Growing recession fears pushed US stocks briefly into bear market territory on Friday with the S&P′s decline from its all-time high in January reaching 20%. However, a late-day reversal helped push the benchmark slightly into the green for the day at the close.

Stocks had been under pressure all week, and especially after Fed Chair Powell reiterated that the Fed will not hesitate to rise rates beyond neutral should inflation continue to remain elevated. This could mean that the FED may have to continue tightening even when the economy falls into recession due to persistent inflationary pressure.

Despite that, the USD fell 1.5% against a basket of its peers as the 10-year Treasury yield eased below 3%. However, that failed to lift stocks as lousy quarterly earnings and negative forward guidance dished out by retail giants Target and Walmart sent a cloud of gloom over the economy.

For the week, the Dow lost 2.9% for its first eight-week losing streak since 1923. The S&P lost 3%, while the Nasdaq shed 3.8%, with the two indices posting seven-week losing streaks.

Over at Europe, the situation appears even worse as the UK reported that its inflation has jumped to 9% on the back of spiralling food and energy prices. The rise in the UK CPI is the highest since records began in 1989, outstripping the 8.4% annual rise posted in March 1992 and well ahead of the 7% seen in March of this year.

As investors begin to come to terms with persistent inflation, precious metals, the de facto inflation hedge, saw prices jump as the USD retreated, with Gold managing to bounce 2.6% higher after a brief break below $1,800 on Monday. Silver also gained 3.6% last week, while is adding on another 0.7% in early Asian trading this week. Gold has also gained around 0.3% in early Asian trading as the USD continues to see some selling.

Oil prices were a lot more subdued on a week-by-week basis, even though intra-day movements remained volatile. While Oil prices appear to have gone back to where they were at the start of the week, one noteworthy development was the US WTI Crude Oil price catching up with that of Brent Crude. While Brent has been trading at a price premium against WTI Crude since 2013, that premium has disappeared last Tuesday, with both grades of Oil now trading at the same price even by the market close on Friday. At one point on Tuesday, the WTI price even exceeded that of Brent Crude. However, Brent Crude has managed to gain back some ground, trading around $1 higher than the WTI in Asian trading today.

The narrowing gap could underscore an increasing demand and supply bottleneck for WTI Crude which is produced only in the USA. On Tuesday, US Treasury Secretary Janet Yellen pledged to increase supplies of US Oil into Europe to help the EU reduce its reliance on Russian Oil, which coincidentally was the day that the WTI started to trade higher than Brent Crude.

Unlike the US stock market which had continued to fall rather drastically, price action on the cryptocurrency market was a lot more subtle. Trading volume was also thin, with most of the market merely trading within the tight range that was set the week prior. While retail traders appeared to be dip buying, their hopes for a rebound did not materialise.

Bitcoin bulls gaining strengthUpdates On UST-LUNA-Terra

Following backlash from the community, South Korea’s top financial regulators have launched an emergency investigation into the collapse of cryptocurrency LUNA and stablecoin UST. The authorities have asked domestic cryptocurrency exchanges to provide information relating to transactions and investors of the two coins.

A recovery proposal has been put forth by team Terra. The Terra chain would be forked into a new chain without the algorithmic stablecoin. The old chain is to be called Terra Classic, and the new chain to be called Terra. Tokens for the new chain will be airdropped to participants that were in various stages of the UST-LUNA collapse. It will also be airdropped to holders of LUNA post collapse. However, the catch here is that 70% of whatever airdrops participants receive will be subject to a 2-year lockup. The snapshot will be taken on 27 May, this Friday.

Calls For Tougher Regulation Increasing

In the aftermath of Terra’s collapse, as expected, a horde of regulators are urging tougher regulations on the industry, with special mention of stablecoins.

Former US Fed Chair Ben Bernanke told CNBC on Monday that he does not believe BTC works as money, a store of value or digital gold. The man went further to add that Gold has underlying use value, while the underlying use value of BTC is to do ransomware.

Gary Gensler, chair of the US SEC, also said on Monday that cryptocurrency assets are highly speculative and investors in them need more protections, or they could lose trust in the markets, referencing the LUNA incident.

In Europe, G7 Leaders also urged crypto-asset regulation to speed up as they met up in Germany on Thursday, citing the urgent need for crypto regulation in the wake of LUNA’s collapse. The UK’s market regulator is also paying close attention to crypto market to watch for any potential chaos and contagion effects from the fallout of Terra.

Regardless of increasing calls for tougher regulation in the crypto sphere, many countries are still very bullish on crypto’s prospect, especially that of BTC’s. In El Salvador’s 3-day financial inclusion conference last week, delegates from 44 countries met on Bitcoin Beach in El Salvador to discuss “Bitcoin”. Apparently, it was revealed that BTC was well-received by delegates present, including those from Paraguay, Ghana and Egypt.

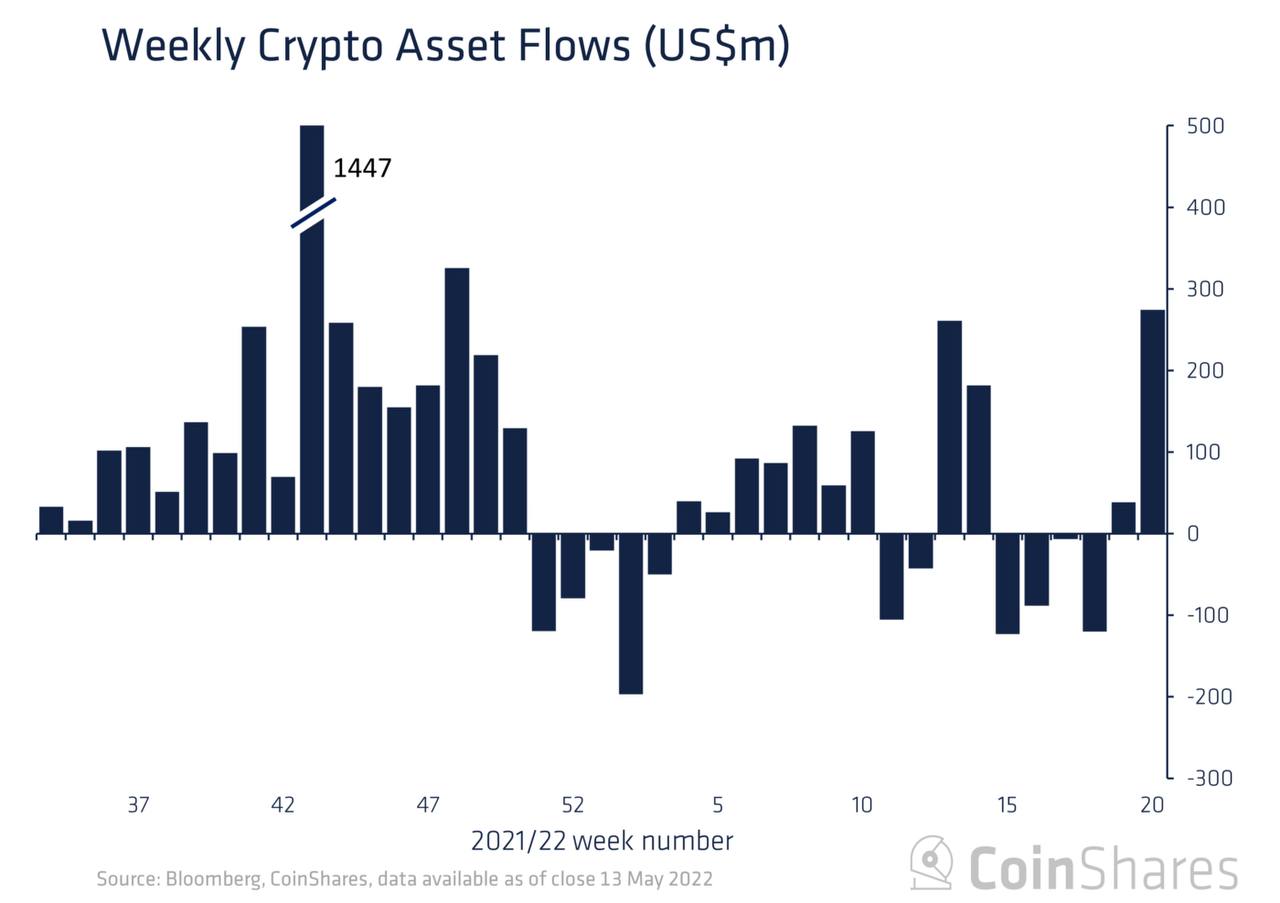

Not all investors were stirred in the LUNA debacle, as some took the dip as an opportunity to load up. Crypto funds were one of those.

These funds recorded a big inflow after weeks of outflow as the price of BTC dipped to $25,000 during the week of 9 May, proving that there is still a lot of demand at a “good” entry level. Out of a total $274 million of inflows, $299 million went into BTC, which implies that some existing altcoins were sold into the safety of BTC.

Whether these crypto funds, who are known to have been consistently on the wrong side of the market, will be correct this time around will be known in the coming weeks.

Stablecoin Exodus Could Signal Eroding Trust

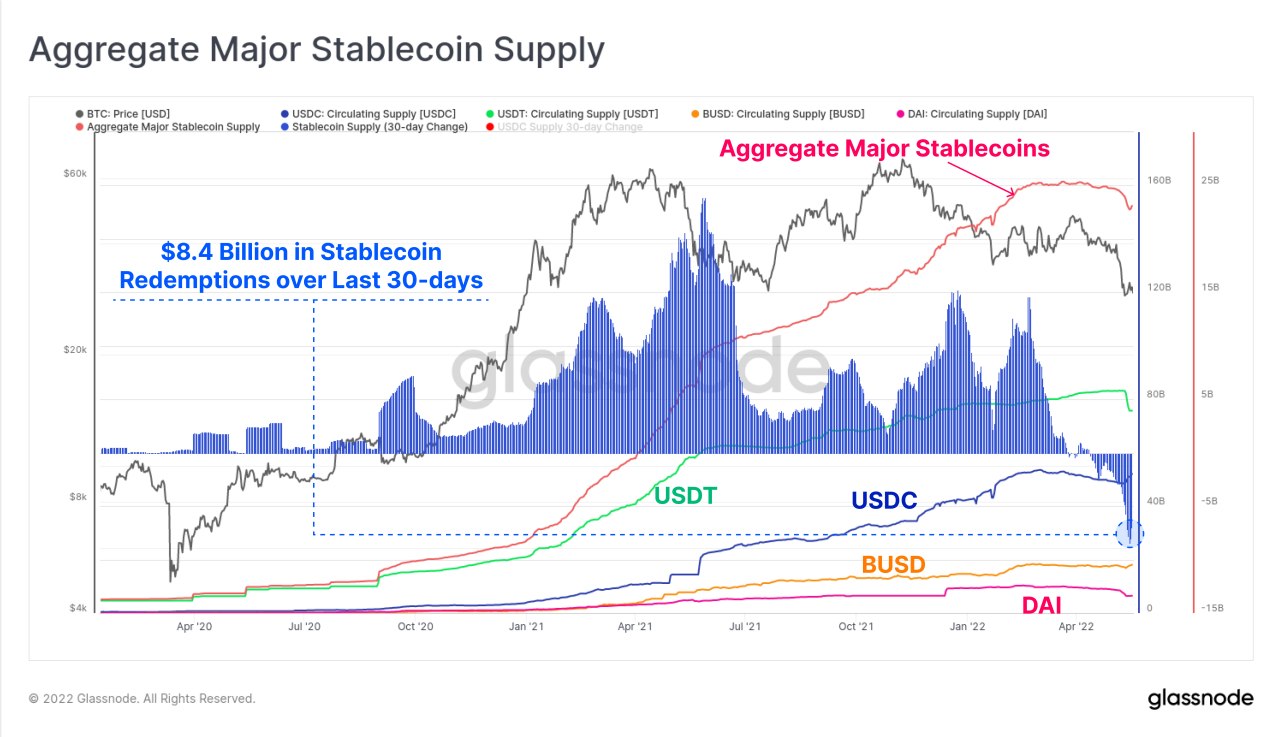

Stablecoins naturally came under scrutiny after the collapse of UST, with many other small algorithmic stablecoins like Dei, Fei and USDX also depegging. However, these had little primetime coverage due to their relatively small market cap, which meant they may not have a big impact on the broad market even when they failed.

Centralised stablecoins on the other hand, witnessed a mixed fortune. While USDC saw net inflow of about 2.3 billion (8.6 billion USDC issued and 6.3 billion USDC redeemed), USDT witnessed a huge outflow, with more than $9 billion worth of USDT redeemed over the past week. The total USDT supply declined from near the $82 billion ATH to below $74 billion as worries over the US SEC’s targeting of Tether resurfaced again following a court decision on 16 May that rejected Tether’s request to not need to disclose its reserve holdings to holders. However, after the management of Tether disclosed their 1Q2022 report that shows that they have more assets than liabilities in their reserve basket, the fears hovering over USDT have subsided for the time being.

Regardless of the renewed calm, stablecoins on aggregate are still experiencing declining supplies. The current redemption has grown by a total of $8.4 billion over the last month, which is the largest in history. A persistent drop in stablecoin supply may signal a loss of trust in the crypto ecosystem, which may bring about larger and a more sustained fall in crypto prices.

Signs of More Pain Ahead For BTC

On Tuesday, a large volume of BTC flowed into exchanges ahead of comments by FED Chair Powell, and just before price started to drop on Wednesday. This could be a sign that some BTC holders are selling their BTC. While price has somewhat stabilised, we are uncertain if the sellers have completed their selling. This overhang may cast doubts in the minds of some traders even if the price of BTC were to rebound, which may exert further pressure on the asset.

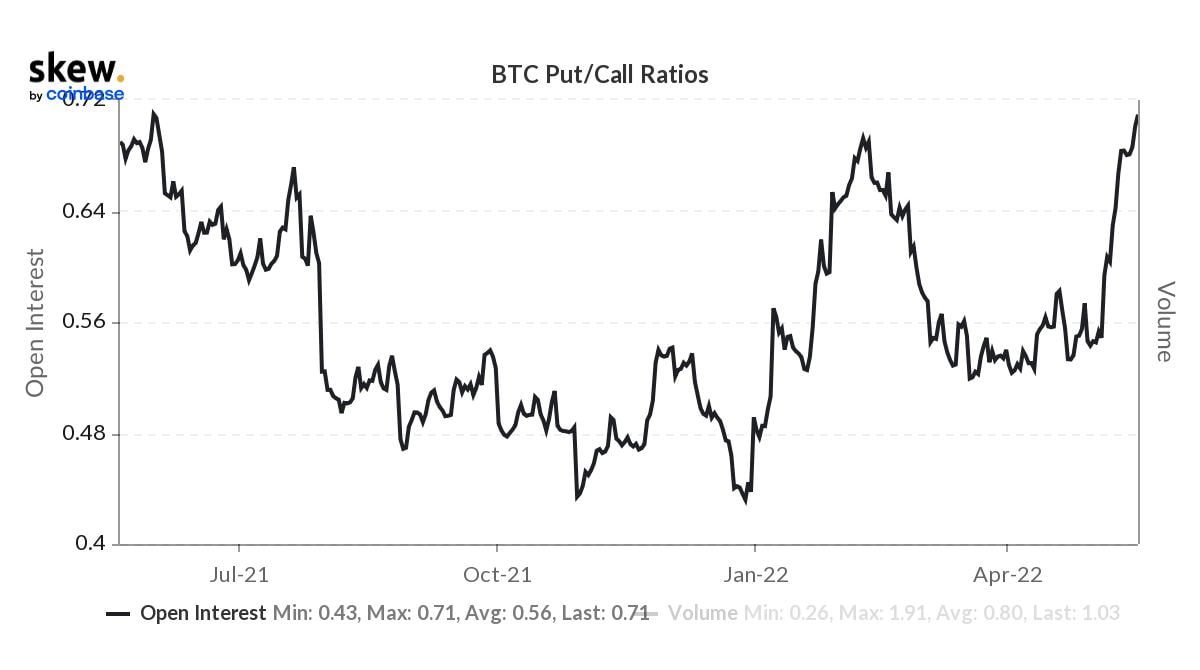

Furthermore, the BTC Put/Call ratio has hit a 12-month high, a sign that investors are bearish and expecting price to fall further. The rise in puts relative to calls could signal that traders are either hedging to protect their existing portfolio from downside, or that they are outrightly bearish and trying to profit from more downside in BTC’s price.

Last April, the put/call ratio traded as high as 0.96 before BTC’s price dropped over 50% in May 2021.

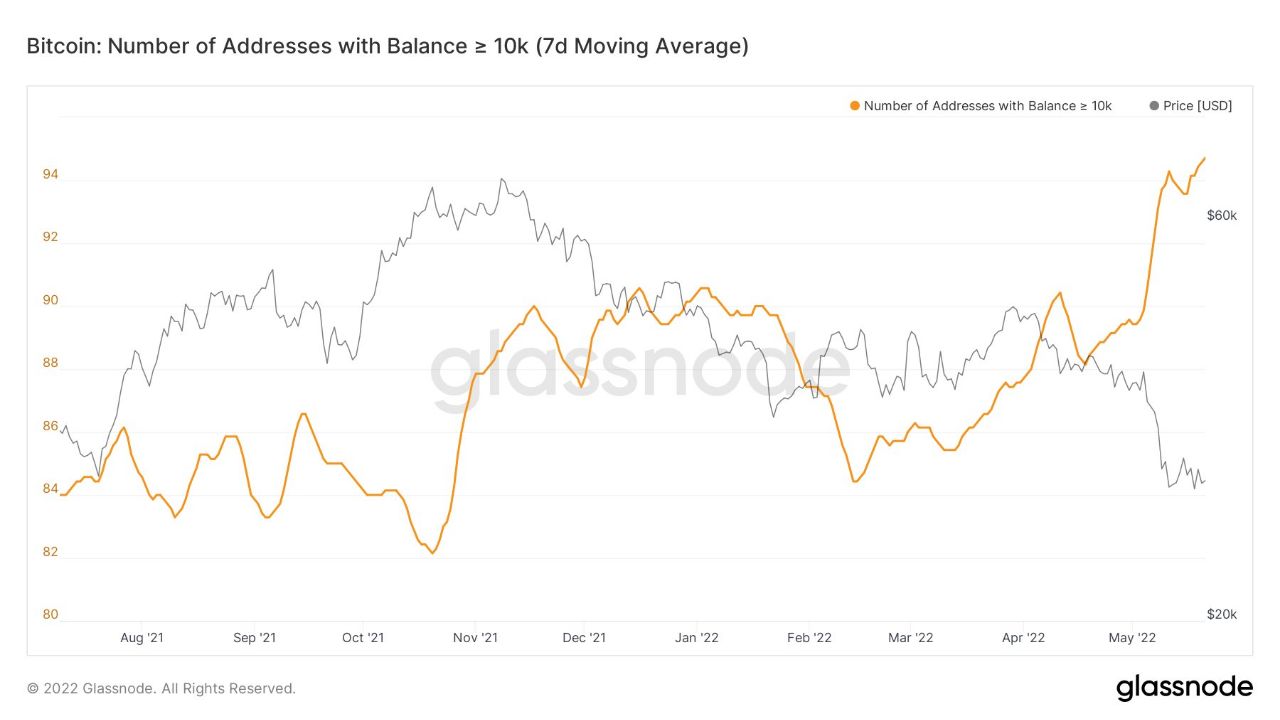

BTC Large Whales Add At Slower Pace

While market sentiment is bearish, large BTC whales remain unperturbed by the recent weak price action and continue to add to their BTC holdings, albeit at a slower pace than earlier in the month.

Also, the Finex whales have also been reportedly reducing their long BTC position and adding some new short positions over the weekend when the price of BTC recovered above $30,000.

China Returns To BTC Mining

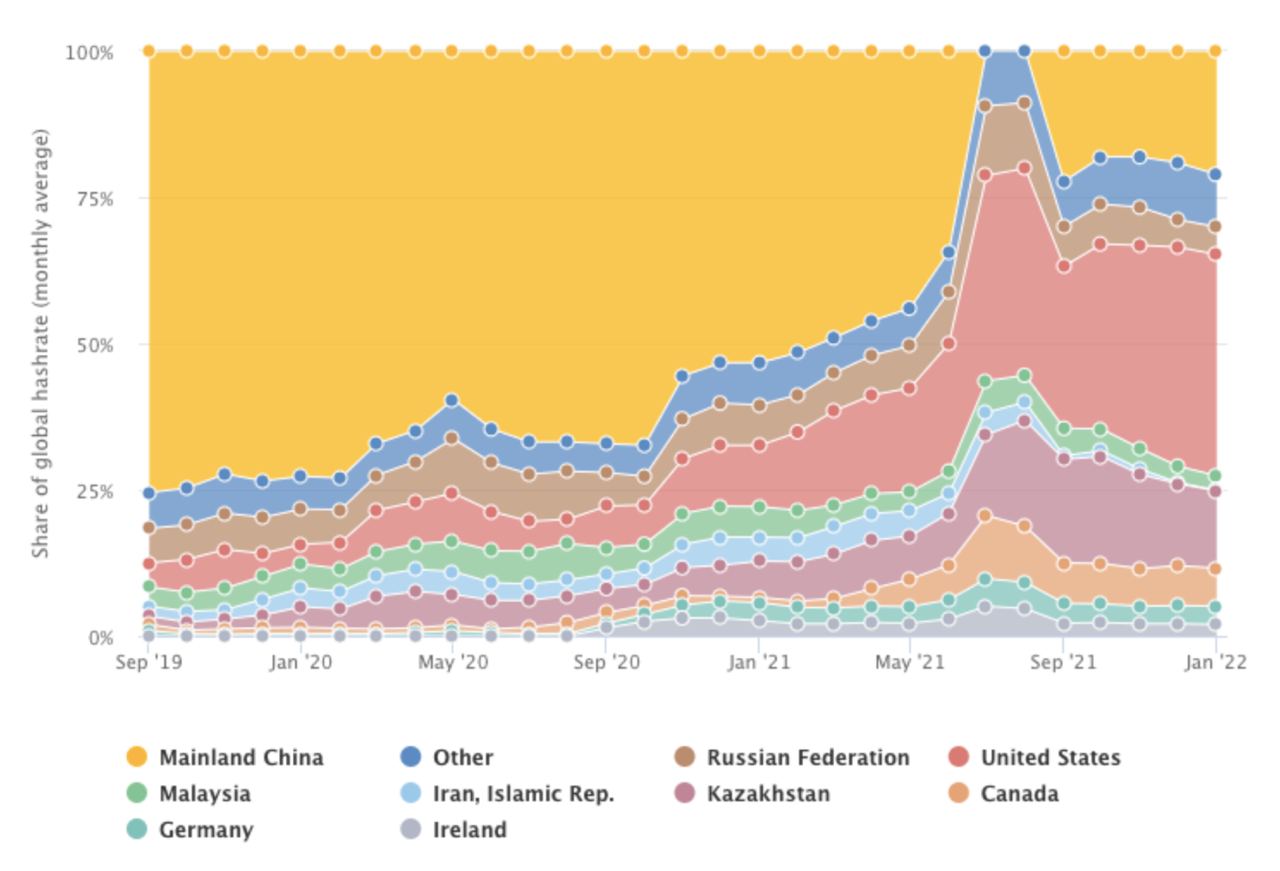

While not having a direct impact on prices, China has returned as the 2nd top BTC mining hub despite last year’s ban.

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), BTC miners in China have started to account for 21.1% of the total global BTC mining hash rate distribution as of early 2022, following only the United States, which produced 37.8% of the total hash rate. This is a new increase following a destruction on hashing power immediately post the widely known China mining ban. However, in merely five months, the indicator recovered by more than 20% and did not drop below 18% over the analysed period.

Tell will tell if this could be a precursor to China residents having the ability to trade crypto again, which will be bullish news.

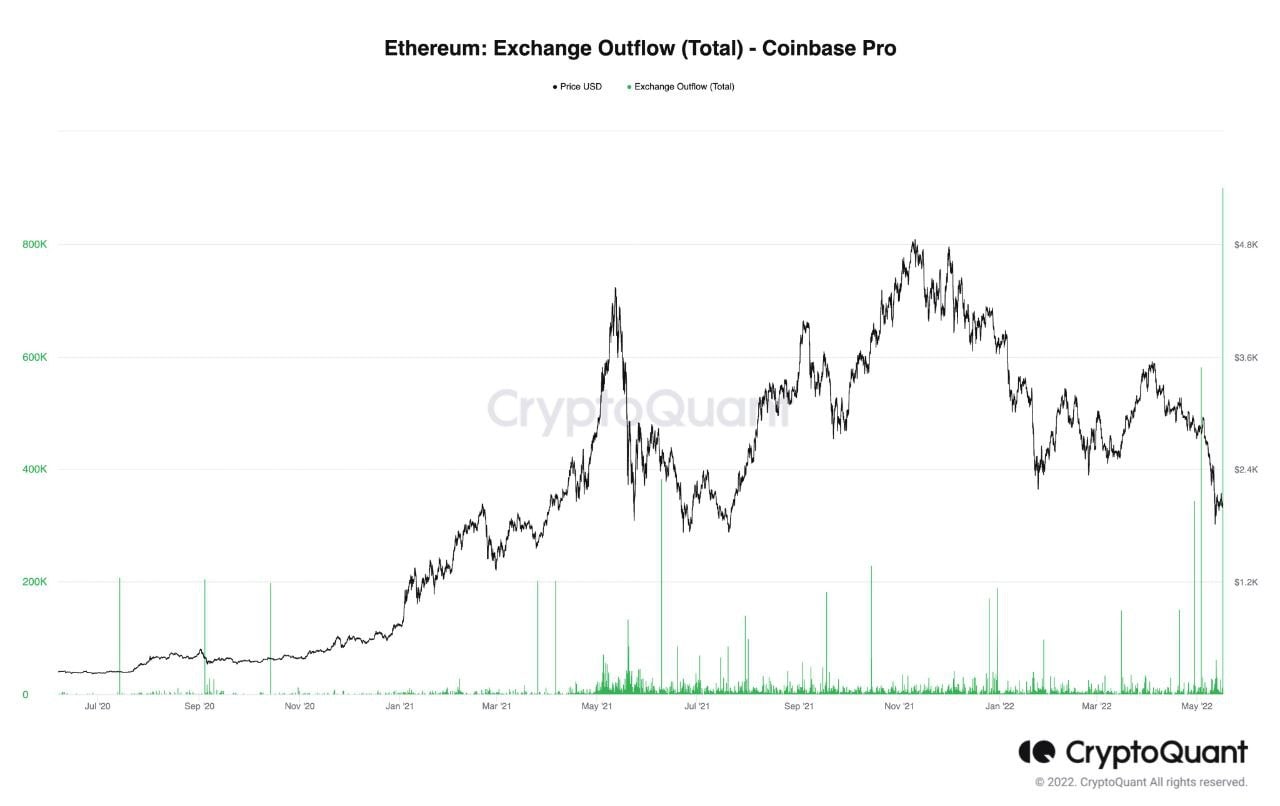

Large ETH Withdrawal Spotted At Coinbase

While ETH saw its biggest exchange outflow ever, with 900,634 ETH flowing out of Coinbase on Wednesday, the price of ETH did not go up subsequently. Hence, this withdrawal could be attributed to existing holders removing their tokens from Coinbase for fear of credit issues with the company, as the CEO had warned just a week ago that in the event of bankruptcy, the customers’ crypto assets held at Coinbase will not be safe.

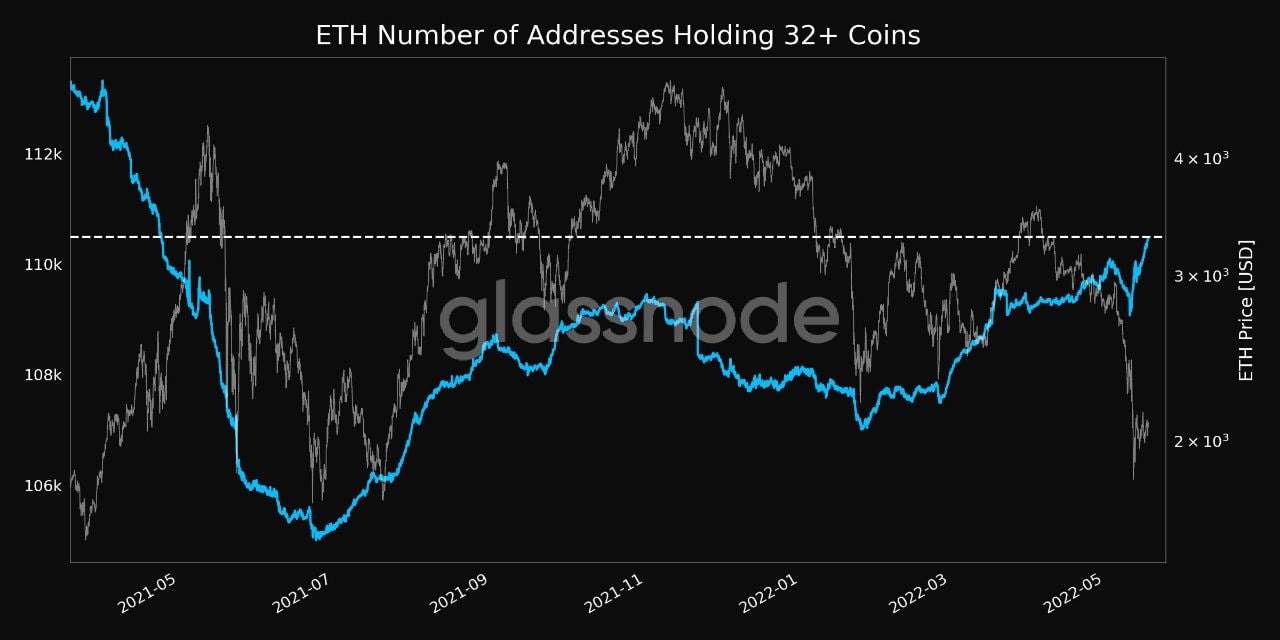

While price action has been pointing towards further weakness, ETH is not without good news. Last week, ETH founder Vitalik Buterin, along with a few core ETH developers, claimed that The Merge, in which ETH will move from PoW to PoS and begin a series of upgrades that will realise ETH 2.0, could be completed in August this year if there are no mishaps.

The revelation of this timeline is perhaps the reason why addresses with at least 32 ETH has seen a sharp rise last week. 32 is the minimum number of ETH that holders will need to stake to become a validator on ETH 2.0.

Hence, while this important update on The Merge does not appear to have an immediate impact on ETH’s price, it nonetheless has increased the number of ETH buyers during this time of downturn to acquire at least 32 ETH for staking to benefit in the long-term.

The start of this week has seen BTC clock an 8th consecutive week of losses, even though price has bounced above $30,000 once again. With funding rates negative and the FED meeting minutes being the key risk event that could shake markets, some traders may choose to stay sidelined and close out some short positions until after the minutes are released this coming Wednesday. However, as the traditional markets return, movement in the crypto market is likely to be swayed by movement in tech stocks rather than on its own fundamentals again.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.