Recap

Last week saw US stocks rebound, recouping losses from the previous week, while the USD extended losses and Gold rose to a fresh record high. The moves came as the marker weighed up a mixed US inflation report and assessed the likelihood of a 50-basis-point rate cut at the coming FOMC meeting.

Major events

Federal Reserve rate decision

The Fed will announce its interest rate decision at the end of a two-day meeting on September 17th to 18th. It’s as good as certain that the Fed will cut rates, but the size of the rate cut is up for debate. The market has flip-flopped over whether the Fed will cut rates by 25 basis points or opt for an outsized 50 basis point rate cut on Wednesday. Either way, this will be a first-rate cut in early 2020.

Former New York Fed President Bill Dudley said at the end of last week that there was a strong case for a deeper cut as the Fed tries to navigate towards a soft landing for the economy. His comments, in addition to reports from the Financial Times and the Wall Street Journal, suggested that some policymakers were struggling to come to a decision, fuelling expectations for a larger cut.

How big will the Fed go?

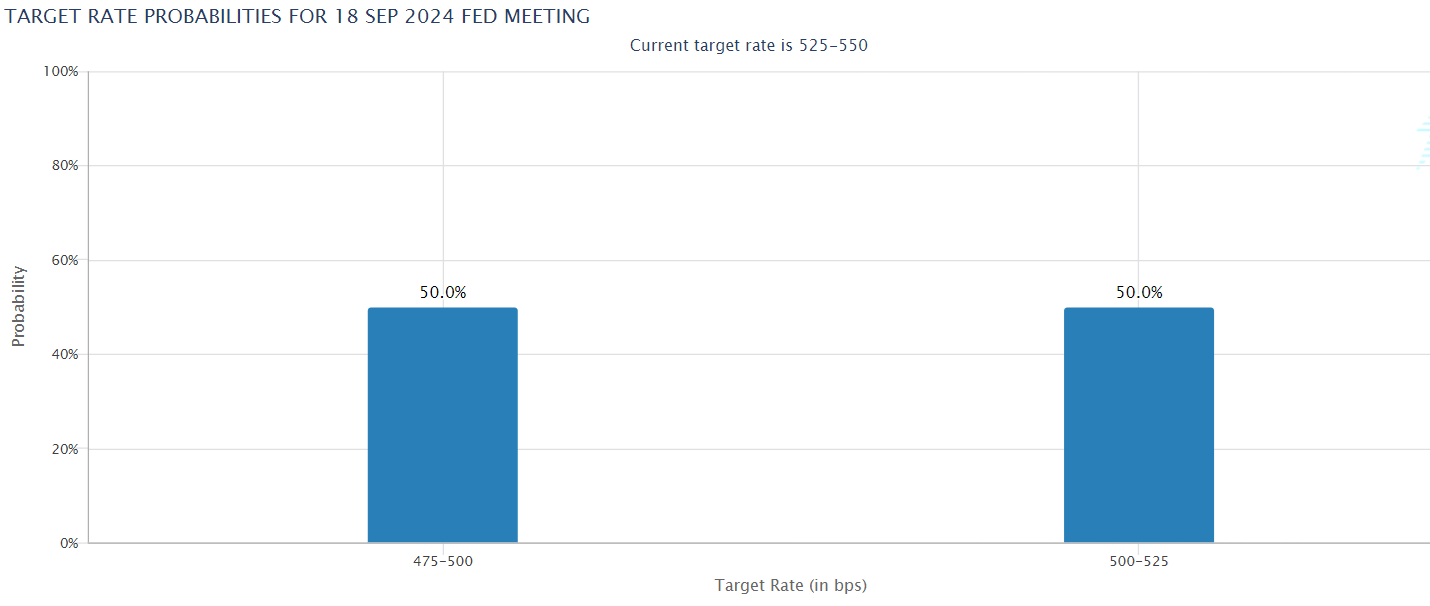

The market sees the decision as a 50/50 coin toss over whether the Fed will reduce the current rate of 5.25% to 5.5% by 25 or 50 basis points. There is a case to be made for both.

Inflation is above the 2% target on an annual basis, and core monthly inflation was hotter than expected; this would suggest just a 25 basis point rate cut. However, other data, including jobs reports, indicate that the labor market is weakening, raising concerns that the Fed may already be behind the curve.

Given that the market is 50/50, there will be volatility, whatever the outcome. An outsized cut, however, could spook the market, raising fears of recession and sending stocks and the US dollar crosses, such as EUR/USD and GBP/USD, sharply higher. Safe-haven gold and the Japanese yen could benefit.

Meanwhile, a 25 basis point rate cut could support the view that the Fed is adopting a steady, methodical pace of rate cuts. This pace could still be bearish for the USD but may well benefit stock indices and Gold.

Gold trades at a fresh record high at the start of the week, with the prospect of a lower interest rate environment pulling USD lower and lifting the precious metal.

US retail sales

US retail sales will also be closely watched on Tuesdays as investors wait to see whether the robust rebound seen in July can be sustained. Economists expect retail sales to fall 0.2% in August compared to the previous month. However, given that real disposable incomes are still proving to be resilient and consumer confidence data on Friday reached a recent high, consumer spending is expected to rise again in the coming months. The data is unlikely to provoke a big reaction in the markets, given that the focus is on the Fed.

The tech-heavy Nasdaq 100 rallied almost 6% last week, recovering losses from the previous week and marking the strongest weekly rise since late October 2023. In-line retail sales and a 25 basis point Fed rate cut could help the Nasdaq 100 recover towards its record high of 20,750.

BoE rate decision

The Bank of England is expected to leave interest rates on hold when it meets on Thursday after reducing rates by 25 basis points at the August meeting. The monetary policy decision came as service sector inflation cooled more than expected in July, and economic output stagnated in June and July. Meanwhile, wage growth has also continued to ease, supporting the view of declining underlying price pressures.

That said, service sector inflation and wage growth are still higher than the Bank of England is comfortable with, and policymakers made it clear in the August meeting that this will not be a rapid easing cycle. The market is pricing in just a 25% chance of a rate cut this week even though the ECB cut rates last week, and the Fed is expected to reduce rates this week.

Instead, the market expects the Bank of England to hold out until November before cutting rates again.

GBP/USD is rising towards 1.32 after rising 0.35% last week. A dovish-sounding Federal Reserve and a more cautious BoE could help the pair back up towards 1.3265 and fresh 2024 highs.

UK CPI

Inflation data for August will be released on Wednesday, the day before the BoE meeting, and could impact investors’ expectations.

UK CPI inflation is expected to be 2.2% in August, which is in line with July’s, and service inflation is expected to rise to 5.5% from 5.2% previously. Hotter than forecast inflation could see the market push back BoE rate cut bets, boosting GBP/USD.

BoJ rate decision

The Bank of Japan is the third and final major central bank to announce its interest rate decision this week. The meeting comes after the BoJ hiked interest rates to 0.25% in July and scaled back its purchases of Japanese government bonds.

This was a momentous move, given that the BoJ had not raised rates for over a decade, and the hike came far sooner than economists had expected. As a result, volatility ripped through equity and currency markets in the days following as the carry trade unwound.

Investors are weighing the likelihood of an August rate hike. Despite hawkish comments from BoJ officials last week, the expectation is that the BoJ will keep rates on hold at this time. The deputy BoJ governor, Himino, noted that the central bank was still examining the impact of its July move.

Furthermore, the data provides no compelling argument to support a back-to-back rate cut. The leading party’s LDP leadership election and the change of Prime Minister on September 27th may prompt the central to move later in the year, most likely in December.

The diverging BoJ – Fed monetary policy outlook has pulled USD/JPY to an 8-month low this month. Hawkish commentary from the Bank of Japan and a more dovish Federal Reserve could see the pair test 137.25, the July 2023 low.

Meanwhile, the Nikkei 225 failed to recover in the previous week, ending the week flat after previous losses. The Nikkei 225 has booked a series of lower highs and trades below its 200-day moving average, keeping bears in control.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.