US stocks started the week hammered into the open after the Independence Day holiday, with the Dow crashing more than 600 points on Tuesday, before stocks staged a strong rebound to recoup those losses after bond yields started dipping again.

After investors digested US President Biden’s plan to remove import tariffs on China goods to try and contain inflation, the markets showed optimism even as doubts about his ability to execute climbed. Indeed, as expected, Biden mentioned on Friday that he has not yet confirmed plans on the China tariffs. Nevertheless, the possibility of having at least some China tariffs removed kicked started a wave of positives in the US market, which is a welcome sign after the markets have been hammered heavily recently.

Fed meeting minutes released on Wednesday, despite being hawkish, had already been anticipated by investors and thus had no negative effect on sentiment. The report revealed that Fed officials said at the June meeting that another interest rate increase of 50 or 75 basis points is likely at the July meeting, and that policymakers recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist. Further to the minutes, two Fed officials revealed on Thursday in an interview that other than the market-anticipated 75-bps rate increase in July, there is a high chance that there could be another hike in September.

The markets, however, did not react negatively as the Fed did not seem to think that the US economy would head into a recession this year. While the US 10-year Treasury yield inched up shortly after, the higher rate has largely been priced in.

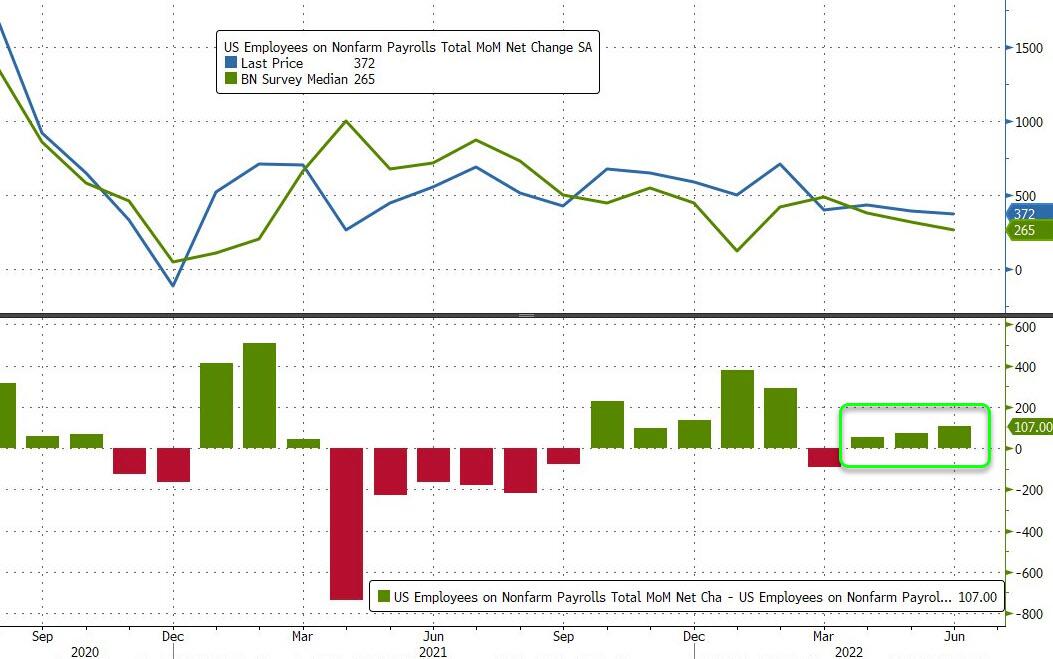

The main risk event of the week, the non-farm payrolls report, surprisingly turned out much better than expected, gaining 372,000 jobs, way beyond analysts’ estimate of 265,000. The big payroll gains pushed back recent recession fears as the US economy appears to be storming ahead without issue as the job market continues to improve.

With more positive news each passing day, the stock market gained from strength to strength throughout the week, with the Dow eventually gaining 0.77%, the S&P rising 1.94%, and the Nasdaq up an impressive 4.56%, having gained on every single day of the week.

Treasury yields spiked after the jobs report as expected, with the US 10-year Treasury eventually closing the week back above 3% at 3.084%. This has led the USD higher against its peers, as the DXY rocketed to a high of 107.5 before eventually settling the week at 106.65.

The second-quarter earnings season begins this week, with reports due out from most major banks. The main risk event for this week is the June CPI report, which is to be released on Wednesday. Investors may still react to the inflation numbers even though the Fed has already informed the market about what it will be doing regardless of what the report says.

As the USD rise gained momentum, forex action has been jam-packed, especially in Europe where the euro fell to its lowest level in two decades as data coming out of Europe remains sluggish. The EUR/USD fell below the $1.03 mark for the first time since 2002 on Tuesday and has been rolling down ever since and is now trading at around $1.0135 in early Asian trade.

Drama surrounding the mass resignation of the British cabinet led the pound to first fall against most other currencies before rallying when resignation of the scandal plagued Prime Minister, Boris Johnson, was made known. The GBP/USD first fell to a low of $1.187 as more than 50 ministers resigned but has been retracing some losses after Johnson tendered his resignation.

Down Under, the RBA on Tuesday raised rates for the third time in three months, imposing a 50-bps increase which lifts the official cash rate from 0.85% to 1.35%. As the move was widely anticipated, the AUD/USD did not move up but fell almost 2% even when the RBA governor signalled more rate hikes were likely in the coming months. The fall is likely due to recession fears as the commodity currency is highly dependent on commodity prices, which have tumbled over the last three months.

Overall, forex action in the past week has been exciting to say the least.

It was just as action-packed in previous metals, where Gold broke below $1,800 again to drop 3.8% for the week as the flight to the USD pressured precious metals intensely. Similarly, Silver declined by 3.45%. Both metals are beginning the new week falling by around 0.3%.

Oil tanked below $100 for the first couple of days as recession fears reached a climax before resuming its uptrend again as those fears subsided after the better-than-expected US jobs report. Brent Crude eventually closed the week still down by more than 6.4% while the WTI was weaker by 7% as the flushing out of leveraged traders on Tuesday saw the price of oil slipping more than 13% just that day.

Goldman Sachs revealed on Thursday that its price target for oil is $140 at the base case, citing robust demand and a tight market that is compounded by years of underinvestment in oil exploration, creating this long-term supply issue that is immune to any speedy remedy, even if the global economy were to be hit with a recession.

Cryptocurrencies had a less volatile week in comparison, although news out of the industry has been getting better. This has led the two top coins, BTC and ETH, higher. BTC gained about 15% while ETH gained about 20% at their highest point for the week. Altcoins, however, saw a mixed picture as the two blue chip coins led in market dominance.

Risk assets ready for a Bull RunMore Crypto Bankruptcies but Worst May Be Over

Crypto lender Voyager Digital filed for bankruptcy late Tuesday, becoming the second high-profile crypto firm to do so in recent days.

The Toronto-based company filed for Chapter 11 bankruptcy protections, estimating that it had more than 100,000 creditors and between $1 billion and $10 billion in assets and liabilities.

Another crypto lending platform, Vauld, suspended withdrawal on Monday. The firm is backed by prominent crypto thought leaders, Peter Thiel, Pantera Capital and Coinbase.

In the wake of several high-profile bankruptcies within the crypto space lately, the Bank of England has called for an enhanced crypto regulatory framework. Likewise, the Singapore central bank has proposed tougher regulation on crypto after most of the failures came from the country.

Not all was bad news however, as Celsius, who has been in the news lately for its possible bankruptcy and liquidation of positions, has been revealed to have repaid all its debts so that liquidation no longer is a risk to the firm. The rate Celsius has been repaying back its loan shows that the firm has been able to raise money, which would mean the firm could very well escape bankruptcy. The fact that they no longer will be forced to liquidate is bullish for the crypto market since it reduces forced-selling pressure which would otherwise cause prices to tank further.

Another positive turn is that Sam Bankman-Fried revealed that he has another couple of billions to deploy to help distressed crypto firms in order to prevent a systematic collapse of the crypto industry, while citing that the worst of the crypto liquidtiy crunch is likely over.

Likewise, Changpeng Zhao, the CEO of Binance, also revealed that the firm in in talks with several distressed crypto firms to bail them out of the current liquidity crunch, while Justin Sun chipped in to say that he has set aside $5 billion to bail out troubled crypto firms to prevent the contagion from spreading. The crypto market seems relieved to hear such commitment from leading industry figureheads, and confidence is creeping back in.

June Saw Largest BTC Withdrawal in History

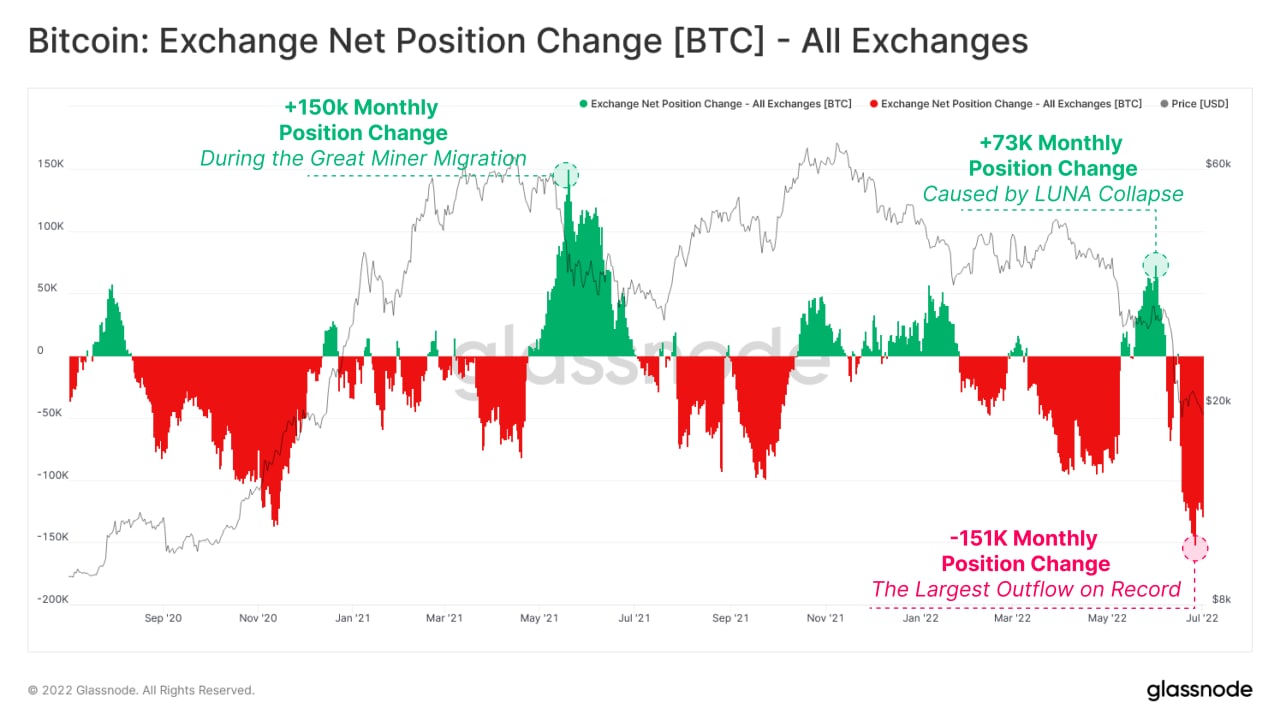

Despite weak price-action through June, BTC has been withdrawn from exchanges at the most aggressive rate in history.

Total BTC exchange outflows in June peaked at 151,000 a month, with Shrimp and Whales as the main receivers.

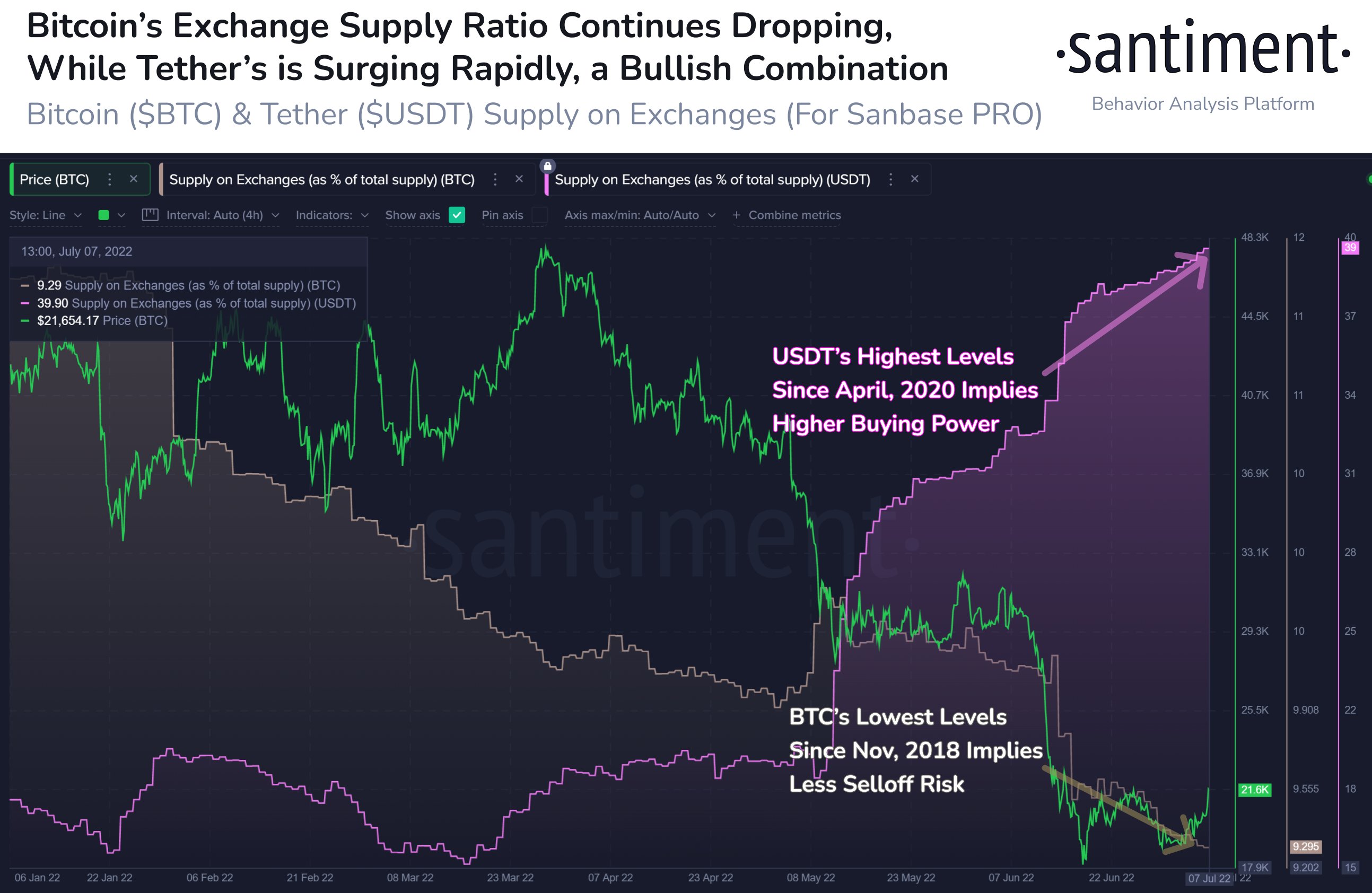

In line with the largest BTC withdrawal on record, BTC supply on exchanges has continued to fall. This is happening in conjunction with the USDT stablecoin reserve rising sharply since May, which was a sign of traders selling their tokens into the safety of stablecoins. However, the current large reserve of stablecoins as a result of that also implies that there is now a large pool of stablecoins sitting on the sidelines that could enter the market to buy, especially after a more than 50% decline in BTC’s price since April when the stablecoin reserve was at a low.

Should these stablecoins be deployed to go long again, the crypto market could rebound.

BTC Enters Best Risk-Reward Long Opportunity

It really may make sense for investors to go long now, as the BTC Reserve Risk has fallen into the green “low-risk” zone. Reserve Risk is a cyclical indicator that tracks the risk-reward balance relative to the confidence and conviction of long-term holders. It shows the amount of risk vs reward to an investor if he were to buy at any given level. A buy in the green area would signify a low-risk entry while a purchase when the indicator is in the red zone would indicate the risk of the trade is at a higher level.

The last and only other time the indicator dropped to the green zone was in August 2015. This shows just how drastic this year’s selloff has been in comparison to the previous cycles. The extent of BTC’s decline currently is only matched by the 2015 downturn. However, this also means that the current downturn provides a massive reward vs risk for the patient investor.

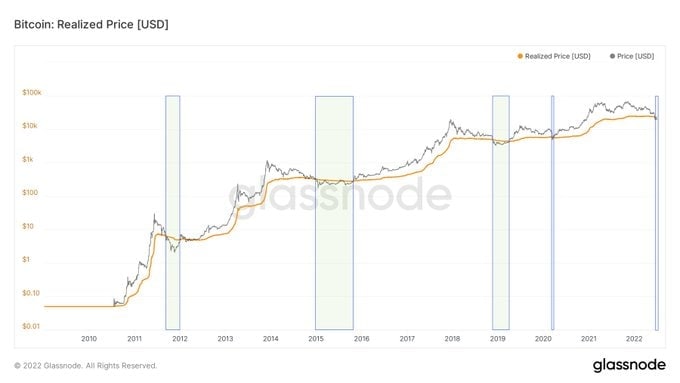

BTC realised price, which gives us the average cost at which all BTC were purchased, is also beginning to show up a good entry area around current prices as traditionally, buying BTC below its realised price often offers the buyer one of the best rewards vs risks.

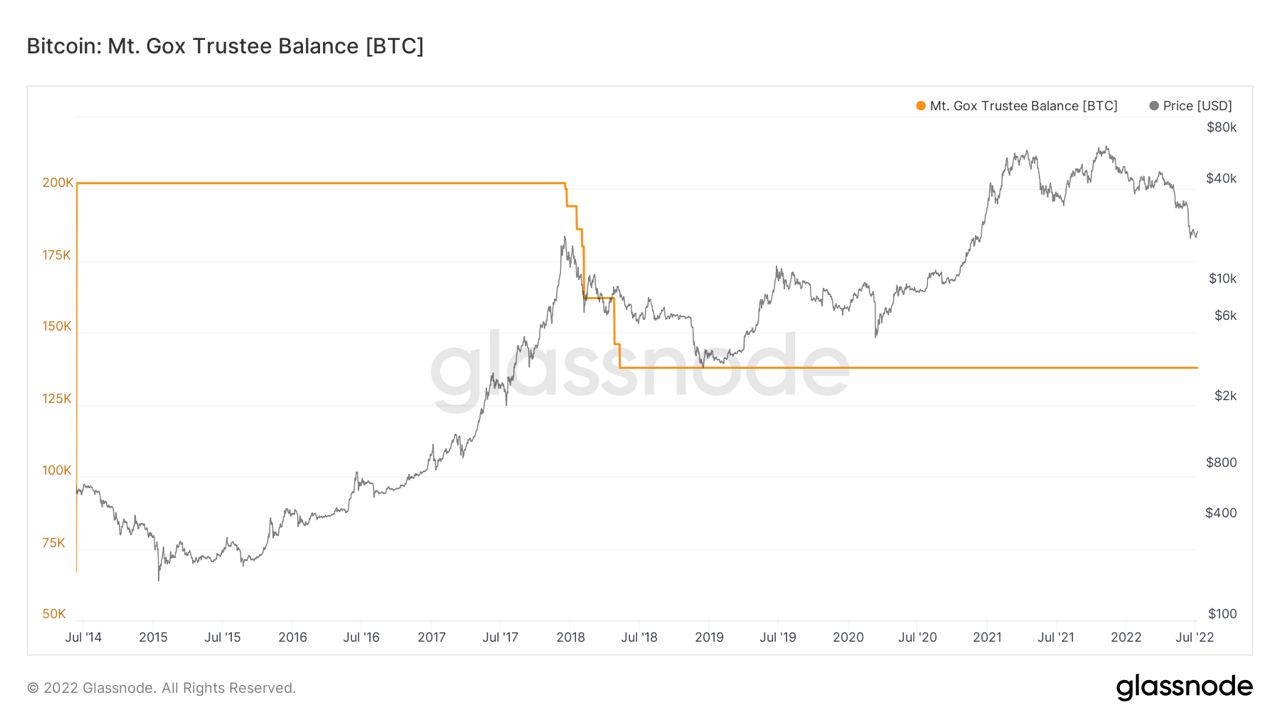

Could Mt Gox Repayment Throw a Spanner in The Works?

While news flow had been largely positive last week, one small hiccup came from the Mt Gox rehabilitation team, who announced on 6 July that they are preparing to make repayments to their account holders, albeit without citing an exact date.

Out of the initial 850,000 BTC lost by Mt. Gox’s hack between 2011 and 2014, only around 141,000 BTC has been recovered and will be returned to affected account holders.

However, while 141,000 BTC sounds like a big scary number, going by the statistics we have just seen from June, this amount could be absorbed by the market in just one month. Hence, while the return to circulation of these BTC may put a damper on price expectations in the near-term, it is not expected to have a significant long-term impact on price. Furthermore, the account holders may not necessarily sell their newly found BTC, and much less probable, to be selling them all at the same time.

Altcoins Gaining Traction Despite Market Downturn

In spite of the overwhelmingly negative headlines we see on the media regarding the dangers of crypto assets, adoption is actually increasing as activities on select networks continue to grow.

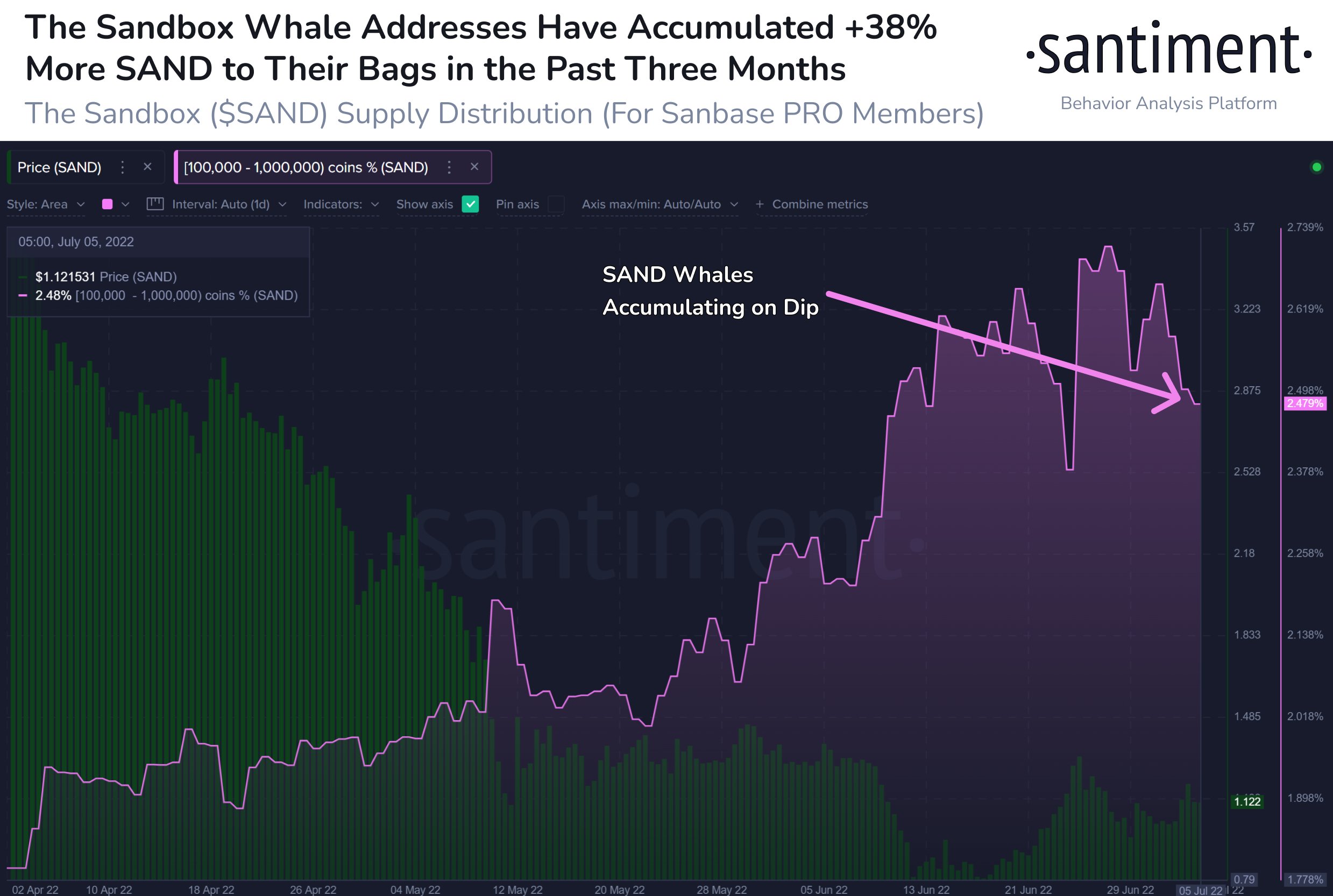

One example is SAND, which is gaining good traction as its adoption has been increasing significantly with a steady rise in usership.

Accumulation has also been ongoing for the past three months as the price of SAND declined in line with the market, with whales holding more than 100,000 SAND adding about 38% more to their bags. Accumulation coupled with an increase in activity often bodes well for a network and a price increase generally comes after these two activities increase.

Meanwhile, everyone’s favourite meme coin, DOGE, has gotten another new use case as Elon Musk adds another use for his favourite token.

The Boring Company, another company owned by the DogeFather, has launched a way for customers to pay for rides on Loop, its Las Vegas transit system, with DOGE. Loop consists of passengers traveling via a tunnel on Tesla vehicles driven by humans at about 35 mph. The Boring Company hopes to eventually expand Loop to more than 50 stations on the Vegas Strip, including casinos and resorts. Riders will be able to scan a large QR code on a wall at the new Resorts World station to purchase a ticket using DOGE. People who do not wish to pay with DOGE can still use a traditional credit card and USD.

As more stations on Loop open and passenger load increase, the publicity and usership DOGE may get from this may increase exponentially with time.

Ripple Labs, the San Francisco-based blockchain company that uses the XRP token, trialled its NFT transaction throughput to an amazing result last Wednesday. The team loaded its network with more than 1 million new accounts and 20 million NFTs on top of its existing 70.6 million accounts on the network, but still managed to sustain its workload and recorded an average functionality rate of 751 transactions per second, giving the Ripple team much pride in the consistency of the network at a time when other more established networks have had to pause and restart their blockchains due to DDos attacks. This test result, coupled with the whale accumulation we highlighted last week, may continue to boost XRP’s price even as traders await updates from the SEC lawsuit.

Polygon, the layer 2 scaling solution that is the network for MATIC, which has retraced its 100% explosive move recently, has more good news announced that could help its price. First, Polygon has announced a partnership with Nothing, the creator of Phone (1). MATIC’s tech will be integrated into Nothing’s first smartphone. While MATIC will not be manufacturing its own smartphone, the partnership aims to bring crypto and NFTs to a larger audience by enabling access to Web3 functionality to such users, thereby increasing the adoption for MATIC.

Another good development for MATIC is that Reddit, the immensely popular social media platform, has announced that it will launch a new NFT-based avatar marketplace on the Polygon network. According to June 2021 data, Reddit has about 48 million monthly users.

Also, more than 50 projects that were run on the beleaguered Terra blockchain have migrated to Polygon, with more projects expected to follow suit after the CEO of Polygon Studios said that the team will do what they can to assist affected projects so that they can continue to build. More existing projects moving to Polygon will definitely increase its adoption sharply and put the L2 chain in good stead for the next cycle.

AAVE, one of the most prominent DeFi lending platform, which has escaped unscathed in this downturn, has proposed its own stablecoin called GHO.

The blockchain AAVE is built on, ETH, has gone one step closer to PoS. On Wednesday, the second in a series of three testnet deployments to the PoS chain has successfully concluded. The next stage will be for the third testnet, Goerli, to move to PoS before ETH fully transitions to PoS later this year.

As can be seen, the crypto market is not without good news. Builders continue to build and increase adoption despite the current difficult market environment. This goes to show that the current spate of negativity is merely growing pains the industry needs to go through in order to sieve the weed from the grass. Once weeded out, those that remain will be able to sustain an even more explosive stage of growth in the next cycle. Hence, investor should take this downturn to pick out the gems at a low price before another price explosion begins when the new bull market comes.

Currently, the crypto market is pulling back after having made considerable gains in the last couple of days. Prices could still break higher as both BTC and ETH seem to be consolidating near the neckline of a double bottom. At the same time however, it is also quite clear that the bears are trying to prevent the price from going higher as selling intensified on Sunday.

As the bulls and bears are locked in a fierce battle, the eventual winner may only be decided later in the week after the release of the US CPI data on Wednesday.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.