Bitcoin traded flat last week despite a 5% mid-week selloff. The largest cryptocurrency started last week at 57.8k and quickly rose to a peak of 61.5k before sellers took control, pulling the price to a low of 56.2k mid-week. Here, dip buyers came in, bringing the price up towards 60k at the end of the week. Heading into the new week, Bitcoin is again on the back foot, trading -1.5% at 58.7k.

Altcoins saw a mixed performance, with BNB and Ether booking gains of 2.2% and 0.47% last week, respectively. Meanwhile, Solana was one of the worst-performing major altcoins, falling 5.5% last week.

US recession fears ease & Fed September rate cut bets are in focus

Macro continues to be a strong driver of the crypto market owing to an absence of major sector-specific factors. US data last week helped to calm recession fears while keeping bets on track for a September rate cut from the Federal Reserve.

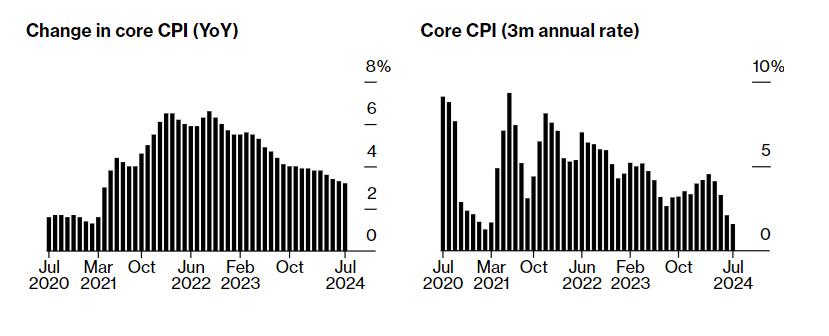

US inflation data (CPI) showed that inflation eased to 2.9% annually, down from 3%, which is in line with forecasts and the lowest level in three years. The data supports the view that inflation continues to cool toward the Fed’s 2% target level and reinforces the view that a September rate cut is likely.

Meanwhile, retail sales rose by a stronger-than-expected 1% in July. US Michigan consumer confidence was also ahead of estimates, helping to calm fears of a recession that had flared up at the start of the month following a weak US non-farm payroll jobs report.

As a result, the market reined back expectations of a 50 basis point rate cut from the Federal Reserve in September to 25%, down from a 50/50 probability just a week ago. The market continues to price in a 25 basis point rate cut.

Stocks post strongest gains since October 2023 & Gold hits an ATH

As inflation cooled and recession fears eased, US stocks saw exceptionally strong weekly performances. The S&P 500 gained almost 4%, its strongest weekly rise since October last year. Meanwhile, the Dow Jones rose back above 40k.

It wasn’t just stocks that outperformed; the prospect of a lower interest rate environment, a weaker USD, and renewed signs of China buying sent Gold above $2500 to a record high.

Meanwhile, the USD has fallen to a 7.5-month low against its major peers. A weaker USD can often help lift BTC/USD, although that doesn’t appear to be the case currently.

Bitcoin struggles to retake 60k

Despite the upbeat data, a weaker USD, and strong gains in stocks and Gold, Bitcoin has been trading relatively range-bound and has been unable to break above the 61K level. Sentiment in the market has slowed in the past week owing to a lack of crypto-specific catalysts. Bitcoin’s perpetual futures funding rates turned negative. Gas prices also slumped, which could be considered an indication of lower activity on the network.

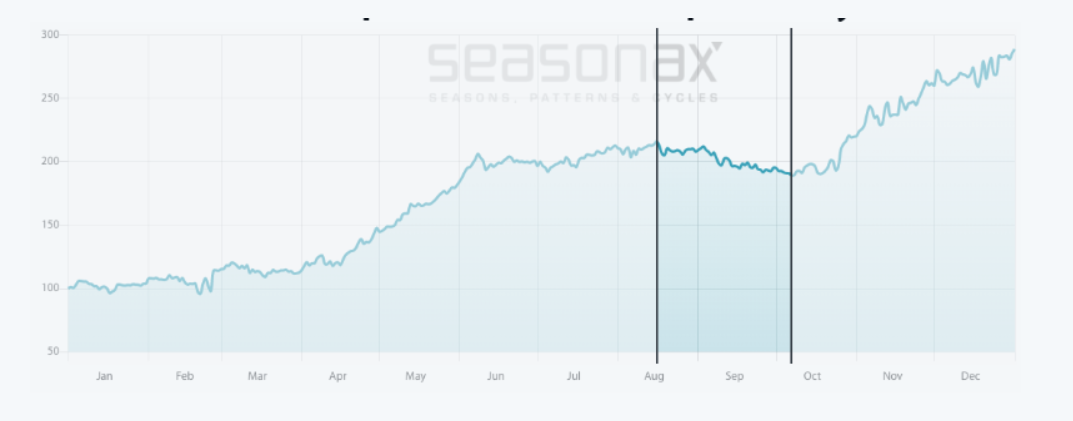

Bitcoin has struggled to push above 60k amid ongoing concerns over the distribution of coins from the Mt Gox estate and the US government. Still, the price has shown resilience to these distribution headlines, which bodes well for the outlook for the remainder of the year. Seasonality doesn’t favor Bitcoin in August or September, which could also play into Bitcoin’s indecision.

Bitcoin seasonality over the past ten years:

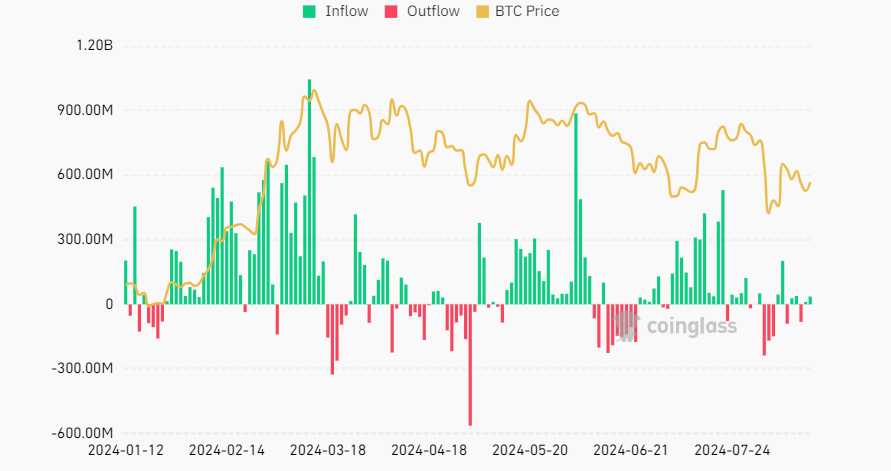

Bitcoin ETF flows & institutional ownership

Spot Bitcoin ETFs saw $32.4 million in cumulative net inflows last week. The products recorded four days of positive net inflows versus one day of net outflows. The only day in the red was August 14, when net outflows reached $81.4 million.

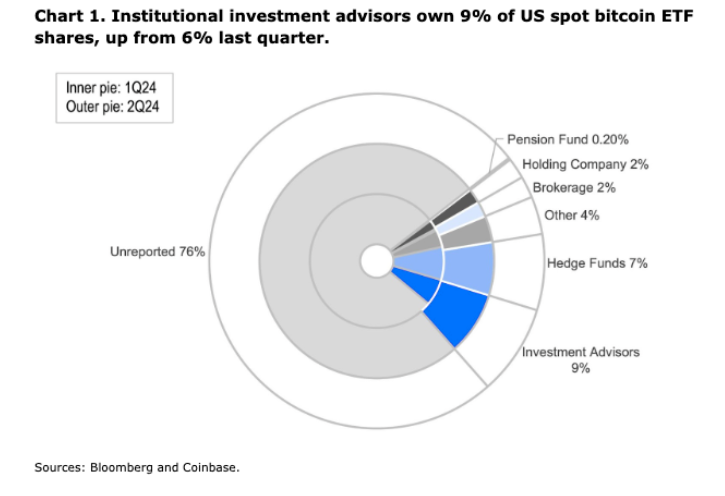

Updated 2Q2413F filings for US spot Bitcoin ETFs were released on August 14th and captured the position of institutional ownership as of June 30. Notable new holders included Goldman Sachs with $412 million and Morgan Stanley with $188 million, both of whom are likely to hold shares on behalf of clients as part of their private banking and wealth management arms.

Across Q2, the ETF complex saw net inflows of $2.4 billion, although total assets under management (AUM) of spot Bitcoin ETFs dropped from $59.3 billion to $51.8 billion. This is due to the Bitcoin price dropping from 70.7K to 60.3K.

Continued ETF inflows during Bitcoin’s underperformance could be seen as a positive- a promising indicator of sustained interest in crypto from new pools of capital.

Notably, a growing portion of these plays are driven by institutions, whose ownership rose from 24% to 21.4%. The proportion of institutional holders categorized as investment advisors increased to 36.6% from 29.8%.

We will likely continue to see the investment advisors’ holdings increase as more brokerage houses complete due diligence on these funds and they become more accepted within the institutional sphere.

Week Ahead

The outlook for US interest rates could become more apparent this week when Federal Reserve Chair Jerome Powell speaks at the central bank’s Jackson Hole Symposium at the end of the week. Before then, politics will be focused on the Democratic National Convention, and PMI data will shed some light on the strength of the economy.

1. Jackson Hole Symposium

Federal Reserve Chair Jerome Powell will speak on Friday, delivering a keynote address at the Central Bank’s annual economic symposium in Jackson Hole, Wyoming. The markets will be watching for signals of the pace and timing of rate cuts over the coming months. Fed Chair Jerome Powell could use this opportunity to prepare the market for a September cut, which could help the debate change from “Will they or won’t they cut” to “How big will they go?”. If traders hear rate cuts are coming, they could react favourably.

A lower interest rate environment benefits risk assets such as Bitcoin and stocks. Meanwhile, the USD could fall further, and Gold could reach fresh record levels.

2. FOMC minutes

The Fed will publish the minutes of the July FOMC meeting on Wednesday. At the meeting, the Fed left rates unchanged, but Fed Chair Powell acknowledged progress on curbing inflation, leaving the door open to a September rate cut. In addition to the minutes of the Fed meeting, several Fed officials are due to speak across the week and could provide more clues about the Fed’s next moves.

3. Democrat Convention

The US Presidential election race is heating up. Kamala Harris is currently neck and neck with Trump. The Democrats will look to boost Kamala Harris’ candidacy at the party convention in Chicago. Key Democrat figures are expected to deliver speeches supporting Harris. Investors will be keen to gain clarity on Hariss’ policy position. So far, Trump has maintained a pro-crypto stance across the election campaign, making him the preferred candidate in the crypto space. When Trump was ahead in the polls, Bitcoin and cryptocurrencies received a boost. Now Kamala Harris could take the lead, sentiment toward crypto could take a hit.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.