US stocks had a positive week after they put in a strong mid-week rally after Fed Chairman Powell confirmed that the amount of rate increases would be reduced, possibly beginning in December. Even though Powell did caution that rates could stay elevated for longer than expected as inflationary pressures, even though they have eased, are still well above the Fed’s 2% target, traders decided to take it as a dovish indication and began to pile into risk assets. Even the core PCE price index rose only 0.2% in October, below the estimate of 0.5%, giving traders reasons to cheer.

With such news, the US dollar was crushed, losing another 3% after starting to crash since the start of November, and broke its 200-day moving average on the way down. The DXY closed the week at 103.6 despite a much better-than-expected non-farm payrolls report released on Friday.

The November payrolls rose by 263,000 in November, a bigger gain than the 200,000-increase expected by economists. Average hourly earnings also came in above expectations, jumping 0.6% compared with the prior month and 5.1% against the same month a year ago. The unemployment rate held steady at 3.7%.

Stocks initially fell on the “good news is bad news” logic but managed to recover some losses by the close to end higher for the week. The Dow only gained a meagre 0.2%, the S&P rose 1.1%, while the Nasdaq was the best performer, rising 2.1%.

With the US dollar weaker, precious metals climbed higher. Gold rose 2.8% while Silver gained 10% for one of its largest weekly gains in two years. Both metals are still inching higher at the start of this new trading week as the US dollar continues to weaken.

Oil saw only slight gains on the back of the weaker US dollar last week, however, at the start of Asia trading today, both distillates rose 2% after OPEC+ agreed on Sunday to stay the course on output policy ahead of a pending ban from the European Union on Russian crude. The cartel decided to stick to its existing policy of reducing oil production by 2 million barrels per day, or about 2% of world demand, from November until the end of 2023.

The only asset that did not see a big reaction from the US dollar’s weakness was cryptocurrency, which could be still undergoing the negative impact of the FTX bankruptcy and its contagion. Miners’ financial trouble could also affect the price of the leading crypto BTC as many BTC miners have signalled that they will have only until December, which is this month, to raise funds or face bankruptcy.

Miners Capitulation Could See Final Pressure on BTC Price

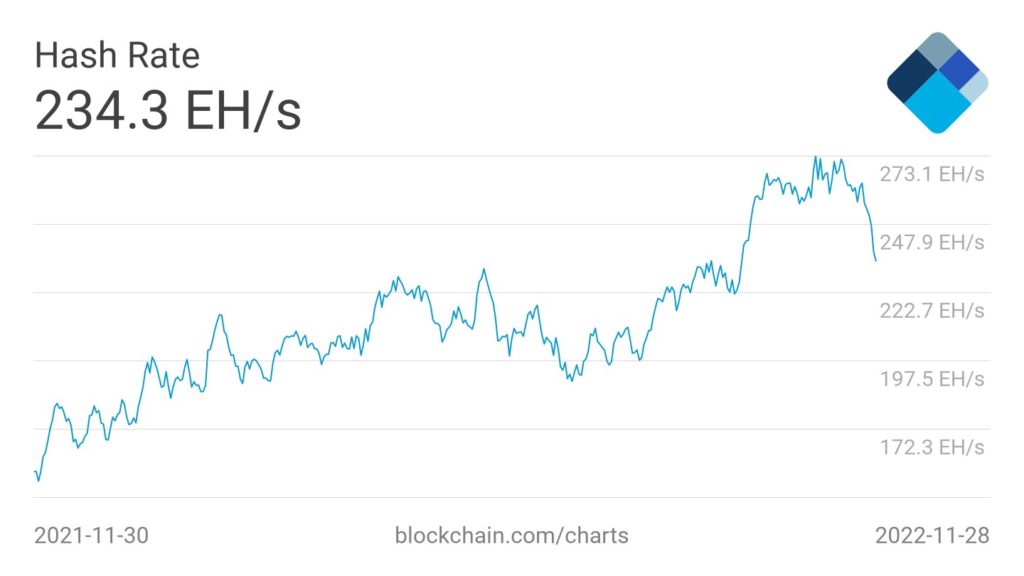

BTC hash rate has made an abrupt turn down after staying at ATH since October. The 7-day average BTC hash rate is now 13.7% lower than its ATH. With this drop, BTC’s upcoming mining difficulty is projected to adjust down by at least 9%.

Could this be a sign that miners are turning off their machines as sustainability starts to be affected?

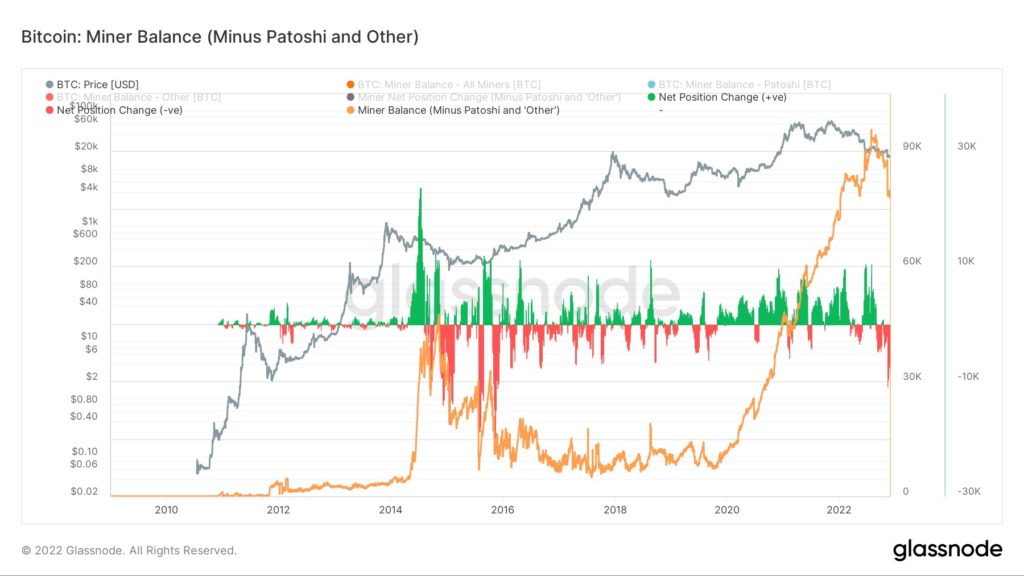

Furthermore, miner’s wallet balance currently also shows a sharp decline in BTC holdings by miners, which means they have been selling BTC recently. Should this selling persist, which is likely to, it could give the price of BTC some pressure in the days and weeks ahead even in the midst of a declining US dollar.

Whales Start Accumulating BTC Post FTX Implosion

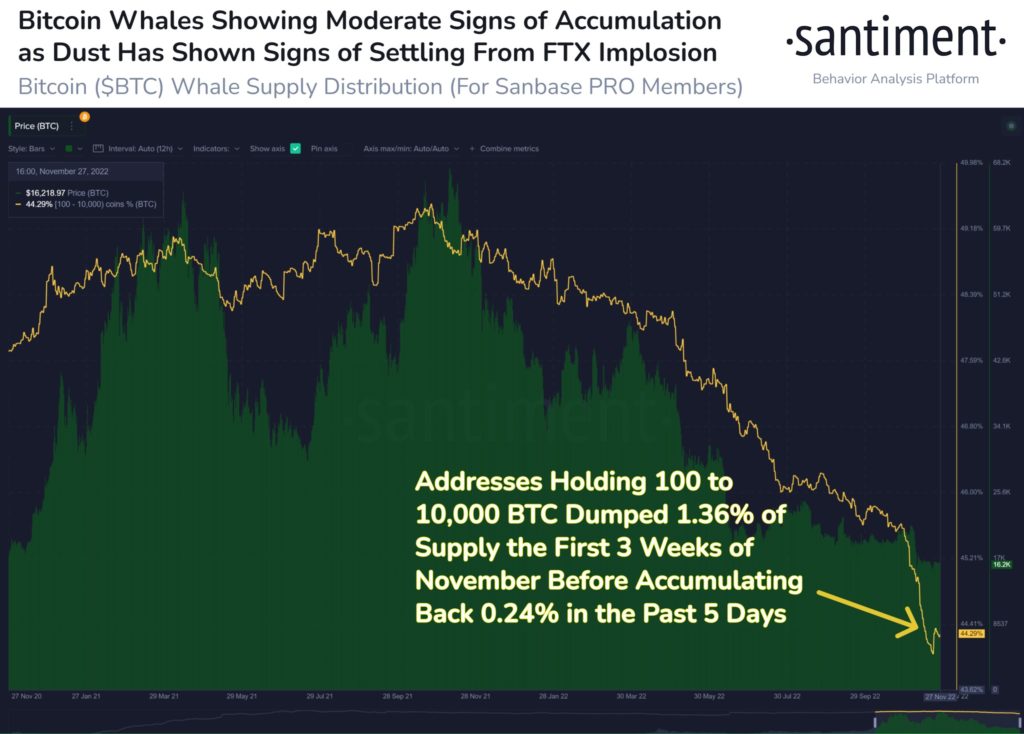

As miners continue to be forced into dumping BTC, the price of BTC, while generally weak, has not made a new low yet, possibly due to whales having started to accumulate BTC again after 13 months of net selling.

Addresses holding between 100 to 10,000 BTC have started to buy BTC again last week, accumulating back around 0.24% of BTC’s supply, or around 47,888 BTC, in the past week as BTC’s price showed signs of stabilisation amid US dollar weakness.

Crypto starting to heat up

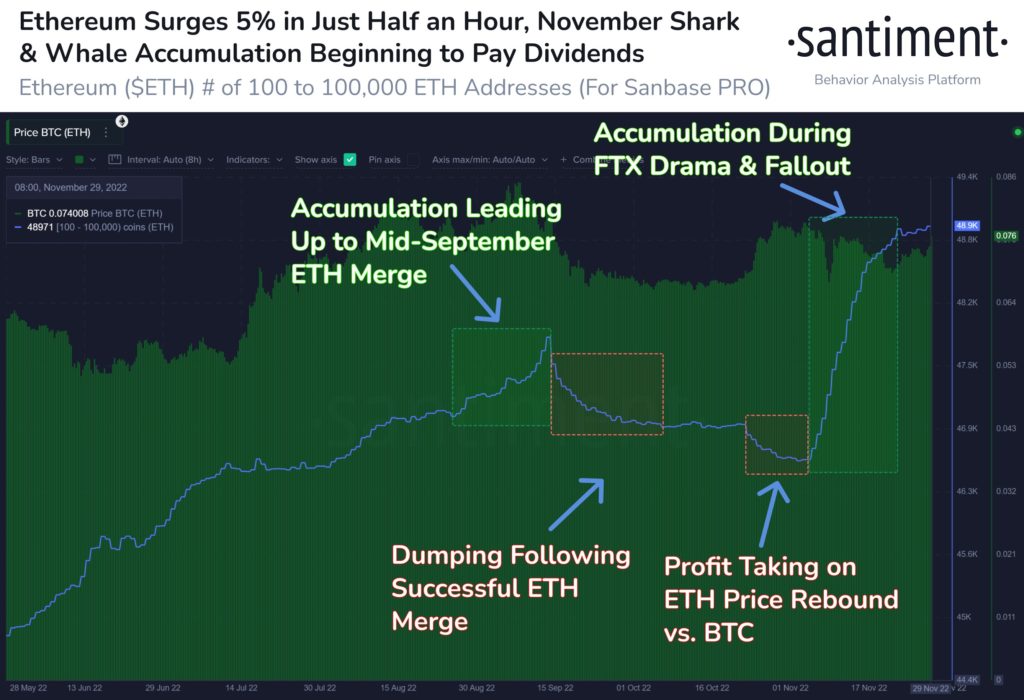

ETH Also Sees Accumulation from Same Class of Whales

The accumulation was not just centred on BTC. ETH also saw strong accumulation from whales in this category. The number of ETH holders with 100 to 100,000 ETH hit a 20-month high as whales accumulated aggressively post the FTX implosion.

As BTC undergoes a bull and bear fight to find a direction, some altcoins like LTC, BNB, DOGE and MASK, have done better in the aftermath of the FTX implosion.

SOL and NEAR Ecosystem Hardest Hit by FTX Saga

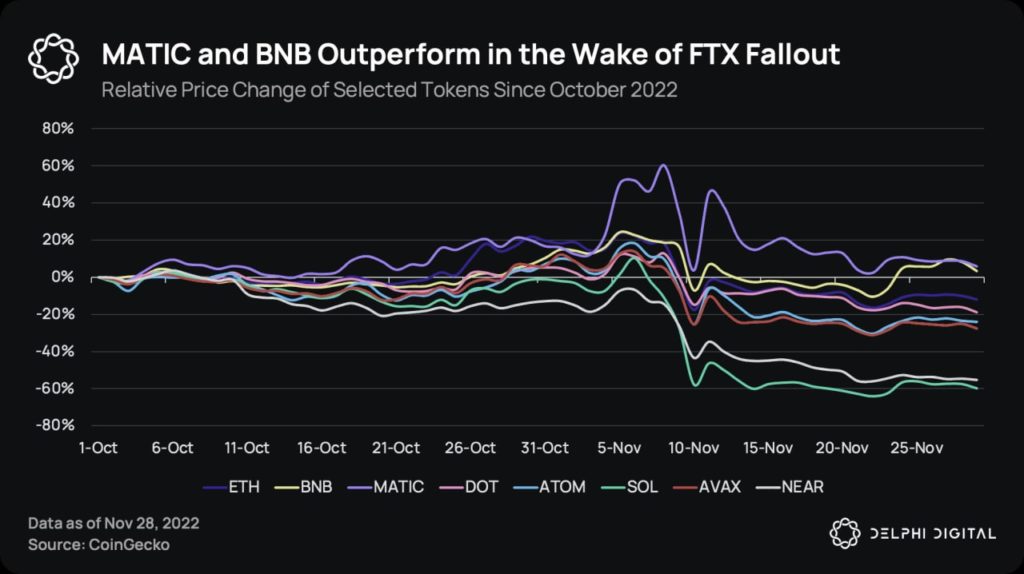

Data from Delphi Digital shows that amongst popular alternative blockchains, two coins, MATIC and BNB, in particular, have outperformed the market, having had their prices increase since October.

As for the poorest performers, SOL has fallen by 60% and NEAR has fallen by 55%. FTX and Alameda were the core investors of the Solana ecosystem, while FTX and 3 Arrows Capital were important investors of NEAR. As the token of a competitor exchange, BNB has come out in front as the key beneficiary of the collapse of FTX.

Another reason for the outperformance of MATIC and BNB could be the change in investor behavior from centralized to decentralized exchanges. Using a decentralized exchange would require the use of the native token of the particular blockchain, which means that the demand for MATIC, BNB and ETH, which are by far the blockchains with the most number of decentralized applications, to increase.

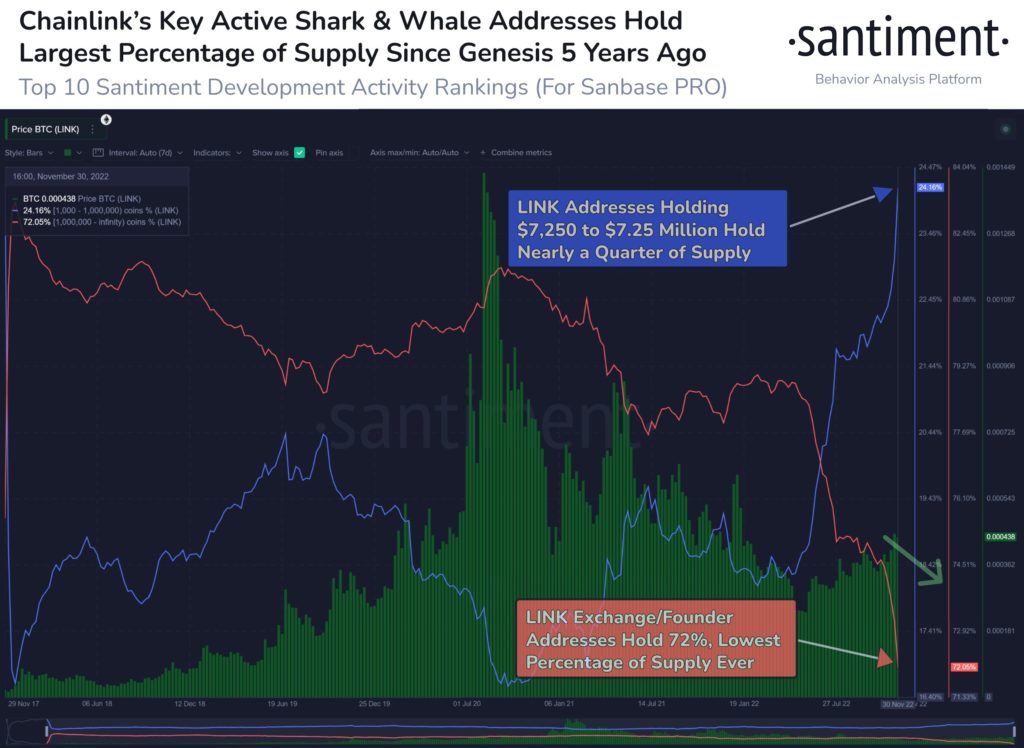

LINK Whales Accumulate at Fastest Pace

Another category of coins that could benefit from the move to decentralized applications are oracles. Being the biggest oracle in use, LINK would likely benefit the most from the increase in the usage of decentralized applications. LINK whales appear to be aware of this and have been accumulating the token at the most aggressive pace. LINK shark and whale addresses holding between 1,000 to 1 million LINK have added a collective 26.8 million LINK over the past 2 months, a 12.8% increase of coins to their bags. These whales now hold the largest percentage of LINK’s supply in history, totalling around 25% of LINK’s supply.

This week, the Reserve Bank of Australia and Canada will meet to decide on interest rates, while economic data out from the US would be concentrated on Friday, with the release of PPI and Consumer Sentiment. Next week, the Fed meets again to decide on interest rates for the last time this year before most banks and trading desks start closing their books for the year.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.