In a quiet week with not much on the calendar, stocks closed lower as traders realign their positions ahead of the last Fed meeting of the year this Wednesday. While a 50-bps point hike is pretty much priced in, investors are getting worried over what Fed Chair Powell would guide at the post meeting press conference, especially after the release of the producer price index (PPI) on Friday.

The producer price index, a measure of the cost of raw materials companies that produce a product have to pay, or sometimes also referred to as wholesale prices, increased 0.3% for the month and 7.4% from a year ago, despite expectations for it to cool down. A 38% surge in wholesale vegetable prices pushed the food index up by 3.3%, offsetting an identical 3.3% decline in energy costs. As an increase in the PPI could spill into the CPI, which is the price that consumers pay, the markets are now closely watching the CPI that will be out on Tuesday, which coincides with the first day of the Fed meeting.

Stocks sold off upon the release of the PPI number, which capped the worst week since September, with the Dow losing 2.77%, the S&P declining 3.37% and the Nasdaq dropping 4%.

Gold and Silver closed almost the same levels as where they opened at the start of the week after rebounding from an early week decline. Gold closed a tad below $1,800, while Silver closed at around $23.45. Both metals are a tad lower in the new week on the back of a slight dollar bounce to start the week.

Oil prices fell to their biggest losses in months after the EU price cap on Russian oil took effect. In a retaliatory move, Russian president Putin threatened to cut output, however, it did nothing for the price of oil, which continued to slump. Eventually, Brent closed the week down 13.5% to $76.80 while the WTI dropped 13.4% to close at $71.80. OIl is starting the new week rebounding a little, by around 1%.

Crypto prices continued to remain range bound, with neither BTC nor ETH managing to break out of the 1% range that had pinned the pair down all week. Altcoins however, slipped slightly more as a lack of fresh positive catalysts sent prices drifting lower.

Institutional Interest in BTC Drops to Pre-COVID Levels

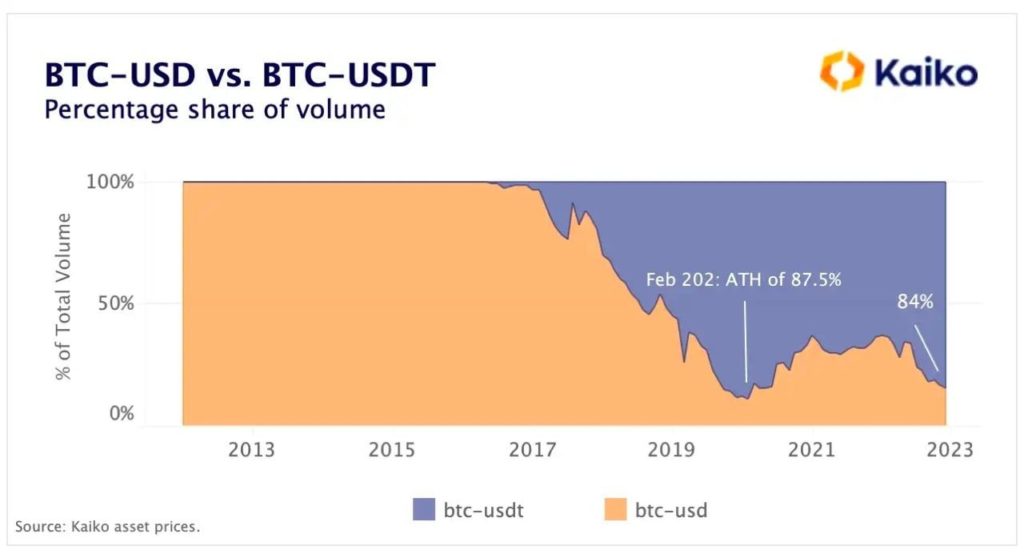

According to blockchain analytics firm Kaiko, historically, the BTC-USD versus BTC-USDT trading volume could be considered an indicator of institutional inflows into crypto, as institutional investors would typically buy BTC using fiat directly instead of using an onramp like the USDT.

During the 2021 bull market, institutional investors poured funds into crypto markets via American platforms, thereby boosting the market share for BTC-USD relative to BTC-USDT. At the peak of the 2021 bull market, the market share of BTC-USDT dipped to around 65%, which meant that the market share of USD traders were 35%. This trend has since reversed, and the dominance of USDT based BTC trades have since risen to 84%, implying that USD trades only made up 16% of trading volume, a level seen just before the COVID selloff and way before the start of the 2021 bull market. While this lack of institutional participation could be one reason why the price of BTC has been lacklustre recently, this could also imply that a reset of key institutional players in the crypto scene is happening as the players in 2021 get flushed out in the current deleveraging. If this really is the case, it is actually good news for the retail investor as they now get the chance to come in before the large institutional investors do so again later.

Has Bitcoin Hit Bottom?

Coincidentally, the amount of USDT stablecoins on crypto exchanges is still at an elevated level. The amount of BTC and ETH have declined sharply in the aftermath of the FTX debacle, but the level of USDT has not changed since May 2022. This goes to show that investors have set aside ammunition to buy as otherwise, they would have withdrawn those USDT from the exchanges together with BTC and ETH for safekeeping as well. Hence, while interest from the Wall Street type of institutional investors has waned, overall investor interest in crypto has not declined; they are merely on the side-lines waiting for a good opportunity to load up the truck.

ETH To Finally Allow Staked ETH Withdrawals Come March

After the timeline on the deployment of the withdrawal function on ETH 2.0 upgrade was removed in mid-November that resulted in weeks of paranoia within the ETH community, ETH developers have finally agreed on a date that this function would be enabled – this would be deployed in March 2023 in the Shanghai hard fork that is poised to begin testnet around the end of this week. Investors in ETH cheered the news, which sent the price of ETH higher momentarily last week before the release of the higher-than-expected US PPI numbers sent all crypto prices tumbling again on Friday.

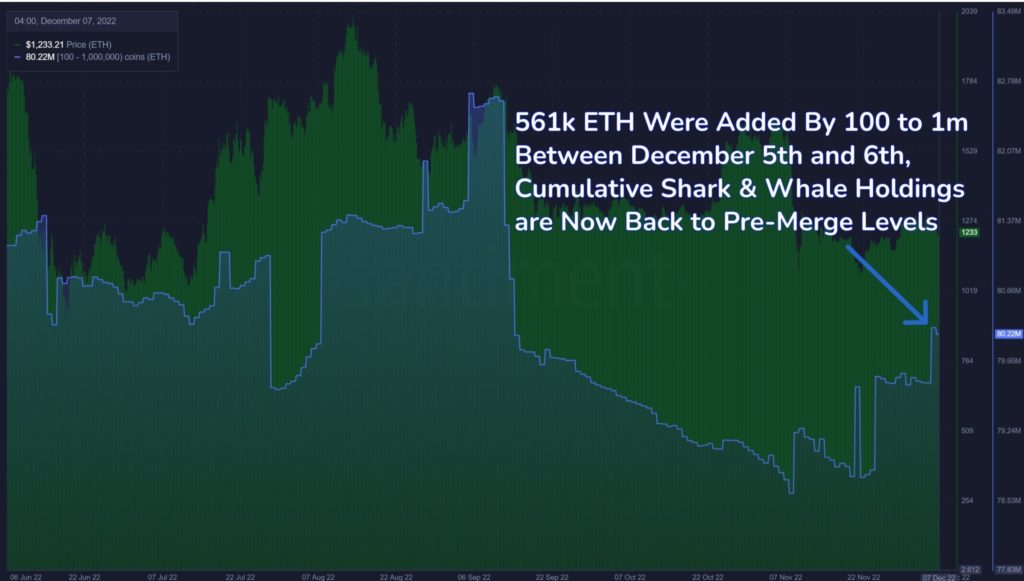

Regardless, the positive turn of events has caused the accumulation on ETH to pick up again, with whales holding between 100 to 1 million ETH adding about 561,000 ETH last week. The amount of ETH this category of whales hold is now back to pre-Merge levels, but still substantially lower than its high of the year. However, with the price of ETH continuing to weaken, this group of whales are likely to keep adding on dips.

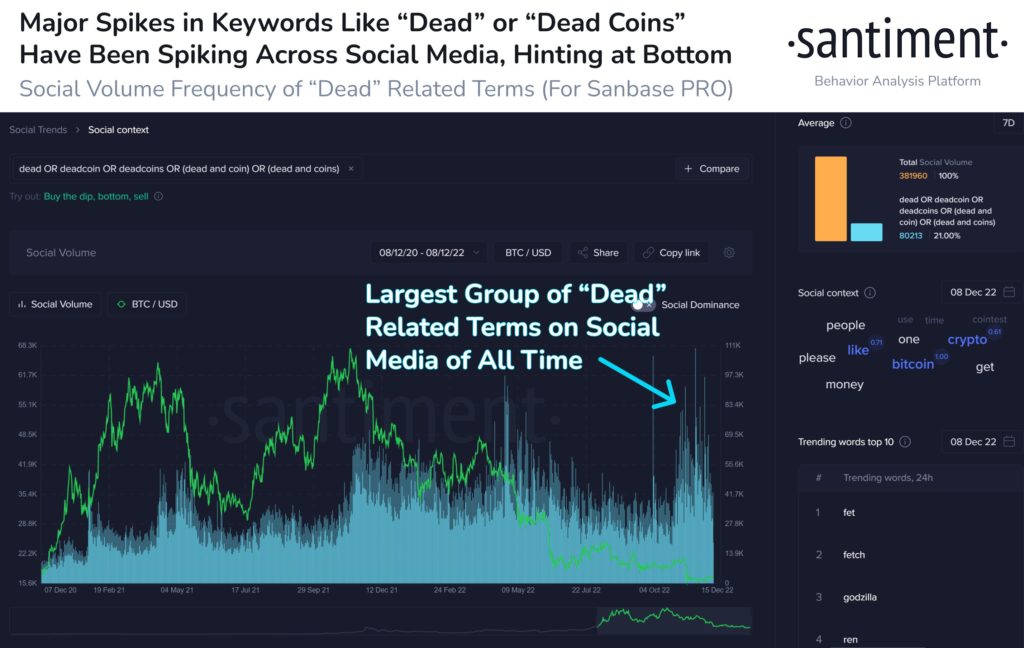

Crypto Sentiment at Low Hints of a Contrarian Bottom

As the market comes to almost a standstill due to a lack of fresh catalyst, the upcoming Fed meeting as well as the effect of the World Cup, social media mentions that crypto is dead is surging again. However, as retail speculators get impatient and leave the scene, this is often a good contrarian indicator of positive price action to come.

As the year 2022 starts to draw to a close, trading activities could start to wind down as traders pause to celebrate the year-end festive season after this week. However, before that, this week still has a string of activities to pay attention to, both for crypto as well as for the traditional markets. The Fed meeting on Wednesday will no doubt be the most followed. However, the markets could react ahead based on the results of the CPI release that is scheduled for Tuesday. After the Fed, there are also a string of central bank meetings on Thursday. The Swiss National Bank, the ECB and the Bank of England will all meet on Thursday and their interest rate decisions could cause heightened volatility in the currency markets between Tuesday to Thursday, especially when the banks are also starting to wind down trades as they prepare to close their trading books for the year. Hence, traders in forex will need to exercise prudence and not over leverage as the year end price volatility in the currency markets can get rather high, albeit with low volume.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.