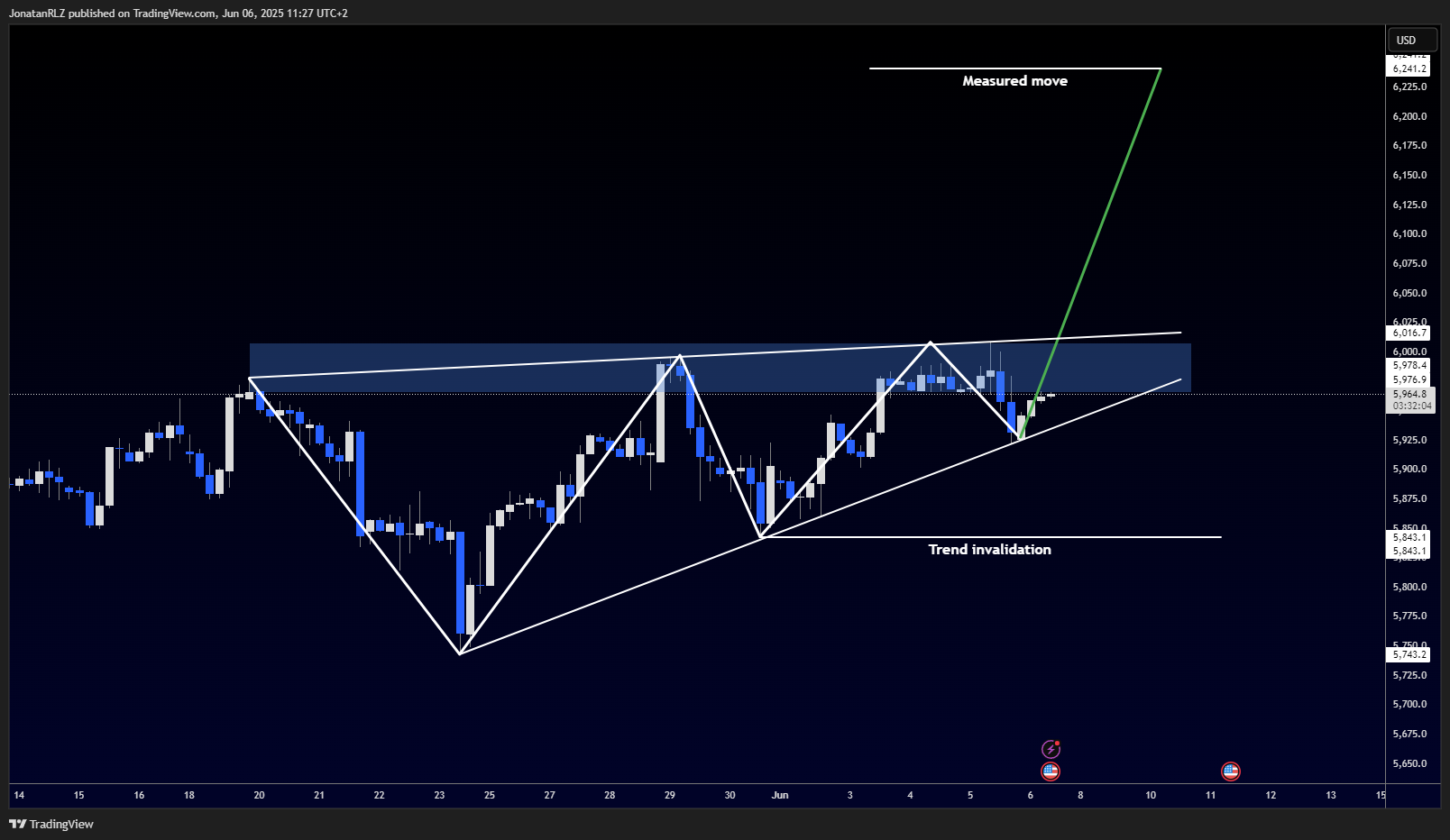

With the US non-farm payrolls, NFP, numbers scheduled for release today at 12:30 GMT, global markets are on alert, and the S&P 500 is firmly in focus. Looking at the daily chart, we can see a potential ascending triangle formation taking shape. This pattern is defined by an ascending trendline pushing up into a flat horizontal resistance zone, often seen as a bullish continuation pattern.

In this case, the horizontal resistance comes in just below the 6,000 level. A clean breakout above this area, particularly if supported by strong momentum and rising volume, could confirm the pattern. Using the measured move technique often applied to ascending triangles, such a breakout could open the door to new all-time highs for the S&P 500.

The 6,000 level is psychologically and technically important, and with a high-impact macro event like the NFP on deck, this area is likely to see elevated volatility and trading activity.

Zooming into the 4-hour chart, the triangle structure becomes even more apparent. We can see a series of higher lows pushing up against a relatively flat resistance band. Interestingly, the structure could also be interpreted as a rising wedge, given the slight upward slope of both trendlines.

It is important to distinguish between the two. A rising wedge is typically a bearish formation, but context is key. In this case, the overall trend is bullish, and price has approached the formation from below in a constructive manner, which supports the idea of an ascending triangle.

For either interpretation to be validated, a breakout above the upper resistance, currently around 6,009, is required. This level marks the top of the structure. On the downside, the first sign of invalidation would be a break below the local swing low and ascending trendline. Full trend invalidation would occur if price drops below the key level marked as trend invalidation at approximately 5,843.

As with most high-impact news events, volatility is expected to increase sharply around the time of the release. Price action near key levels is often prone to fakeouts during these periods. However, the structure is clear, and the breakout or breakdown from this triangle should offer strong directional clues regardless of whether the market treats it as an ascending triangle or rising wedge.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.