On Friday the S&P 500 and Nasdaq managed to finish their best week of the year, as continued strength in earnings reports extended the tech-led rebound from the January rout.

Amazon led the S&P and Nasdaq’s gains as it added 13.5% on strong quarterly earnings and cloud revenue beats. Friday’s surge was also Amazon’s biggest one-day gain since 2015. Snap rocketed up by 58.8% the day after reporting earnings, while Pinterest rose by 11.2%.

Traders also received a much stronger-than-expected jobs report: in January the number showed a 467,000 gain in payrolls vs consensus expectation of between 0 to 150,000.

The market is now expecting a 0.5% rate increase in March, with current numbers already sending the 10-year Treasury yield jumping above 1.9% and hitting its highest level since December 2019.

The S&P 500 was trading 1.5% higher, while the Nasdaq and the Dow rose by 2.4% and 1.1% respectively. These gains mark the second weekly advances of 2022 for the major averages which were under pressure last month as worries of higher interest rates dragged down tech names. However, good earnings numbers that were released last week have enticed traders back in to take long bets in companies that reported better-than-expected numbers and a positive outlook. For instance, Meta – formerly known as Facebook – suffered their worst day ever on Thursday, losing 26.4% on the back of disappointing quarterly earnings.

Oil continued to advance for the 7th week, gaining around 6% and closing above $90. Tension between Russia and Ukraine, coupled with ongoing worries about supply disruptions fuelled by a frigid US weather, sent oil prices jumping up on Thursday and Friday.

On the other hand, precious metals had a more subdued week, with Gold and Silver gaining less than 1%. However silver is seeing some fresh positive volatility at the start of the new week, gaining almost 1% early Asian time.

Meanwhile, the Bank of England imposed back-to-back interest rate hikes for the first time since 2004. The central bank first raised rates by 0.25% in December, and added another 0.25% last Thursday. Even though the move was anticipated by market participants, it nonetheless led the pound higher against all other currencies – by the end of the week the GBPUSD was higher by around 1.5%.

In stark contrast to England, the Bank of Japan announced that it will continue its easy monetary policies as inflation remains subdued in Japan, causing the Yen to fall against its peers.

Cryptocurrencies had a stronger week, led by ETH which gained more than 10% and crossed the $3,000 mark. Traders could be moving back to ETH after setbacks in other smart contract blockchains like SOL and ONE.

BTC, which initially lost a bit of ground after the announcement of better-than-expected jobs number on Friday, came back roaring past $40,000 the moment the stock market opened. With the top two coins performing well, altcoins also witnessed a powerful bounce, with many registering double-digit gains by the end of the week which saw some notable news headlines.

Noteworthy Bullish Crypto News

Coming after Russia’s walk back on banning crypto, India has also decided not to ban the nascent asset class. India will instead impose a 30% tax on the sale of or on the income derived from the transfer of digital assets. Users would have to pay a 30% tax as long as they transfer cryptocurrency, regardless of whether they have a gain or a loss. While the bill sounds harsh, contrary to a full ban it at least legitimises cryptocurrency in India.

ADP employment number’s big miss could have made some traders less hawkish on interest rates expectation even though the non-farm payroll released on Friday was a beat. The market has already priced in 5 interest rate increases by the FED this year with a 0.5% rise in March. Some traders may think this could be a little excessive after looking at the mixed employment numbers, leading to plenty of dip buying on especially bombed out names like ETH.

MicroStrategy announced that it has purchased additional 660 BTC for around $25 million at an average price of $37,865 per coin. As of 31 January 2022, they hold 125,051 BTC acquired at an average price of $30,200 per coin.

Towards the end of the week another influential news was very welcomed by crypto traders: the USA is reintroducing a bill to reduce crypto tax on transactions as use cases increase, making it a happy development for crypto users in the USA. The bill would exempt crypto transactions from tax if they are worth less than $200.

Institutions and Miners Buying Led BTC Price Higher

The latest bullish tone in the price of BTC could be attributed to dip buyers continuing to nibble away at any small price fall, lending support to price. One such buyer last week was MicroStrategy, which added another 660 BTC to their coffers. Other than this high-profile name, there are many other smaller buyers who have contributed to the rise in price.

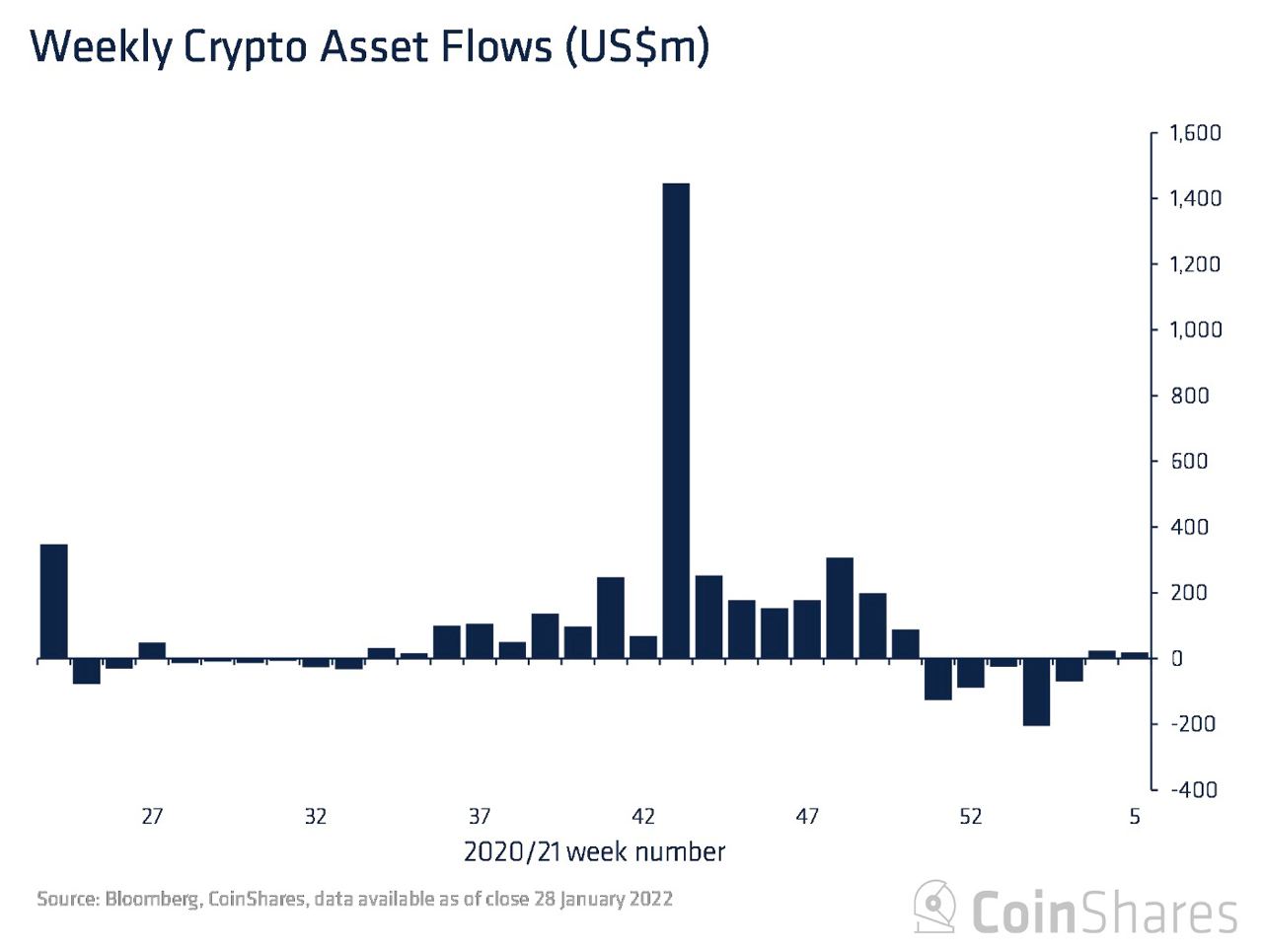

Digital asset investment products saw inflows for a second week totalling $19 million last week, while small, it continues to suggest institutional investors are beginning to cautiously add to positions at these depressed price levels.

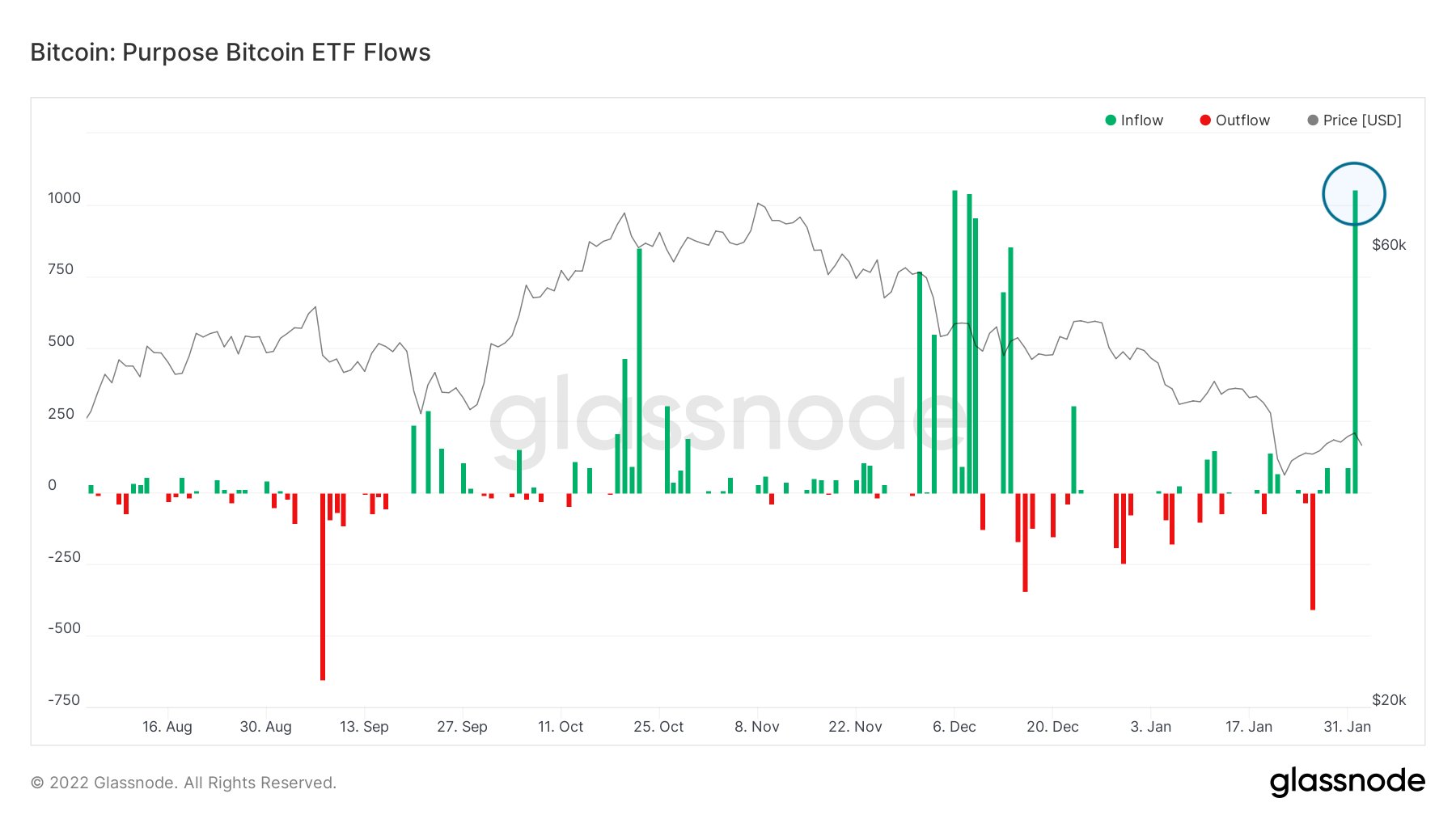

Crypto’s first Spot BTC ETF – the Purpose BTC ETF listed in Canada – also recorded its first significant inflow since 8th December 2021.

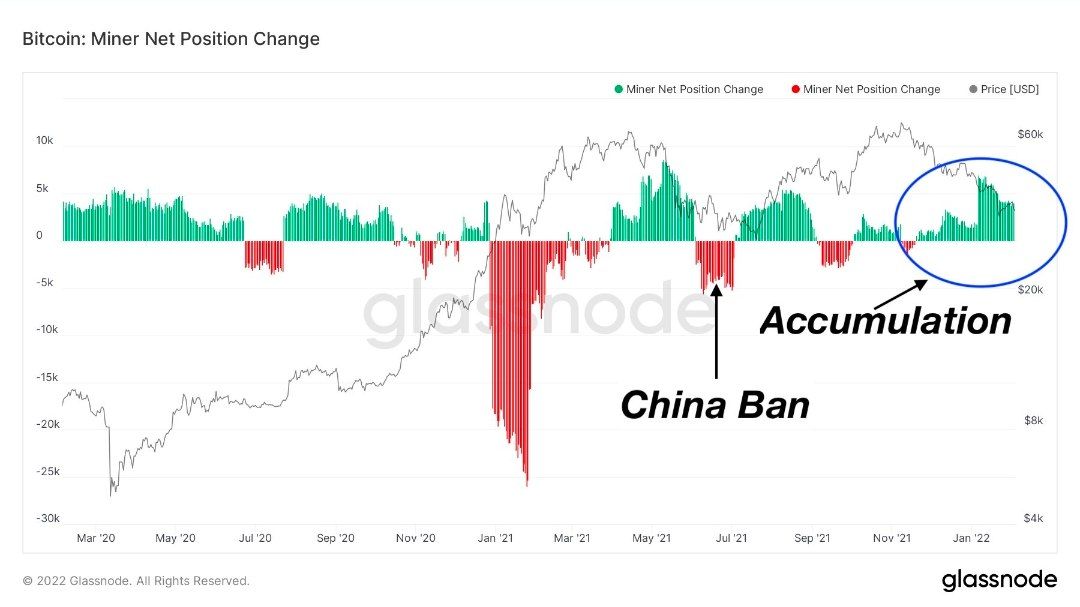

BTC miners have also continued to accumulate ever since November 2021 when they reportedly sold some BTC at its ATH.

Metrics Suggest BTC In Accumulation Phase

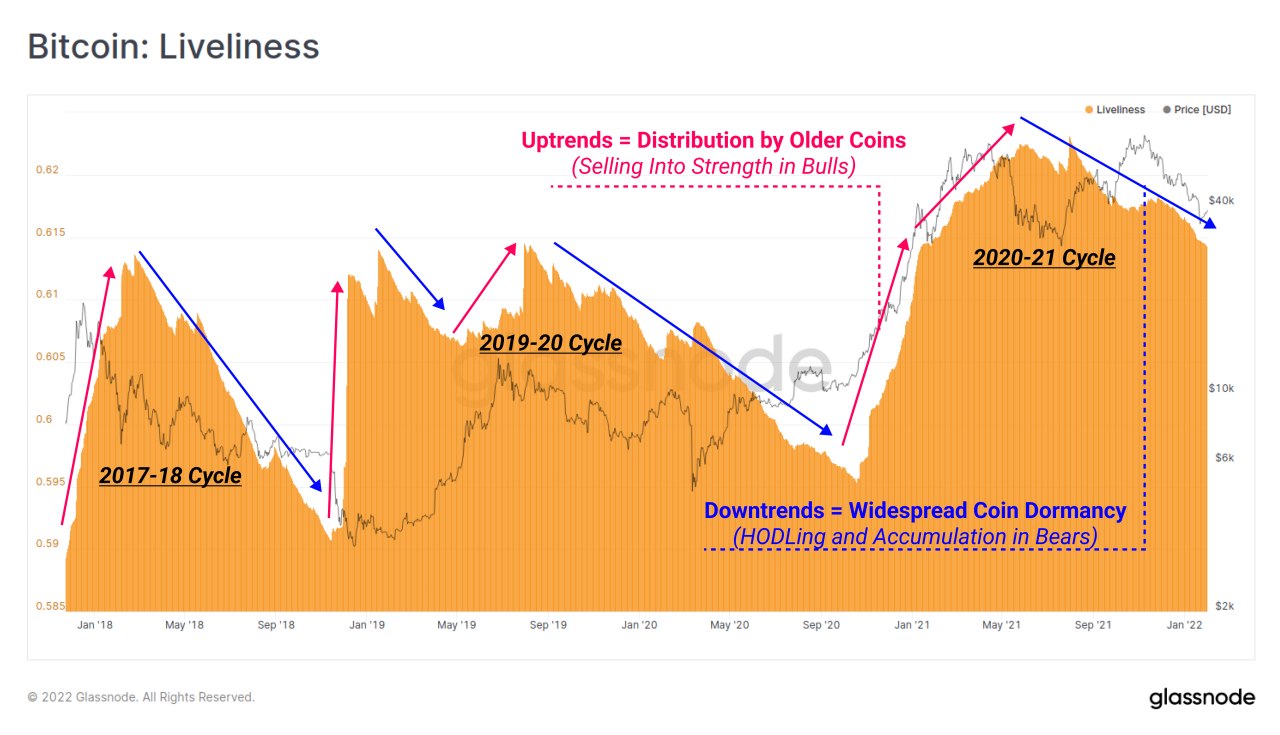

BTC Liveliness is a macro metric which tracks coin dormancy vs coin-day destruction.

The current market is showing that long-term holders prefer to hold, rather than sell. This leads to a downtrend in liveliness, typically seen within the context of bear market accumulation phases. As shown by the diagram below, it could signal that we are in the mid stage of a bear market. The positive point is that we may already be halfway through the bear market, bringing the bull market closer.

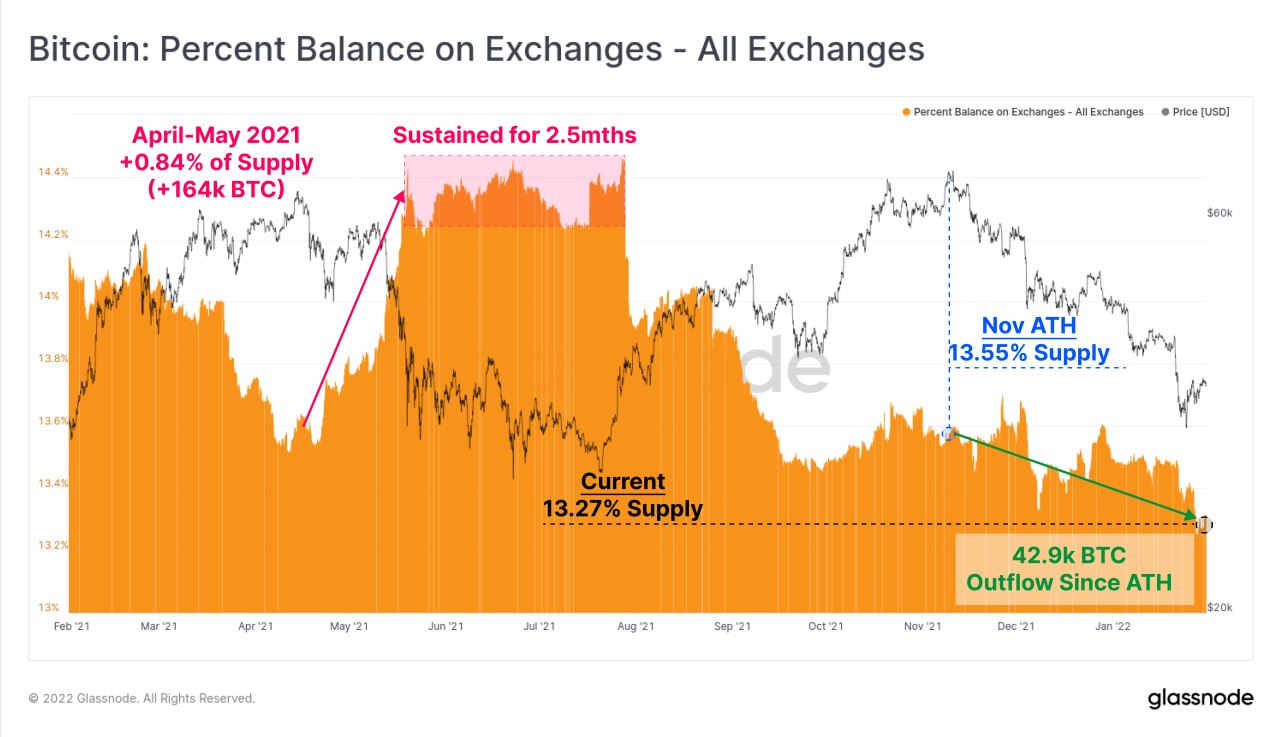

Data shows that accumulation is still ongoing, resulting in even lower amounts of BTC being held at exchanges. BTC exchange-balances have currently dropped to multi-year lows, with a total of 42,900 BTC in outflows since the November ATH.

This is very different from the May 2021 situation when exchanges had 164,000 BTC in net inflows as can be seen in the diagram below. This may suggest that the current bear market could be more short-lived than previous bear markets as the supply crunch of BTC gets worse.

ETH Price Jumps After Whales Purchase

As predicted in our last week report, traders have indeed turned bullish on ETH after problems surfaced in other blockchains. ETH surged more than 10% for the week leading the entire market and even outdoing BTC which ended the week up by 8% after its drop early in the week.

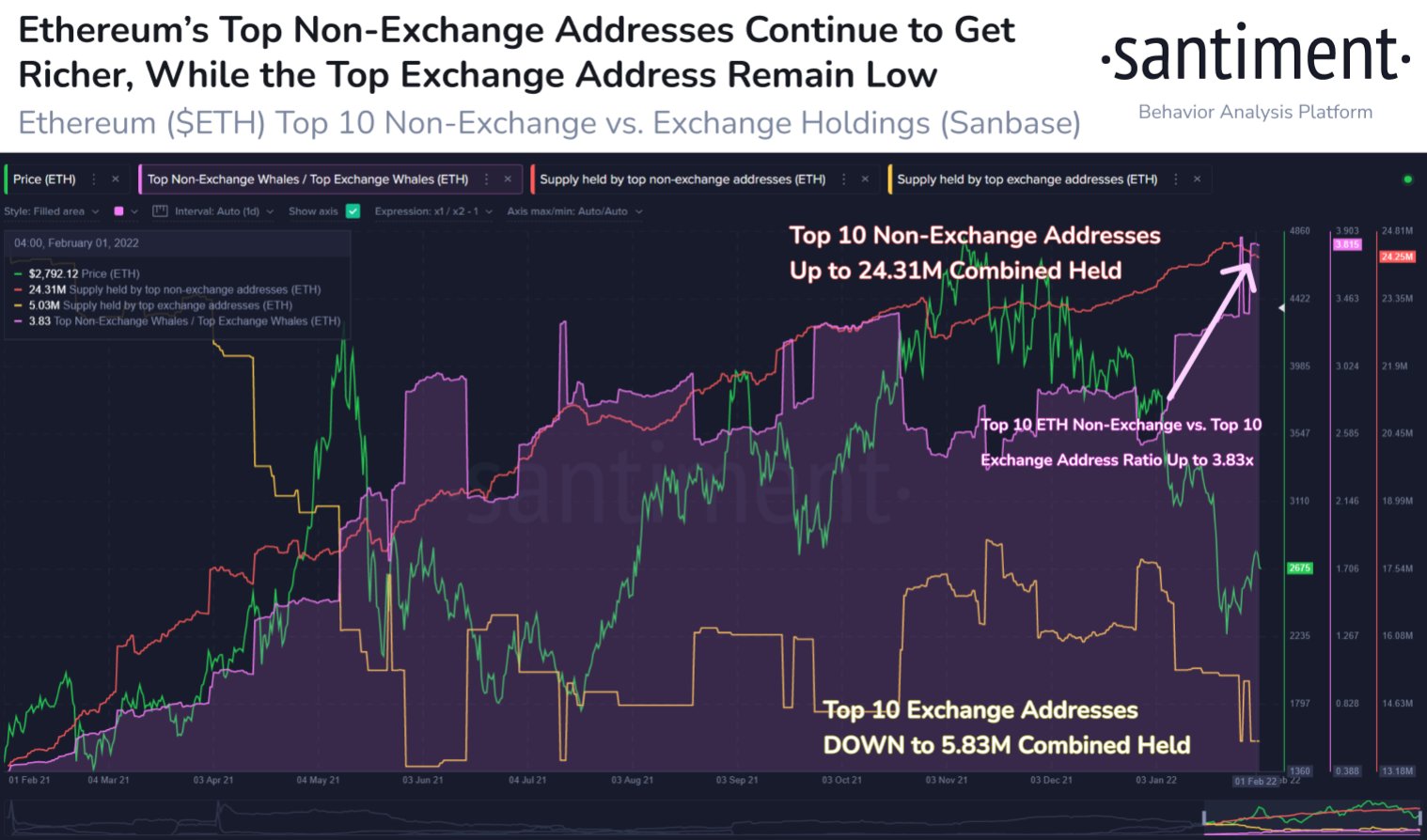

As ETH price continued falling early in the week, top ETH addresses were observed to be scooping up the coin aggressively. It can be seen through the vertical increase in supply held by the top 10 wallets in the diagram below. Those largest non-exchange addresses now hold 24.31 million ETH, while the top 10 exchange addresses have seen an in-tandem drop in supply held at just 5.83 million units.

Metaverse Tokens Edge Higher After Meta-led Selloff

Altcoins are now mostly in the green area after BTC and ETH bumped prices across the board. The leading gainers are MANA, LEO, XTZ, QNT, and YOUC. A commendable market segment consists of the Metaverse tokens, which had experienced a sharp selloff mid-week after Meta – former Facebook,- reported a $10 billion loss on its augmented and virtual reality division. However Metaverse tokens rebounded strongly, trading at even higher levels than they were at before Meta results.

Even though prices have bounced more than 10%, funding rates have remained in the negative territory over the quiet weekend as prices consolidated on low volume. The negative funding rate implies that either retail long bets have not flooded the market yet, or that there are still more short than long opened positions. However the possibility for further upside remains because when the market bounced higher last Friday, only about $160 million worth of positions were liquidated. Normally, it needs between $800 million to $2 billion worth of liquidations for the market to be considered to have flushed out traders on one particular side.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.