A surprise rate cut from China after the world’s second largest economy released yet another set of dismal economic data managed to support crypto prices a little in the early part of week. However, news that the US SEC had delayed all BTC ETF approval decisions to 2024 disappointed the market, dragging down the broad crypto market at the same time as risk-off selling continued in the traditional markets, which worsened the dip in crypto prices.

FED minutes released midweek which suggested that more rate hikes could be coming added fuel to the fire, causing BTC to break the $29,000 level which it had been coiling around for almost a month. The break of the $29,000 support quickly sent the price of BTC tumbling by more than 10%, hitting a low of $25,000 on a number of exchanges on Thursday before recovering slightly to around $26,000 by the week’s close. Altcoins naturally fell a lot more than BTC, falling an average of 20%.

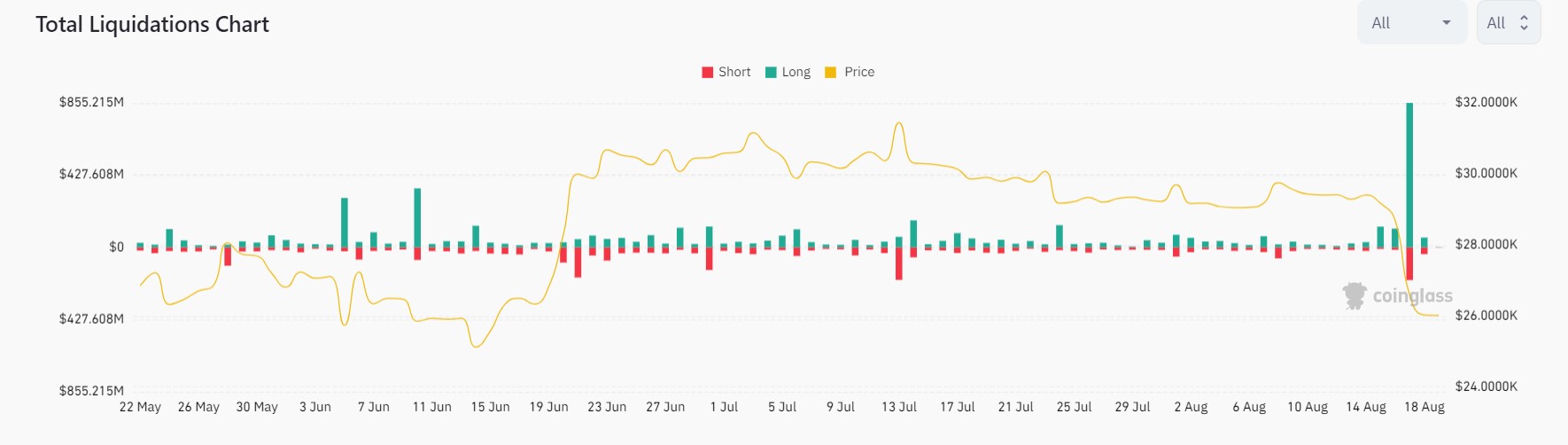

Largest closing out of positions this year

The significant move in prices after a long period of low volatility brought about the biggest liquidation event so far this year, with the amount of liquidation exceeding $1 billion. Understandably, more than 20% of those liquidated were long positions.

BTC liquidations took up around 68% of positions and ETH ones around 30%, which goes to show that trading in altcoins was negligible. This however, could imply that the lower amount of leveraged trades in altcoins could potentially result in outperformance and better downside resilience as there is less liquidation risk. For instance, RUNE still managed to stage a 30% rally in the midst of the bloodbath in the more popular coins.

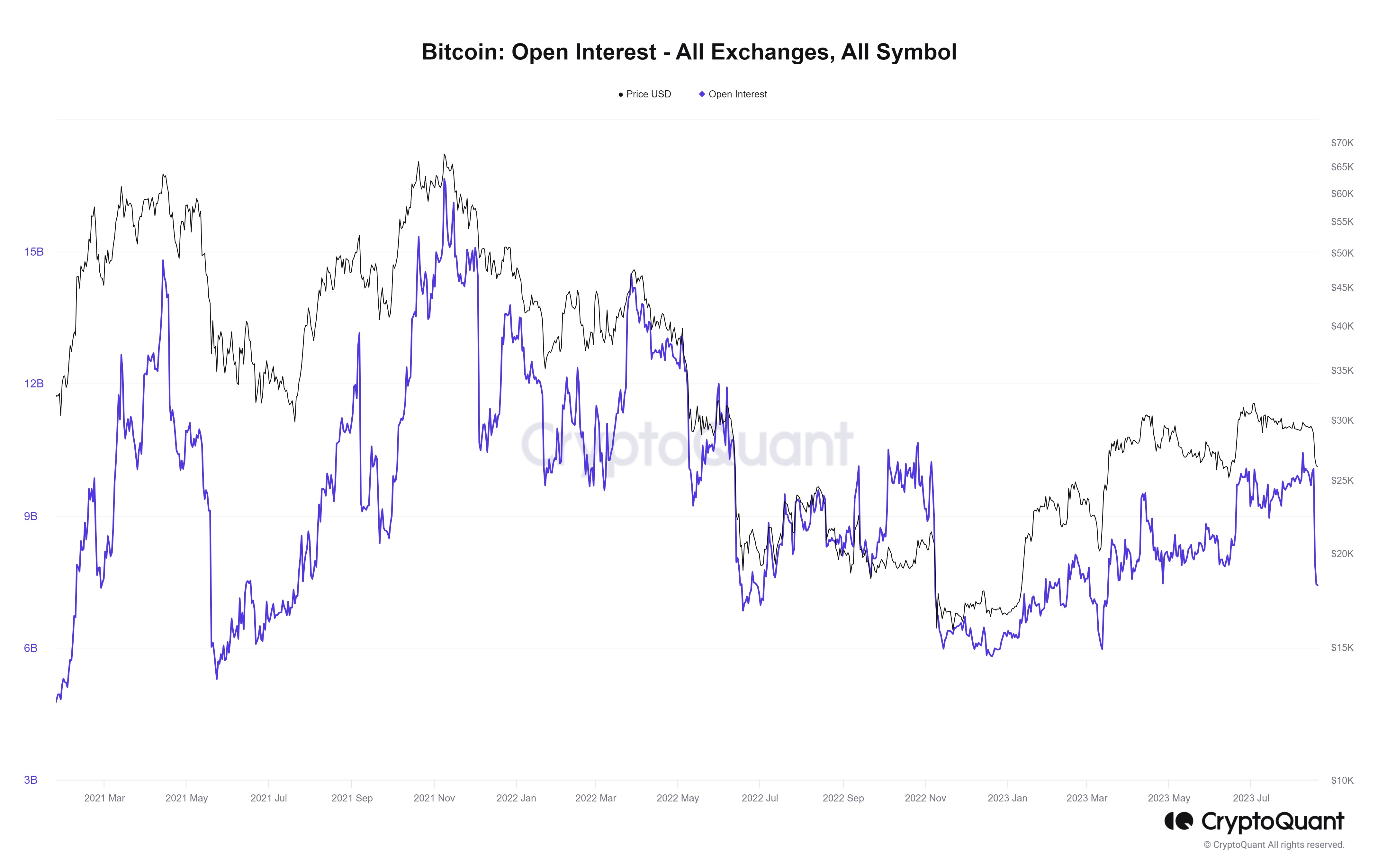

Equally as notable as the amount of liquidation was the drop in BTC’s open interest after Thursday’s liquidation event. According to data, the liquidation caused BTC’s open interest in the futures market to drop by almost 7%, which is the largest closing out of positions since the FTX selloff last November. Historically, after such a large flushing out, the price of BTC would normally consolidate for a period of time or even rebound slightly before finding its next big directional move as can be seen in the diagram below.

Domino of bad news crashed crypto prices

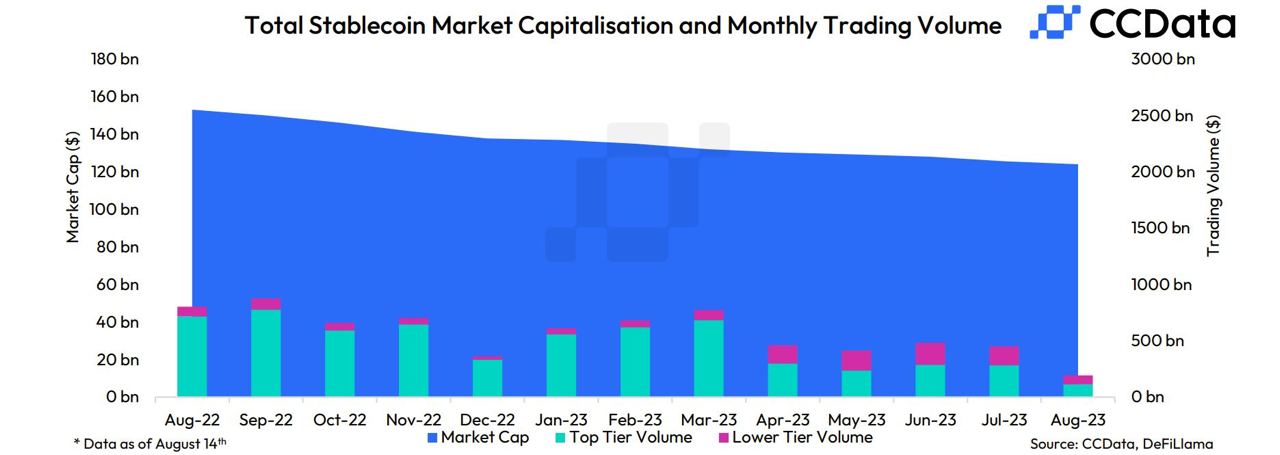

While the more hawkish than expected FED statement worsened the outlook for crypto, the main trigger to the quick caving in of more than 10% in the price of BTC was news that China property developer Evergrande Holdings had filed for bankruptcy protection in the US. One reason why Evergrande’s woe would affect the crypto market was because of the amount of China commercial papers that Tether had been rumored to be holding. While Tether had denied holding any Evergrande papers, FUD started circulating again about the commercial papers of other Chinese companies which Tether held that could be impacted by the fast deteriorating credit situation in China.

While Tether had clarified that the other China commercial papers it held was only a small fraction of its reserves and that they were of good credit rating, it comes as no surprise that investors had been slowly getting funds out from the stablecoin market due to unfriendly policies against them over the past year.

According to data, the total market capitalization of stablecoins has fallen 1.28% month-over-month to $124 billion, the lowest level since August 2021. This is the seventeenth consecutive month of decline in stablecoin market capitalization. While the decline has been slow, it nonetheless shows that the supply of stablecoins has been shrinking over 2023, which historically has not been a good sign for the price of cryptocurrencies. The supply of stablecoins needs to grow in order for crypto to be able to sustain a price increase.

Other than the Tether FUD, another old tale hit the market at the same time. The Wall Street Journal broke news that SpaceX had sold its BTC holdings even as the Tether FUD was making its rounds on Thursday. Although the article did mention that the BTC could have been sold two years ago, its headlines still managed to affect many traders who assumed that SpaceX had recently sold its BTC.

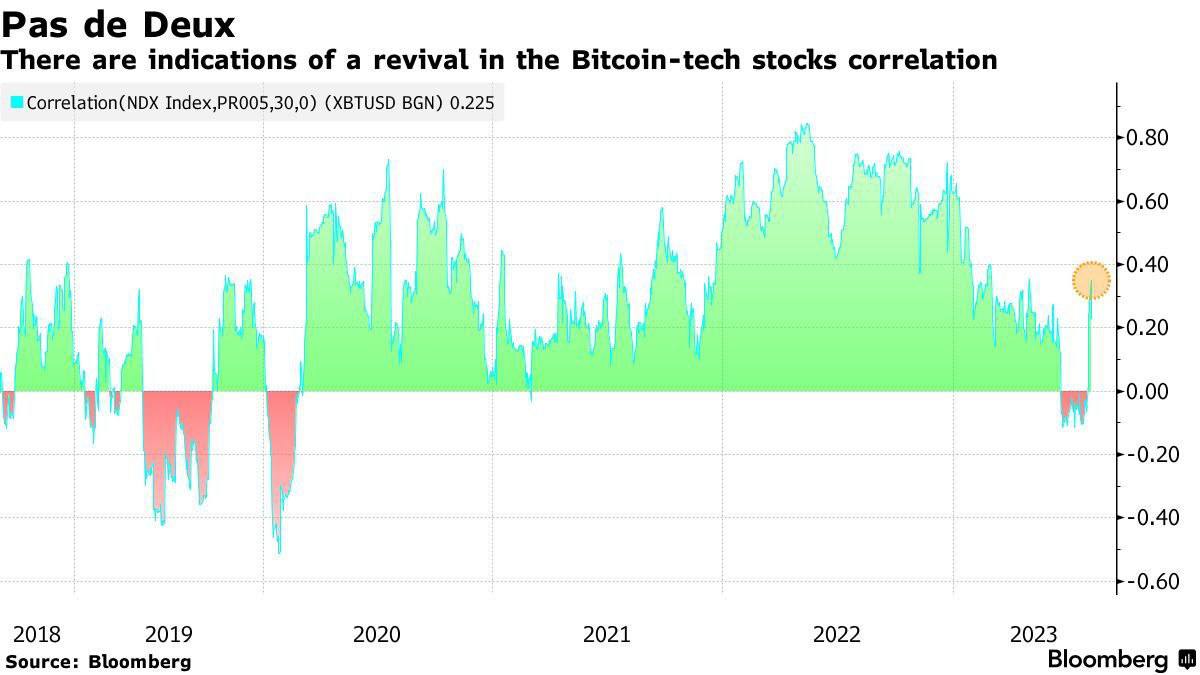

Regardless of the objective of these FUDs, what is important for the trader is to make use of the volatility to trade and earn profits. While we can blame the FUD for causing a drop in crypto prices, there is no denying that the macro environment, which has deteriorated substantially, is one big reason causing prices to tumble across the board. A large risk-off selling in the traditional market would usually spill over into crypto as traders get margin calls across all asset classes. This phenomenon would typically cause the short-term correlation between stocks and crypto to jump back into positive territory, often feeding on itself.

Correlation between crypto and Nasdaq returns

As expected, the correlation between BTC and Nasdaq has jumped back into a high positive. Thus, crypto traders need to be watchful of what happens in the traditional markets, especially with technology stocks, which have been under pressure of late. A large dip in the Nasdaq could have a material negative impact on the price of cryptocurrencies hereon.

SHIB crashed after problematic L2 launch

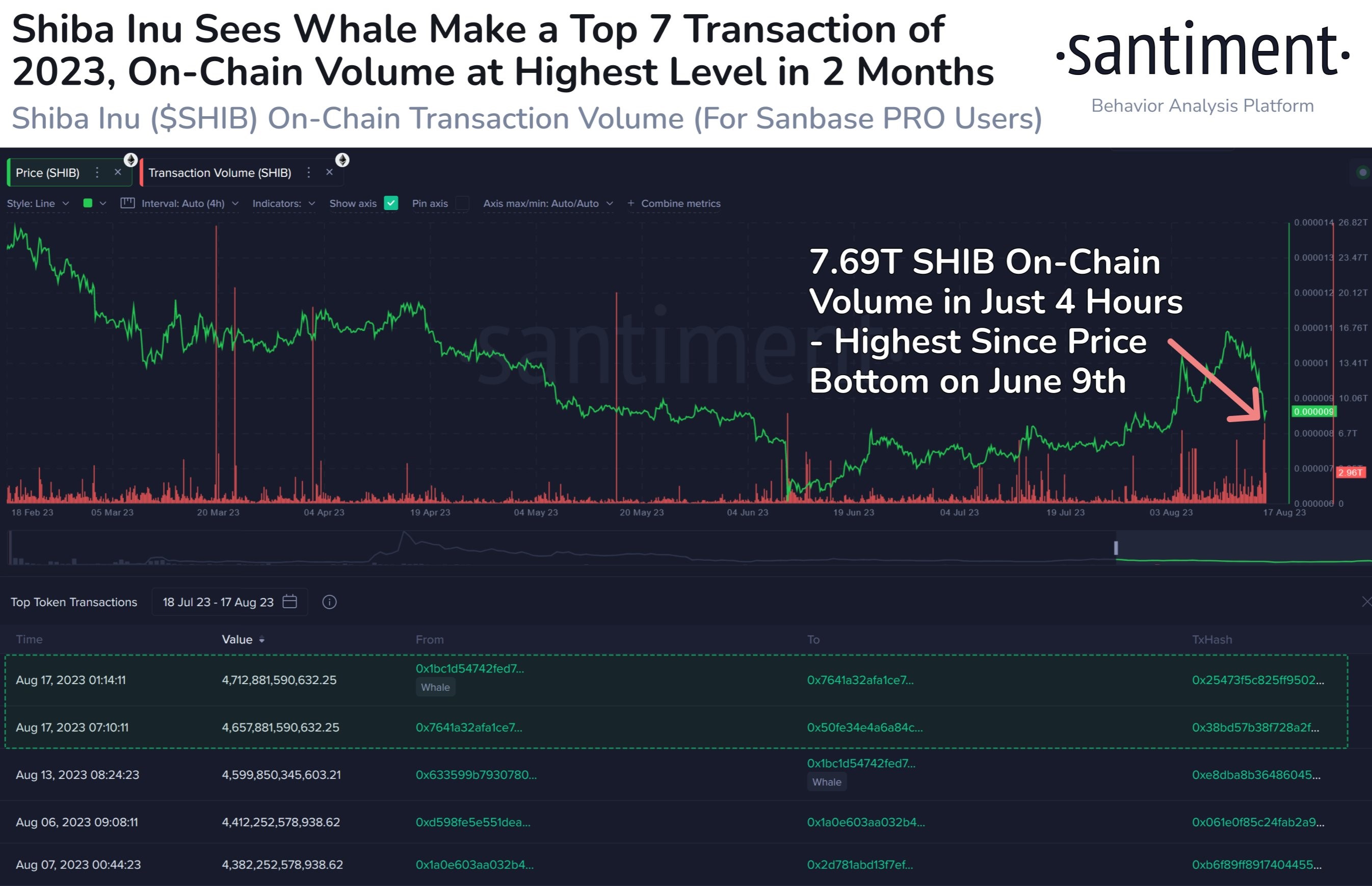

After a big rally, SHIB’s profit-taking came after the much-touted Shibarium Layer-2 scaling solution finally launched last Wednesday. SHIB had been rising for two weeks due to this major milestone and as such, the “sell on news” came as no surprise. What was unexpected however, was that the network experienced a bridging problem soon after launch, where users reported an inability to connect the new L2 network to their wallets. This incident occurring at the time the broad market was selling off dealt a ruthless blow to SHIB, which crashed more than 40%, giving up all its gains made prior to Shibarium’s launch.

However, after a huge crash back to below $0.000007, a large whale appeared to have bought the dip as around 4.7 trillion SHIB tokens worth around $41 million were observed to be moving to a new cold wallet, suggesting that at least this whale still sees long-term potential in the token. The purchase has since helped the price of SHIB to stabilize above $0.000008.

Macro troubles sent traditional markets on a tailspin

Despite a strong beat in the US retail sales figure, the data could not neutralise the risk-off selling that originated from Asia due to dismal data from China. Renewed worries about the US banking sector surfaced too as Fitch Ratings, following a downgrade by Moody’s a week earlier, also warned that they could be downgrading the US banking sector.

Wednesday’s release of the FED meeting minutes did not help the situation, as officials were reportedly worried about the persistent high inflation and deemed that more rate hikes might still be needed unless “conditions changed”. The comments caused US yields to spike again, intensifying the risk-off selling in the equities market.

Another event that sparked off the fear in the traditional markets was that Michael Burry of “The Big Short”, who correctly predicted a stock market crash in 2008, had placed a large sell order on US equities. While Burry’s more recent record over the past 10-years have not been as accurate, his large sell order of around $1.6 billion still left an ominous cloud over the markets.

Action out of China also fanned the fear contagion, as the PBOC cut rates unexpectedly again for the second time in three months, a move that most investors think was out of an act of desperation, which was proven correct as quickly as Thursday when Evergrande Holdings, the property firm which had been in the headlines last year for failing to repay its bond holders, finally filed for bankruptcy.

As a result of all the bad things happening, the Nasdaq had one of its lousiest weeks this year, losing around 2.6%. The Dow ended the week lower by 2.2%, its worst performance since March, while the S&P fell 2.1% and registered a third straight week of losses, its worst since February.

The 10-year US Treasury yield on Thursday rose to its highest level since October 2022 to 4.3% before easing to close the week at 4.25%, pushing the dollar higher by around 0.5% and pressuring Gold to lose another 1.3% to close below $1,900. Silver however, eked out a small gain as rumors of supply shortage managed to support its price.

China’s troubles finally made their impact felt on oil prices, dragging the WTI lower by 1.8% and causing Brent Crude to lose 1.9% for the week. However, oil prices are around 0.5% higher in early Asian trading as the markets welcome a new week.

This is an exciting week as the much-anticipated BRICS Summit will take place between 22-24 August, i.e. Tuesday to Thursday. The countries involved are said to be launching a new trade currency that would threaten the dollar’s status as the reserve currency of the world, while 24-26 August is the Jackhole Hole Symposium where the FED Chief and other important speakers would be discussing interest rate and monetary policies in the US. With the Jackhole Hole and the BRICS Summit happening after one another in the same week, traders ought to be prepared for potential heightened two-way volatility in the dollar, which will inevitably impact all other asset classes. As such, while economic data will still be important, most of the large moves in the market this week are anticipated to come from the two important summits instead.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.