Weekly recap:

US Global stocks recap

US stocks rose for a third straight week, reaching multiple record highs before falling back on Wednesday after the Federal Reserve cut interest rates by 25 basis points, but warned that a December rate cut was not a foregone conclusion. As a result, the bond market sold off, and market December rate cut expectations fell to 70% from 90%. Stock indices slipped, and the USD rose.

Major US data/themes

Last week’s high-stakes meeting between President Trump and China’s Xi Jinping went well but stopped short of an all-out trade deal. Trump lowered tariffs on Chinese imports to 47% from 57% in exchange for China buying soybeans and keeping rare earth exports flowing. This eased trade tensions, which should reassure investors that the relationship is on a more stable footing.

Corporate earnings have been better than expected, showing that profitability remains resilient. Five Magnificent seven firms reported earnings. Meta and Microsoft fell sharply amid concerns over AI spending, while Alphabet, Amazon, and Apple impressed, lifting indices such as the Nasdaq 100 at the end of the week. Earnings will continue this week.

Gold moves

Gold prices fell over 2.4% last week, marking the second straight weekly decline as the market weighed up reduced expectations for a December rate cut, and improved US-China trade tensions. The stronger USD also weighed on USD-denominated Gold. Even so, the precious metal still posted gains of 3.7% in October and has posted gains every month this year except July.

Oil moves

Crude oil slipped modestly last week, falling 0.8%, as news that the US would impose sanctions on Russian oil firms Lukoil and Rosneft was quickly overshadowed by supply glut concerns. Over the weekend, OPEC+ agreed to increase oil production by 137k barrels per day, in line with expectations. The oil cartel also agreed to pause planned oil output increases in the first quarter of 2026, moderating plans to regain market share amid rising fears of a supply glut. OPEC+ has lifted output targets by 2.9 million barrels a day, or around 2.7% of global supply, since April, but has slowed the pace in recent months owing to concerns about oversupply. Oil prices are holding over $60.00 following the meeting.

Indian markets

Indian markets ended a four-week winning streak with minor losses as investors booked profits near record highs. The mild declines came amid weak cues from Asian markets and amid a cautious tone ahead of key earnings releases. Banks and Energy stocks outperformed while the healthcare sector lagged.

For the 28th straight week, Domestic Institutional Investors (DIIs) remained heavy buyers, buying stocks worth Rs. 18,804.26 crore. Foreign Institutional Investors (FIIs) continued to sell shares worth Rs 2,102 crore. However, FIIs turned net buyers across the month of October after 3 months of outflows.

Indian industrial growth eased to a 3-month low in September at 4% YoY as output in the mining nd electricity sectors fell.

USD/INR rose 1.06% last week, settling at 88.76 on Friday.

Pakistan markets

The KSE 100 fell 1% across last week, marking a second straight weekly decline, settling at 161,631 on Friday. Profit taking, rollover activity, and mixed corporate earnings weighed on sentiment.

The Pakistan Central Bank kept its interest rate unchanged at 11% for a fourth straight meeting, as recent floods had a milder-than-expected impact on crops and inflation, while growth and reserves continued to improve.

USD/PKR fell 0.03% last week to settle at 283.200 on Friday.

Week ahead (focus on the US & Asia)

US ISM manufacturing PMI (Monday)

Given the lack of U.S. government data owing to the ongoing shutdown, ISM PMIs will take on a more important role than usual, with the manufacturing PMI due on Monday and the services PMI on Wednesday. Using the S&P Global PMI data to shape expectations, manufacturing rose to 52.2 in October, up from 52 previously, while services rose to 55.2, defying expectations of a decline, and rose from 54.2 in September. This report noted that business activity growth in October was the second fastest pace this year and was accompanied by the largest rise in new business seen in 2025 so far.

The market will look to see if this trend shows in the ISM PMIs. The employment subcomponent showed that employment increased modestly but weakened in manufacturing. With inflation still above target, attention will be on prices paid, particularly in the service sector, which is not directly linked to tariffs and could give more information about inflation in the economy. Weak data could fuel expectations of a Fed rate cut and lift stocks such as the Dow Jones Industrial Average.

Earnings season

US earnings season continues this week, with big names including Palantir, AMD, Uber, and Spotify reporting. As of October 31, 64% of S&P 500 companies have reported results indicating that EPS will jump 10.7% this quarter. Solid results will help the S&P 500.

In India, earnings season has so far delivered mixed results. Several heavyweights are scheduled to release earnings this week, including Bharti Airtel, Titan Company, Adani Enterprises, Adani Ports, and InterGlobe Aviation, among others, which could drive sentiment and help lift stock indices such as the Sensex.

Indian Manufacturing and Services PMI (Monday & Thursday)

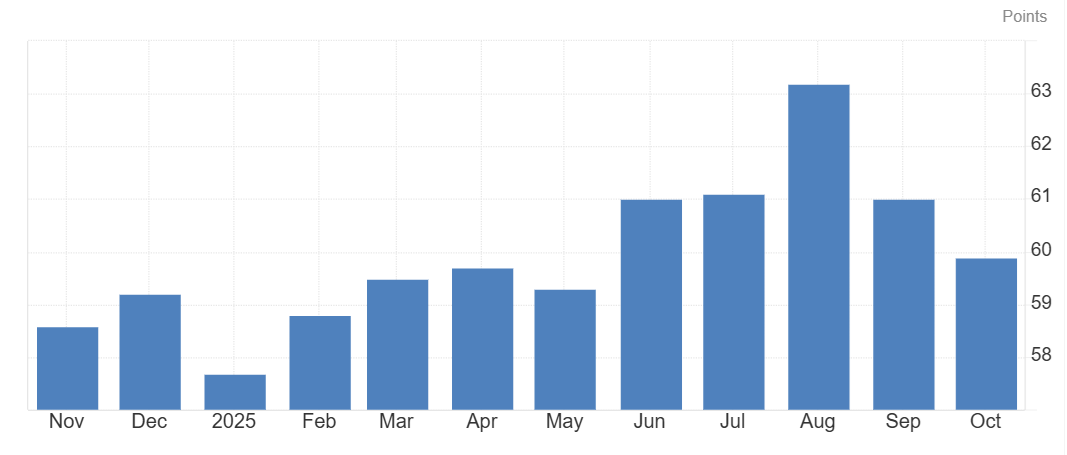

India’s manufacturing PMI rose to 59.2 in October, up from 58.4 in September, growing at the fastest pace in 5 years. The acceleration in growth comes amid strong domestic demand and increased investment. The data is lifting sentiment at the start of the week. Attention will now turn to Wednesday’s services, and composite PMI data is due to be released on Thursday, November 6th. Expectations are for the services activity to improve to 60.9 from 58.8 in September. The composite PMI, a good gauge of business activity, is expected to rise to 61 from 59.9. The level 50 separates expansion from contraction.

Indian Composite PMI chart

Pakistan inflation data (Monday)

Pakistan CPI accelerated to 6.2% year on year in October, up from 5.6% in September, and is higher than the finance ministry’s estimate of 5 to 6%. On a monthly basis, CPI rose 1.8% in October, up from 2% the previous month, marking the highest level since November 2024. In its monthly outlook last week, the Ministry of Finance noted that the uptick in inflation was a temporary phenomenon in the wake of floods, projecting the reading to range between 5 percent and 6%.

ADP payrolls (Wednesday)

In the absence of BLS data due to the ongoing US government shutdown, the market is having to make do with third-party reports as to the health of the US economy. So far, it hasn’t been too challenging to assess the health of the economy using ADP payrolls this week, following the US CPI release last week. The Fed cited the labour market slowdown as a reason for cutting rates. The most recent ADP payroll report for September showed -32k jobs were lost, making it the second straight month of a negative print. In fact, over the past 4 months, there’s been only one positive month: July, with 104K jobs added.

This is a slowdown from the first five months of the year, which supports the Fed’s view of a cooling jobs market. Expectations are for 25k jobs added in October. Weaker-than-forecast ADP payroll data could boost Fed rate-cut expectations and pull the USD lower, dragging USD/JPY lower.

US Supreme Court Tariff Hearing (Wednesday)

US Supreme Court will hear arguments in the case challenging President Trump’s reciprocal tariff policy. This hearing follows a federal court ruling that Trump exceeded his authority under the International Emergency Economic Powers Act (IEEPA) in imposing tariffs on several trading partners, including Mexico, Canada, and China. The court is expected to consider whether the IEEPA allows the president to impose tariffs beyond its intended scope. Tariffs will remain in place until the court’s final decision, expected early next year.

According to Bloomberg, there is currently a 60% chance the court will rule against Trump, leaving the US government exposed to refund claims that could hit the US economy. The market is unlikely to react until the final decision is made, which could impact market sentiment and the USD.

Chinese trade balance (Friday)

Chinese trade balance last month showed a narrower surplus as both exports and imports surprised to the upside. Exports grew by 8.3% year on year, up from 4.4% in August, a solid performance that few expected in the midst of the trade war. Exports are holding up better than expected, boosted by stronger demand from the rest of the world, which offsets the US drag. Meanwhile, imports were the largest surprise, reaching a 17-month high of 7.4% up from 1.3% in August. This was a surprise given recent signs of softness in domestic demand. However, it’s worth noting that the upcoming data could prove to be sale given the recent trump XI meeting, which helped to de-escalate trade tensions further and reduce immediate policy uncertainty, which likely impacted import-export behaviour in previous months. Signs of strong export and import growth could boost the Hang Seng.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.