US stocks declined for the week, with the Dow dipping 0.28%, the S&P 500 closing down 1.27% and the Nasdaq losing 3.86%. The market moves came as investors reacted to FED minutes released on Wednesday. The minutes indicated a changing tone by the FED, signalling that it will act even more aggressively to fight inflation.

FED officials plan to shrink the balance sheet by $95 billion a month, while there are also strong indications that 50 basis point interest rate increases are ahead.

Initial Jobless Claims released on Thursday which had crashed to its second lowest level on record further fuelled the flames of an aggressively tightening FED.

The pivot by the FED has caused rates to shoot higher, with the 10-year Treasury yield hitting a new three-year high by Friday, rising above 2.7%. The rate ended last week at 2.38% and started the year at 1.63%.

The DXY thus gained 1.3% to close in on the 100-mark against a basket of its peers, while the Euro and GBP continued to decline.

Precious metals however, did not seem affected by the strong USD as both Gold and Silver notched gains last week. Both metals gained around 1.8% last week and are flat at the start of trading today.

On Oil, Brent Crude dropped 1.5% while WTI Crude slid 1% last week. Member nations of the International Energy Agency (IEA) agreed to release 60 million barrels of oil over the next six months to match the 180 million barrels the USA said it would release from its reserves at the end of March. For the short-term, both moves could prevent oil prices from rising further. As a result, oil prices have continued to plummet at the start of this new week, falling another 2.5% from the close on Friday. Even Brent Crude has now broken below $100.

Cryptocurrencies had as bad a week as the Nasdaq due to the threat of a more aggressive FED sending crypto prices reeling. BTC fell around 9% from its early week price of $45,800 to $42,000, while ETH fell about the same magnitude after hitting a recent high of $3518, only to fall to $3,200. Altcoins fared far worse, with many falling at least 20% off their early week prices. Sentiment is currently at a low point again, with the Greed and Fear Index at the Fear region of 30 points.

Large BTC Purchases Failed To Excite Market

BTC edged higher to start last week after two large BTC purchases were revealed on Tuesday. However, by the end of Wednesday, prices were down sharply after FED meeting minutes revealed a more hawkish FED than expected.

The early week positivity was started by MicroStrategy, which through its subsidiary, MacroStrategy, announced that it has purchased an additional 4,167 BTC for $190.5 million at an average price of $45,714 per BTC from the $200 million loan it received in March. As of April 4 2022, MicroStrategy holds 129,218 BTC acquired for $3.97 billion at an average price of $30,700 per BTC.

Following MicroStrategy’s announcement, the LUNA Foundation was also seen to have bought another 5,000 BTC worth around $231 million, and further indicated the addition of $100 million in AVAX to the UST reserve. This positive news prompted traders to pile into long positions ahead of Wednesday’s FED minutes. These positions were subsequently liquidated after the FED minutes was released. Around $500 million in long positions were liquidated within 24 hours of the release, a high number of liquidations in the current market condition.

Despite the weak showing in the market however, BTC metrics are still showing an ongoing accumulation trend.

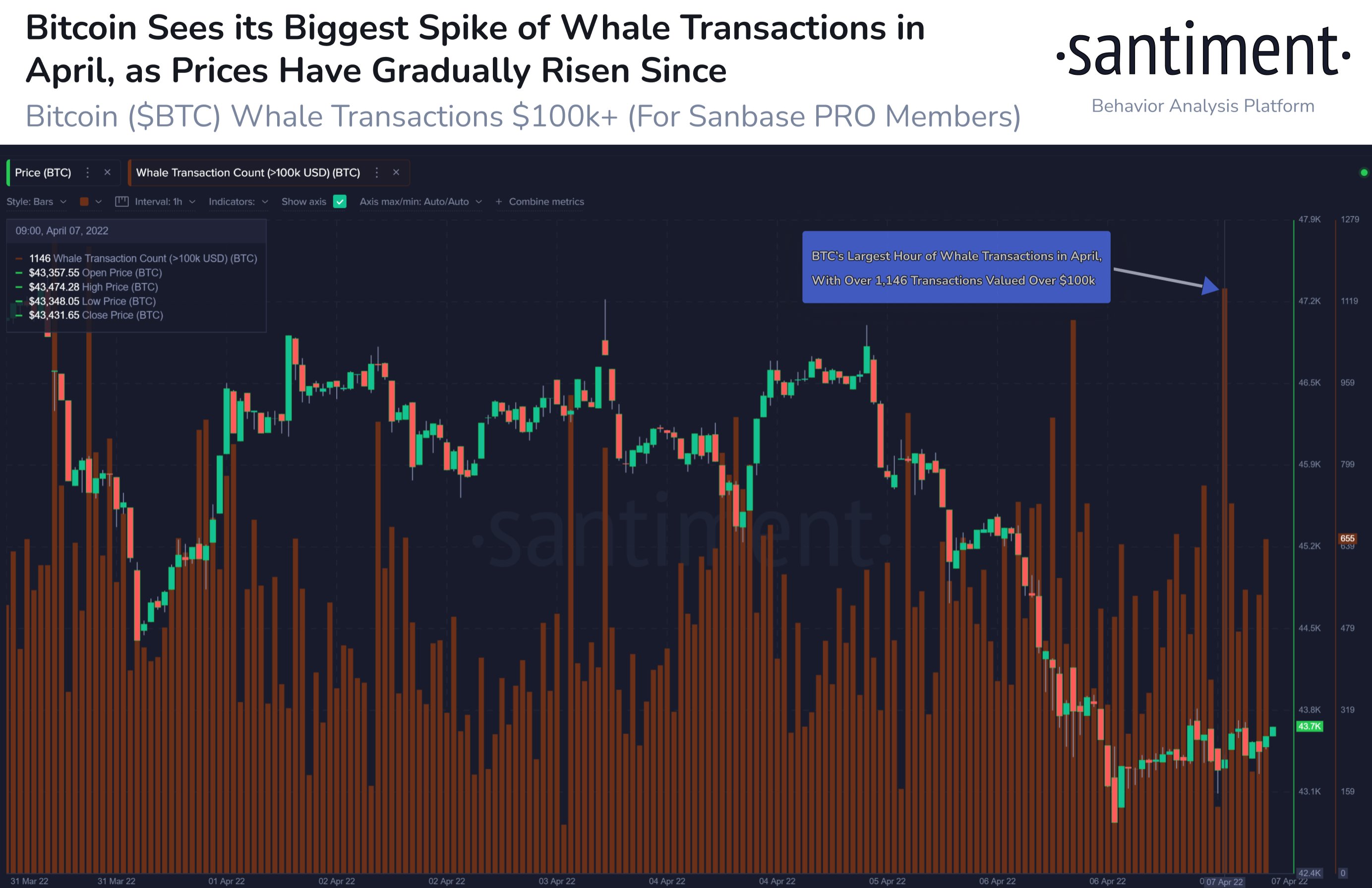

As the price of BTC dropped to its lowest point of the week on Thursday, as many as 1,146 transfers valued at $100,000 worth of BTC or more were seen to have been transacted. While this may not necessarily be bullish since it means there are sellers, it nonetheless shows that there are still large buyers waiting for price dips to accumulate. It is possible that the sellers could be panic-selling traders dumping their tokens to whales who are buying the dip.

Buy and hold - the best investment strategy

Accumulation Still Ongoing Despite Weak Price

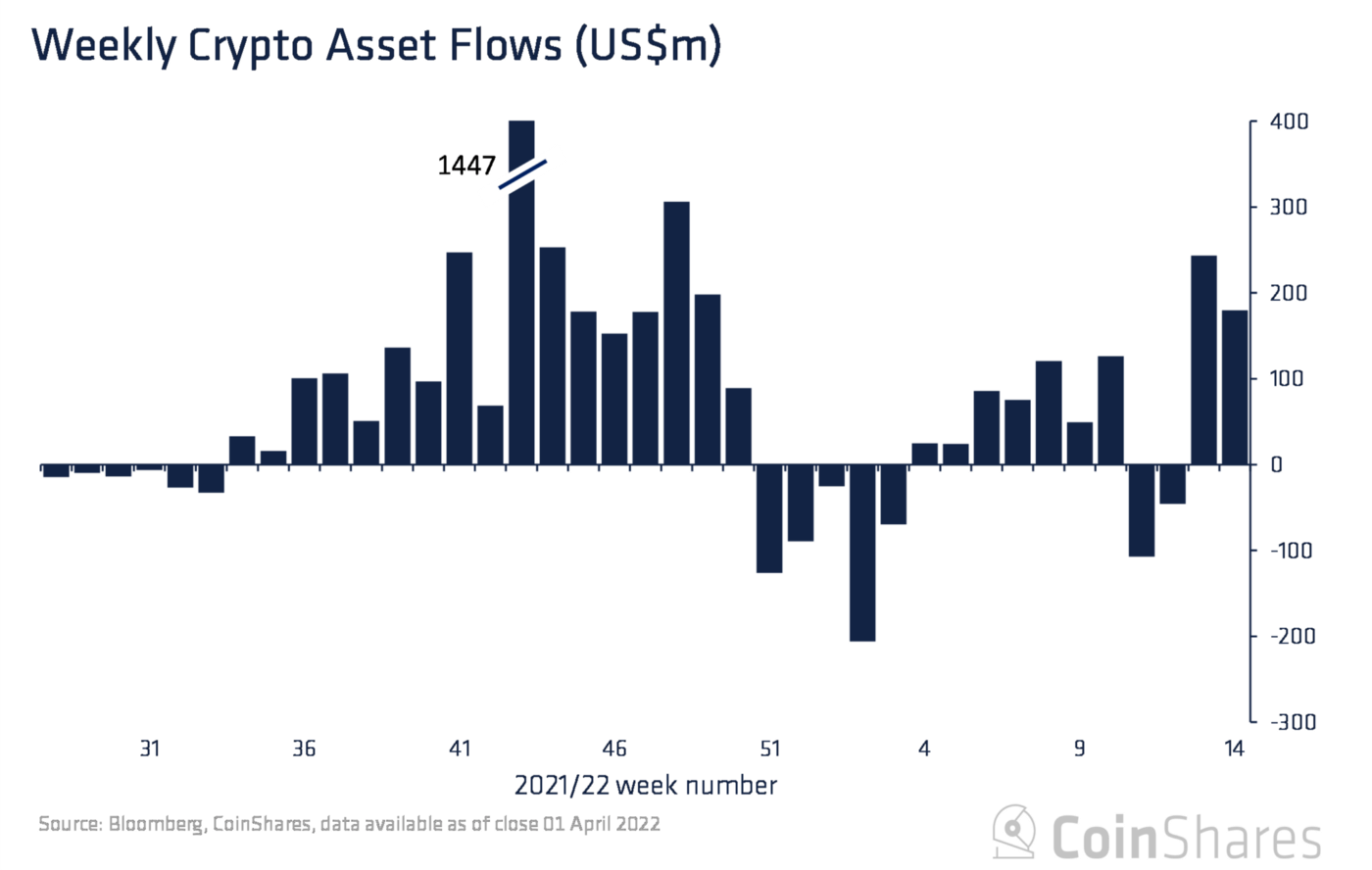

Crypto fund products saw inflows totalling $180 million the week before, while the reporting of some late trades pushed up inflows in the last full week of March from $193 million to $244 million.

99% of inflows are derived from Europe, while the Americas remain hesitant, seeing only $1.7 million of inflows.

SOL and ADA saw inflows totalling $8.2million and $1.8 million respectively.

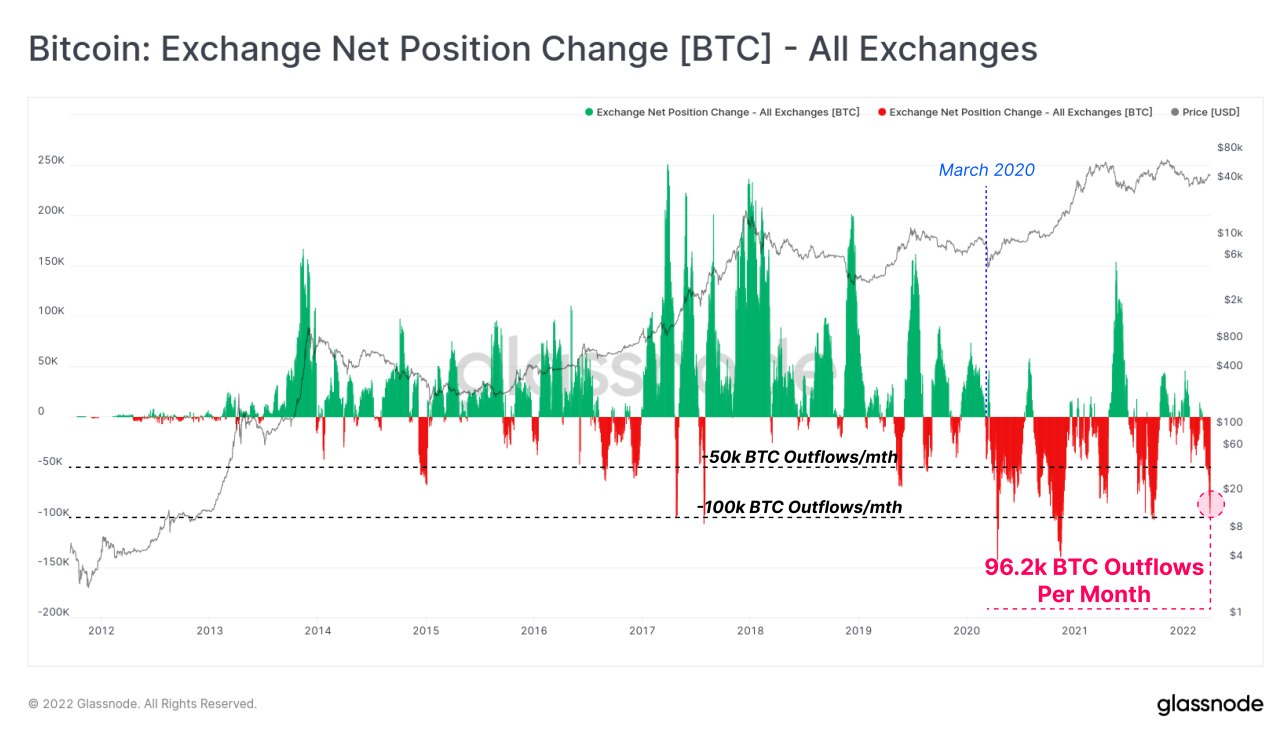

One of the most prominent signs of accumulation is the exchange flow. BTC exchange outflow volume recently hit a rate of 96,200 BTC per month.

Aggregate exchange outflows of this magnitude have only been seen on a handful of occasions through history, with most being after the March 2020 liquidity crisis.

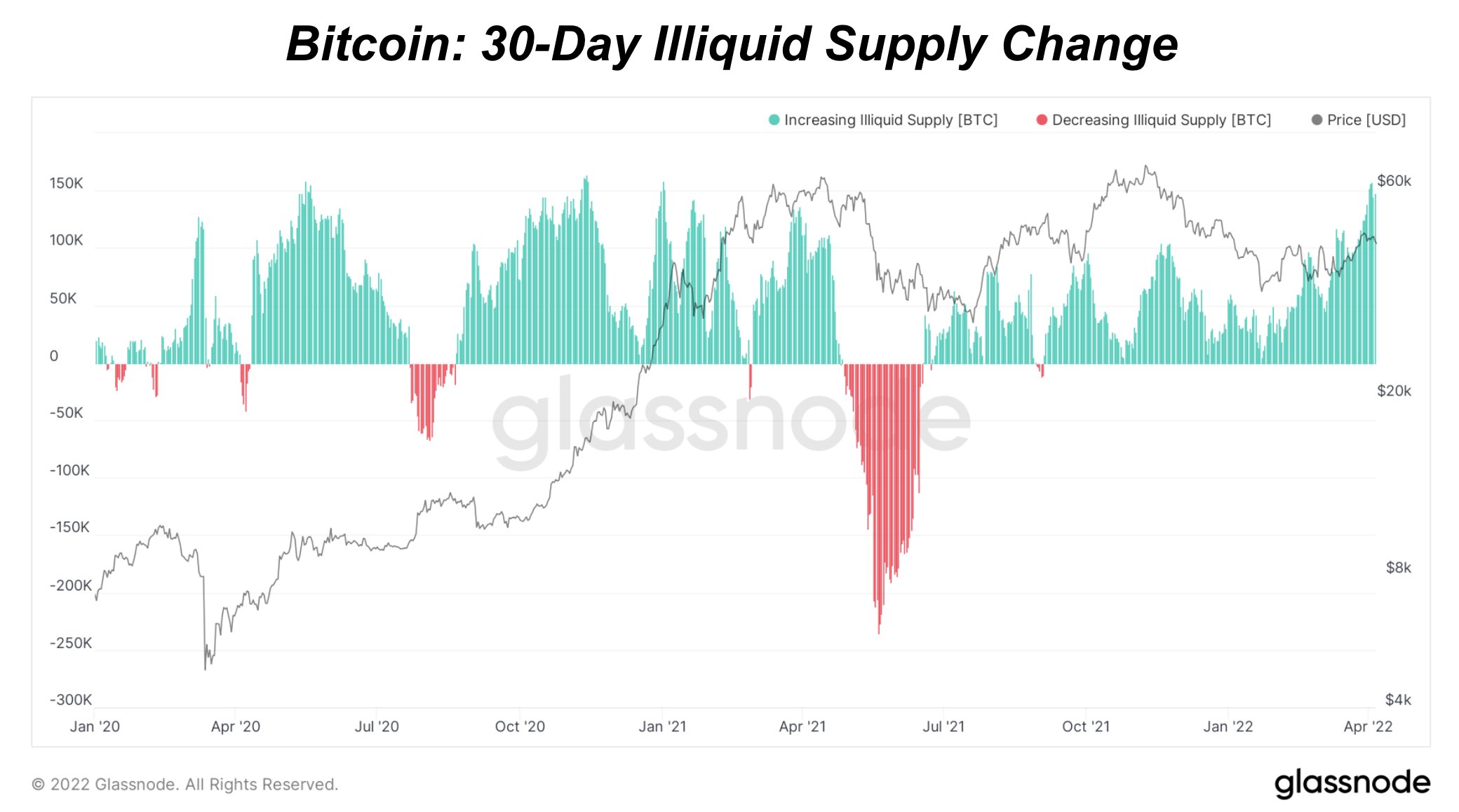

BTC wallets with little history of selling are also continuing to accumulate more aggressively over March and April. The last time accumulation of such magnitude was made by these wallets, the price of BTC went another leg higher, as can be seen in May 2020 and October 2020.

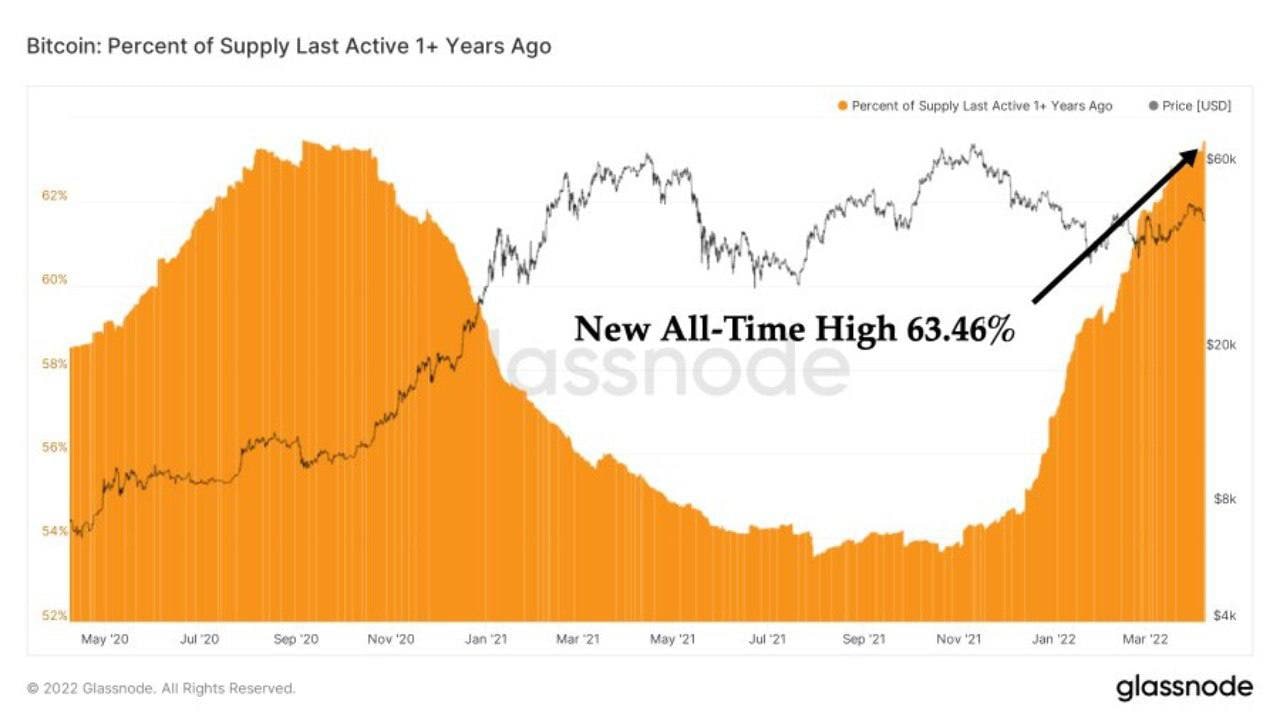

The BTC supply that has not moved in at least 1 year, has also just set a new ATH at 63.46%, proving that holders are still holding their BTC instead of selling.

The last time this metric broke its previous ATH, a significant price uptrend had followed over the subsequent few months.

Short-Term Holder Trend Shows Sign of Impending Bull

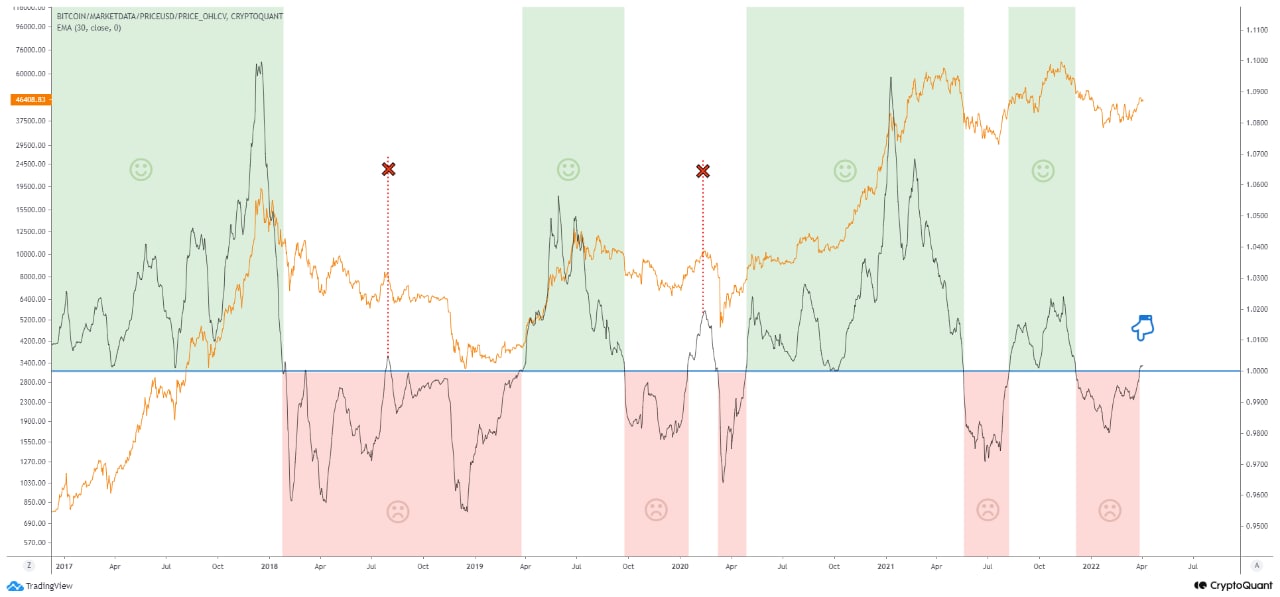

After nearly four months, from December 2021 to now, the STH-SOPR (Exponential Moving Average – 30) value is back to being greater than 1.

Examining the trend implies that short-term investors realize their coins where the trading condition is more profitable.

From 2017, when STH-SOPR (EMA-30) is greater than 1, BTC price has increased. If the index stayed below 1, it was followed by a bear market.

For the current time period, this indicator has just crossed 1 and it could be beneficial to observe if it continues to edge higher to indicate a bullish market, or reverses back lower to indicate a bear market.

Big Announcements Failed To Generate Interest

Last week’s Bitcoin Conference in Miami saw various big announcements which are beneficial to crypto adoption. Some notable ones include Strike, which announced that BTC will be available via the Lightning Network to over 400,000 storefronts and all US Shopify sites.

Trading app Robinhood, also announced that it will finally release crypto wallet to 2 million users, and plans integration with the BTC Lightning Network.

Both announcements however, failed to make any impact on the market as crypto prices continued reeling on the back of fears of rising interest rate.

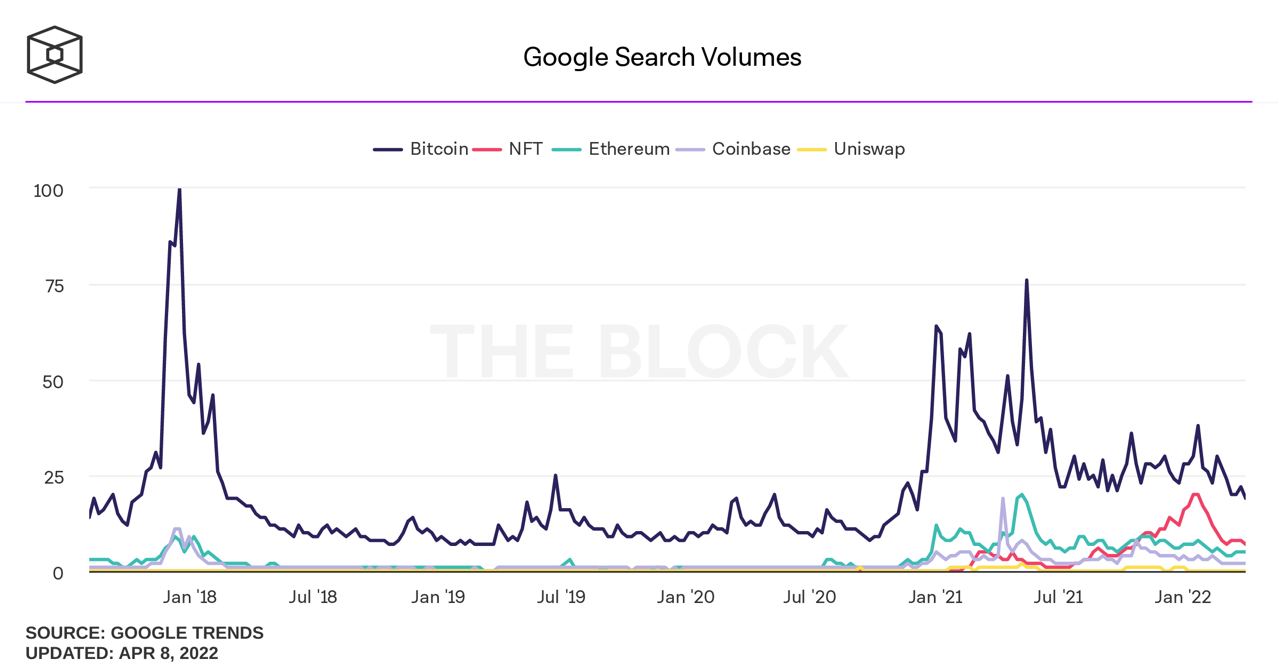

Indeed, a check of the Bitcoin keyword at the google search engine shows that interest in BTC has been on a decline ever since the beginning of the year. Searches about BTC is now near the level of the bear market lull of 2019 and 2020.

This is actually a good sign which means that the market is not in a speculative bubble as spikes in google search are normally associated with market peaks. The low search volume could in fact, imply that we are close to a market bottom.

LTC Sees Largest Amount Transacted This Year

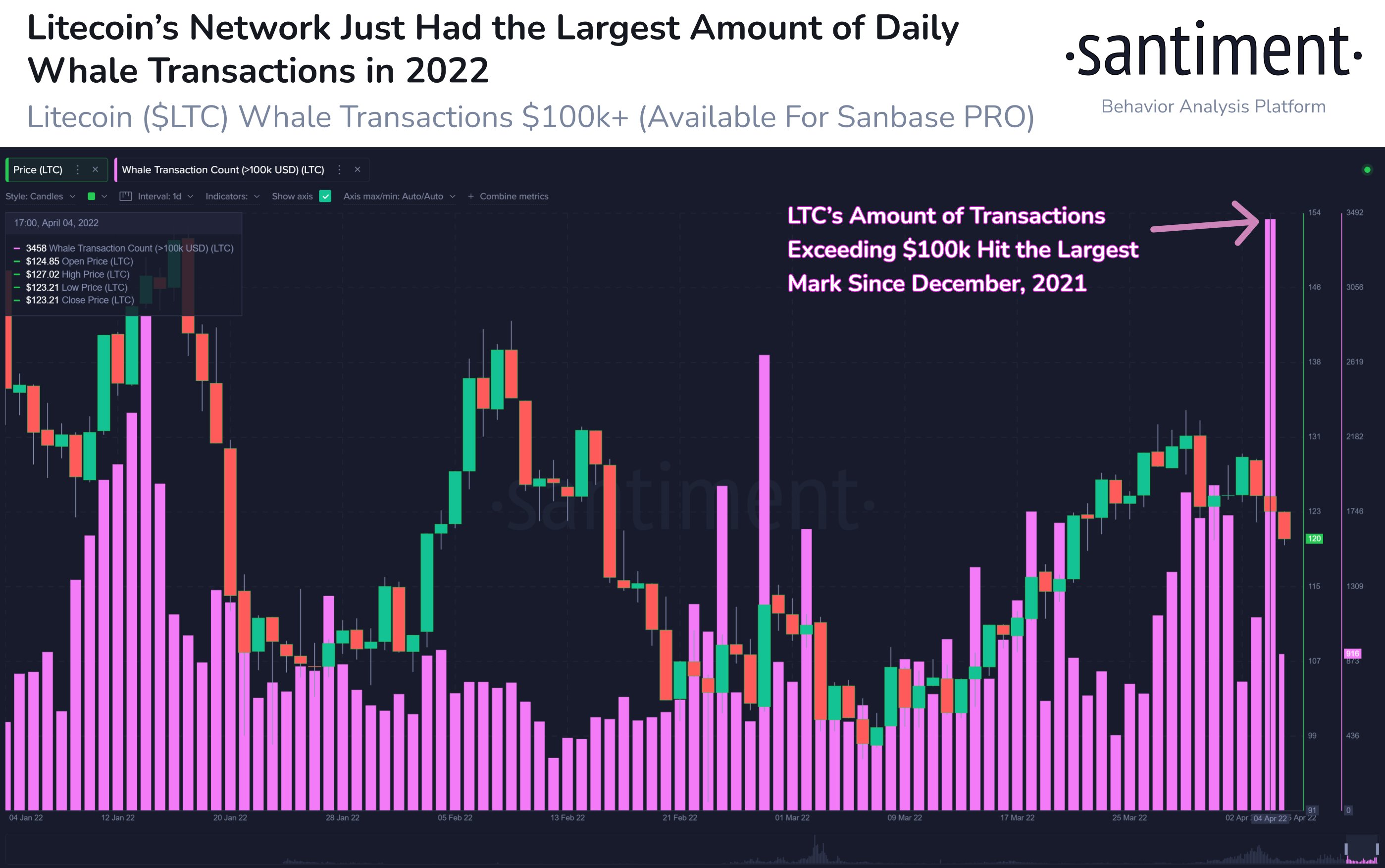

While retail interest in cryptocurrencies is waning, whales seem to be busy mopping up whatever they can as prices decline. Last week, the largest amount of daily LTC whale transactions exceeding $100,000 (3,458 transactions) this year occurred. This shows that there is stealthy accumulation going on as traders sold their tokens to whales. Similar to the BTC situation, while not necessarily bullish in the short term, this nonetheless may be an indicator of a bullish price direction shift in time to come.

Don't miss the chance to follow LTC whales

LUNA Foundation Buys More BTC

On Sunday, the LUNA Foundation purchased another 4,130 BTC to take the total holdings under its reserve to be at 39,898 BTC. However, the market did not seem bothered by the news since LUNA’s purchase has been priced in. With BTC trading closely in tandem with the stock market, the unwinding of positions in the stock market may continue to put pressure on BTC, unless something able to make BTC decouple from the stock market happens.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.