With fresh volatility surging into the crypto market this week, many altcoins are starting to show signs of life again. One name that stands out is SAND (SAND/USD), which is building a compelling technical setup following a clean breakout earlier this month.

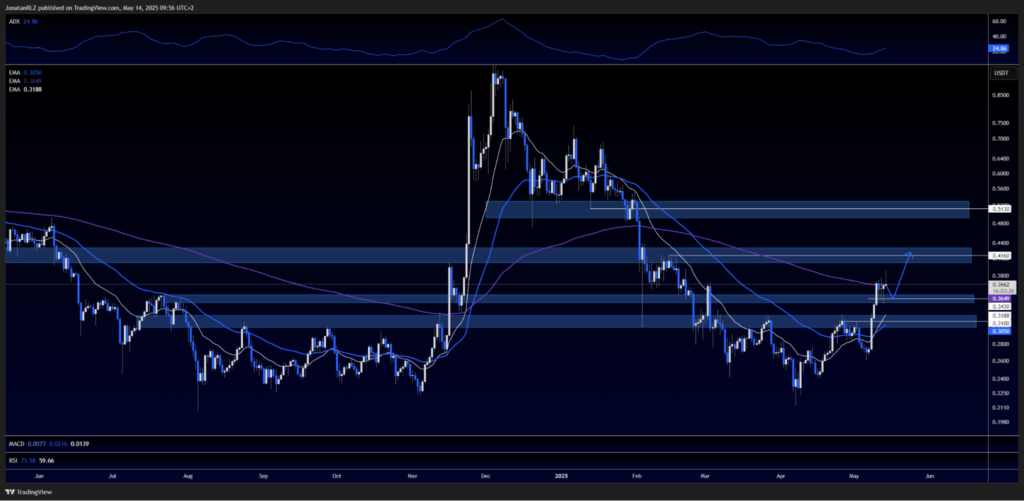

At the beginning of May, SAND exploded above the 0.310 level, triggering renewed bullish momentum. Price has since reclaimed the important 0.343 zone, a level that acted as resistance during multiple prior attempts. We are now trading right into the 200-day EMA, marked in purple on the chart, which is providing short-term resistance and is currently wedged between high time frame support and resistance.

A sustained break above the 200 EMA could be the catalyst that propels SAND higher into the next major resistance area at 0.416. This level has acted as high time frame resistance in previous cycles and would likely attract sellers again if reached.

However, rejection at the 200 EMA has already occurred once, and price continues to test that level repeatedly, forming a well-defined short-term range. The range highs sit just below the moving average, while the local support below remains at 0.343.

For intraday traders, this low time frame range offers clean levels to manage their risk based on. A breakout in either direction could offer an opportunity, with 0.343 acting as the immediate downside level to watch, and 0.416 as the next target if bulls reclaim momentum.

If the broader altcoin market continues to benefit from current bullish sentiment, setups like SAND — which show strong structure but still have room to run toward high time frame resistance — are worth keeping on the radar.

Trade SAND

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.