Bitcoin gained last week, rising 4%, adding to the 5% gains in the previous week. The price started the week at 63.5k before rising above the key resistance of 65k to reach a peak of 66.5k on Friday, its highest level for two months. While BTC has slipped back below 65k at the start of the new week, the price is set to gain over 10% in September, a typically bearish month for Bitcoin.

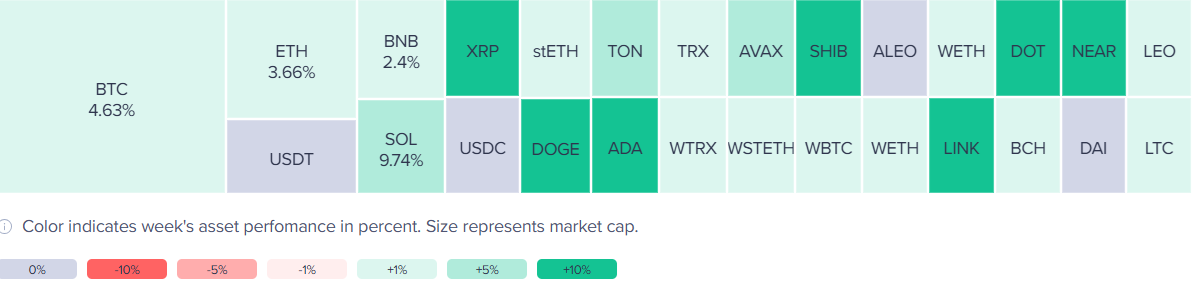

Altcoins were also in the black last week as the positive mood boosted cryptocurrencies across the board. Ether rose 3.8%, and BNB rose 2.8%. However, Solana and XRP outperformed, rising 9.7% and 12.2%, respectively. Meanwhile, AI link NEAR jumped 23%, and Shiba Inu surged 34%.

Along with Bitcoin and altcoins, other risk assets were on a roll last week, with the US S&P 500 and Dow Jones reaching multiple fresh record highs. The correlation between stocks and crypto remains high.

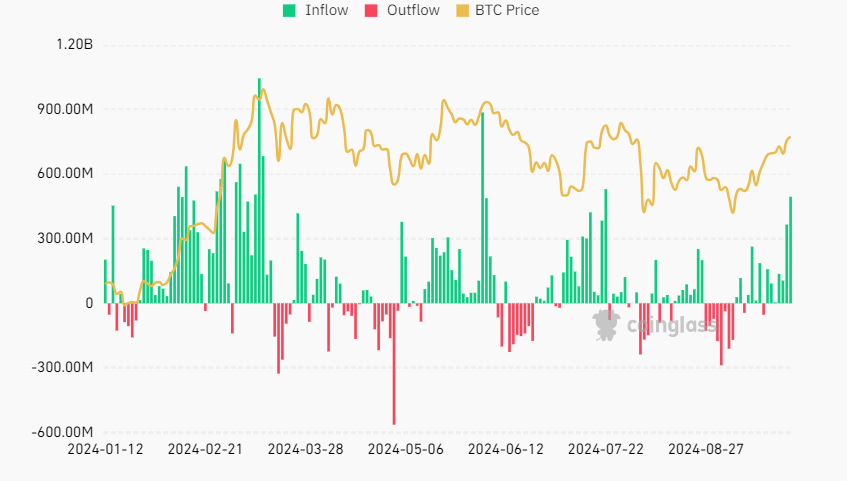

Bitcoin ETF inflows rise $1.1bn

Bitcoin spot ETFs saw $1.1 billion in inflows last week, marking the most since mid-July. BlackRock, Ark 21 shares, and Fidelity Bitcoin ETFs led the way with $499 million, $289.5 million, and $206.1 million in inflows, respectively.

According to Farside data, September 27 saw $494.4 million in inflows, the best-performing day since June 4th.

The latest data shows that inflows for the 11 spot BTC ETFs combined have reached $18.8 billion since they were launched in January. The rise in spot ETFs comes as the Bitcoin price is now just 10% off its all-time high of 73.7k.

Meanwhile, spot Ether ETFs recorded $85 million in inflows this week, their largest weekly gain since early August. Since launching in July, Ethereum products have seen inflows of $1.1 billion, factoring in the $2.9 billion outflows from Grayscale.

Macro outlook

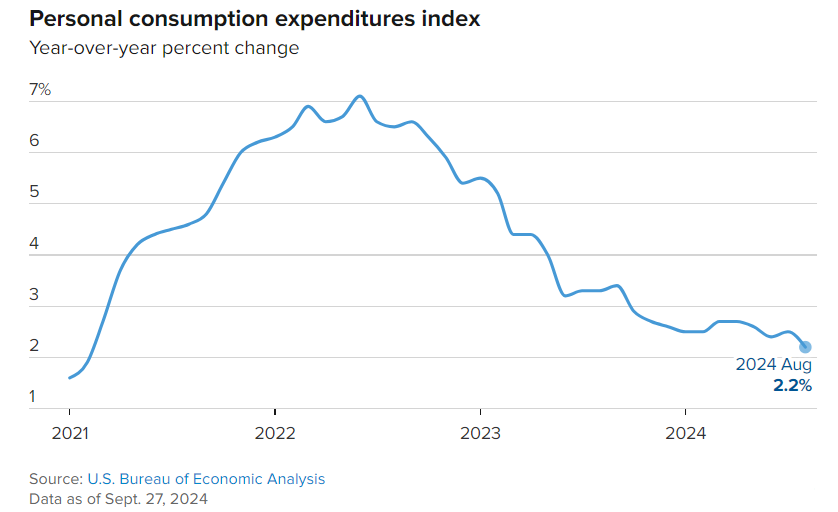

Sentiment has been bullish owing to a combination of factors, including the Federal Reserve cutting interest rates by 50 basis points on September 18th, signaling the start of a rate-cutting cycle. The market is currently pricing in a 50/50 likelihood that the Fed will cut rates by 50 or 25 basis points in the November meeting. A lower interest rate environment increases liquidity, which benefits risk assets such as Bitcoin.

Data this week showed that the US economy remains resilient despite some labour market concerns raised at the previous FOMC meeting. US GDP came in at 3%, which is in line with forecasts reaffirming the view that, at least for now, recession risks remain low. US core PCE, the Fed’s preferred gauge for inflation, eased to 2.2% annually and was weaker than expected on a monthly basis, supporting the view that the Fed will be cutting rates over the next meetings.

Meanwhile, China, the world’s second-largest economy, unveiled a vast stimulus program, including fiscal and monetary stimulus measures such as record-breaking rate cuts, liquidity support for stocks, and a drop in the banking reserve requirements, to boost lending and reduce existing loan burdens. The lower banking reserve requirement, in particular, could benefit market liquidity, which is often positively correlated to Bitcoin’s performance. While risk assets rose sharply on the news amid an improved outlook, there will likely be a lag in the possible impact of these measures.

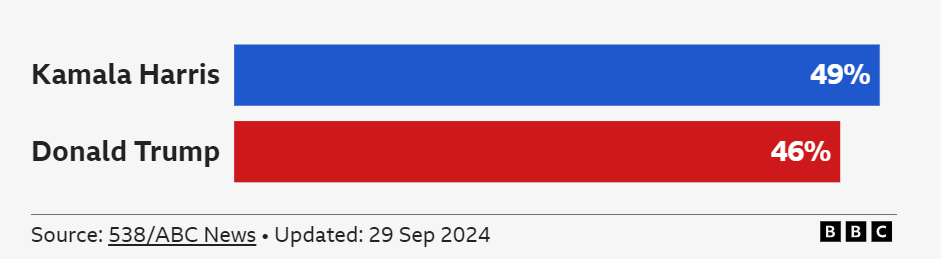

Political update: Harris talks crypto

With about a month before the US presidential election, Vice President Kamala Harris has stretched her lead over Republican candidate Donal Trump in what is still a very tight race. Even so, crypto traders feel more relaxed about a win by Kamala Harris after she gives reasons for optimism.

In a speech last week in Pittsburgh about the economy, Harris said it was important for the US to maintain its dominance in blockchain technology, which facilitates cryptocurrency trades such as Bitcoin. The Harris campaign also released a policy document saying it would encourage innovative technology such as AI and digital assets. Furthermore, on Sunday, Harris also promised donors in New York City a safer business environment for digital assets.

While Harris has not detailed any specific plan for promoting crypto, recent statements have shown that she values crypto and favors a friendlier relationship with the crypto industry than the Biden administration.

Bitcoin enters a bull market-Q4 outlook

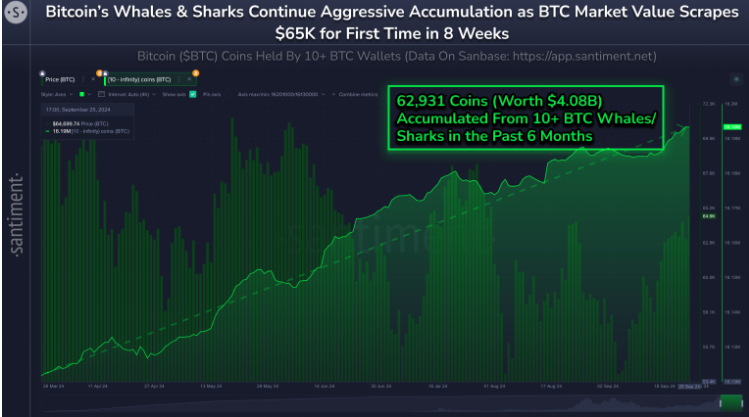

Bitcoin has entered a technical bull market, rising over 21% from its lowest point this month. Increased accumulation by whales and sharks has primarily fueled the price action.

MicroStrategy has been at the forefront of these purchases, buying $458 million earlier this month. Institutional investors have been driving inflows totaling $600 million this month.

With the Fed and China pursuing looser monetary policies, these conditions have historically been very supportive of Bitcoin. Therefore, the current macro outlook is favorable heading into Q4 and is set to continue to be supportive, provided the US economy doesn’t slow too sharply.

Seasonality is on Bitcoin’s side. The cryptocurrency has recorded 50% or higher gains in Q4 in five of the past nine years, meaning that Q4 is typically a bullish time for the cryptocurrency. This coincides with the Bitcoin price testing its key 200 SMA resistance.

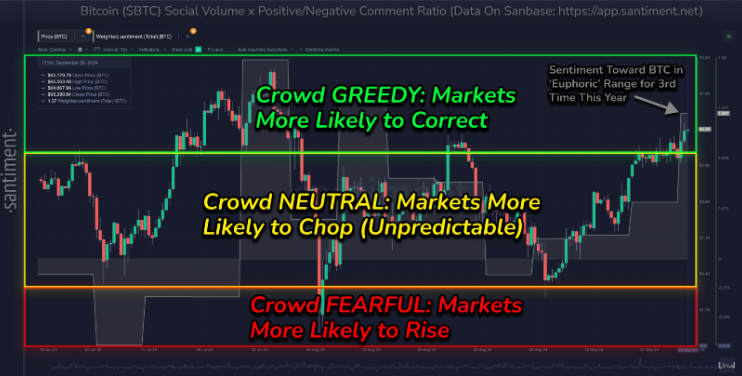

While Q4 is historically a strong quarter for Bitcoin, near-term bull patience could be tested as sentiment has crossed into Greedy levels, where Fear Of Missing Out (FOMO) takes hold. This typically coincides with local tops and could suggest that a correction is coming, which we could see at the start of this week.

Week ahead

On the data front, this week is a big week for US data, which, together with a speech from Fed Chair Powell, could provide more clues about the appetite of Federal Reserve policymakers for another outsized interest rate cut in November.

NFP report & Powell

Federal Reserve chair Jerome Powell will discuss the US economic outlook at the National Association for Business Economics conference.

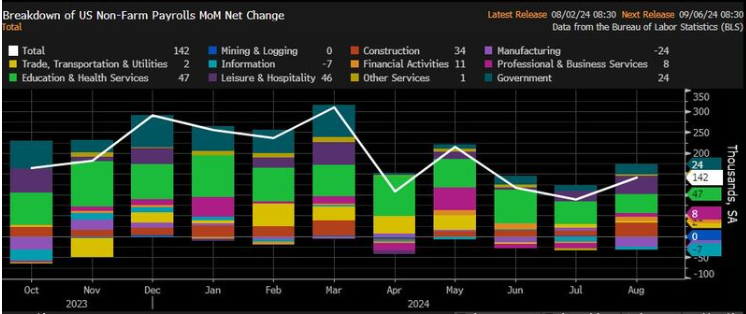

On Friday, the September jobs report is expected to show a healthy yet slightly cooler jobs market. Economists expect payrolls in the world’s largest economy to rise by 146,000, similar to the level seen in August and a level that puts the three-month average job growth at its weakest level since mid-2019. Meanwhile, the unemployment rate is expected to hold steady at 4.2%, while average earnings are projected to be frozen at 3.8% yearly.

This will likely be the last clean US employment report before the Fed’s policy meeting in early November, given that the Boeing factory workers walked out mid-September and dock workers on the Atlantic and gulf coasts are potentially striking from October 1st.

Ahead of Friday’s NFP, several lead indicators, including JOLTS job vacancies, ISM manufacturing and services PMIs, and ADP payrolls, should be monitored.

Investors will want confirmation that the labour market is not collapsing, particularly after the July jobs report’s scare. A steadily cooling jobs market will help boost Fed rate cut expectations without fearing a further recession.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.