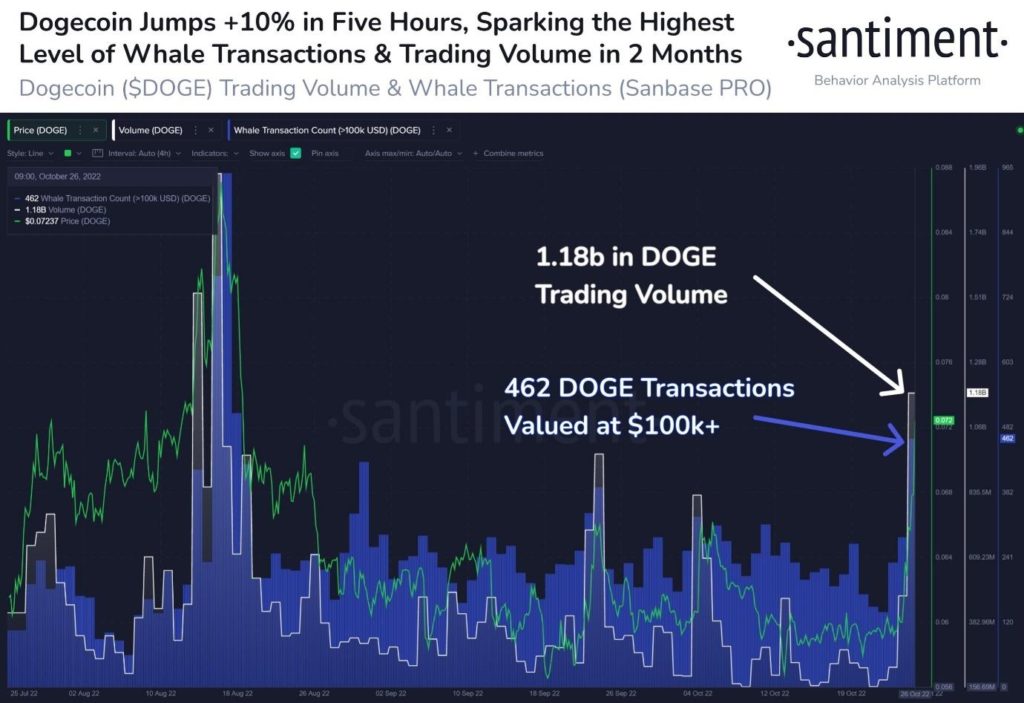

Crypto prices continued to bounce higher heading into the weekend, led by DOGE, which surged by more than 100% over the week after Elon Musk’s acquisition of Twitter was complete. On Thursday, Elon posted a video of himself walking into Twitter premises holding a sink, which sparked excitement within the DOGE community and ignited the price of DOGE to explode by 10% in just five hours.

Transaction volume on DOGE spiked to its highest level in two months as sentiment surrounding the meme coin starts to turn positive as investors bet that Elon would find ways to integrate DOGE into Twitter.

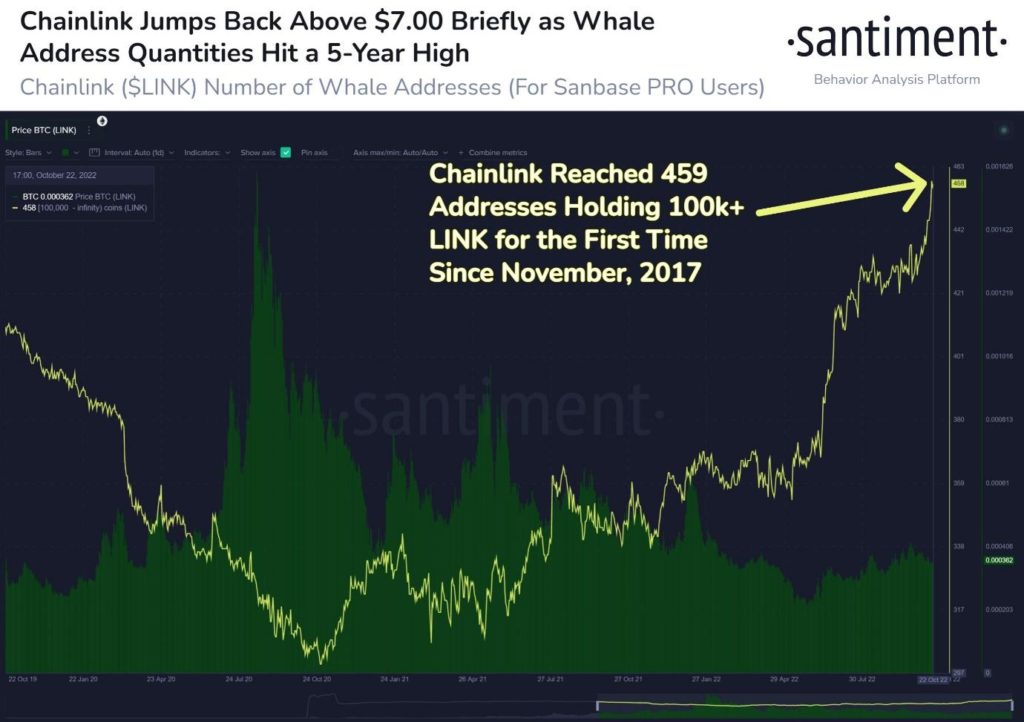

LINK Whale Addresses Reach ATH

LINK, which has seen whale activity increasing and price slowly but surely on the ascent, continues to see accumulation by large holders as the number of wallets holding at least 100,000 LINK has hit ATH. This translates into a holding of around $700,000 each and the number of such wallets has increased to 458, its highest number since LINK was listed.

Will This Rally Have Legs?

Even Core Scientific’s financial woes did not sour crypto sentiment. The world’s largest BTC miner revealed that it will not make payments due in late October and early November 2022 as its reserves are dwindling. The firm further elaborated that it anticipates existing cash resources to be depleted by the end of the year or possibly sooner, and should its current capital raise alternatives fail, the firm may have to file for bankruptcy protection by the end of the year.

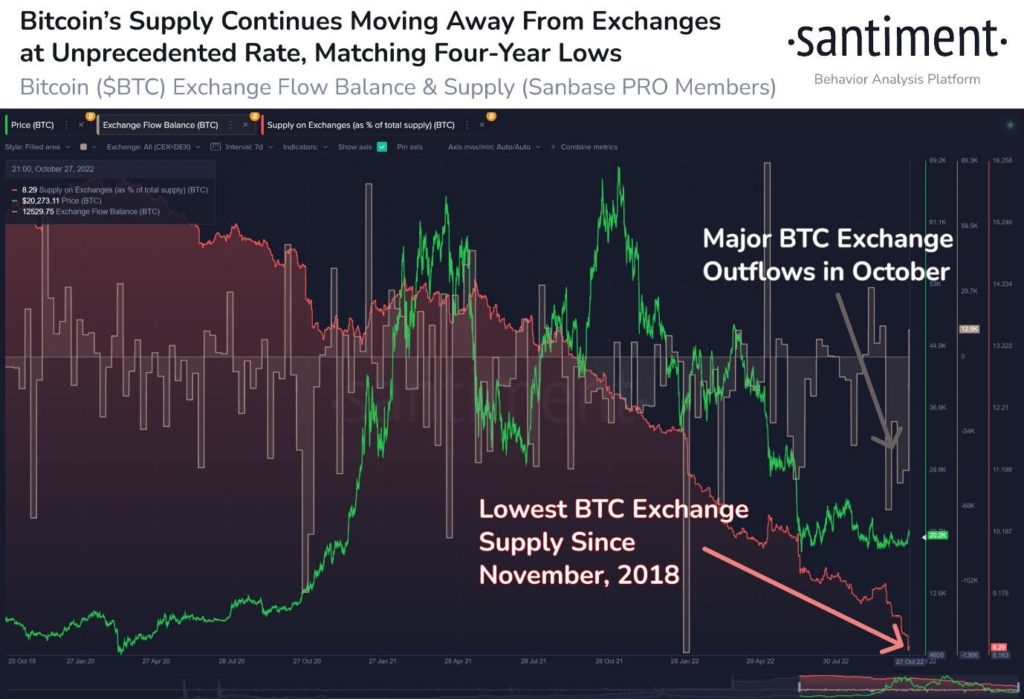

Despite more and more miners getting into financial trouble, no one seems bothered and more BTC continues to flow out of exchanges. The rate of movement of BTC out of exchanges has picked up pace in October to one of its quickest paces in history. This has made the supply of BTC fall by an unprecedented rate, leaving only 8.29% of BTC supply on exchanges.

The key risk event this week will be the Fed meeting this Wednesday, where Fed Chair Powell is expected to give more insight about whether the Fed will indeed cut back on rate increases. While an affirmation could spark prices to rally even higher, a denial by the Fed could send stock prices retreating. However, the impact on crypto could be less concerning as crypto prices appear to be shaking away their correlation with stock prices since September. In any case though, traders do keep a mental note that Tuesday-Wednesday-Thursday could experience heightened volatility, while Friday will see the release of October’s US non-farm payrolls, which would contribute to volatility in the currency markets.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.